UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed

by a Party other than the Registrant

☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

Definitive Additional Materials

|

|

|

|

|

☒

|

Soliciting Material Pursuant to §240.14a-12

|

HELIOS AND MATHESON ANALYTICS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

☒

|

No fee required.

|

|

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

|

Filing Party:

|

|

|

(4)

|

|

Date Filed:

|

The following is a copy

of a news article published online on October 11, 2017 by Reuters.com, containing quotes from Ted Farnsworth, the Chief Executive

Officer of Helios and Matheson Analytics Inc. (“HMNY,”

Helios” or the “Company”) relating to HMNY’s transaction

with MoviePass Inc. (“MoviePass”):

Helios & Matheson CEO eyes options for MoviePass expansion

Supantha Mukherjee, Arjun Panchadar

(Reuters) - Helios and Matheson Analytics is in talks with several

investors and investment banks over the future of its growing MoviePass business and does not rule out delaying a public floatation

past March, Chief Executive Ted Farnsworth said.

The IT firm agreed to buy a majority stake in online ticketing service,

MoviePass, for $27 million on Aug. 15 and has seen its shares rocket by more than 1000 percent in value since.

“We know it’s going to take a lot of capital but we

also know that there’s a lot of people that understand the business model, the subscription side,” he told Reuters

in a telephone interview. “We are talking to several of them as we speak.”

“We knew this going into it with our business model that we

would go out there and raise more money for MoviePass and right now I think especially with so much going on with the stock it’s

a lot of excitement around.”

Analysts say a surge in MoviePass subscribers from 20,000 to more

than 400,000 between mid-August and mid-September suggested company targets of 2.5 million subscribers next year may prove overly

conservative.

Farnsworth declined to give an updated figure for subscriber numbers

or the company’s targets, but said the numbers using MoviePass every day were now in the tens of thousands.

When asked about MoviePass’ plan to go public by March 31,

2018, Farnsworth said it was still on track but that he and MoviePass chief executive, former Netflix manager Mitch Lowe, did not

rule out a delay.

“We are wide open and more than flexible, but that’s

our plan right now,” Farnsworth said.

Reporting by Supantha Mukherjee and Arjun Panchadar; editing by

Patrick Graham

Cautionary Statement on Forward-looking Information

Certain information in this communication contains

“forward-looking statements” about HMNY and MoviePass within the meaning of the Private Securities Litigation Reform

Act of 1995 or under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended (collectively, “forward-looking statements”), that may not be based on historical fact, but instead

relate to future events. events. Forward-looking statements are generally identified by words such as “projects,”

“may,” “will,” “could,” “would,” “should,” “believes,”

“expects,” “anticipates,” “estimates,” “intends,” “plans,” “potential”

or similar expressions Such forward-looking statements include, without limitation, statements regarding (i) the expected completion

of HMNY’s acquisition of a controlling interest in MoviePass, (ii) the time frame in which such acquisition is expected

to occur, (iii) the expected benefits to HMNY and MoviePass from completing the acquisition and (iv) MoviePass’ business

and subscriber growth. Statements regarding future events are based on the parties' current expectations and are necessarily subject

to associated risks related to, among other things, the conditions to the closing of the acquisition may not be satisfied, the

occurrence of any event, change or other circumstances that could give rise to the termination of the acquisition agreement between

MoviePass and HMNY, MoviePass’ continuing need for additional financing, and general economic conditions. Therefore, actual

results may differ materially and adversely from those expressed in any forward-looking statements.

Such forward-looking statements are based on

a number of assumptions. Although management of HMNY and MoviePass believe that the assumptions made and expectations represented

by such statements are reasonable, there can be no assurance that a forward-looking statement contained herein will prove to be

accurate. Actual results and developments may differ materially and adversely from those expressed or implied by the forward-looking

statements contained herein and even if such actual results and developments are realized or substantially realized, there can

be no assurance that they will have the expected consequences or effects.

Risk factors and other material information

concerning HMNY and MoviePass are described in the Current Report on Form 8-K filed with the SEC on October 11, 2017, in HMNY’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and other HMNY filings, including subsequent current and

periodic reports, information statements and registration statements filed with the SEC. You are cautioned to review such reports

and other filings at www.sec.gov.

Given these risks, uncertainties and factors,

you are cautioned not to place undue reliance on such forward-looking statements and information, which are qualified in their

entirety by this cautionary statement. All forward-looking statements and information made herein are based on HMNY’s and

MoviePass’ current expectations and HMNY does not undertake an obligation to revise or update such forward-looking statements

and information to reflect subsequent events or circumstances, except as required by law.

In particular, MoviePass’ $9.95 per month

subscription pricing model is new. There can be no assurance that the resulting rate of increase in its subscribers will continue

or be sustained. Moreover, the increase in the number of MoviePass subscribers provides no assurance that the MoviePass business

model will lead to profitability.

1

Important Additional Information

This communication does

not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

This communication relates to the MoviePass Transaction, which will become the subject of a proxy statement to be filed with the

SEC by Helios, and may be deemed to be solicitation material in respect of the MoviePass Transaction. This document is not a substitute

for the proxy

statement that Helios will file with the SEC or any other documents that Helios may file with the SEC

or transmit to stockholders in connection with the MoviePass Transaction. Before making any voting decision, investors and security

holders are urged to read the proxy statement and all other relevant documents filed or that will be filed with the SEC in connection

with the MoviePass Transaction as they become available because they will contain important information about the proposed transaction

and related matters. Investors and security holders will be able to obtain free copies of the proxy statement and all other relevant

documents filed or that will be filed with the SEC by Helios through the website maintained by the SEC at www.sec.gov.

In addition, investors

and security holders will be able to obtain free copies of the proxy statement, once it is filed, from

Helios

by accessing Helios’ website at www.hmny.com or upon written request to: Helios and Matheson Analytics Inc., Attn: Secretary,

Empire State Building, 350 Fifth Avenue, Suite 7520, New York, New York 10118, (212) 979-8228.

Participants in the Solicitation

Helios, MoviePass and

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Helios’

stockholders in connection with the MoviePass Transaction. Information regarding Helios’ directors and executive officers

is contained in its annual report on Form 10-K for the year ended December 31, 2016, filed with the SEC on April 14, 2017, and

its definitive proxy statement on Schedule 14A filed with the SEC on October 3, 2017. You can obtain a free copy of these documents

at the SEC’s website at www.sec.gov or by accessing Helios’ website at www.hmny.com. Additional information regarding

the interests of those persons and other persons who may be deemed participants in the MoviePass Transaction may be obtained by

reading the proxy statement regarding the MoviePass Transaction, when it becomes available. You may obtain free copies of this

document as described in the preceding paragraph.

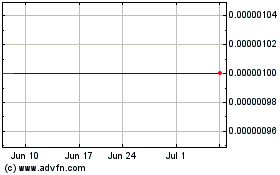

Helios and Matheson Anal... (CE) (USOTC:HMNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

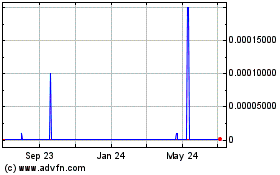

Helios and Matheson Anal... (CE) (USOTC:HMNY)

Historical Stock Chart

From Apr 2023 to Apr 2024