PayPal's Market Value Eclipses AmEx, Nears Morgan Stanley, Goldman

October 14 2017 - 9:29AM

Dow Jones News

By Peter Rudegeair

PayPal Holdings Inc. vaulted over American Express Co. in terms

of market value this week, punctuating a rally that has pushed up

the payments company's shares by nearly 75% since the start of

2017.

The San Jose, Calif.-based company has enjoyed breakneck growth

in both e-commerce and mobile money transfers. Its market

capitalization stands at about $83 billion, nearly double the $47

billion value it had when it spun off from eBay Inc. a little over

two years ago.

PayPal is even gaining ground on Wall Street titans. Its market

value is now around $6 billion less than Morgan Stanley's and

around $10 billion less than that of Goldman Sachs Group Inc.

The strong share gains for the company run by former AmEx

executive Dan Schulman have fueled investor debate about its

prospects. On Wednesday, analysts at Morgan Stanley upgraded

PayPal's stock, writing that it "is among the few large companies

that can deliver high-teens revenue [growth] ... with significant

upside opportunities."

But Craig Maurer, an analyst at Autonomous Research, said in an

interview that PayPal's shares are trading so richly that

shareholders aren't pricing in much room for error if the company

doesn't deliver on its projections.

"When I talk to bulls, they're in the nothing-can-go-wrong camp

because it's the only way to justify the valuation," Mr. Maurer

said.

PayPal, which reports earnings on Thursday, now trades at a

multiple of around 32 times forward earnings, according to FactSet.

So although its market value is around half that of Mastercard Inc.

and around two-fifths that of Visa Inc., its earnings multiple is

far dearer. Visa trades at around 27 times forward earnings and

Mastercard is around 29 times. AmEx, meanwhile, trades just shy of

15 times.

Under Mr. Schulman, PayPal has sought to branch out beyond its

best-known offering of a checkout button that enabled shoppers to

easily pay for goods and services on retailers' websites. The

company has spent more than $1 billion on acquisitions of firms

that provide services such as cross-border remittances,

utility-bill payments and small-business lending.

Additionally, PayPal has cut deals with credit-card networks,

banks, smartphone makers and other technology companies to make it

easier for customers of those firms to use its namesake digital

wallet. It is also pushing to expand the reach of divisions like

Braintree, which enables tech companies such as Uber Technologies

Inc. to accept mobile payments, and Venmo, which lets users send

money digitally to one another.

"It's grown into much more of a technology platform play," said

Lori Keith, a portfolio manager and research analyst at Parnassus

Investments, which owns PayPal shares. "They were trying to be the

disrupter in the space, but now they are very much focused on

partnering."

One of the biggest pending issues on which investors and

analysts are looking for clarity is what PayPal plans to do with

its lending operation.

Unlike Visa and Mastercard, PayPal makes and holds on to loans

to consumers and small businesses, which exposes it to the risk of

default should the economic environment worsen. At the end of the

second quarter, PayPal had $6.1 billion in loan balances on its

books largely financed with the company's cash.

"If they have an adverse credit report, people are suddenly

reminded of risk on the balance sheet," said Mr. Maurer.

PayPal executives have said they are looking at ways to continue

making loans but unload the credit risk to third parties and

potentially sell its outstanding loan portfolio.

Additionally, PayPal faces questions about whether the growth in

its payment volume is coming at the expense of profitability.

PayPal's so-called take rate, which measures the transaction

revenue it earns as a share of total payment volume, slipped to

2.58% in the second quarter from 2.69% in the same period a year

ago.

Then there is the threat PayPal faces from rival mobile wallets

from companies including Apple Inc. and Amazon.com Inc. Each

company has been looking to expand the number of online and

brick-and-mortar merchants that accept Apple Pay and Amazon

Pay.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

October 14, 2017 09:14 ET (13:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

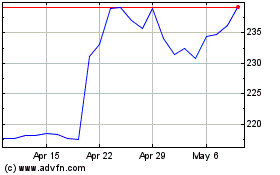

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

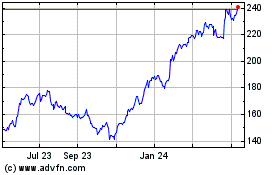

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024