Kellogg CEO John Bryant to Step Down -- Update

September 28 2017 - 10:02AM

Dow Jones News

By Annie Gasparro

Kellogg Co. Chief Executive John Bryant is stepping down next

week after nearly seven years leading the cereal and snack giant

through a tumultuous time in the food industry.

Steven Cahillane, chief executive of health-and-wellness company

Nature's Bounty and a former Coca-Cola Co. executive, will join

Kellogg to succeed Mr. Bryant, the company said Thursday.

Kellogg, the maker of Frosted Flakes, Pop-Tarts and Pringles,

has been battling sluggish sales as Americans stray from big brands

and processed foods, in favor of fresher, more niche

alternatives.

It isn't alone in its difficulties. Other big food makers are

also starving for sales growth. Mondelez International Inc.,

Hershey Co. and General Mills Inc. have all announced new chiefs in

the past year.

Mr. Bryant, 51, will remain chairman of the board until March

15, at which point Mr. Cahillane, 52, will assume that role. Mr.

Bryant said his successor has "an exceptional track record" and

will "continue the transformation" of Kellogg.

Mr. Bryant said in a statement Thursday that he chose to retire.

It is unclear when the discussions for succession began. Kellogg

declined to comment.

The company's core business, cereal in the U.S., has weighed on

its performance for years. Last month, Kellogg said its quarterly

sales fell 2.5% to $3.19 billion, including a 2% drop in North

America. On a comparable basis, sales fell 3.8%.

Mr. Bryant, who was born in Australia, joined Kellogg in 1998

and had stints in global strategic planning, as finance chief and

as chief operating officer, before taking on the CEO job in

2011.

At the time, the 45-year-old inherited a swath of lagging cereal

brands like Special K and Rice Krispies, which were becoming

outdated as consumers sought fresher and more natural products in

the grocery aisles. High-protein, low-carbohydrate diets had left

cereal behind, while more convenient and trendy protein bars and

egg sandwiches gained popularity.

Mr. Bryant aimed to turned around Kellogg following the sudden

departure of his predecessor and fellow Australian David Mackay.

About a year into Mr. Bryant's tenure, Kellogg acquired Pringles

chips, signaling a strategic shift to become more of a snacking

company with a greater focus on global markets.

The acquisition has served the company well but the its main

cereal business has continued to suffer. In an effort to boost

sales, Kellogg is renovating its brands to include simpler, more

natural ingredients. It has said products like frozen Eggo waffles,

which no longer contain artificial colors, have improved sales.

Meanwhile, Kellogg has followed its peers in the U.S. food

industry in drastically cutting costs through layoffs at its

corporate headquarters and by closing factories in response to

lower demand for its food.

Over the past year, Kellogg's stock has fallen 19%, similar to

its peers. During his tenure as chief, shares have climbed about

24%.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

September 28, 2017 09:47 ET (13:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

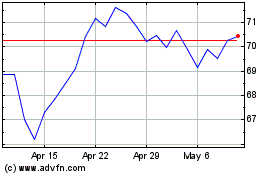

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

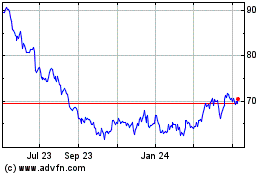

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024