- Third Quarter 2017 Revenue:

$1.84 billion; up 9%

- Third Quarter 2017 Operating

Income: $165 million; down 10%

- Third Quarter 2017 EPS: 91

cents vs. 97 cents

J.B. Hunt Transport Services, Inc., (NASDAQ: JBHT) announced

third quarter 2017 net earnings of $100.4 million, or diluted

earnings per share of 91 cents vs. third quarter 2016 net earnings

of $109.4 million, or 97 cents per diluted share.

Total operating revenue for the current quarter was $1.84

billion, compared with $1.69 billion for the third quarter 2016.

Load growth of 6% in Intermodal (JBI), a 14% increase in revenue

producing trucks and improved asset productivity in Dedicated

Contract Services (DCS)™ and a 17% increase in revenue per load in

Integrated Capacity Solutions (ICS) contributed to the increase in

consolidated revenue compared to prior year. Operating revenue

growth was partially offset by a 7% decrease in load count in the

Truck (JBT) business segment and the disruption caused by

hurricanes Harvey, Irma and Maria. Current quarter total operating

revenue, excluding fuel surcharges, increased 8% vs. the comparable

quarter 2016.

Operating income for the current quarter totaled $165 million

vs. $183 million for the third quarter 2016. Operating income

decreased from third quarter 2016 primarily from increases in

driver wages and recruiting costs, increased rail purchase

transportation rates, higher insurance and claims costs, increased

legal and consulting costs, higher equipment maintenance costs and

acquisition and integration costs incurred by DCS with the purchase

of Special Logistics Dedicated (SLD) that closed during the

quarter.

Interest expense in the current quarter increased primarily from

higher debt balances and higher interest rates compared to third

quarter 2016. The effective income tax rate for the current quarter

is 35.9%, compared to 38% in the third quarter 2016. We expect our

2017 annual tax rate to be approximately 35%.

Segment Information:

Intermodal (JBI)

- Third Quarter 2017 Segment

Revenue: $1.05 billion; up 8%

- Third Quarter 2017 Operating

Income: $109.1 million; down 7%

Overall volumes increased 6% over the same period in 2016. The

Eastern network realized load growth of 2% and Transcontinental

loads grew 8% over the third quarter 2016. The network disruption

caused from hurricanes Harvey, Irma and Maria limited our ability

to handle approximately 5,500 loads in the current period. Revenue

increased 8% reflecting the 6% volume growth and an approximate 2%

increase in revenue per load, which is the combination of changes

in customer rate, freight mix and fuel surcharges. Revenue per load

excluding fuel surcharges was flat compared to third quarter

2016.

Operating income decreased 7% over prior year. Benefits from

improved volumes were offset by increased costs to attract, place

and retain drivers; higher insurance and claims costs; increases in

rail purchased transportation rates; increases in costs from

inefficiencies due to rail congestion, rationalization and

maintenance; and approximately $1.8 million in additional costs and

inefficiencies in the dray and rail networks in areas directly

affected by natural disasters. The current period ended with

approximately 87,000 units of trailing capacity and 5,500 power

units assigned to the dray fleet.

Dedicated Contract Services (DCS)

- Third Quarter 2017 Segment

Revenue: $438 million; up 11%

- Third Quarter 2017 Operating

Income: $42.9 million; down 18%

DCS revenue increased 11% during the current quarter over the

same period in 2016. Productivity (revenue per truck per week)

increased by approximately 2% vs. 2016. Productivity excluding fuel

surcharge revenue was flat from a year ago. Increased revenue from

better integration of assets between customer accounts and customer

rate increases was partially offset by lower productivity at new

contracts implemented during the current quarter. A net additional

1,024 revenue producing trucks, 621 net additions sequentially from

second quarter 2017 including 328 acquired in the SLD purchase,

were in the fleet by the end of the quarter. Approximately 63% of

these additions represent private fleet conversions versus

traditional dedicated capacity services. Customer retention rates

remain above 98%.

Operating income decreased by 18% from a year ago primarily from

the timing between increasing driver wages and recovery through

customer contracts, increased driver recruiting costs including the

length of time to fill open trucks, increased insurance and claims

costs, increased salaries and benefits costs, higher equipment

ownership costs and approximately $1 million of excess costs

associated with operations in the hurricane affected regions

compared to the same period in 2016. During the current period, DCS

incurred approximately $3 million in acquisition costs and $1.5

million in intangible asset amortization due to the purchase of

SLD.

Integrated Capacity Solutions (ICS)

- Third Quarter 2017 Segment

Revenue: $269 million; up 16%

- Third Quarter 2017 Operating

Income: $ 7.3 million; down 14%

ICS revenue increased 16% in the current quarter vs. the third

quarter 2016. Revenue per load increased 17% from increased spot

market activity while load volumes decreased 1% vs third quarter

2016. While continuing to meet our customer commitments, increased

spot market activity created a better balance between contractual

and spot revenues. Contractual volumes represented approximately

65% of total load volume and 48% of total revenue in the current

quarter compared to 75% and 64%, respectively, in third quarter

2016.

Operating income decreased 14% over the same period 2016. Gross

profit margin was flat at 12.8% compared to the prior year as

continued compression of gross margins in contractual business

offset improvements in spot market gross margins. Higher year over

year technology development costs and a higher number of branches

open less than two years (23 vs. 15) more than offset the increased

revenue compared to a year ago. Total location count grew to 44

compared to 40 at the end of third quarter last year. ICS’s carrier

base increased 10% and the employee count increased 17% vs. third

quarter 2016.

Truck (JBT)

- Third Quarter 2017 Segment

Revenue: $ 93 million; down 5%

- Third Quarter 2017 Operating

Income: $ 5.7 million; up 12%

JBT revenue was down 5% from the same period in 2016. Revenue

excluding fuel surcharge decreased 6%, primarily from a 7% decrease

in load count from third quarter 2016. Revenue per load increased

approximately 1% due to a 4% increase in rates per loaded mile

offset by a 3% decrease in length of haul compared to a year ago.

Comparable contractual customer rates were flat compared to the

same period in 2016. At the end of the period, JBT operated 2,040

tractors compared to 2,183 a year ago.

Operating income increased 12% compared to third quarter 2016.

Favorable changes from higher rates per loaded mile and lower

insurance and claims costs were partially offset by increased

driver wages and independent contractor costs per mile, a decrease

in fleet size, lower tractor utilization from an increase in

unseated trucks and higher equipment maintenance costs compared to

third quarter 2016.

Cash Flow and Capitalization:

At September 30, 2017, we had a total of $1.08 billion

outstanding on various debt instruments compared to $944 million at

September 30, 2016 and $986 million at December 31, 2016.

Our net capital expenditures for the nine months ended September

30, 2017 approximated $330 million compared to $359 million for the

same period 2016. At September 30, 2017, we had cash and cash

equivalents of approximately $7.7 million. Other assets include

approximately $55-$65 million of amortizable intangible assets

related to the purchase of SLD.

We had no purchases of our common stock during the third quarter

2017. At September 30,2017, we had approximately $521 million

remaining under our combined share repurchase authorizations.

Actual shares outstanding at September 30, 2017 approximated 110

million.

This press release may contain forward-looking statements, which

are based on information currently available. Actual results may

differ materially from those currently anticipated due to a number

of factors, including, but not limited to, those discussed in Item

1A of our Annual Report filed on Form 10-K for the year ended

December 31, 2016. We assume no obligation to update any

forward-looking statement to the extent we become aware that it

will not be achieved for any reason. This press release and

additional information will be available immediately to interested

parties on our web site, www.jbhunt.com.

J.B. HUNT TRANSPORT SERVICES,

INC. Condensed Consolidated Statements of Earnings (in

thousands, except per share data) (unaudited)

Three Months Ended

September 30 2017 2016 % Of % Of

Amount Revenue Amount

Revenue Operating revenues, excluding fuel

surcharge revenues $ 1,657,380 $ 1,538,701 Fuel surcharge revenues

185,954 151,958 Total operating

revenues 1,843,334 100.0 % 1,690,659 100.0 % Operating

expenses Rents and purchased transportation 947,145 51.4 % 846,238

50.1 % Salaries, wages and employee benefits 408,340 22.2 % 374,517

22.2 % Depreciation and amortization 95,959 5.2 % 91,001 5.4 % Fuel

and fuel taxes 87,006 4.7 % 74,179 4.4 % Operating supplies and

expenses 67,578 3.7 % 62,191 3.7 % Insurance and claims 26,463 1.4

% 21,862 1.3 % General and administrative expenses, net of asset

dispositions 29,389 1.6 % 21,025 1.1 % Operating taxes and licenses

10,744 0.6 % 11,665 0.7 % Communication and utilities 5,738

0.3 % 5,004 0.3 % Total operating expenses

1,678,362 91.1 % 1,507,682 89.2 %

Operating income 164,972 8.9 % 182,977 10.8 % Net interest expense

8,310 0.4 % 6,485 0.4 % Earnings before

income taxes 156,662 8.5 % 176,492 10.4 % Income taxes

56,277 3.1 % 67,067 3.9 % Net earnings $

100,385 5.4 % $ 109,425 6.5 % Average diluted shares

outstanding 110,628 113,363 Diluted

earnings per share $ 0.91 $ 0.97

J.B. HUNT TRANSPORT SERVICES, INC. Condensed

Consolidated Statements of Earnings (in thousands, except per

share data) (unaudited)

Nine Months Ended September

30 2017 2016 % Of % Of

Amount Revenue Amount

Revenue Operating revenues, excluding fuel

surcharge revenues $ 4,670,200 $ 4,448,709 Fuel surcharge revenues

529,208 385,688 Total operating

revenues 5,199,408 100.0 % 4,834,397 100.0 % Operating

expenses Rents and purchased transportation 2,624,707 50.5 %

2,381,547 49.3 % Salaries, wages and employee benefits 1,178,524

22.7 % 1,108,997 22.9 % Depreciation and amortization 281,198 5.4 %

269,717 5.6 % Fuel and fuel taxes 246,725 4.7 % 205,082 4.2 %

Operating supplies and expenses 190,085 3.7 % 173,222 3.6 %

Insurance and claims 76,930 1.5 % 58,384 1.2 % General and

administrative expenses, net of asset dispositions 74,597 1.4 %

61,570 1.3 % Operating taxes and licenses 32,329 0.6 % 34,156 0.7 %

Communication and utilities 16,337 0.3 %

15,063 0.3 % Total operating expenses 4,721,432

90.8 % 4,307,738 89.1 % Operating income

477,976 9.2 % 526,659 10.9 % Net interest expense 22,521

0.4 % 19,347 0.4 % Earnings before income

taxes 455,455 8.8 % 507,312 10.5 % Income taxes 154,499

3.0 % 192,778 4.0 % Net earnings $ 300,956

5.8 % $ 314,534 6.5 % Average diluted shares

outstanding 111,154 113,709 Diluted

earnings per share $ 2.71 $ 2.77

Financial Information By

Segment (in thousands) (unaudited)

Three Months Ended

September 30 2017 2016 % Of % Of

Amount Total Amount

Total

Revenue

Intermodal $ 1,048,187 57 % $ 969,654 57 % Dedicated 437,521

24 % 393,770 23 % Integrated Capacity Solutions 269,451 14 %

233,022 14 % Truck 92,632 5 % 97,154 6

% Subtotal 1,847,791 100 % 1,693,600 100 % Intersegment

eliminations (4,457 ) (0 %) (2,941 ) (0 %)

Consolidated revenue $ 1,843,334 100 % $ 1,690,659

100 %

Operating

income

Intermodal $ 109,130 66 % $ 116,885 64 % Dedicated 42,867 26

% 52,463 28 % Integrated Capacity Solutions 7,291 4 % 8,516 5 %

Truck 5,713 4 % 5,080 3 % Other (1) (29 ) (0 %) 33

0 % Operating income $ 164,972 100 % $ 182,977

100 %

Nine Months Ended September 30

2017 2016 % Of % Of Amount

Total Amount Total

Revenue

Intermodal $ 2,986,746 57 % $ 2,798,284 58 % Dedicated

1,241,899 24 % 1,134,861 23 % Integrated Capacity Solutions 701,335

14 % 619,956 13 % Truck 280,895 5 % 291,468

6 % Subtotal 5,210,875 100 % 4,844,569 100 % Intersegment

eliminations (11,467 ) (0 %) (10,172 ) (0 %)

Consolidated revenue $ 5,199,408 100 % $ 4,834,397

100 %

Operating

income

Intermodal $ 314,105 66 % $ 325,625 62 % Dedicated 136,195

29 % 147,700 28 % Integrated Capacity Solutions 11,520 2 % 30,186 6

% Truck 16,216 3 % 23,112 4 % Other (1) (60 ) (0 %)

36 0 % Operating income $ 477,976 100 % $ 526,659

100 % (1) Includes corporate support activity

Operating

Statistics by Segment (unaudited)

Three Months Ended September 30

2017 2016

Intermodal

Loads 516,260 489,109 Average length of haul 1,685 1,662

Revenue per load $ 2,030 $ 1,983 Average tractors during the period

* 5,461 5,279 Tractors (end of period) Company-owned 4,768

4,568 Independent contractor 773 714

Total tractors 5,541 5,282 Net change in trailing equipment

during the period 1,724 1,578 Trailing equipment (end of period)

87,305 82,821 Average effective trailing equipment usage 86,622

79,107

Dedicated

Loads 655,881 607,876 Average length of haul 177 177 Revenue

per truck per week** $ 4,196 $ 4,120 Average trucks during the

period*** 8,105 7,357 Trucks (end of period) Company-owned

7,792 6,936 Independent contractor 55 22 Customer-owned (Dedicated

operated) 549 414 Total trucks 8,396

7,372 Trailing equipment (end of period) 24,524 22,391

Average effective trailing equipment usage 24,914 22,939

Integrated

Capacity Solutions

Loads 236,796 239,399 Revenue per load $ 1,138 $ 973 Gross

profit margin 12.8 % 12.8 % Employee count (end of period) 899 769

Approximate number of third-party carriers (end of period) 54,900

50,100

Truck

Loads 90,520 97,052 Average length of haul 437 453 Loaded

miles (000) 39,516 43,865 Total miles (000) 47,292 52,317 Average

nonpaid empty miles per load 86.0 87.2 Revenue per tractor per

week** $ 3,524 $ 3,468 Average tractors during the period * 2,055

2,162 Tractors (end of period) Company-owned 1,340 1,384

Independent contractor 700 799 Total

tractors 2,040 2,183 Trailers (end of period) 7,538 7,572

Average effective trailing equipment usage 7,099 7,083

* Includes company-owned and independent contractor tractors

** Using weighted workdays *** Includes company-owned, independent

contractor, and customer-owned trucks

Operating Statistics by Segment

(unaudited)

Nine Months Ended September 30

2017 2016

Intermodal

Loads 1,484,138 1,424,733 Average length of haul 1,680 1,648

Revenue per load $ 2,012 $ 1,964 Average tractors during the period

* 5,301 5,206 Tractors (end of period) Company-owned 4,768

4,568 Independent contractor 773 714

Total tractors 5,541 5,282 Net change in trailing equipment

during the period 2,711 3,864 Trailing equipment (end of period)

87,305 82,821 Average effective trailing equipment usage 85,719

75,702

Dedicated

Loads 1,888,770 1,794,432 Average length of haul 178 175

Revenue per truck per week** $ 4,156 $ 4,021 Average trucks during

the period*** 7,737 7,280 Trucks (end of period)

Company-owned 7,792 6,936 Independent contractor 55 22

Customer-owned (Dedicated operated) 549 414

Total trucks 8,396 7,372 Trailing equipment (end of

period) 24,524 22,391 Average effective trailing equipment usage

24,126 22,657

Integrated

Capacity Solutions

Loads 714,923 614,334 Revenue per load $ 981 $ 1,009 Gross

profit margin 12.9 % 14.9 % Employee count (end of period) 899 769

Approximate number of third-party carriers (end of period) 54,900

50,100

Truck

Loads 283,053 288,392 Average length of haul 435 460 Loaded

miles (000) 123,080 132,562 Total miles (000) 147,227 157,526

Average nonpaid empty miles per load 86.1 86.6 Revenue per tractor

per week** $ 3,484 $ 3,432 Average tractors during the period*

2,103 2,202 Tractors (end of period) Company-owned 1,340

1,384 Independent contractor 700 799

Total tractors 2,040 2,183 Trailers (end of period) 7,538

7,572 Average effective trailing equipment usage 7,165 6,846

* Includes company-owned and independent contractor tractors

** Using weighted workdays *** Includes company-owned, independent

contractor, and customer-owned trucks

J.B. HUNT TRANSPORT SERVICES, INC.

Condensed Consolidated Balance Sheets (in thousands)

(unaudited)

September

30, 2017 December 31, 2016

ASSETS Current assets: Cash and cash equivalents $ 7,707 $

6,377 Accounts receivable 858,720 745,288 Prepaid expenses and

other 140,164

194,016 Total current assets

1,006,591

945,681 Property and equipment 4,507,917 4,258,915

Less accumulated depreciation

1,632,108 1,440,124 Net

property and equipment 2,875,809

2,818,791 Other assets

171,523

64,516 $

4,053,923 $ 3,828,988

LIABILITIES & STOCKHOLDERS' EQUITY Current

liabilities: Trade accounts payable $ 493,585 $ 384,308 Claims

accruals 117,645 109,745 Accrued payroll 47,514 51,929 Other

accrued expenses 23,011

27,152 Total current liabilities

681,755

573,134 Long-term debt 1,084,801

986,278 Other long-term liabilities 68,564 64,881 Deferred income

taxes 746,833 790,634 Stockholders' equity

1,471,970

1,414,061 $ 4,053,923

$ 3,828,988

Supplemental Data (unaudited)

September 30, 2017

December 31, 2016 Actual shares outstanding at end of

period (000) 109,752

111,305 Book value per

actual share outstanding at end of period

$ 13.41 $ 12.70

Nine Months Ended September 30 2017

2016 Net cash provided by operating activities (000)

$ 628,549 $

683,963 Net capital expenditures (000)

$ 329,775 $ 358,754

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171013005065/en/

J.B. Hunt Transport Services, Inc.David G. Mee,

479-820-8363Executive Vice President, Finance/Administration and

Chief Financial Officer

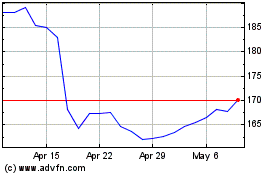

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

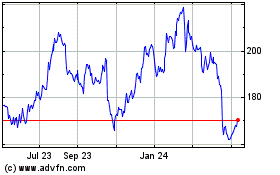

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Apr 2023 to Apr 2024