Filed pursuant to Rule 433

Registration No. 333-218295

Issuer Free Writing Prospectus dated October 2, 2017

Relating to Preliminary Prospectus Supplement dated October 2, 2017

A copy of this preliminary short form prospectus has been filed with the securities regulatory authorities in the provinces of Ontario

,

British Columbia and Alberta, but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary short form prospectus may not be complete and may have to be amended. The securities may not

be sold until a receipt for the short form prospectus is obtained from the securities regulatory authorities.

No securities regulatory authority

has expressed an opinion about any information contained herein and it is an offence to claim otherwise. This preliminary short form prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully

offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this

preliminary short form prospectus from documents filed with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the secretary of

the issuer at 665 Anderson Street, Winnemucca, Nevada 89445 USA, Telephone: (613) 226-9881, and are also available electronically at www.sedar.com.

The Corporation has filed a registration statement (including a prospectus and related prospectus supplement) with the U.S. Securities and

Exchange Commission (“SEC”) for this offering. Before you invest, you should read the prospectus supplement (the “prospectus supplement”) and prospectus for this offering in that registration statement, and other documents the

Corporation has filed with the SEC for more complete information about the Corporation and this offering. You may get these documents for free by EDGAR at the SEC web site at www.sec.gov. The prospectus supplement, together with the prospectus, is

attached hereto and incorporated herein.

PRELIMINARY SHORT FORM PROSPECTUS

|

|

|

|

|

New Issue

|

|

October 2, 2017

|

PARAMOUNT GOLD NEVADA CORP.

US$•

• Shares

of Common Stock

This short form prospectus (the “

Prospectus

”) qualifies the distribution (the “

Offering

”) of

• shares of common stock, par value of US$0.01 per share (the “

Offered Shares

”) of Paramount Gold Nevada Corp. (“

Paramount

” or the “

Corporation

”) at a price of US$• per Offered Share (the

“

Offering Price

”), for aggregate gross proceeds of US$•. The Offering is made pursuant to an underwriting agreement (the “

Underwriting Agreement

”) dated October •, 2017 among the Corporation and Canaccord

Genuity Corp. and Cantor Fitzgerald Canada Corporation, as representatives of the underwriters (collectively with their affiliates, the

Underwriters

”). See “Plan of Distribution”. The Offering is being made concurrently in the

United States under the terms of a registration statement on Form S-3 (the “

Registration Statement

”) filed with the SEC under the Securities Act of 1933, as amended. The Registration Statement contains a form of

U.S. prospectus dated October •, 2017 (the “

U.S. Prospectus

”), a copy of which is attached to and forms part of and is incorporated in this Prospectus.

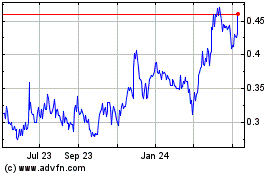

The outstanding shares of common stock of the Corporation (the “

Common Shares

”) are listed and posted for trading on the NYSE American

LLC (the “

NYSE American

”) under the symbol “PZG”. On October •, 2017, the last trading day prior to the date of announcement of the Offering, the closing price per Common Share on the NYSE American was US$•.

On September 29, 2017, the last trading day prior to the date of this Prospectus, the closing price per Common Share on the NYSE American was US$1.57.

The Corporation has made an application to the NYSE American to list the Offered Shares.

Pursuant and subject to the terms and conditions of the Underwriting Agreement, the Corporation has agreed to

issue and sell, and the Underwriters have agreed to purchase from the Corporation, • Offered Shares at a price of US$• per Offered Share (see “Plan of Distribution”).

The terms of the Offering, including the Offering Price, were determined by negotiation between the Corporation and the Underwriters.

|

|

|

Price: US$• per Offered Share

|

|

|

|

|

|

|

|

|

|

|

|

Price to public

|

|

Underwriters’ Fee

(1)

|

|

Net Proceeds to the

Corporation

(2)

|

|

Per Offered Share

|

|

US$•

|

|

US$•

|

|

US$•

|

|

Total Offering

(3)

|

|

US$•

|

|

US$•

|

|

US$•

|

Notes:

|

(1)

|

The compensation to be paid to the Underwriters by the Corporation consists of underwriting discounts and commissions to be paid by the Corporation in the amount of US$• (or US$• if the Over-Allotment Option

(as defined herein) is fully exercised). The Corporation has agreed to reimburse the Underwriters of up to US$• of their expenses. Paramount estimates its total expenses associated with the Offering, excluding underwriting discounts and

commissions, will be approximately US$•. The Underwriters will also serve as placement agents for the Private Placement (as defined herein), and the Corporation will pay the placement agents a cash fee equal to 5.0% of the gross sales price of

the Private Placement Shares (as defined herein). See “Plan of Distribution”.

|

|

(2)

|

After deducting the Underwriters’ Fee, but before deducting the expenses relating to the Offering, including the preparation and filing of this Prospectus, which total expenses are estimated to be US$• and

which will be paid from the proceeds of the Offering.

|

|

(3)

|

The Corporation has granted the Underwriters an option (the “

Over-Allotment Option

”), exercisable in whole or in part, exercisable for 30 days from the date of the Underwriting Agreement, to purchase up

to • additional Common Shares (the “

Additional Shares

”) at the Offering Price per share less the underwriting discount and commissions. The Underwriters may exercise this option solely to cover over-allotments, if any, made in

connection with this Offering. See “Plan of Distribution” and the table below.

|

|

|

|

|

|

|

|

|

|

Underwriters’ Position

|

|

Number of Common

Shares Available

|

|

Exercise Period

|

|

Exercise Price

|

|

Over-Allotment Option

|

|

Up to • Additional Shares

|

|

Up to 30 days from date of the Underwriting Agreement

|

|

US$• per Additional Share

|

The Underwriters propose to offer the Offered Shares initially at the Offering Price. After the Underwriters have made

reasonable efforts to sell all of the Offered Shares by this Prospectus at such price, the Offering Price may be decreased, and further changed from time to time, to an amount not greater than the Offering Price. However, in no event will the

Corporation receive less than net proceeds of US$• per Offered Share. See “Plan of Distribution”.

The Underwriters, as principals,

conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Corporation and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of

Distribution”.

Subject to applicable laws, the Underwriters may, in connection with the Offering, effect transactions intended to stabilize or

maintain the market price of the Common Shares at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See “Plan of Distribution”.

Without affecting the firm obligation of the Underwriters to purchase the Offered Shares in accordance with the Underwriting Agreement, the Underwriters may

decrease the Offering Price of the Offered Shares which they sell under this Prospectus after they have made a reasonable effort to sell all of such Offered Shares at the Offering Price. The sale by the Underwriters of Offered Shares at a price less

than the Offering Price will have the effect of reducing the compensation realized by the Underwriters by the amount that the aggregate price paid by the purchasers for the Offered Shares is less than the gross proceeds paid by the Underwriters for

those Offered Shares. See “Plan of Distribution”.

- 2 -

Closing of the Offering is expected to occur on or about October •, 2017 or such earlier or later date as

the Corporation and the Underwriters may agree, but in any event the Offered Shares are to be taken up by the Underwriters, if at all, on or before a date not later than 42 days after the date of the final receipt for this Prospectus (the

“

Closing Date

”).

It is expected that the Corporation will arrange for the instant deposit of the Offered Shares distributed under this

Prospectus under the book-based system of registration, to be registered in the name of the Depositary Trust Company (“

DTC

”) and the Offered Shares will be deposited with, or on behalf of, DTC on the Closing Date. No certificates

evidencing the Offered Shares will be issued to purchasers of the Offered Shares. Purchasers of Offered Shares will receive only a customer confirmation from the Underwriters or other registered dealer who is a DTC participant and from or through

whom a beneficial interest in the Offered Shares is purchased.

An investment in the Offered Shares is speculative and involves a high degree of risk. An

investment in the Offered Shares should only be made by those persons who can afford a loss of their entire investment. Prospective investors should carefully consider the risk factors described in this Prospectus under “Risk Factors” and

“Forward-Looking Information” and in the documents incorporated by reference herein before purchasing Offered Shares.

Prospective investors

should rely only on the information contained or incorporated by reference in this Prospectus. The financial statements included or incorporated by reference in this Prospectus have not been prepared in accordance with Canadian generally accepted

accounting principles and may not be comparable to financial statements of Canadian issuers. The Corporation and the Underwriters have not authorized anyone to provide purchasers with information different from that contained or incorporated by

reference in this Prospectus. The Underwriters are offering to sell and seeking offers to buy the Offered Shares only in jurisdictions where, and to persons whom, offers and sales are lawfully permitted. This Prospectus has been prepared only for

the benefit of prospective investors in the Canadian jurisdictions in which it has been filed.

Prospective investors are advised to consult their own tax

advisors regarding the application of Canadian and U.S. federal income tax laws to their particular circumstances, as well as any other provincial, foreign and other tax consequences of acquiring, holding or disposing of the Offered Shares.

Concurrently with the Offering, the Corporation has entered into subscription agreements with FCMI Financial Corp. and Seabridge Gold Inc. (collectively, the

“

Private Placement Subscribers

”), whereby the Private Placement Subscribers have agreed to purchase via private placement, an aggregate of 1,800,000 Common Shares (the “

Private Placement Shares

”) at the Offering

Price (the “

Private Placement

”). See “Concurrent Private Placement”. This Prospectus does not qualify the distribution of the Private Placement Shares issuable pursuant to the Private Placement. The Offering and the

Private Placement are contingent on the completion of the other and are expected to close concurrently. Closing of the Private Placement is subject to customary closing conditions including, but not limited to, the listing of the Private Placement

Shares on the NYSE American and the receipt of all necessary approvals, including the approval of the NYSE American. The Private Placement Shares issuable under the Private Placement will be subject to a four month hold period pursuant to applicable

Canadian securities laws and will also be “restricted securities” under U.S. securities laws.

The Corporation was incorporated under the

General Corporation Law of the State of Nevada, USA, and certain of its directors and officers providing the certificate forming part of this Prospectus reside outside of Canada. Although the Corporation has appointed Gowling WLG (Canada) LLP, 160

Elgin St., Suite 2600, Ottawa, Ontario K1P 1C3, as its agent for service of process in Ontario, it may not be possible for investors to enforce judgments obtained in Canada against the Corporation and certain of its directors and officers.

- 3 -

The Corporation’s head office is located at 665 Anderson Street, Winnemucca, Nevada 89445, USA. The

Corporation’s website address is www.paramountnevada.com. The Corporation’s registered office is located at 50 W Liberty St., Suite 750, Reno, Nevada 89501, USA.

Investors should not assume that the information contained in this Prospectus is accurate as of any date other than the date of this Prospectus. Subject to

the Corporation’s obligations under applicable Canadian securities laws, the information contained in this Prospectus is accurate only as of the date of this Prospectus regardless of the time of delivery of the Prospectus or of any sale of the

Offered Shares.

- 4 -

TABLE OF CONTENTS

-i-

FORWARD-LOOKING INFORMATION

This Prospectus, and the documents incorporated by reference into this Prospectus, contain forward-looking information within the meaning of Canadian

securities laws. This forward-looking information may contain certain references to future expectations and other forward-looking statements and information relating to the Corporation’s financial condition, results of operations and business.

These statements include, among others:

|

|

•

|

|

statements about the Corporation’s anticipated exploration results, cost and feasibility of production, receipt of permits or other regulatory or government approvals and plans for the development of its

properties;

|

|

|

•

|

|

statements concerning the benefits or outcomes that the Corporation expect will result from its business activities; and

|

|

|

•

|

|

statements of the Corporation’s expectations, beliefs, future plans and strategies, anticipated developments and other matters that are not historical facts.

|

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events

or performance (often, but not always, using words or phrases such as “may”, “could”, “should”, “would”, “believe”, “estimate”, “expect”, “anticipate”, “plan”,

“forecast”, “potential”, “intend”, “continue”, “project” and similar expressions) speak only as of the date the statement is made, are not statements of historical fact and may be forward-looking

information (collectively referred to in the following information simply as “

forward-looking statements

”). In addition, statements concerning mineral resource estimates constitute forward-looking statements to the extent that they

involve estimates of the mineralization expected to be encountered if a mineral property is developed.

Forward-looking statements and information

are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no

assurance that such statements and information will prove to be accurate. Do not unduly rely on forward-looking statements. Actual results may differ materially from those expressed or implied by these forward-looking statements and information.

Further, the information contained in this document or incorporated herein by reference is a statement of the Corporation’s present intention and is based on present facts and assumptions, and may change at any time and without notice, based on

changes in such facts or assumptions. Factors that could cause actual results to differ materially from these forward-looking statements include:

|

|

•

|

|

the risks and hazards inherent in the exploration mining businesses (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related

conditions);

|

|

|

•

|

|

changes in the market prices of gold and silver and a sustained lower price environment;

|

|

|

•

|

|

the uncertainties inherent in the Corporation’s exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions and grade variability;

|

|

|

•

|

|

any future labor disputes or work stoppages (involving the Corporation and its subsidiaries or third parties);

|

|

|

•

|

|

the uncertainties inherent in the estimation of gold and silver reserves and mineralized material;

|

|

|

•

|

|

changes that could result from the Corporation’s future acquisition of new mining properties or businesses;

|

|

|

•

|

|

the effects of environmental and other governmental regulations; and

|

|

|

•

|

|

the Corporation’s ability to raise additional financing necessary to conduct its business,

|

as well as other factors described elsewhere in this Prospectus, the accompanying U.S. Prospectus, the

Corporation’s Annual Report on Form 10-K for the fiscal year ended June 30, 2017 and in other filings the Corporation makes with securities commissions or similar authorities in Canada and the SEC. This list is not exhaustive of the

factors that may affect any of the Corporation’s forward-looking information. Forward-looking information consists of statements about the future and are inherently uncertain, and actual achievements of the Corporation or other future events or

conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this Prospectus under the heading “Risk

Factors”, elsewhere in this Prospectus and in documents incorporated by reference herein. In addition, although the Corporation has attempted to identify important factors that could cause actual achievements, events or conditions to differ

materially from those identified in the forward-looking information, there may be other factors that cause achievements, events or conditions not to be as anticipated, estimated or intended. Many of the foregoing factors are beyond the

Corporation’s ability to control or predict.

The forward-looking information contained herein are based on the beliefs, expectations and opinions of

management on the date the statements are made and the Corporation does not assume any obligation to update forward-looking information, except as required by applicable securities laws, if circumstances or management’s beliefs, expectations or

opinions should change. For the reasons set forth above, investors should not place undue reliance on forward-looking information.

The forward-looking

information contained in this Prospectus and the documents incorporated herein by reference herein and therein are qualified by the foregoing cautionary statements.

CAUTIONARY NOTE REGARDING TECHNICAL DISCLOSURE

This Prospectus uses the terms “measured”, “indicated” and “inferred” resources. Paramount caution investors that, while

such terms are recognized and required pursuant to National Instrument 43-101

Standards of Disclosure for Mineral Projects

(“

NI 43-101

”), the SEC does not recognize them. Investors are cautioned not to assume

that any part of or all mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources”, in particular, have a great amount of uncertainty as to their existence, and great uncertainty as to their

economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or

pre-feasibility studies. Investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally minable.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

The Corporation publishes its consolidated financial statements in U.S. dollars.

All references in this Prospectus to “dollars”,

“$” or “US$” are to U.S. dollars and all references to “CAD$” are to Canadian dollars, unless otherwise noted.

The following table presents, in Canadian dollars, (i) the daily average exchange rate in effect at

the end of the period; (ii) the high and low daily average exchange rate during such period; and (iii) the daily average exchange rate for such period, for one U.S. dollar, expressed in Canadian dollars, as quoted by the Bank of Canada.

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended June 30

|

|

2016

|

|

|

2017

|

|

|

End of Period

|

|

CAD$

|

1.2917

|

|

|

CAD$

|

1.2977

|

|

|

High

|

|

CAD$

|

1.4661

|

|

|

CAD$

|

1.3743

|

|

|

Low

|

|

CAD$

|

1.2497

|

|

|

CAD$

|

1.2765

|

|

|

Average

|

|

CAD$

|

1.3246

|

|

|

CAD$

|

1.3273

|

|

- 2 -

The average exchange rate is calculated using the average of the exchange rates on the last business day of each

month during the applicable fiscal year. As of September 29, 2017, the daily exchange rate for the conversion of one U.S. dollar into Canadian dollars was CAD$1.2480, as quoted by the Bank of Canada.

ELIGIBILITY FOR INVESTMENT

The Offered Shares, if issued on the date hereof, would be “qualified investments” under the Tax Act for a trust governed by a registered retirement

savings plan (“

RRSP

”), a registered education savings plan (“

RESP

”), a registered retirement income fund (“

RRIF

”), a deferred profit sharing plan, a registered disability savings plan

(“

RDSP

”), and a tax-free savings account (“

TFSA

”), provided the Offered Shares are listed on a “designated stock exchange” as defined in the Tax Act. In July 2017, NYSE MKT, which was listed by the

Department of Finance Canada as a “designated stock exchange”, was rebranded as NYSE American. The Department of Finance Canada has not yet confirmed that NYSE American is a designated stock exchange. As a result, it is not clear whether

the Common Shares will be considered as being listed on a “designated stock exchange” for tax purposes. As such, the Corporation can provide no assurance that the Offered Shares are eligible for investment through RRSP, RESP, RRIF, RDSP or

TFSA accounts. See “Risk Factors”.

A Holder of Offered Shares will be subject to a penalty tax if the Offered Shares are held in a RRSP, RRIF,

or TFSA (a “

Registered Plan

”), as the case may be, and is a “prohibited investment” for such Registered Plan under the Tax Act. However, provided that the controlling individual or annuitant of a Registered Plan

(a) deals at arm’s length with the Corporation and (b) does not hold a “significant interest” (as defined in the Tax Act) in the Corporation, the Offered Shares will not be a prohibited investment for a trust governed by a

Registered Plan. In addition, Offered Shares will generally not be a prohibited investment if the Offered Shares are equity of a corporation and certain conditions designed to minimize the risk of self-dealing are satisfied making such Offered

Shares “excluded property” (as defined in the Tax Act). The federal budget released by the Minister of Finance of Canada on March 22, 2017, included proposals to amend the Tax Act to extend the application of the “prohibited

investment” rules to investments held by RDSPs and RESPs, applicable to investments acquired, and transactions occurring, after March 22, 2017.

Holders or annuitants of a RDSP, RESP, RRSP, RRIF, or TFSA should consult their own tax

advisors as to whether the Offered Shares will be a prohibited investment in their particular circumstances, including with respect to whether the Offered Shares will be “excluded property”.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar regulatory authorities in

Ontario. The Corporation is a “SEC foreign issuer” pursuant to National Instrument 71-102—

Continuous Disclosure and Other Exemptions Relating to Foreign Issuers

(“

NI 71-102

”). The Corporation

satisfies its Canadian continuous disclosure requirements by complying with the disclosure requirements of the United States as permitted by NI 71-102 and accordingly, the documents set out below are filings required by United Securities laws other

than the Grassy Mountain Report (as defined below) and the Sleeper Report (as defined below). Copies of the documents incorporated by reference herein may be obtained on request without charge from the secretary of the issuer at 665 Anderson Street,

Winnemucca, Nevada 89445, USA, Telephone: (613) 226-9881, and are also available electronically under the profile of the Corporation at www.sedar.com.

The following documents filed by the Corporation with the securities commissions or similar regulatory authorities in each of the provinces of Ontario,

British Columbia and Alberta are specifically incorporated by reference into, and form an integral part of, this Prospectus:

- 3 -

|

(a)

|

the Annual Report on Form 10-K for the fiscal year ended June 30, 2017 (the “Form 10-K”);

|

|

(b)

|

the Current Report on Form 8-K dated •, 2017 relating to the announcement of the Offering;

|

|

(c)

|

the definitive proxy statement on Schedule 14A of the Corporation dated October 27, 2016 regarding the annual meeting of stockholders held on December 14, 2016;

|

|

(d)

|

the technical report entitled “Amended Preliminary Economic Assessment, Calico Resources Corp., Grassy Mountain Project, Malheur County, Oregon, USA” with an amended date of July 9, 2015 and an effective

date of January 13, 2015 (the “

Grassy Mountain Report

”); and

|

|

(e)

|

the technical report entitled “Technical Report and Preliminary Economic Assessment, Paramount Gold Nevada Corp., Sleeper Project, Humboldt County Nevada” dated December 10, 2015 and amended September 25, 2017

(the “

Sleeper Report

”).

|

Any document of the type referred to in section 11.1 of Form 44-101F1 Short Form Prospectus, if

filed by the Corporation after the date of this Prospectus and prior to the termination of this distribution, shall be deemed to be incorporated by reference in this Prospectus.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or

superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is, or is deemed to be, incorporated by reference herein modifies, replaces or supersedes such

statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus. The modifying or superseding statement need not state that it has modified or superseded a prior

statement or include any other information set forth in the document that it modifies or supersedes.

The making of a modifying or superseding

statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be

stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

THE CORPORATION

Paramount Gold Nevada Corp. was incorporated under the General Corporation Law of the State of Nevada, USA, on June 15, 1992

under the name X-Cal (USA), Inc. In December 2014, the Corporation changed its name to “Paramount Gold Nevada Corp.” On March 17, 2015, the Corporation merged with Paramount Nevada Gold Corp. (formerly, X-Cal Resources Inc.), its

former parent corporation.

On April 17, 2015, the Corporation entered into a separation and distribution agreement with Paramount Gold and Silver

Corp. (“

PGSC

”), to effect the separation (the “

Separation

”) of the Corporation from PGSC, and to provide for the allocation between the Corporation and PGSC of the Corporation’s and PGSC’s assets,

liabilities and obligations attributable to periods prior to, at and after the separation. The Corporation filed a registration statement on Form S-1 (the “

Spin-out Registration Statement

”) in connection with the distribution (the

“

Distribution

”) by PGSC to its stockholders of all the outstanding shares of common stock of the Corporation, par value US$0.01 per share. The Spin-out Registration Statement was declared effective by the Securities and Exchange

Commission on April 9, 2015. The Distribution, which effected a spin-off of the Corporation from PGSC, was made on April 17, 2015 to PGSC stockholders of record on April 14, 2015. As a result of the Distribution, the Corporation

became a publicly-traded company independent from PGSC. On April 20, 2015, the Common Shares commenced trading on the NYSE American under the symbol “PZG”. An aggregate of 8,101,371 Common Shares were distributed in the Distribution.

In connection with the Separation and PGSC’s merger with and into Coeur Mining, Inc. (“

Coeur

”), PGSC contributed approximately US$8.45 million to the Corporation as an equity contribution, and the Corporation issued 417,420

Common Shares to Coeur in exchange for a cash payment by Coeur in the amount of US$1.47 million.

- 4 -

On March 14, 2016, the Corporation and Calico Resources Corp. (“

Calico

”) entered into an

arrangement agreement (the “

Arrangement Agreement

”) providing for the acquisition of all of the outstanding equity securities of Calico by the Corporation. On July 7, 2016, after having received the approval of the Supreme

Court of British Columbia to the plan of arrangement pursuant to which the transaction was completed, Paramount and Calico completed the transaction contemplated by the Arrangement Agreement and Calico became a wholly-owned subsidiary of the

Corporation.

On November 14, 2016, Calico Resources Corp. was merged into Calico Resources USA Corp. As a result, Calico Resources USA Corp.

(“

Calico US

”) became a wholly-owned subsidiary of the Corporation.

The head office of the Corporation is at 665 Anderson Street,

Winnemucca, Nevada 89445, USA. The registered office of the Corporation is at 50 W Liberty St., Suite 750, Reno, Nevada 89501, USA. The following chart illustrates certain of the Corporation’s subsidiaries (the “

Subsidiaries

”)

and the jurisdiction of incorporation of each company. Unless the context otherwise requires, references in this Prospectus to the “Corporation” or “Paramount” include Paramount Gold Nevada Corp. and its Subsidiaries.

The Corporation currently has three active wholly owned direct subsidiaries: New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate its mining

interests in Nevada, and Calico US, which holds its interest in the Grassy Mountain Project in Oregon.

The Corporation’s corporate structure is as

follows:

DESCRIPTION OF THE CORPORATION’S BUSINESS

General

The Corporation is engaged in the business of

acquiring, exploring and developing precious metal projects in the United States of America. Paramount owns advanced stage exploration projects in the states of Nevada and Oregon. Paramount believes there are several ways to realize the value of its

projects: selling its projects to producers; joint venturing its projects with other companies; or building and operating small mines on its own.

- 5 -

Paramount holds a 100% working interest in the Grassy Mountain project (the “

Grassy Mountain

Project

”) which consists of approximately 9,300 acres located on both private lands as well as lands falling under the jurisdiction of the Bureau of Land Management (“

BLM

”) land in Malheur County, Oregon, USA, and which was

acquired as a result of the acquisition of Calico in July 2016. The Grassy Mountain Project contains a gold-silver deposit for which a preliminary economic assessment (“

PEA

”) has been prepared and key permitting milestones

accomplished.

Following Paramount’s acquisition of Calico in July, 2016, Paramount commenced plans to proceed with a pre-feasibility study (the

“

PFS

”) for the proposed construction and operation of an underground mine to exploit the high-grade gold core at the Grassy Mountain Project. In the fall of 2016, Paramount initiated a 30-hole drill program (the “

Drill

Program

”) as part of the preparation of the PFS to: better define the Grassy Mountain Project’s high grade gold zone for underground mining and to potentially expand its size and grade; acquire material for PFS-level metallurgical

testing to design the gold recovery process, including studies to better define the crushing equipment and milling circuits necessary to optimize gold recoveries; and obtain geotechnical data on rock quality for underground mine design and mining

methodology. Paramount expects to complete the PFS in the first quarter of 2018.

During the Drill Program, for resource confirmation and metallurgical

drilling, a reverse circulation rig was used to drill the upper portion of the holes while the two core rigs were used to complete the lower portions of the holes in the targeted high-grade core. For geotechnical data, core rigs were used for the

entire hole employing a triple tube technique to preserve the in situ characteristics of the rock.

Particulars in respect of the location and survey of

the completed drill holes are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

hole_id

|

|

Easting

|

|

|

Northing

|

|

|

Elevation (feet)

|

|

|

Depth (feet)

|

|

|

Azimuth

|

|

|

Dip

|

|

|

GM16-02

|

|

|

1,545,308

|

|

|

|

15,863,841

|

|

|

|

3,925

|

|

|

|

742.0

|

|

|

|

234.2

|

|

|

|

-89.9

|

|

|

GM16-03

|

|

|

1,545,469

|

|

|

|

15,863,782

|

|

|

|

3,930

|

|

|

|

785.0

|

|

|

|

200.7

|

|

|

|

-89.1

|

|

|

GM16-04

|

|

|

1,545,315

|

|

|

|

15,863,982

|

|

|

|

3,898

|

|

|

|

744.5

|

|

|

|

141.3

|

|

|

|

-89.6

|

|

|

GM16-05

|

|

|

1,545,314

|

|

|

|

15,864,034

|

|

|

|

3,884

|

|

|

|

618.0

|

|

|

|

0.0

|

|

|

|

-90.0

|

|

|

GM16-06

|

|

|

1,545,239

|

|

|

|

15,863,920

|

|

|

|

3,911

|

|

|

|

731.0

|

|

|

|

32.7

|

|

|

|

-89.5

|

|

|

GM16-09

|

|

|

1,545,519

|

|

|

|

15,863,898

|

|

|

|

3,912

|

|

|

|

795.0

|

|

|

|

241.6

|

|

|

|

-88.8

|

|

|

GM17-07

|

|

|

1,545,317

|

|

|

|

15,863,752

|

|

|

|

3,932

|

|

|

|

850.5

|

|

|

|

304.9

|

|

|

|

-75.3

|

|

|

GM17-10

|

|

|

1,545,461

|

|

|

|

15,863,781

|

|

|

|

3,930

|

|

|

|

822.0

|

|

|

|

345.3

|

|

|

|

-77.8

|

|

|

GM17-11

|

|

|

1,545,548

|

|

|

|

15,863,849

|

|

|

|

3,913

|

|

|

|

385.0

|

|

|

|

0.0

|

|

|

|

-90.0

|

|

|

GM17-12

|

|

|

1,545,407

|

|

|

|

15,863,912

|

|

|

|

3,913

|

|

|

|

689.0

|

|

|

|

358.3

|

|

|

|

-89.7

|

|

|

GM17-15

|

|

|

1,545,329

|

|

|

|

15,863,752

|

|

|

|

3,933

|

|

|

|

780.0

|

|

|

|

317.3

|

|

|

|

-69.2

|

|

|

GM17-16

|

|

|

1,545,641

|

|

|

|

15,863,842

|

|

|

|

3,897

|

|

|

|

923.0

|

|

|

|

356.5

|

|

|

|

-64.6

|

|

|

GM17-17

|

|

|

1,545,634

|

|

|

|

15,863,835

|

|

|

|

3,896

|

|

|

|

929.5

|

|

|

|

332.0

|

|

|

|

-58.6

|

|

|

GM17-18

|

|

|

1,545,553

|

|

|

|

15,863,847

|

|

|

|

3,913

|

|

|

|

884.5

|

|

|

|

340.4

|

|

|

|

-66.5

|

|

|

GM17-19

|

|

|

1,545,470

|

|

|

|

15,863,588

|

|

|

|

3,960

|

|

|

|

857.5

|

|

|

|

321.4

|

|

|

|

-64.7

|

|

|

GM17-20

|

|

|

1,545,877

|

|

|

|

15,864,017

|

|

|

|

3,838

|

|

|

|

856.5

|

|

|

|

354.1

|

|

|

|

-79.4

|

|

|

GM17-21

|

|

|

1,545,693

|

|

|

|

15,864,263

|

|

|

|

3,812

|

|

|

|

832.0

|

|

|

|

154.7

|

|

|

|

-69.1

|

|

|

GM17-22

|

|

|

1,545,464

|

|

|

|

15,863,789

|

|

|

|

3,930

|

|

|

|

953.5

|

|

|

|

341.0

|

|

|

|

-60.6

|

|

|

GM17-23

|

|

|

1,545,509

|

|

|

|

15,863,898

|

|

|

|

3,913

|

|

|

|

956.0

|

|

|

|

336.8

|

|

|

|

-60.0

|

|

|

GM17-24

|

|

|

1,545,699

|

|

|

|

15,864,257

|

|

|

|

3,812

|

|

|

|

896.0

|

|

|

|

132.7

|

|

|

|

-64.2

|

|

|

GM17-25

|

|

|

1,545,638

|

|

|

|

15,864,256

|

|

|

|

3,813

|

|

|

|

887.0

|

|

|

|

151.6

|

|

|

|

-59.1

|

|

|

GM17-26

|

|

|

1,545,791

|

|

|

|

15,863,960

|

|

|

|

3,857

|

|

|

|

875.0

|

|

|

|

340.8

|

|

|

|

-65.2

|

|

|

GM17-27

|

|

|

1,545,510

|

|

|

|

15,864,175

|

|

|

|

3,837

|

|

|

|

772.0

|

|

|

|

155.7

|

|

|

|

-55.4

|

|

|

GM17-28

|

|

|

1,545,360

|

|

|

|

15,864,219

|

|

|

|

3,829

|

|

|

|

862.0

|

|

|

|

149.6

|

|

|

|

-50.7

|

|

|

GM17-29

|

|

|

1,545,789

|

|

|

|

15,863,957

|

|

|

|

3,856

|

|

|

|

800.0

|

|

|

|

287.3

|

|

|

|

-64.1

|

|

|

GM17-30

|

|

|

1,545,802

|

|

|

|

15,863,950

|

|

|

|

3,857

|

|

|

|

810.0

|

|

|

|

322.6

|

|

|

|

-78.8

|

|

- 6 -

Results for the holes completed to their targeted depths are as follows:

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hole-id

|

|

Type

|

|

|

|

|

|

From

(ft.)

|

|

|

To

(ft.)

|

|

|

Width

(ft.)

(2)

|

|

|

Au

(g/T)

|

|

|

Ag

(g/T)

|

|

|

GM16-02

|

|

|

RC

|

|

|

|

|

|

|

|

130

|

|

|

|

400

|

|

|

|

270

|

|

|

|

0.60

|

|

|

|

3.2

|

|

|

|

|

|

Core

|

|

|

|

|

|

|

|

450

|

|

|

|

525

|

|

|

|

75

|

|

|

|

1.69

|

|

|

|

9.85

|

|

|

|

|

|

Core

|

|

|

|

|

|

|

|

545

|

|

|

|

685

|

|

|

|

140

|

|

|

|

47.51

|

(3)

|

|

|

12.68

|

|

|

GM16-03

|

|

|

Core

|

|

|

|

|

|

|

|

85

|

|

|

|

415

|

|

|

|

330

|

|

|

|

0.53

|

|

|

|

2.0

|

|

|

|

|

|

Core

|

|

|

|

|

|

|

|

455

|

|

|

|

785

|

|

|

|

330

|

|

|

|

2.17

|

|

|

|

5.0

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

500

|

|

|

|

672

|

|

|

|

172

|

|

|

|

3.35

|

|

|

|

7.5

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

500

|

|

|

|

545

|

|

|

|

45

|

|

|

|

3.41

|

|

|

|

7.1

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

605

|

|

|

|

633

|

|

|

|

28

|

|

|

|

5.96

|

|

|

|

8.7

|

|

|

GM16-04

|

|

|

Core

|

|

|

|

|

|

|

|

130

|

|

|

|

681

|

|

|

|

551

|

|

|

|

1.12

|

|

|

|

5.1

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

520

|

|

|

|

601

|

|

|

|

81

|

|

|

|

2.48

|

|

|

|

7.3

|

|

|

GM16-14

|

|

|

Core

|

|

|

|

|

|

|

|

367

|

|

|

|

750

|

|

|

|

383

|

|

|

|

2.20

|

|

|

|

9.1

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

546

|

|

|

|

579

|

|

|

|

33

|

|

|

|

7.51

|

|

|

|

18.0

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

613

|

|

|

|

679

|

|

|

|

66

|

|

|

|

3.56

|

|

|

|

9.2

|

|

|

GM16-5

|

|

|

Core & RC

|

|

|

|

|

|

|

|

35

|

|

|

|

618

|

|

|

|

583

|

|

|

|

1.62

|

|

|

|

5.8

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

185

|

|

|

|

618

|

|

|

|

433

|

|

|

|

2.08

|

|

|

|

7.6

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

440

|

|

|

|

618

|

|

|

|

178

|

|

|

|

3.62

|

|

|

|

11.6

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

499

|

|

|

|

618

|

|

|

|

119

|

|

|

|

4.53

|

|

|

|

12.9

|

|

|

GM16-6

|

|

|

Core & RC

|

|

|

|

|

|

|

|

185

|

|

|

|

695

|

|

|

|

510

|

|

|

|

1.63

|

|

|

|

8.0

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

305

|

|

|

|

380

|

|

|

|

75

|

|

|

|

1.52

|

|

|

|

10.9

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

395

|

|

|

|

437

|

|

|

|

42

|

|

|

|

2.32

|

|

|

|

17.5

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

471

|

|

|

|

617

|

|

|

|

146

|

|

|

|

2.67

|

|

|

|

10.5

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

520

|

|

|

|

617

|

|

|

|

97

|

|

|

|

3.37

|

|

|

|

10.5

|

|

|

GM17-7

|

|

|

Core & RC

|

|

|

|

|

|

|

|

300

|

|

|

|

774

|

|

|

|

474

|

|

|

|

1.25

|

|

|

|

5.1

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

439

|

|

|

|

486

|

|

|

|

47

|

|

|

|

1.04

|

|

|

|

3.5

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

524

|

|

|

|

540

|

|

|

|

16

|

|

|

|

2.69

|

|

|

|

17.7

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

551.5

|

|

|

|

616

|

|

|

|

64.5

|

|

|

|

2.31

|

|

|

|

6.9

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

651

|

|

|

|

690

|

|

|

|

39

|

|

|

|

1.92

|

|

|

|

8.9

|

|

|

GM16-9

|

|

|

Core & RC

|

|

|

|

|

|

|

|

225

|

|

|

|

750

|

|

|

|

525

|

|

|

|

1.28

|

|

|

|

6.4

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

555

|

|

|

|

596

|

|

|

|

41

|

|

|

|

2.72

|

|

|

|

14.2

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

632

|

|

|

|

679

|

|

|

|

47

|

|

|

|

3.14

|

|

|

|

7.1

|

|

|

GM17-10

|

|

|

Core & RC

|

|

|

|

|

|

|

|

130

|

|

|

|

767

|

|

|

|

637

|

|

|

|

2.74

|

|

|

|

6.3

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

460

|

|

|

|

767

|

|

|

|

307

|

|

|

|

5.06

|

|

|

|

8.7

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

640

|

|

|

|

767

|

|

|

|

127

|

|

|

|

10.30

|

|

|

|

6.6

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

747

|

|

|

|

749

|

|

|

|

2

|

|

|

|

339.0

|

|

|

|

35.2

|

|

|

GM17-12

|

|

|

Core & RC

|

|

|

|

|

|

|

|

85

|

|

|

|

145

|

|

|

|

60

|

|

|

|

1.00

|

|

|

|

1.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

170

|

|

|

|

255

|

|

|

|

85

|

|

|

|

0.52

|

|

|

|

1.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

280

|

|

|

|

682

|

|

|

|

388

|

|

|

|

1.89

|

|

|

|

8.7

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

472

|

|

|

|

682

|

|

|

|

195.5

|

|

|

|

2.79

|

|

|

|

10.3

|

|

|

|

|

|

|

|

|

|

Including

|

|

|

|

575

|

|

|

|

682

|

|

|

|

93

|

|

|

|

3.77

|

|

|

|

10.3

|

|

- 7 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hole-id

|

|

Type

|

|

|

|

|

From

(ft.)

|

|

|

To

(ft.)

|

|

|

Width

(ft.)

(2)

|

|

|

Au

(g/T)

|

|

|

Ag

(g/T)

|

|

|

GM17-15

|

|

|

Core & RC

|

|

|

|

|

|

327

|

|

|

|

732

|

|

|

|

400

|

|

|

|

1.88

|

|

|

|

7.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

348

|

|

|

|

421

|

|

|

|

73

|

|

|

|

1.26

|

|

|

|

7.6

|

|

|

|

|

|

|

|

|

Including

|

|

|

487

|

|

|

|

537

|

|

|

|

50

|

|

|

|

3.41

|

|

|

|

11.0

|

|

|

|

|

|

|

|

|

Including

|

|

|

607

|

|

|

|

688

|

|

|

|

81

|

|

|

|

3.68

|

|

|

|

7.4

|

|

|

GM17-18

|

|

|

Core & RC

|

|

|

|

|

|

454

|

|

|

|

871

|

|

|

|

417

|

|

|

|

2.87

|

|

|

|

12.2

|

|

|

|

|

|

|

|

|

Including

|

|

|

559

|

|

|

|

597

|

|

|

|

38

|

|

|

|

2.46

|

|

|

|

20.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

614

|

|

|

|

632

|

|

|

|

18

|

|

|

|

3.33

|

|

|

|

16.2

|

|

|

|

|

|

|

|

|

Including

|

|

|

670

|

|

|

|

77

|

|

|

|

97

|

|

|

|

6.15

|

|

|

|

15.1

|

|

|

|

|

|

|

|

|

Including

|

|

|

830

|

|

|

|

858

|

|

|

|

28

|

|

|

|

5.70

|

|

|

|

13.6

|

|

|

GM17-19

|

|

|

Core & RC

|

|

|

|

|

|

315

|

|

|

|

390

|

|

|

|

75

|

|

|

|

0.60

|

|

|

|

3.7

|

|

|

|

|

|

|

|

|

|

|

|

527

|

|

|

|

772

|

|

|

|

245

|

|

|

|

8.15

|

|

|

|

12.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

532

|

|

|

|

652

|

|

|

|

120

|

|

|

|

3.68

|

|

|

|

10.7

|

|

|

|

|

|

|

|

|

Including

|

|

|

682

|

|

|

|

772

|

|

|

|

90

|

|

|

|

16.83

|

|

|

|

15.6

|

|

|

|

|

|

|

|

|

Including

|

|

|

732

|

|

|

|

772

|

|

|

|

40

|

|

|

|

31.10

|

|

|

|

21.7

|

|

|

GM17-16

|

|

|

Core & RC

|

|

|

|

|

|

25

|

|

|

|

833

|

|

|

|

808

|

|

|

|

1.28

|

|

|

|

5.5

|

|

|

|

|

|

|

|

|

Including

|

|

|

295

|

|

|

|

833

|

|

|

|

538

|

|

|

|

1.70

|

|

|

|

7.6

|

|

|

|

|

|

|

|

|

Including

|

|

|

672

|

|

|

|

833

|

|

|

|

161

|

|

|

|

2.91

|

|

|

|

7.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

672

|

|

|

|

727

|

|

|

|

55

|

|

|

|

2.89

|

|

|

|

8.7

|

|

|

|

|

|

|

|

|

Including

|

|

|

769

|

|

|

|

784

|

|

|

|

15

|

|

|

|

4.65

|

|

|

|

6.3

|

|

|

|

|

|

|

|

|

Including

|

|

|

807

|

|

|

|

828

|

|

|

|

21

|

|

|

|

7.09

|

|

|

|

14.4

|

|

|

GM17-17

|

|

|

Core & RC

|

|

|

|

|

|

200

|

|

|

|

921

|

|

|

|

721

|

|

|

|

1.85

|

|

|

|

8.7

|

|

|

|

|

|

|

|

|

Including

|

|

|

544

|

|

|

|

581

|

|

|

|

37

|

|

|

|

3.28

|

|

|

|

38.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

705

|

|

|

|

786

|

|

|

|

81

|

|

|

|

5.42

|

|

|

|

14.3

|

|

|

|

|

|

|

|

|

Including

|

|

|

831

|

|

|

|

876

|

|

|

|

45

|

|

|

|

3.59

|

|

|

|

6.0

|

|

|

GM17-20

|

|

|

Core & RC

|

|

|

|

|

|

275

|

|

|

|

750

|

|

|

|

475

|

|

|

|

1.89

|

|

|

|

7.6

|

|

|

|

|

|

|

|

|

Including

|

|

|

280

|

|

|

|

694

|

|

|

|

114

|

|

|

|

1.78

|

|

|

|

11.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

611

|

|

|

|

726

|

|

|

|

115

|

|

|

|

4.53

|

|

|

|

8.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

657

|

|

|

|

726

|

|

|

|

69

|

|

|

|

6.38

|

|

|

|

9.1

|

|

|

GM17-21

|

|

|

Core & RC

|

|

|

|

|

|

165

|

|

|

|

719

|

|

|

|

554

|

|

|

|

1.49

|

|

|

|

5.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

560

|

|

|

|

702

|

|

|

|

142

|

|

|

|

2.74

|

|

|

|

7.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

560

|

|

|

|

644

|

|

|

|

84

|

|

|

|

3.07

|

|

|

|

8.5

|

|

|

|

|

|

|

|

|

Including

|

|

|

595

|

|

|

|

611

|

|

|

|

16

|

|

|

|

5.46

|

|

|

|

12.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

669

|

|

|

|

702

|

|

|

|

33

|

|

|

|

3.35

|

|

|

|

8.2

|

|

|

GM17-22

|

|

|

Core & RC

|

|

|

|

|

|

220

|

|

|

|

862

|

|

|

|

642

|

|

|

|

2.02

|

|

|

|

8.1

|

|

|

|

|

|

|

|

|

Including

|

|

|

522

|

|

|

|

792

|

|

|

|

270

|

|

|

|

3.58

|

|

|

|

12.2

|

|

|

|

|

|

|

|

|

Including

|

|

|

552

|

|

|

|

627

|

|

|

|

75

|

|

|

|

2.42

|

|

|

|

12.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

677

|

|

|

|

792

|

|

|

|

115

|

|

|

|

5.37

|

|

|

|

10.8

|

|

|

GM17-23

|

|

|

Core & RC

|

|

|

|

|

|

250

|

|

|

|

901

|

|

|

|

649

|

|

|

|

1.26

|

|

|

|

6.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

637

|

|

|

|

671

|

|

|

|

34

|

|

|

|

2.76

|

|

|

|

16.1

|

|

|

|

|

|

|

|

|

Including

|

|

|

730

|

|

|

|

782

|

|

|

|

52

|

|

|

|

2.85

|

|

|

|

4.6

|

|

|

GM17-24

|

|

|

Core & RC

|

|

|

|

|

|

100

|

|

|

|

896

|

|

|

|

786

|

|

|

|

0.95

|

|

|

|

4.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

862

|

|

|

|

896

|

|

|

|

34

|

|

|

|

2.58

|

|

|

|

2.9

|

|

|

GM17-25

|

|

|

Core & RC

|

|

|

|

|

|

556

|

|

|

|

747

|

|

|

|

191

|

|

|

|

4.02

|

|

|

|

6.5

|

|

|

|

|

|

|

|

|

Including

|

|

|

644

|

|

|

|

725

|

|

|

|

81

|

|

|

|

8.04

|

|

|

|

8.9

|

|

|

GM17-26

|

|

|

Core & RC

|

|

|

|

|

|

185

|

|

|

|

807

|

|

|

|

622

|

|

|

|

2.10

|

|

|

|

7.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

702

|

|

|

|

804

|

|

|

|

102

|

|

|

|

6.09

|

|

|

|

9.5

|

|

|

GM17-27

|

|

|

Core & RC

|

|

|

|

|

|

225

|

|

|

|

772

|

|

|

|

547

|

|

|

|

1.17

|

|

|

|

4.8

|

|

|

|

|

|

|

|

|

Including

|

|

|

703

|

|

|

|

761

|

|

|

|

58

|

|

|

|

2.84

|

|

|

|

4.9

|

|

|

GM17-28

|

|

|

Core & RC

|

|

|

|

|

|

175

|

|

|

|

860

|

|

|

|

680

|

|

|

|

2.41

|

|

|

|

7.3

|

|

|

|

|

|

|

|

|

Including

|

|

|

662

|

|

|

|

691

|

|

|

|

29

|

|

|

|

5.83

|

|

|

|

10.5

|

|

|

|

|

|

|

|

|

Including

|

|

|

705

|

|

|

|

722

|

|

|

|

17

|

|

|

|

35.70

|

|

|

|

21.9

|

|

|

|

|

|

|

|

|

Including

|

|

|

763

|

|

|

|

787

|

|

|

|

23.5

|

|

|

|

5.19

|

|

|

|

8.1

|

|

|

GM17-29

|

|

|

Core & RC

|

|

|

|

|

|

270

|

|

|

|

747

|

|

|

|

477

|

|

|

|

4.01

|

|

|

|

8.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

694

|

|

|

|

747

|

|

|

|

52.5

|

|

|

|

25.46

|

|

|

|

18.5

|

|

|

GM17-30

|

|

|

Core & RC

|

|

|

|

|

|

519

|

|

|

|

770

|

|

|

|

251

|

|

|

|

3.36

|

|

|

|

8.4

|

|

|

|

|

|

|

|

|

Including

|

|

|

715

|

|

|

|

749

|

|

|

|

34

|

|

|

|

11.22

|

|

|

|

7.4

|

|

- 8 -

Notes:

|

(1)

|

Michael McGinnis, Paramount’s Grassy Mountain Project Manager, a professional geologist and a Qualified Person under National Instrument 43-101, has reviewed and approved of the aforementioned disclosure of the

results from the drill program.

|

|

(2)

|

These holes were oriented to intersect the target at true thickness.

|

|

(3)

|

Intercept includes 5 ft @ 1,090 Au g/T.

|

A comprehensive quality control/quality assurance

(“

QA

/

QC