Tyson Foods, Inc. (NYSE:TSN) today announced increased adjusted

guidance for fiscal 2017, adjusted guidance for fiscal 2018 and

cost savings targets for 2018-2020.

Adjusted earnings guidance for the 2017 fiscal year, which ends

Saturday, has been increased to an adjusted $5.20-5.30 per share,

up from $4.95-5.05, primarily due to much better than expected

earnings in the Beef segment.

Guidance for fiscal 2018 is an adjusted $5.70-5.85 earnings per

share, which would be the seventh consecutive year of record

adjusted EPS.

The company plans to provide GAAP results for its fourth quarter

and full-year 2017 in its fourth quarter earnings report scheduled

for Nov. 13; however, at this time the company is unable to

reconcile its full-year fiscal 2017 and 2018 adjusted EPS guidance

to its full-year fiscal 2017 and 2018 projected GAAP guidance

because certain information necessary to calculate such measures on

a GAAP basis is unavailable or dependent on the timing of future

events outside of our control. These potential items include, but

are not limited to, the potential impairment of a non-protein

business classified as an asset held for sale and any gains or

losses upon the completion of the sale of three non-protein

businesses, potential impairments of long-lived assets and

intangible assets, and additional expense or modifications to its

restructuring plan and other charges. Therefore, because of the

uncertainty and variability of the nature of the amount of future

adjustments, which could be significant, the company is unable to

provide a reconciliation of this measure without unreasonable

efforts. Adjusted EPS should not be considered a substitute for net

income per share attributable to Tyson or any other measure of

financial performance reported in accordance with GAAP. Investors

should rely primarily on our GAAP results and use non-GAAP

financial measures only supplementally in making investment

decisions.

Tom Hayes, Tyson’s president and chief executive officer, said

the company is implementing its previously announced “Financial

Fitness” plans. “We are creating momentum behind our continuous

improvement agenda as we know we can be even more efficient

operators,” he said. “We are a good partner for growth for our

customers and are constantly challenging ourselves to identify

opportunities to create value for our consumers, customers and

shareowners.”

Through a combination of synergies from the integration of

AdvancePierre Foods acquired in June, and additional eliminations

of non-value-added costs, the company expects cumulative net

savings of $200 million, $400 million and $600 million over fiscal

years 2018, 2019 and 2020, respectively. These savings primarily

will impact the Prepared Foods and Chicken segments, focusing on

three areas:

- Supply Chain

- Procurement

- Overhead

The company plans to reduce headcount by approximately 450

positions across several areas and job levels. Most of the

eliminated positions will come from the corporate offices in

Springdale, Chicago and Cincinnati.

“We’re grateful to everyone who has contributed to the company’s

success, and we’re thankful for their time with Tyson Foods,” Hayes

said. “These are hard decisions, but I believe our customers and

consumers will benefit from our more agile, responsive organization

as we grow our business through differentiated capabilities,

deliver ongoing financial fitness through continuous improvement

and sustain our company and our world for future generations.”

In its fiscal fourth quarter earnings report, Tyson Foods plans

to report restructuring and other charges of approximately $140 -

$150 million, composed of an approximately $70 million impairment

for costs related to in-process software implementations, $45 - $50

million in employee termination costs and $25 - $30 million in

contract termination costs.

The company plans to provide a reconciliation of its fourth

quarter adjusted EPS and its full-year fiscal 2017 adjusted EPS

guidance to its fourth quarter GAAP EPS and its full-year fiscal

2017 GAAP guidance in its fourth quarter earnings report scheduled

for Nov. 13. The company last provided a reconciliation of adjusted

EPS and GAAP EPS in its third quarter earnings release. For a

reconciliation of the company’s third quarter adjusted EPS and its

nine-months ended adjusted EPS to its third quarter and nine-months

ended GAAP EPS, respectively, see the company’s Current Report on

Form 8-K filed with the SEC on August 7, 2017.

Adjusted net income per share attributable to Tyson (adjusted

EPS) is a supplementary measure of our financial performance that

is not required by, or presented in accordance with, GAAP. We use

adjusted EPS as an internal performance measurement and as one

criterion for evaluating our performance relative to that of our

peers. We believe adjusted EPS is meaningful to our investors to

enhance their understanding of our financial performance and is

frequently used by securities analysts, investors and other

interested parties to compare our performance with the performance

of other companies that report adjusted EPS. Further, we believe

that adjusted EPS is a useful measure because it improves

comparability of results of operations from period to period.

Adjusted EPS should not be considered a substitute for net income

per share attributable to Tyson or any other measure of financial

performance reported in accordance with GAAP. Investors should rely

primarily on our GAAP results and use non-GAAP financial measures

only supplementally in making investment decisions. Our calculation

of adjusted EPS may not be comparable to similarly titled measures

reported by other companies.

The company will host a conference call with analysts to discuss

these announcements at 9 a.m. EDT Friday, Sept. 29, 2017.

Participants may pre-register for the call at

http://dpregister.com/10112611. Callers who pre-register will be

given a conference passcode and unique PIN to gain immediate access

to the call and bypass the operator. Participants may

pre-register at any time, including up to and after the call start

time. Those without internet access or who are unable to

pre-register may dial-in by calling toll free 1-844-890-1795 or

international toll 1-412-717-9589.

A live webcast, including slides, will be available on the Tyson

Foods Investor Relations website at http://ir.tyson.com. The

webcast also can be accessed by using the direct link

https://event.on24.com/wcc/r/1517267/0A51C0B8DD32E46218B1A4E8572833A7

A replay of the call will be available until Oct. 29, 2017, toll

free at 1-877-344-7529, international toll 1-412-317-0088 or Canada

toll free 855-669-9658. The replay access code

is 10112611. Financial information, such as

this news release, can be accessed from the Company's web site at

http://ir.tyson.com.

To download the free Tyson IR App, which offers access to SEC

filings, news releases, transcripts, webcasts and presentations,

please visit the App Store for iPhone and iPad or Google

Play for Android mobile devices.

About Tyson FoodsTyson Foods Inc. (NYSE:TSN) is

one of the world’s largest food companies and a recognized leader

in protein. Founded in 1935 by John W. Tyson and grown under three

generations of family leadership, the company has a broad portfolio

of products and brands like Tyson®, Jimmy Dean®, Hillshire Farm®,

Ball Park®, Wright®, Aidells®, ibp® and State Fair®. Tyson Foods

innovates continually to make protein more sustainable, tailor food

for everywhere it’s available and raise the world’s expectations

for how much good food can do. Headquartered in Springdale,

Arkansas, the company had 114,000 team members at October 1, 2016.

Through its Core Values, Tyson Foods strives to operate with

integrity, create value for its shareholders, customers,

communities and team members and serve as stewards of the animals,

land and environment entrusted to it. Visit www.tysonfoods.com.

Forward-Looking Statements Certain information

contained in this news release may constitute forward-looking

statements, including but not limited to statements relating to

expected performance, statements relating to adjusted EPS guidance

and synergies estimates, and statements relating to impairment and

other charges regarding restructuring and other termination

actions. These forward-looking statements are subject to a number

of factors and uncertainties which could cause our actual results

and experiences to differ materially from the anticipated results

and expectations expressed in such forward-looking statements. We

wish to caution readers not to place undue reliance on any

forward-looking statements, which speak only as of the date made.

Among the factors that may cause actual results and experiences to

differ from anticipated results and expectations expressed in such

forward-looking statements are the following: (i) the effect of, or

changes in, general economic conditions; (ii) fluctuations in the

cost and availability of inputs and raw materials, such as live

cattle, live swine, feed grains (including corn and soybean meal)

and energy; (iii) market conditions for finished products,

including competition from other global and domestic food

processors, supply and pricing of competing products and

alternative proteins and demand for alternative proteins; (iv)

successful rationalization of existing facilities and operating

efficiencies of the facilities; (v) risks associated with our

commodity purchasing activities; (vi) access to foreign markets

together with foreign economic conditions, including currency

fluctuations, import/export restrictions and foreign politics;

(vii) outbreak of a livestock disease (such as avian influenza (AI)

or bovine spongiform encephalopathy (BSE)), which could have an

adverse effect on livestock we own, the availability of livestock

we purchase, consumer perception of certain protein products or our

ability to access certain domestic and foreign markets; (viii)

changes in availability and relative costs of labor and contract

growers and our ability to maintain good relationships with

employees, labor unions, contract growers and independent producers

providing us livestock; (ix) issues related to food safety,

including costs resulting from product recalls, regulatory

compliance and any related claims or litigation; (x) changes in

consumer preference and diets and our ability to identify and react

to consumer trends; (xi) significant marketing plan changes by

large customers or loss of one or more large customers; (xii)

adverse results from litigation; (xiii) impacts on our operations

caused by factors and forces beyond our control, such as natural

disasters, fire, bioterrorism, pandemics or extreme weather; (xiv)

risks associated with leverage, including cost increases due to

rising interest rates or changes in debt ratings or outlook; (xv)

compliance with and changes to regulations and laws (both domestic

and foreign), including changes in accounting standards, tax laws,

environmental laws, agricultural laws and occupational, health and

safety laws; (xvi) our ability to make effective acquisitions or

joint ventures and successfully integrate newly acquired businesses

into existing operations; (xvii) cyber incidents, security breaches

or other disruptions of our information technology systems; (xviii)

effectiveness of advertising and marketing programs; (xix) our

ability to fully realize expected cost savings or operating

efficiencies associated with our strategic initiatives or

restructuring programs; and (xx) those factors listed under Item

1A. “Risk Factors” included in our Annual Report filed on Form 10-K

for the period ended October 1, 2016 and subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Media Contact: Gary Mickelson, 479-290-6111

Investor Contact: Jon Kathol, 479-290-4235

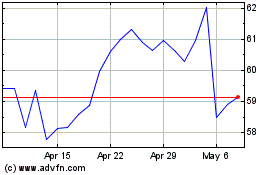

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

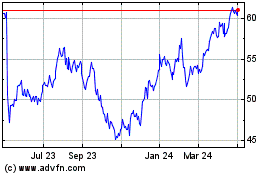

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024