By Melanie Evans

Some of the hospital industry's most active investing these days

is happening outside the hospital.

Giant U.S. hospital operators, including Tenet Healthcare Corp.,

Dignity Health and HCA Healthcare Inc., are investing heavily in

surgery centers, emergency rooms and urgent care clinics located

outside hospitals, chasing after patients who increasingly want

cheaper and more convenient care.

Insurers and employers that pay for health care are helping

drive the change as they shift more Americans to high-deductible

insurance plans, which require patients to pay more of their

medical bills before insurance kicks in. That has pushed more

patients to seek lower-cost options, says RBC Capital Markets

managing director Frank Morgan, a hospital analyst.

Hospital demand slumped during the last recession, a trend that

has continued even as the economy recovers, American Hospital

Association data through 2014 show. Admissions growth at HCA

hospitals has slowed in recent quarters to 1% to 2%, as a boost

from the Affordable Care Act faded, while Tenet's admissions have

been flat or down 1% to 3% most quarters since late 2015.

In an effort to strengthen their hold on their markets and

prevent rivals from siphoning off patients, hospitals are investing

outside their own walls. They are "following the patient," Mr.

Morgan said.

The strategy also places hospital satellites closer to where

patients live and work, which executives say they hope will win

over new, loyal customers.

In July, Ashley Hammack rushed to a new free-standing ER in

Spring Hill, Tenn., after growing weak from vomiting. The facility,

a satellite of TriStar Centennial Medical Center, is a 10 minute

drive from her home, about 20 minutes closer than the hospital

where she delivered her daughter five months before.

Doctors saw her quickly. "I never even sat down," Ms. Hammack

recalled. She was treated for severe dehydration from what doctors

suspected was food poisoning and sent home with medication.

Trevor Fetter, Tenet's outgoing chief executive, says company

executives have pursued rapid outpatient expansion partially out of

necessity. Slumping admissions contributed to Tenet and HCA

lowering their earnings estimates for 2017, which in turn hit stock

prices.

It's unclear how the shift to out-of-hospital care will affect

long-term earnings. Non-hospital operations typically generate

lower revenue than hospitals but produce higher profit and require

less capital to build and run.

But "it's happening anyway," Mr. Fetter said. "Somebody else is

going to do it to us if we don't do it ourselves."

Prices for common surgical care can be sharply lower outside of

hospitals, which generally have higher overhead related to

round-the-clock operations and the technology and specialists

needed to treat more complex cases.

Cataract surgery and knee arthroscopy prices at ambulatory

surgery centers were $5,000 to $2,500 less than at hospitals for

employees and retirees with health insurance provided by the

California Public Employees' Retirement System, according to

researchers at the University of California, Berkeley. Calpers

changed its benefits five years ago to nudge patients toward the

cheaper ambulatory option, a spokesman said, and will expand its

plan to include a dozen more surgeries starting in January.

Tenet Healthcare, which operates 77 hospitals, is expected to

spend up to $1.9 billion through 2020 to complete the buyout of

private-equity-backed United Surgical Partners International, an

operator of ambulatory surgery centers. The company acquired

slightly more than half of USPI in 2015 and agreed to buy the rest

over five years. Tenet said it would spend an additional $100

million to $150 million annually on other free-standing surgery

centers, emergency rooms and satellite locations.

Business from outside hospitals accounted for 28% of Tenet's

earnings before interest, taxes, depreciation and amortization as

of August, up from 5% in 2014. That business could be spun off or

sold under pressure from an activist investor that is Tenet's

largest institutional shareholder, according to analysts.

Dignity Health, a nonprofit based in San Francisco, owns

hospitals in three states. After a string of joint ventures and a

2012 acquisition, it also now operates more than 280 free-standing

emergency rooms, urgent care and workplace clinics and so-called

microhospitals, which have emergency rooms, fewer beds and more

limited technology.

Peggy Sanborn, vice president of strategic growth, mergers and

acquisitions for Dignity Health, said joint-replacement surgery

outside a hospital seemed impossible a decade ago. Now, aided by

technology that has improved implants and made procedures less

invasive, Dignity Health is able to replace hips and knees outside

the hospital in limited cases, she said. Patients who receive the

outpatient procedures are relatively healthy and at low risk for

complications.

HCA, the largest publicly traded U.S. hospital company with 172

hospitals, says it will operate 120 free-standing urgent care

centers by the end of the year, an increase of 40% from two years

ago. The Nashville-based firm has doubled the number of

free-standing emergency rooms it operates since 2015 to 64, and

expects to increase that number to 80 by early next year.

HCA plans to spend $3 billion on expansion this year, including

on new satellite locations, according to Chairman and Chief

Executive Milton Johnson.

Some hospital executives tout outpatient growth as a strategy to

win market share for hospitals. Patients who seek care at a

neighborhood retail clinic may choose a hospital owned by the same

company, they say. Employers and insurance companies may also

prefer hospital operators with an expansive outpatient network.

HCA's hospital market share in Nashville grew to 35% from about

32% over the past five years as the company added three ambulatory

surgery centers, four free-standing emergency rooms and 10 urgent

care centers to the market. HCA also invested in its hospitals

during that period.

Patients' drift away from hospitals has focused executives'

attention on what hospitals should look like in the future.

Tenet is studying which services "over the next 10 to 20 years

will stay in the hospital," Eric Evans, president of hospital

operations for Tenet, told analysts on a conference call last

month. For now, that includes trauma care and neurosurgery.

"Technology continues to open the door for more things to be

done on an outpatient basis," Mr. Evans said. "Our goal is, as

technology moves, is to be location-agnostic."

(END) Dow Jones Newswires

September 25, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

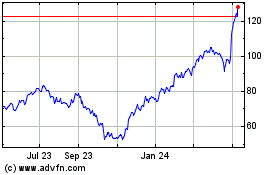

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

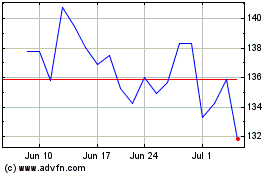

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024