|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

(Name of Issuer)

Common Stock, no par value

(Title of Class of Securities)

(CUSIP Number)

Blake W. Nordstrom

Peter E. Nordstrom

Nordstrom, Inc.

1617 Sixth Avenue,

Seattle, Washington 98101

(206) 628-2111

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

with copies to:

Barry L. Dastin

Allison M. Donovan

Hogan Lovells US LLP

1999 Avenue of the Stars #1400,

Los Angeles, CA 90067

October 13, 2017

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1

|

Names of Reporting Person

Bruce A. Nordstrom

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

19,189,930

|

|

|

|

8

|

Shared Voting Power

6,506,716

|

|

|

|

9

|

Sole Dispositive Power

19,189,930

|

|

|

|

10

|

Shared Dispositive Power

6,506,716

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

25,696,646*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

15.5%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

2

|

|

1

|

Names of Reporting Person

Anne E. Gittinger

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

15,403,460

|

|

|

|

8

|

Shared Voting Power

-0-

|

|

|

|

9

|

Sole Dispositive Power

15,403,460

|

|

|

|

10

|

Shared Dispositive Power

-0-

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

15,403,460*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

9.3%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

3

|

|

1

|

Names of Reporting Person

Blake W. Nordstrom

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

2,818,799

|

|

|

|

8

|

Shared Voting Power

526,081

|

|

|

|

9

|

Sole Dispositive Power

2,818,799

|

|

|

|

10

|

Shared Dispositive Power

526,081

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,344,880*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

2.0%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

4

|

|

1

|

Names of Reporting Person

Erik B. Nordstrom

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

3,409,563

|

|

|

|

8

|

Shared Voting Power

42,646

|

|

|

|

9

|

Sole Dispositive Power

3,409,563

|

|

|

|

10

|

Shared Dispositive Power

42,646

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,452,209*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

2.1%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

5

|

|

1

|

Names of Reporting Person

James F. Nordstrom, Jr.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

829,663

|

|

|

|

8

|

Shared Voting Power

76,009

|

|

|

|

9

|

Sole Dispositive Power

829,663

|

|

|

|

10

|

Shared Dispositive Power

76,009

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

905,642*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

0.5%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

6

|

|

1

|

Names of Reporting Person

Peter E. Nordstrom

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

o

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

United States of America

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

2,978,536

|

|

|

|

8

|

Shared Voting Power

324,417

|

|

|

|

9

|

Sole Dispositive Power

2,978,536

|

|

|

|

10

|

Shared Dispositive Power

324,417

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,302,953*

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

2.0%

|

|

|

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

*The Reporting Person is reporting on this Schedule 13D as a member of a “group” with the other Reporting Persons. The group beneficially owns

51,957,366 shares of Common Stock owned by all of the Reporting Persons in the aggregate, representing approximately 31.3% of the outstanding shares of Common Stock. See Item 5.

7

This Amendment No. 1 to Schedule 13D (“Amendment”) amends and supplements the information set forth in the Schedule 13D filed by the Reporting Persons with the United States Securities and Exchange Commission (the “Commission”) on June 7, 2017 (the “Schedule 13D”), relating to

the common stock, no par value (the “Common Stock”), of Nordstrom, Inc., a Washington corporation (the “Issuer”)

. Unless otherwise defined herein, all capitalized terms used herein shall have the meanings ascribed to them in the Schedule 13D.

Item 4.

Purpose of Transaction.

Item 4 is hereby amended and supplemented by adding the following immediately after the third paragraph thereof:

On October 13, 2017, representatives of the Group advised the Special Committee that, in light of the difficulty of obtaining debt financing in the current retail environment prior to the conclusion of the approaching holiday season, the Group has suspended active exploration, for the balance of the year, of the possibility of proposing a Going Private Transaction. The management members of the Group believe it is important to maintain their focus on the execution of the Issuer’s business plan for the year-end period. The Group’s representatives also advised the Special Committee that the Group intends to continue its efforts to explore the possibility of making a proposal for a Going Private Transaction after the conclusion of the holiday season. No assurance can be given that a proposal for a Going Private Transaction will be made after such time. The Reporting Persons remain subject to the obligations set forth in the Letter Agreement referenced above.

Item 5.

Interest in Securities of the Issuer.

Item 5(a) is hereby amended and restated with the following:

(a)

As of October 13, 2017, the Reporting Persons, on a combined basis, are the beneficial owners of an aggregate of 51,957,366 shares of Common Stock of the Issuer, representing approximately 31.3% of the outstanding shares of Common Stock of the Issuer.(1)

Item 5(b) is hereby amended to amend the previously reported information as to Blake W. Nordstrom, Erik B. Nordstrom, James F. Nordstrom, Jr. and Peter E. Nordstrom as follows:

Blake W. Nordstrom

has:

(i)

sole power to vote or direct the vote of 2,818,799 shares of Common Stock;

(ii)

shared power to vote or direct the vote of 526,081 shares of Common Stock;

(iii)

sole power to dispose or direct the disposition of 2,818,799 shares of Common Stock; and

(iv)

shared power to dispose or direct the disposition of 526,081 shares of Common Stock.

Blake W. Nordstrom reports beneficial ownership of 3,344,880 shares of Common Stock, representing 2.0% of the outstanding shares of Common Stock.

The shares of Common Stock with respect to which Blake W. Nordstrom reports shared voting and dispositive power consist of 148,455 shares of Common Stock held by Mr. Nordstrom with Peter E. Nordstrom as co-trustees in family trusts for the benefit of the children of Erik B. Nordstrom. Pursuant to Rule 13d-4 under the Securities and Exchange Act of 1934, Mr. Nordstrom disclaims beneficial ownership with respect to any shares held in family trusts for which he would not otherwise be deemed to be beneficial owner. In addition, Mr. Nordstrom’s spouse, Molly Nordstrom, owns 377,626 shares of Common Stock, as to which Mr. Nordstrom may be deemed to have shared beneficial ownership.

(1)

Based on 166,239,726 shares of Common Stock issued and outstanding as of August 23, 2017, as reported in the Issuer’s Quarterly Report on Form 10-Q for the second fiscal quarter, 2017, the most recently filed Securities Exchange Act of 1934 filing made by the Issuer that contains outstanding share information, filed with the U.S. Securities and Exchange Commission on August 29, 2017.

8

Applicable information required by Item 2 for Peter E. Nordstrom is provided in Item 2 above.

Erik B. Nordstrom

has:

(i)

sole power to vote or direct the vote of 3,409,563 shares of Common Stock;

(ii)

shared power to vote or direct the vote of 42,646 shares of Common Stock;

(iii)

sole power to dispose or direct the disposition of 3,409,563 shares of Common Stock; and

(iv)

shared power to dispose or direct the disposition of 42,646 shares of Common Stock.

Erik B. Nordstrom reports beneficial ownership of 3,452,209 shares of Common Stock, representing 2.1% of the outstanding shares of Common Stock.

The shares of Common Stock with respect to which Erik B. Nordstrom reports shared voting and dispositive power consist of 42,646 shares of Common Stock owned by his spouse, Julie Nordstrom, as to which Mr. Nordstrom may be deemed to have shared beneficial ownership.

James F. Nordstrom, Jr.

has:

(i)

sole power to vote or direct the vote of 829,633 shares of Common Stock;

(ii)

shared power to vote or direct the vote of 76,009 shares of Common Stock;

(iii)

sole power to dispose or direct the disposition of 829,633 shares of Common Stock; and

(iv)

shared power to dispose or direct the disposition of 76,009 shares of Common Stock.

James F. Nordstrom reports beneficial ownership of 905,642 shares of Common Stock, representing 0.5% of the outstanding shares of Common Stock.

The shares of Common Stock with respect to which James F. Nordstrom, Jr. reports shared voting and dispositive power consist of 73,777 shares of Common Stock held by Mr. Nordstrom with his wife, Lisa Nordstrom, as co-trustees in family trusts for the benefit of their children. In addition, Lisa Nordstrom owns 2,232 shares of Common Stock, as to which Mr. Nordstrom may be deemed to have shared beneficial ownership.

Applicable information required by Item 2 for Lisa Nordstrom is the same as that of James F. Nordstrom, Jr.

Peter E. Nordstrom

has:

(i)

sole power to vote or direct the vote of 2,978,536 shares of Common Stock;

(ii)

shared power to vote or direct the vote of 324,417 shares of Common Stock;

(iii)

sole power to dispose or direct the disposition of 2,978,536 shares of Common Stock; and

(iv)

shared power to dispose or direct the disposition of 324,417 shares of Common Stock.

Peter E. Nordstrom reports beneficial ownership of 3,302,953 shares of Common Stock, representing 2.0% of the outstanding shares of Common Stock.

The shares of Common Stock with respect to which Peter E. Nordstrom reports shared voting and dispositive power consist of 148,455 shares of Common Stock held by Mr. Nordstrom with Blake W. Nordstrom as co-trustees in family trusts for the benefit of the children of Erik B. Nordstrom. Pursuant to

9

Rule 13d-4 under the Securities and Exchange Act of 1934, Mr. Nordstrom disclaims beneficial ownership with respect to any shares held in family trusts for which he would not otherwise be deemed to be beneficial owner. In addition, Mr. Nordstrom’s spouse, Brandy Nordstrom, owns 175,962 shares of Common Stock, as to which Mr. Nordstrom may be deemed to have shared beneficial ownership.

Applicable information required by Item 2 for Blake W. Nordstrom is provided in Item 2 above.

10

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: October 13, 2017

|

|

*

|

|

|

Bruce A. Nordstrom

|

|

|

|

|

|

*

|

|

|

Anne E. Gittinger

|

|

|

|

|

|

/s/ Blake W. Nordstrom

|

|

|

Blake W. Nordstrom

|

|

|

|

|

|

*

|

|

|

Erik B. Nordstrom

|

|

|

|

|

|

*

|

|

|

James F. Nordstrom, Jr.

|

|

|

|

|

|

*

|

|

|

Peter E. Nordstrom

|

|

|

|

|

|

|

|

By:

|

/s/ Blake W. Nordstrom

|

|

|

Blake W. Nordstrom as Attorney-In-Fact

|

|

|

|

|

|

11

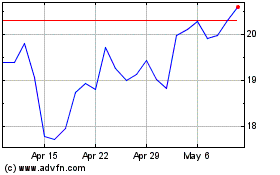

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

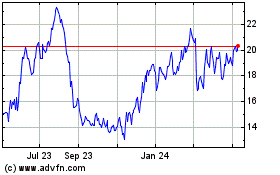

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Apr 2023 to Apr 2024