E-Commerce Mania Spreads To Warehouse Market

September 26 2017 - 7:29AM

Dow Jones News

By Esther Fung

E-commerce is setting off a scramble for industrial real estate

near urban centers, giving landlords of once-unglamorous properties

a chance to push up rents to record levels.

Amazon.com Inc. and other online retailers, as well as

fulfillment companies such as FedEx Corp., increasingly are seeking

out "last-mile" locations in urban areas to feed consumer demand

for ever-faster delivery of their purchases.

That, in turn, is giving landlords of such facilities pricing

power they have never enjoyed before.

On average, U.S. industrial rents stood at a record $5.35 per

square foot in the second quarter, up from $5.25 in the first

quarter, according to data from real estate services firm JLL.

A well-located last-mile facility "has the functional equivalent

of a high-end retail store," said Hamid Moghadam, chairman and

chief executive officer of industrial real-estate investment trust

Prologis Inc. Such facilities are productive for the tenant and

reduce transportation and labor costs.

But they also are scarce, prompting some landlords to get

creative. Prologis, a San Francisco-based REIT, purchased the old

ABC Carpet building in the Bronx earlier this year to convert to

warehouse space. It expects to get rents in the low-$20 per square

foot, which would be comparable to some office and retail asking

rents in the area.

When a company is shipping to individual customers rather than

in bulk to stores, most of their costs are in transportation and

labor, and reducing them is a priority, said Eric Frankel, an

analyst at real-estate research firm Green Street Advisors.

Warehouse rent, by contrast, represents just 5% or so of costs in a

supply chain.

"If you think about sales productivity across the entire supply

chain, paying a high rent is not a big deal," said Mr. Frankel.

Modest levels of new warehouse supply are coming onto the market

at a time when some e-commerce companies are expanding rapidly.

Amazon is now the largest tenant of Prologis, Duke Realty Corp.,

Jones Lang LaSalle Income Property Trust and DCT Industrial Trust

by percentage of rental revenue at year-end 2016, according to

S&P Global Market Intelligence.

"Consumer purchasing behavior and the rise of e-commerce have

shifted in a way that is extremely beneficial for industrial real

estate. Proximity of warehouses is more important than ever, and we

aim to own properties closest to transportation and consumers,"

said Phil Hawkins, president and chief executive of DCT in a

statement.

Some retailers, meanwhile, are embracing the practice of

"showrooming," in which shoppers use bricks-and-mortar retail

locations to check out goods they later purchase online. Nordstrom

Inc. earlier this month said it is opening a store in West

Hollywood, Calif., where shoppers can try on clothes, but the store

won't carry inventory. Instead, the merchandise would be retrieved

from other nearby Nordstrom locations or through its website.

If the concept becomes more commonplace, it would fuel more

demand for more logistics space and services, analysts said.

Other markets where warehouse space is poised to generate

premium rents include Seattle, San Francisco, parts of Los Angeles,

Chicago and possibly Miami, said Mr. Moghadam, adding that in the

future the company might be able to lease 4 million or 5 million

square feet of such premium space in each location. All told,

Prologis owns about 381 million square feet of space in the

U.S.

Warehouses commanding rents near those of office and retail

space are highly profitable for landlords in part because the

build-outs are cheaper than office or retail spaces, but analysts

said it still remains too early for the emergence of a form of

classification of warehouses akin to the different tiers of malls

in the U.S. as such high-rent deals aren't commonplace.

"It's too small a piece of the portfolio," said Steve Sakwa, an

analyst at Evercore ISI, noting that such leasing deals are still

few and aren't going to redefine Prologis' massive portfolio

anytime soon.

Mr. Sakwa noted that equity investors have already been

assigning higher valuations to industrial REITs, with some of their

stock prices up 30% in the past year.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

September 26, 2017 07:14 ET (11:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

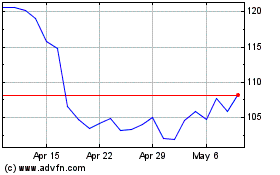

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

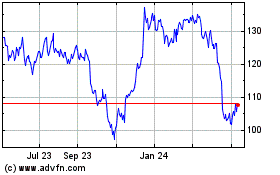

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024