Current Report Filing (8-k)

October 16 2017 - 5:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported)

October 16, 2017 (October 12, 2017)

MGT

Capital Investments, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-32698

|

|

13-4148725

|

|

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

512

S. Mangum Street, Suite 408, Durham, NC 27701

(Address

of principal executive offices, including zip code)

(914)

630-7430

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item

1.01 Entry into Material Definitive Agreements.

On

October 12, 2017, MGT Capital Investments, Inc., a Delaware corporation (the “Company”), entered into two management

agreements (each, a “Management Agreement”, collectively “Management Agreements”) with two accredited

investors (“Users”), respectively, on substantially similar terms whereby Users agreed to purchase a total number

of 1,944 Bitmain Antminer S9 mining computers (the “Bitcoin Hardware”) to mine bitcoins with the Company acting as

the exclusive manager for each of the Users. Pursuant to the Management Agreements, the Company shall install, host, maintain,

repair and provide ancillary services necessary to operate the Bitcoin Hardware. In accordance with each of the Management Agreements,

the Company will receive a management fee that equals 10% of the total bitcoins produced by each User’s Bitcoin Hardware

and share the respective net profits of such bitcoin mining operation with each User. In connection with the Management Agreements,

the Company issued 193,000 shares of the Company’s common stock and a Series F Warrant to purchase 193,000 shares of the

Company’s common stock at an initial exercise price of $2.00 per share exercisable for a period of three years to one User

and 154,400 shares of the Company’s common stock and another Series F Warrant to purchase 154,400 shares of the Company’s

common stock at an initial exercise price of $2.00 per share exercisable for a period of three years to the other User. On the

same day, the Company executed the two Series F Warrants for the benefits of the two Users as described above. As a condition

to the execution of the two Management Agreements, each of the two Users signed an Acknowledgement and Acceptance Agreement, respectively,

to acknowledge its accredited investor status as defined in the Securities Act and investment sophistication and experience, among

other things.

The

foregoing description of the terms of the Management Agreements, Acknowledgement and Acceptance Agreements and Series F Warrants

is not complete and is qualified in its entirety by reference to the full text thereof, the forms of which are filed as Exhibit

10.1, Exhibit 10.2 and Exhibit 10.3 to this Current Report on Form 8-K and are incorporated by reference herein.

Unless

specifically defined herein, the capitalized terms shall have the meanings as defined in the respective documents attached herein.

Item

3.02 Unregistered Sales of Equity Securities.

The

information contained in Item 1.01 is hereby incorporated by reference.

Item

7.01 Regulation FD Disclosure

On

September 16, 2017, the Company issued a press release intended to provide recent development and updates on its cryptocurrency

business. A copy of the press release is attached hereto as Exhibit 99.1.

The

information contained in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under

the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set

forth by specific reference in such a filing. The furnishing of the information in this Current Report on Form 8-K is not intended

to, and does not, constitute a representation that such furnishing is required by Regulation FD or that the information contained

in this Current Report on Form 8-K constitutes material investor information that is not otherwise publicly available.

This

Current Report on Form 8-K and exhibits may contain these types of statements, which are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995, and which involve risks, uncertainties and reflect

the Registrant’s judgment as of the date of this Current Report on Form 8-K. Forward-looking statements may relate to, among

other things, operating results and are indicated by words or phrases such as “expects,” “should,” “will,”

and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results

to differ materially from those anticipated at the date of this Current Report on Form 8-K. The Company disclaims any obligation

to, and will not, update any forward-looking statements to reflect events or circumstances after the date hereof. Investors are

cautioned not to rely unduly on forward-looking statements when evaluating the information presented within.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

Dated:

October 16, 2017

|

|

MGT

Capital Investments, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Robert Ladd

|

|

|

Name:

|

Robert

Ladd

|

|

|

Title:

|

President

and CEO

|

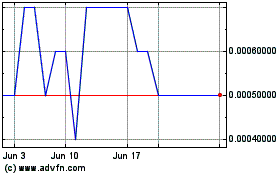

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

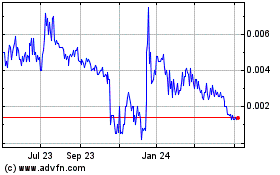

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024