Meritage Homes reports preliminary home closings, orders, and backlog for the third quarter of 2017

October 03 2017 - 8:13AM

Meritage Homes Corporation (NYSE:MTH), a leading U.S. homebuilder,

reported its preliminary home orders, closings and backlog for the

third quarter ended September 30, 2017.

Home closings increased approximately 9% to 1,969 in the third

quarter of 2017 from 1,800 in the third quarter of 2016. Net orders

increased approximately 8% to 1,874 in the third quarter from 1,737

in the same period of 2016.

Ending backlog increased to 3,333 units at the end of third

quarter of 2017, compared to 3,251 at September 30, 2016.

“Considering that two of our largest divisions were severely

impacted by hurricanes in the third quarter, we are pleased to have

delivered solid year-over-year growth, which could have been even

greater without the storms,” said Steven J. Hilton, chairman and

chief executive officer for Meritage Homes. “We lost two weeks of

production and sales in Houston, which delayed an estimated 30-35

closings and as many as 40 sales during the quarter, though our

operations in Houston have been fully up and running for most of

September.

“Florida is a different story, where we experienced severe

disruptions due to extensive damage to the electrical grid,” he

continued. “Sales and production were interrupted for about three

weeks, which pushed approximately 20 closings and 50 sales out of

the third quarter. We have resumed operations in all of our

communities in Florida and are working through many issues, though

we’re experiencing general delays in the after-effects of the

storms.”

The Company expects to report its full third quarter results on

October 27, 2017, and will provide additional details and updated

guidance at that time.

The information included in this press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include

management's expectations with respect to the estimated impacts of

the recent hurricanes on our Texas and Florida business in the

third quarter of 2017.

Such statements are based upon the current beliefs and

expectations of Company management, and current market conditions,

which are subject to significant uncertainties and fluctuations.

Actual results may differ from those set forth in the

forward-looking statements. The Company makes no commitment, and

disclaims any duty, to update or revise any forward-looking

statements to reflect future events or changes in these

expectations. Meritage's business is subject to a number of risks

and uncertainties. As a result of those risks and uncertainties,

the Company's stock and note prices may fluctuate dramatically.

These risks and uncertainties include, but are not limited to, the

following: potential adverse impacts on our Houston and Florida

sales, closings, revenue and costs due to Hurricanes Harvey and

Irma; the availability and cost of finished lots and undeveloped

land; changes in interest rates and the availability and pricing of

residential mortgages; the success of strategic initiatives;

shortages in the availability and cost of labor; changes in tax

laws that adversely impact us or our homebuyers; the ability of our

potential buyers to sell their existing homes; cancellation rates;

inflation in the cost of materials used to develop communities and

construct homes; the adverse effect of slow absorption rates;

impairments of our real estate inventory; a change to the

feasibility of projects under option or contract that could result

in the write-down or write-off of earnest or option deposits; our

potential exposure to and impacts from natural disasters or severe

weather conditions; competition; construction defect and home

warranty claims; failures in health and safety performance; our

success in prevailing on contested tax positions; our ability to

obtain performance bonds in connection with our development work;

the loss of key personnel; enactment of new laws or regulations or

our failure to comply with laws and regulations; our limited

geographic diversification; fluctuations in quarterly operating

results; our level of indebtedness; our ability to obtain

financing; our ability to successfully integrate acquired companies

and achieve anticipated benefits from these acquisitions; our

compliance with government regulations; the effect of legislative

and other governmental actions, orders, policies or initiatives

that impact housing, labor availability, construction, mortgage

availability, our access to capital, the cost of capital or the

economy in general, or other initiatives that seek to restrain

growth of new housing construction or similar measures; legislation

relating to energy and climate change; the replication of our

energy-efficient technologies by our competitors; our exposure to

information technology failures and security breaches; and other

factors identified in documents filed by the Company with the

Securities and Exchange Commission, including those set forth in

our Form 10-K for the year ended December 31, 2016 and our

subsequent Forms 10-Q, under the caption "Risk Factors," which can

be found on our website.

About Meritage Homes Corporation

Meritage Homes is the eighth-largest public homebuilder in the

United States, based on homes closed in 2016. Meritage Homes builds

and sells single-family homes for first- time, move-up, luxury and

active adult buyers across the Western, Southern and Southeastern

United States. Meritage Homes builds in markets including

Sacramento, San Francisco Bay area, southern coastal and Inland

Empire markets in California; Houston, Dallas-Ft. Worth, Austin and

San Antonio, Texas; Phoenix/Scottsdale, Green Valley and Tucson,

Arizona; Denver, Colorado; Orlando, Tampa and south Florida;

Raleigh and Charlotte, North Carolina; Greenville-Spartanburg and

York County, South Carolina; Nashville, Tennessee; and Atlanta,

Georgia.

Meritage Homes has designed and built over 100,000 homes in its

32-year history, and has a reputation for its distinctive style,

quality construction, and positive customer experience. Meritage

Homes is the industry leader in energy-efficient homebuilding and

has received the U.S. Environmental Protection Agency's ENERGY STAR

Partner of the Year for Sustained Excellence Award every year since

2013 for innovation and industry leadership in energy efficient

homebuilding.

| |

|

|

|

| |

|

Contacts:

|

Brent Anderson, VP

Investor Relations |

| |

|

|

(972) 580-6360

(office) |

| |

|

|

investors@meritagehomes.com |

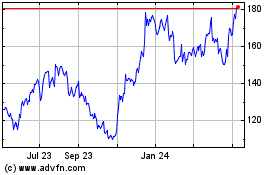

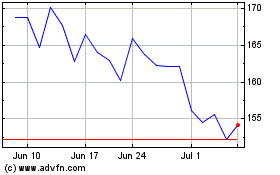

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024