By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Trucking companies are piling up big revenue growth in a

resurgent U.S. economy while they try to keep costs from growing

just as fast. Analysts expect rising driver pay and disruptions

from September's big storms to weight on third-quarter results for

truckload carriers, WSJ Logistics Report's Jennifer Smith writes,

even as manufacturing activity expands and retailers appear to be

restocking inventories at a rapid pace. J.B. Hunt Transport

Services Inc. highlighted the market's whipsaw impact in its

just-released earnings, reporting net profit fell 8.2% in the

September quarter despite an 8.9% boost in revenue. Stronger demand

and hurricane-relief efforts have left capacity tighter and

shipping rates higher, but some fleets are struggling to find

drivers. They're competing for workers in a tight labor market

where construction and energy jobs also beckon, and some companies

are boosting pay and recruiting incentives before they've secured

broader rate increases with shippers. They're betting that if they

can get the revenue sooner the profits will quickly follow.

Here's a real page-turner for the logistics world: books are

back in vogue, and publishers want to speed up supply chains to

catch new readers. With e-book sales declining and consumer-book

sales growing after a decade of technological upheaval cut into

publishing revenues, executives at top companies say they are done

relying on new formats. Instead, the WSJ's Zeke Turner writes,

publishers are returning to fundamentals while streamlining

business to get books to the market faster than ever. Books are

among the array of products that have thinned out in consumer

distribution channels in an increasingly digital world, and the

return to growth will put more demand on trucking and warehousing

that serves the market. But the need for speed, driven in part by

rapid changes in the political world, will put new demands on

logistics. With publishers pushing to get big sellers to readers

sooner, shipping will have to get more nimble and move more quickly

through or even around distribution centers.

Steel is pushing back against aluminum in auto manufacturing

supply chains. Auto makers are using new varieties of lighter,

stronger steel in new models like Honda Motor Co.'s Ridgeline

pickup truck and General Motors Co.'s Chevrolet Malibu sedan, the

WSJ's Bob Tita writes, as the business reverses a years-long move

away from the metal to take the weight off cars with more flexible

aluminum and other light materials like carbon fiber. Steel has

always been cheaper and stronger than aluminum, but the weight of

conventional steel has worked against tougher fuel economy

requirements. New products are changing calculations, however, and

ArcelorMittal N.V. now expects auto makers' global demand for

press-hardened steel sheet, which is strong and malleable for

complex stamped parts, to grow 36% by 2020. That's shifting

industrial supply chains. Arcelor Mittal is opening the third U.S.

plant of its kind in Detroit this year to produce the new

generation of lightweight, super-strong sheets prized at auto

factories.

SUPPLY CHAIN STRATEGIES

Natural-gas producers have built formidable supply chains to

deliver their product around the world except for one key

component: the demand side. Energy companies are trying to

establish new markets for liquefied-natural gas, a version of the

fuel that can be easily shipped, the WSJ's Sarah McFarlane reports,

after erecting big export infrastructure only to see LNG prices

sink on global markets since 2014. Producers now are promoting LNG

for industrial trucking and shipping, and they're considering

building power plants and infrastructure in developing markets such

as South Africa and Vietnam. LNG demand has been growing, largely

because it is inexpensive and technological innovations cut the

cost of building import terminals. But many countries don't have

the infrastructure to distribute large amounts of gas. Investing in

the demand side carries bigger risks for producers, however,

bringing consumers that one expert notes are "less creditworthy,

less experienced, less organized, and politically less

predictable."

Tractor-trailers are put together for transporting food not

cooking it, but that means nothing when you're a truck driver on

the road and crave some jambalaya. That's why trucker Micheal

"Boomer" Welch found that canned chicken and tomato sauce and a

cut-up Slim Jim could help bring a waft of his Louisiana home to

his rig at a snowed-in Wyoming truck stop. Mr. Welch is part of a

small but highly discerning fleet of chefs on the road, WSJ

Logistics Report's Jennifer Smith writes, motivated by thrift,

health and creative attention to gustatory concerns to turn their

rigs into mobile kitchens. The trucker-chefs whip up meals with

cookers and crockpots that plug into the cigarette lighters of

their cabs. And they swap recipes online and compete in virtual

contests like the "Chopped Challenge" run by Big Truck Cooking, a

12,600-member Facebook group. They're helped by more goods at truck

stops aimed at cooking and a growing field of more experienced and

healthier drivers.

QUOTABLE

IN OTHER NEWS

Spending at U.S. retailers jumped 1.6% last month, boosted by

higher car sales and gasoline prices in the wake of several

hurricanes. (WSJ)

U.S. consumer prices rose 0.5% in September, mostly due to

higher fuel costs. (WSJ)

A measure of U.S. consumer sentiment rose swiftly in the first

half of October to its highest level since 2004. (WSJ)

Exports of goods from the eurozone jumped 2.5% in August despite

the euro's appreciation. (WSJ)

China boosted its crude oil imports by roughly 1 million barrels

a day in September. (WSJ)

General Motors Co. reached a tentative agreement with the union

representing factory workers who have been on strike for nearly a

month at an SUV plant in Canada. (WSJ)

Sears Canada Inc. won court approval to hold

going-out-of-business sales to begin liquidation of 130 stores

starting this week. (WSJ)

South Korea's finance minister says Seoul should diversify its

trade relations beyond the U.S. and China. (WSJ)

Glencore PLC has a standstill agreement temporarily preventing

it from making a hostile bid for Bunge Ltd., raising the

possibility it will renew efforts to acquire the grain trader.

(WSJ)

U.S. business inventories rose 0.9% in August in the largest

gain this year. (CNBC)

Maersk Line expects to trim about 11% of the Hamburg Sud

workforce as it integrates the German container line. (Lloyd's

List)

CSX Corp. plans to scale back operations at its North Baltimore,

Ohio, hub, a linchpin of its i ntermodal strategy. (Trains)

Couriers for U.K. delivery company Hermes say they are being

pressured to work for 20 straight days in the runup to Christmas.

(The Guardian)

Amazon.com Inc. is extending its U.K. expansion with the

addition of a distribution center in Bolton, in northwest England.

(Reuters)

U.S. safety regulators shut down Pyle Transportation, an

Iowa-based trucker tied to fatal immigrant deaths in Texas. (Cedar

Rapids Gazette)

Qatar Airways launched Boeing 777 freighter service to

Pittsburgh on a route starting in Doha. (American Shipper)

Yusen Logistics Co. Ltd. won halal certification in Indonesia,

part of an effort to expand in a fast-growing region with a large

Muslim population. (Nikkei Asian Review)

Bashar Obeid resigned as chief financial officer of Dubai-listed

logistics company Aramex. (Al Bawaba)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 16, 2017 06:47 ET (10:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

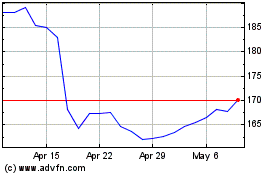

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

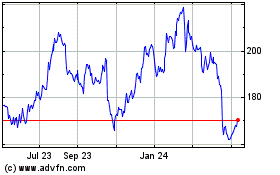

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Apr 2023 to Apr 2024