Sonos, a Wireless-Speaker Pioneer, Plays Catch Up

October 04 2017 - 10:59AM

Dow Jones News

By Yoree Koh

Sonos Inc., the pioneer in wireless speakers, was on its way to

$1 billion in sales in 2015 when Amazon.com Inc.'s Echo smart

speaker took off. Sonos's sales fell off a cliff.

Sonos now has a new game plan: Partnering with its rivals -- all

of them.

On Wednesday, the Santa Barbara, Calif.-based company is

announcing its first smart speaker, the $199 Sonos One, powered by

Amazon's Alexa voice assistant. By next year, the company will

integrate Alphabet Inc.'s Google voice assistant, and down the road

hopes to make its smart speaker compatible with Apple Inc.'s Siri

and others. The partnerships would mean consumers wouldn't need to

choose one tech giant's services over another -- Sonos could serve

them all.

The company built a loyal fan base by letting customers play

music in every room of a home through a network of wireless

speakers that supported streaming services such as Spotify and

Apple Music. Speakers, though, are no longer just for listening to

music.

Chief Executive Patrick Spence admits the company became

"complacent" when it came to artificially intelligent assistants.

Sonos "missed the turn on voice," he said in an interview.

Amazon's Echo has become a game-changing product thanks to

Alexa, which can play music, answer questions, relay the day's

news, provide weather forecasts and more. The Echo has captured

about three-quarters of the U.S. market for smart speakers, with

more than 15 million total devices sold as of June, according to

Consumer Intelligence Research Partners.

On Wednesday, Google, which has the other quarter of the

smart-speaker market, is expected to unveil a successor to its

Google Home speaker. Apple is readying its $349 HomePod speaker for

a December release.

Sonos saw itself getting shut out of a category it helped

create.

Its pivot came amid change at the top. In January, founder John

MacFarlane stepped down after 14 years as chief. Mr. Spence took

over and has sought to make Sonos, known for its obsessive but

time-consuming attention to detail, move faster to catch up in the

smart-speaker revolution.

Sonos, which has raised about $110 million in primary funding

from investors, including Index Ventures and KKR & Co., also is

seriously considering an initial public offering, the company

said.

As part of its strategy of working with the very rivals that

upended it, Sonos said it would support Apple's AirPlay 2 in 2018,

letting owners control their Sonos speakers through any

Siri-enabled device such as an iPhone. A free software upgrade will

allow Sonos speakers to be controlled through any Alexa device such

as an Echo or Dot.

Partnering with a tech giant won't make it any less a

competitor, analysts said. The cash-rich giants are able to adjust

the price on their speakers more easily than a smaller player like

Sonos, said Ben Arnold, an analyst at NPD. Amazon flexed those

muscles last week when it cut the price on the Echo by $80 to

$100.

One hurdle will be getting tech juggernauts to play nice. For

instance, Sonos users can ask Alexa to play music if they also

subscribe to Amazon Prime, but they won't be able to use their

voice to start a song on Apple Music.

Mr. Spence said he isn't worried: "Our job is solving those gaps

over time."

Mr. Spence said the company is back on track to cross $1 billion

in revenue this year, helped by sales of its $699 Playbase, a

wireless speaker for TVs that launched in March. Sonos hopes its

inaugural smart speaker will continue that momentum.

"The promising tailwind that we have is more interest in smart

speakers thanks to the work of Amazon and Google jumping in," Mr.

Spence said.

Write to Yoree Koh at yoree.koh@wsj.com

(END) Dow Jones Newswires

October 04, 2017 10:44 ET (14:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

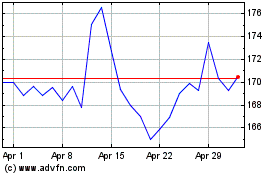

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

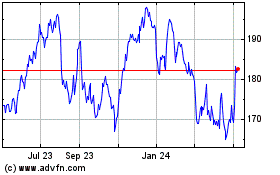

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024