As filed with the Securities and Exchange Commission on October 3, 2017

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN

SUPERCONDUCTOR CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

64 Jackson Road

Devens, Massachusetts 01434

(978) 842-3000

|

|

04-2959321

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

|

|

(I.R.S. Employer

Identification Number)

|

Daniel P. McGahn

President and Chief Executive Officer

American Superconductor Corporation

64 Jackson Road

Devens,

Massachusetts 01434

(978) 842-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Peter

N. Handrinos

Gregory P. Rodgers

Latham & Watkins LLP

200 Clarendon Street

Boston, MA 02116

(617)

948-6000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that

shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be

Registered

|

|

Amount

to be

Registered (1)

|

|

Offering

Price Per Share (2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, $0.01 par value per share

|

|

884,890 shares

|

|

$3.99

|

|

$3,530,711.10

|

|

$439.57

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this registration statement also covers such additional shares as may hereafter be offered or issued to prevent dilution resulting from stock splits,

stock dividends, recapitalizations or certain other capital adjustments.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended. The price per share and aggregate offering price are based on the average

of the high and low prices of the registrant’s common stock on September 26, 2017, as reported on The NASDAQ Global Select Market.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. The

selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to

Completion, Dated October 3, 2017

PROSPECTUS

American Superconductor Corporation

884,890 Shares of Common Stock

This prospectus relates to the proposed offering and resale by the selling stockholders identified in this prospectus of up to an aggregate of

884,890 shares of common stock, par value $0.01 per share, of American Superconductor Corporation. We are not selling any shares of common stock under this prospectus and will not receive any of the proceeds from the sale or other disposition of

common stock by the selling stockholders.

The selling stockholders may sell the shares of common stock on any national securities

exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market, in one or more transactions otherwise than on these exchanges or systems, such as privately negotiated transactions,

or using a combination of these methods, and at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. See the disclosure under the heading “Plan of

Distribution” elsewhere in this prospectus for more information about how the selling stockholders may sell or otherwise dispose of their shares of common stock hereunder.

Except as described in “Selling Stockholders,” the selling stockholders may sell any, all or none of the securities offered by this

prospectus and we do not know when or in what amount the selling stockholders may sell their shares of common stock hereunder following the effective date of the registration statement of which this prospectus forms a part.

Our common stock is listed on The NASDAQ Global Select Market under the symbol “AMSC”. On October 2, 2017, the last reported sale

price of our common stock on The NASDAQ Global Select Market was $4.62 per share.

Investing in

our common stock involves a high degree of risk. Before making an investment decision, please read the information under the heading “

Risk Factors

” beginning on page 3 of this prospectus and in the documents

incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October , 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a

“shelf” registration process. Under this shelf registration process, the selling stockholders may from time to time sell the shares of common stock described in this prospectus in one or more offerings.

We have not authorized anyone to give any information or to make any representation other than those contained or incorporated by reference in

this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in

jurisdictions where it is lawful to do so. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any shares other than the registered shares to which they relate, nor does this prospectus constitute an offer to

sell or the solicitation of an offer to buy shares in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus is accurate

on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus

is delivered or shares are sold on a later date.

When we refer to “AMSC,” “we,” “our,” “us” and

the “Company” in this prospectus, we mean American Superconductor Corporation and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. For this purpose, any statements contained or incorporated

herein that relate to future events or conditions, including, but not limited to, statements regarding industry prospects, our addressable markets, capabilities and potential uses of our products, or our prospective results of operations or

financial position, may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects” and similar expressions are intended to identify

forward-looking statements. Such forward-looking statements represent management’s current expectations and are inherently uncertain. There are a number of important factors that could materially impact the value of our common stock or cause

actual results to differ materially from those indicated by such forward-looking statements. We discuss many of these risks in greater detail in the documents incorporated by reference herein, including under the heading “Risk Factors” in

any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act.

These important factors, among

others, could cause actual results to differ materially from those indicated by forward-looking statements made herein and presented elsewhere by management from time to time. Any such forward-looking statements represent management’s estimates

only as of the date of the relevant document. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing our views as of any date subsequent to the date such statements are made. We undertake no obligation to revise or update any forward-looking statements, except to the extent required by law.

i

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus or in documents incorporated herein by reference. This

summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information set forth in the section entitled

“Risk Factors” and the information that is incorporated by reference into this prospectus. See the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” for a

further discussion on incorporation by reference.

Our Company

American Superconductor Corporation is a leading provider of megawatt-scale solutions that lower the cost of wind power and enhance the

performance of the power grid. In the wind power market, we enable manufacturers to field highly competitive wind turbines through our advanced power electronics products, engineering and support services. In the power grid market, we enable

electric utilities and renewable energy project developers to connect, transmit and distribute power through our transmission planning services and power electronics and superconductor-based products. Our wind and power grid products and services

provide exceptional reliability, security, efficiency and affordability to our customers.

Corporate History and Information

American Superconductor Corporation was incorporated in Delaware in 1987. Our principal executive offices are located at 64 Jackson Road,

Devens, Massachusetts 01434, and our telephone number is (978) 842-3000.

1

THE OFFERING

|

|

|

|

|

|

|

|

Common Stock outstanding as of September 15, 2017

|

|

19,562,042

|

|

|

|

|

Common Stock offered by the selling stockholders

|

|

884,890 shares

|

|

|

|

|

Common Stock outstanding after this offering

|

|

20,446,932 shares(1)

|

|

|

|

|

Terms of the offering

|

|

The selling stockholders will determine when and how they sell the common stock offered in this prospectus, as described in “Plan of Distribution.”

|

|

|

|

|

Use of proceeds

|

|

We will not receive any of the proceeds from the sale of the shares of common stock being offered under this prospectus. See “Use of Proceeds.”

|

|

|

|

|

NASDAQ symbol

|

|

Our common stock is listed on The NASDAQ Global Select Market under the symbol AMSC.

|

|

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

|

(1)

|

Based solely on 19,562,042 shares of common stock outstanding as of September 15, 2017 plus 884,890 shares of common stock issued to the selling stockholders.

|

2

RISK FACTORS

Investment in any securities offered pursuant to this prospectus involves risks. Before making an investment decision, you should carefully

consider the specific risks described under the caption “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, which we have incorporated herein by reference. Each of the risks

described in these headings could adversely affect our business, financial condition, results of operations and prospects, and could result in a complete loss of your investment. For more information, see “Where You Can Find More

Information.”

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares by the selling stockholders.

3

SELLING STOCKHOLDERS

This prospectus covers the resale or other disposition from time to time by the selling stockholders identified in the table below of up to an

aggregate of 884,890 shares of our common stock.

On September 25, 2017, we entered into a stock purchase agreement with the selling

stockholders, which we refer to herein as the “Stock Purchase Agreement”, pursuant to which the selling stockholders sold us all of the issued and outstanding common stock of Infinia Technology Corporation and, in exchange, we, among other

things, issued an aggregate of 884,890 shares of our common stock to the selling stockholders for an aggregate estimated stock consideration of $3.65 million, at a purchase price equal to $4.125 per share of our common stock and, together with other

cash consideration, for an aggregate estimated total purchase price of such issued and outstanding common stock of Infinia Technology Corporation of $3.75 million. This prospectus covers the resale or other disposition by the selling stockholders or

their transferees of up to the total number of shares of our common stock issued to the selling stockholders as consideration pursuant to the Stock Purchase Agreement. Throughout this prospectus, when we refer to the selling stockholders, we are

referring to the persons or entities who purchased our common stock pursuant to the Stock Purchase Agreement.

The selling stockholders

have agreed to use their best efforts, to the extent commercially reasonable, and we have agreed to cooperate as necessary, to sell all of the shares of our common stock that the selling stockholders purchased pursuant to the Stock Purchase

Agreement within 90 days after the date upon which the registration statement of which this prospectus is a part is declared effective by the Securities and Exchange Commission. We have agreed to reimburse the selling stockholders for any reasonable

brokerage fees incurred by the selling stockholders in connection with such sales of shares of our common stock. We will pay all fees and expenses incident to the registration of the shares.

In addition, we have agreed to pay the selling stockholders an amount in cash, if any, equal to (x) an amount equal to (i) $4.125

per share of our common stock, multiplied by (ii) the number of shares of our common stock sold by the selling stockholders within 90 days after the date upon which the registration statement of which this prospectus is a part is declared

effective by the Securities and Exchange Commission, minus (y) the aggregate sales proceeds received by the selling stockholders from the sale of any shares of our common stock within such 90-day period.

We are registering the above-referenced shares to permit the selling stockholders and their pledgees, donees, transferees or other

successors-in-interest that receive their shares after the date of this prospectus to resell or otherwise dispose of the shares in the manner contemplated under “Plan of Distribution” herein.

Except as otherwise disclosed herein, the selling stockholders do not have, and within the past three years have not had, any position, office

or other material relationship with us.

The following table sets forth the name of the selling stockholders, the number of shares owned

by the selling stockholders, the number of shares that may be offered under this prospectus and the number of shares of our common stock owned by the selling stockholder assuming all of the shares registered for resale hereby are sold. The number of

shares in the column “Number of Shares Being Offered” represents all of the shares that the selling stockholders may offer under this prospectus. The selling stockholders may sell some, all or none of their shares. We do not know how long

the selling stockholders will hold the shares before selling them, and, other than as set forth herein, we currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of

the shares. The shares covered hereby may be offered from time to time by the selling stockholders.

4

The information set forth below is based upon information obtained from the selling stockholders

in connection with the Stock Purchase Agreement. The percentages of shares owned after the offering are based on 20,916,419 shares of our common stock outstanding as of September 30, 2017, including the shares of common stock registered for

resale hereby.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

Shares of

Common

Stock

Beneficially

Owned

Prior to

Offering (1)

|

|

|

Number of

Shares

Being Offered

|

|

|

Shares of Common Stock

Beneficially Owned After

Offering (2)

|

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Qnergy Inc.(3)

|

|

|

655,474

|

|

|

|

655,474

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Peter Brehm(4)

|

|

|

114,708

|

|

|

|

114,708

|

|

|

|

—

|

|

|

|

—

|

%

|

|

Tom Mitchell(5)

|

|

|

114,708

|

|

|

|

114,708

|

|

|

|

—

|

|

|

|

—

|

%

|

(1) “Beneficial ownership” is a term broadly defined by the SEC in Rule 13d-3 under the Exchange Act, and includes

more than the typical form of stock ownership, that is, stock held in the person’s name. The term also includes what is referred to as “indirect ownership,” meaning ownership of shares as to which a person has or shares investment

power. For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares that are currently exercisable or exercisable within 60 days of September 30, 2017.

(2) Assumes that all shares being registered in this prospectus are resold to third parties and that the selling stockholders sell all shares of common stock

registered under this prospectus held by such selling stockholder.

(3) Qnergy Inc. (“Qnergy”) is a Delaware corporation. The managing officer of

Qnergy is Jeff Lowe. Mr. Lowe does not have individual voting or investment power with respect to these shares and disclaims beneficial ownership of such shares. The address for Qnergy is 300 W. 12th Street, Ogden, UT 84404.

(4) Peter Brehm is the former President and Chief Executive Officer of Infinia Technology Corporation. His address is 300 Columbia Point Drive, F-121,

Richland, WA 99352.

(5) Tom Mitchell is the former Chief Financial Officer of Infinia Technology Corporation. His address is 327 Columbia Point Drive,

Richland, WA 99352.

5

PLAN OF DISTRIBUTION

The selling stockholders and any of their pledgees, donees, transferees, assignees or other successors-in-interest may, from time to time,

sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions

may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The selling stockholders may use one or more of the

following methods when disposing of the shares or interests therein:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

through brokers, dealers or underwriters that may act solely as agents;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions entered into after the effective date of the registration statement of which this prospectus is a part, whether through an options exchange or

otherwise;

|

|

|

•

|

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

a combination of any such methods of disposition; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell

shares under Rule 144 or Rule 904 under the Securities Act of 1933, as amended, or Securities Act, if available, or Section 4(a)(1) under the Securities Act, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to

exceed what is customary in the types of transactions involved.

The selling stockholders may, from time to time, pledge or grant a

security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell shares of common stock from time to time under this

prospectus, or under a supplement or amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest

as selling stockholders under this prospectus.

The selling stockholders also may transfer the shares of common stock in other

circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of the shares of common stock or interests in shares of common stock, the selling stockholders may enter into

hedging transactions after the effective date of the registration statement of which this prospectus is a part with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging

the positions they assume. The selling stockholders may also sell shares of common stock short after the effective date of the registration statement of which this prospectus is a part and deliver these securities to close out their short positions,

or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions after the effective date of the registration statement of which this prospectus is

a part with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such

broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

6

The selling stockholders and any broker-dealers or agents that are involved in selling the shares

may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any profits realized by such selling stockholders or compensation received by such broker-dealers or agents may be

deemed to be underwriting commissions or discounts under the Securities Act. The maximum commission or discount to be received by any member of the Financial Industry Regulatory Authority (FINRA) or independent broker-dealer will not be greater than

8% of the initial gross proceeds from the sale of any security being sold.

We have advised the selling stockholders that they are

required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended, during such time as they may be engaged in a distribution of the shares. The foregoing may affect the marketability of the common stock.

At the time a particular offer of shares is made, if required, a prospectus supplement will be distributed that will set forth the number of

shares being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or

concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

The aggregate proceeds to the

selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their

agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

7

VALIDITY OF THE COMMON STOCK

The validity of the common stock being offered by this prospectus has been passed upon for us by Latham & Watkins LLP.

EXPERTS

The consolidated financial statements and the related consolidated financial statement schedule of American Superconductor Corporation as of

March 31, 2017 and 2016 and for each of the years in the three-year period ended March 31, 2017 and the effectiveness of internal control over financial reporting as of March 31, 2017 incorporated in this prospectus supplement by reference to the

American Superconductor Corporation Annual Report on Form 10-K for the fiscal year ended March 31, 2017, have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report incorporated by reference herein,

and have been so incorporated in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with

the SEC. Information filed with the SEC by us can be inspected and copied at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of this information by mail from the Public

Reference Room of the SEC at prescribed rates. Further information on the operation of the SEC’s Public Reference Room in Washington, D.C. can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains

reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is

http://www.sec.gov

.

Our web site address is

http://www.amsc.com

. The information on our web site, however, is not, and should not be deemed to be, a part

of this prospectus.

This prospectus is part of a registration statement that we filed with the SEC and does not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. You may inspect a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or

through the SEC’s website, as provided above.

8

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will

automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a

statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

|

|

•

|

|

our Annual Report on Form 10-K for the year ended March 31, 2017, filed with the SEC on May 25, 2017;

|

|

|

•

|

|

our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, filed with the SEC on August 8, 2017;

|

|

|

•

|

|

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on June 16, 2017;

|

|

|

•

|

|

our Current Reports on Form 8-K and Amended Current Reports on Form 8-K/A filed with the SEC on April 4, 2017, May 4, 2017, May 9, 2017, May 10, 2017, May 26,

2017, July 3, 2017, August 1, 2017 and September 26, 2017; and

|

|

|

•

|

|

The description of our Common Stock contained in the our Registration Statement on Form 8-A filed on November 5, 1991, as updated by the Current Reports on Form 8-K filed on November 8,

2010, April 13, 2012 and April 23, 2015, and any other amendment or report filed with the SEC for the purpose of updating the description.

|

These documents may also be accessed on our website at

www.amsc.com

. Except as otherwise specifically incorporated by reference

in this prospectus, information contained in, or accessible through, our website is not a part of this prospectus.

All reports and

other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration

statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus

from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference

in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

AMERICAN SUPERCONDUCTOR CORPORATION

64 JACKSON ROAD, DEVENS, MA 01434

TELEPHONE: (978) 842-3000

ATTN: INVESTOR RELATIONS

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus

and any accompanying prospectus supplement.

9

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

The following is an estimate of the expenses (all of which

are to be paid by the registrant) that we may incur in connection with the securities being registered hereby, other than the Securities and Exchange Commission registration fee.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

440

|

|

|

Legal fees and expenses

|

|

|

50,000

|

|

|

Accounting fees and expenses

|

|

|

10,000

|

|

|

Printing and miscellaneous expenses

|

|

|

3,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

63,440

|

|

|

|

|

|

|

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

Subsection (a) of Section 145 of

the General Corporation Law of the State of Delaware, or the DGCL, empowers a corporation to indemnify any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at

the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in

settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the

corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a

party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person acted in any of the capacities set forth above, against expenses (including

attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the

best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of

Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity

for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent

a director or officer of a corporation has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter

therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that indemnification provided for by Section 145 shall not be deemed exclusive

of any other rights to which the indemnified party may be entitled; and the indemnification provided for by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director,

officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Section 145 also empowers the corporation to purchase and maintain insurance on behalf of any person who is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability

asserted against such person and incurred by such person in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

II-1

Article VI of the registrant’s by-laws provides that a director or officer of the registrant

(a) shall be indemnified by the registrant against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with any litigation or other legal proceeding

(other than an action by or in the right of the registrant) brought against him by virtue of his position as a director or officer of the registrant if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best

interests of the registrant, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful and (b) shall be indemnified by the registrant against expenses (including attorneys’ fees)

incurred in connection with the defense or settlement of any action or suit by or in the right of the registrant by virtue of his position as a director or officer of the registrant if he acted in good faith and in a manner he reasonably believed to

be in or not opposed to the best interests of the registrant, except that no indemnification shall be made with respect to any such matter as to which such director or officer shall have been adjudged to be liable to the registrant, unless and only

to the extent that a court determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems

proper. Notwithstanding the foregoing, to the extent that a director or officer has been successful, on the merits or otherwise, he shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him in

connection therewith. Expenses incurred in defending a civil or criminal action, suit or proceeding may be paid by the registrant upon receipt of an undertaking by the director or officer to repay such amount if the registrant ultimately determines

that he is not entitled to indemnification.

Indemnification shall be made by the registrant upon a determination that the applicable

standard of conduct required for indemnification has been met and that indemnification of a director or officer is proper. Such determination shall be made (a) by the board of directors by a majority vote of a quorum consisting of directors who

were not parties to the action, or (b) if such a quorum is not obtainable, or if a quorum of disinterested directors so directs, by independent legal counsel in a written opinion or (c) by the stockholders of the registrant.

Article VI of the registrant’s by-laws further provides that the indemnification provided therein is not exclusive, and provides that to

the extent the DGCL is amended or supplemented, Article VI shall be amended automatically and construed so as to permit indemnification and advancement of expenses to the fullest extent permitted by such law.

Section 102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or

limiting, and Article VIII of the registrant’s certificate of incorporation eliminates, the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that

such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve

intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit.

The registrant has a directors and officers liability insurance policy covering certain liabilities that may be incurred by its directors and

officers.

(a) Exhibits

A list of exhibits filed with this registration statement on Form S-3 is set forth on the exhibit index, which appears elsewhere herein and is

incorporated herein by reference.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration

statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the

most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Securities and Exchange Commission, or the Commission, pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the

“Calculation of Registration Fee” table in the effective registration statement; and

II-2

(iii) To include any material information with respect to the plan of

distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided

,

however

, that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be

included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by

reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain

unsold at the termination of the offering.

(5) That, for the purpose of determining liability under the Securities Act of

1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part

of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in

reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in

the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for

liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to

such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the

initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of

the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed

pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the

undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing

prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communications that is an offer in the offering made by the undersigned registrant to the purchaser.

II-3

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability

under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(h) Insofar as

indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in

the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT INDEX

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Devens, Massachusetts, on the 3rd day of October, 2017.

|

|

|

|

|

American Superconductor Corporation

|

|

|

|

|

By:

|

|

/s/ Daniel P. McGahn

|

|

|

|

Daniel P. McGahn

|

|

|

|

President, Chief Executive Officer, and Director

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Daniel P. McGahn and John W. Kosiba,

Jr., or either of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to file and sign any and all

amendments, including post-effective amendments and any registration statement for the same offering that is to be effective under Rule 462(b) of the Securities Act, to this registration statement, with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith as fully to all intents and purposes as he or she might or could do

in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes may lawfully do or cause to be done by virtue hereof. This power of attorney shall be governed by and construed with the laws

of the State of Delaware and applicable federal securities laws.

Pursuant to the requirements of the Securities Act of 1933, as amended,

this registration statement has been signed below by the following persons on behalf of the registrant in the capacities and on the dates indicated.

|

|

|

|

|

|

|

SIGNATURE

|

|

TITLE

|

|

DATE

|

|

|

|

|

|

/

S

/ DANIEL P. MCGAHN

Daniel P. McGahn

|

|

President, Chief Executive Officer, and

Director (Principal Executive Officer)

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ JOHN W. KOSIBA, JR.

John W. Kosiba, Jr.

|

|

Senior Vice President, Chief Financial Officer and Treasurer (Principal

Financial and Accounting Officer)

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ JOHN W. WOOD, JR.

John W. Wood, Jr.

|

|

Chairman of the Board

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ VIKRAM S. BUDHRAJA

Vikram S. Budhraja

|

|

Director

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ ARTHUR H. HOUSE

Arthur H. House

|

|

Director

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ PAMELA F. LENEHAN

Pamela F. Lenehan

|

|

Director

|

|

October 3, 2017

|

|

|

|

|

|

/

S

/ DAVID R. OLIVER, JR.

David R. Oliver, Jr.

|

|

Director

|

|

October 3, 2017

|

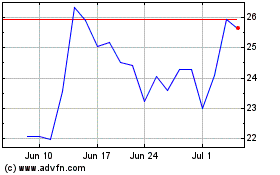

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

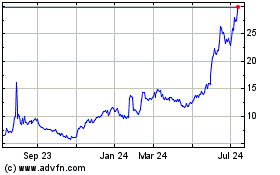

American Superconductor (NASDAQ:AMSC)

Historical Stock Chart

From Apr 2023 to Apr 2024