Proposal 1—Election of Directors

Our Board has nominated 11 directors for election at this Annual Meeting to serve until the next Annual Meeting of Shareholders and until his or her successor is duly elected and qualified. All of the nominees are currently directors of Cardinal Health.

The Board seeks members that possess the experience, skills and diverse backgrounds to perform effectively in overseeing the company's current and evolving business and strategic direction and to properly perform its oversight responsibilities. All of our director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have

extensive healthcare and global business experience, financial expertise and business acumen , as well as public company board experience. Each of our director nominees has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees other than the Chairman and Chief Executive Officer are independent.

Each director nominee agreed to be named in this proxy statement and to serve if elected. If, due to death or other unexpected occurrence, one or more of the director nominees is not available for election, proxies will be voted for the election of all remaining nominees and any substitute nominee(s) the Board selects.

Biographies of our Director Nominees

|

|

|

|

|

|

|

|

|

|

David J. Anderson

|

Age

68

|

Director since

2014

|

|

Senior Vice President and Chief Financial Officer of Honeywell International Inc. (retired); Former Executive Vice President and Chief Financial Officer of Alexion Pharmaceuticals, Inc.

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

American Electric Power Company, Inc., a public utility holding company (since 2011); B/E Aerospace, Inc., a manufacturer of aircraft interior products (2014 -2017); Fifth Street Asset Management Inc., an alternative asset manager (2014 - 2015)

|

ü

Financial Literacy / Expertise - Former CFO roles

ü

Healthcare

ü

International

ü

Executive Leadership

ü

Strategic Planning / Acquisitions

ü

Technology

ü

Operations

ü

Regulatory / Public Policy

|

Mr. Anderson served as Chief Financial Officer of Honeywell International Inc., a global diversified technology and manufacturing company, from 2003 to 2014 and as Chief Financial Officer of Alexion Pharmaceuticals, Inc. ("Alexion"), a biotechnology company, from December 2016 to August 2017. While at Honeywell, Mr. Anderson was responsible for the company’s corporate finance activities including domestic and international tax, accounting, treasury, audit, investments, financial planning, acquisitions and real estate. Prior to his roles at Honeywell and Alexion, Mr. Anderson held a number of other finance-related executive positions with ITT Corporation, Newport News Shipbuilding, RJR Nabisco and Quaker Oats Company.

Skills and Qualifications of Particular Relevance to Cardinal Health

Through his prior finance leadership positions as Chief Financial Officer at Honeywell and Alexion, as well as other leading companies, Mr. Anderson brings to the Board relevant experience in the areas of global finance and accounting, healthcare, management, executive leadership, strategic planning, acquisitions, information technology, manufacturing operations and international markets. Given his extensive financial expertise, Mr. Anderson provides valuable insight in the areas of financial reporting, accounting and internal controls, as well as international tax and finance. In addition, his recent experience as Chief Financial Officer of Alexion brings to the Board relevant experience in the areas of healthcare and pharmaceutical manufacturing. Mr. Anderson also brings to the Board valuable perspectives and insights from his service on the board of directors of American Electric Power, including service on its Audit and Finance Committees, as well as his prior service on B/E Aerospace's board of directors.

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

3

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Colleen F. Arnold

|

Age

60

|

Director since

2007

|

|

Senior Vice President, Sales and Distribution, International Business Machines Corporation (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

None

|

ü

Technology

ü

International and Global Leadership

ü

Operations

ü

Executive Leadership

ü

Strategic Planning

|

Ms. Arnold was Senior Vice President, Sales and Distribution of International Business Machines Corporation ("IBM"), a provider of systems, financing, software and services, from 2014 until March 2016. Prior to that, she held a number of senior positions with IBM from 1998 to 2014, including Senior Vice President, Application Management Services, IBM Global Business Services; General Manager of GBS Strategy, Global Consulting Services, Global Industries and Global Application Services; General Manager, Europe; General Manager, Australia and New Zealand Global Services; and CEO, Global Services Australia, an IBM joint venture.

Skills and Qualifications of Particular Relevance to Cardinal Health

A former senior executive of IBM for over 17 years, Ms. Arnold's significant experience in the areas of global business operations and information technology contributes to the Board's discussions regarding information technology in our business and global strategies. Given her extensive international business experience, including leadership of international commercial operations at IBM, Ms. Arnold provides valuable insight for our growing presence in international markets. She also brings to the Board more than 30 years of relevant experience in the areas of operations, management, executive leadership and strategic planning.

|

|

|

|

|

|

|

|

|

|

George S. Barrett

|

Age

62

|

Director since

2009

|

|

Chairman and Chief Executive Officer, Cardinal Health, Inc.

|

|

Other Public Boards

: Eaton Corporation plc, a diversified power management company (2011 - 2015)

|

Director Qualification Highlights

|

|

ü

Healthcare

ü

Operations

ü

Strategic Planning

ü

Executive Leadership

ü

International

ü

Regulatory / Public Policy

ü

Financial Expertise

|

Mr. Barrett has served as Chairman and Chief Executive Officer of Cardinal Health, Inc. since 2009. He joined Cardinal Health in 2008 as Vice Chairman and Chief Executive Officer of the company's Healthcare Supply Chain Services segment. From 1997 to 2008, Mr. Barrett held a number of executive positions with Teva Pharmaceutical Industries Ltd., a multinational generic and branded pharmaceutical manufacturer, including President and Chief Executive Officer of Teva North America.

Skills and Qualifications of Particular Relevance to Cardinal Health

Having served in leadership positions with companies in the pharmaceutical industry for over 30 years, Mr. Barrett has extensive healthcare experience in the areas of distribution and manufacturing operations, management, regulatory compliance, finance, executive leadership, strategic planning, human resources, corporate governance and global markets. As a result, he provides the Board with unique perspectives and insights regarding our businesses and our growing international presence, industry, challenges and opportunities. He also brings to the Board valuable perspectives and insights from his service as Chairman of the Healthcare Leadership Council, an alliance of leading companies and organizations representing all sectors of U.S. healthcare. In addition, Mr. Barrett brings relevant experience and perspectives to the Board from his service on public and not-for-profit boards of directors, including his prior service on Eaton’s board of directors.

|

|

|

|

|

|

|

4

|

Cardinal Health

|

2017 Proxy Statement

|

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Carrie S. Cox

|

Age

60

|

Director since

2009

|

|

Chairman and Chief Executive Officer of Humacyte, Inc.; Executive Vice President and President of Global Pharmaceuticals, Schering-Plough Corporation (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Texas Instruments Incorporated, a developer, manufacturer and marketer of semiconductors (since 2004); Celgene Corporation, a biopharmaceutical company (since 2009)

|

ü

Healthcare

ü

International

ü

Operations

ü

Executive Leadership

ü

Strategic Planning

ü

Regulatory / Public Policy

|

Ms. Cox has served as Chief Executive Officer of Humacyte, Inc., a privately held, development stage company focused on regenerative medicine, since 2010 and as Chairman of Humacyte since 2013. She previously served as Executive Vice President and President of Global Pharmaceuticals at Schering-Plough Corporation, a multinational branded pharmaceutical manufacturer, from 2003 until its merger with Merck & Co. in 2009. Ms. Cox previously was Executive Vice President and President of Global Prescription Business of Pharmacia Corporation from 1997 to 2003.

Skills and Qualifications of Particular Relevance to Cardinal Health

Through her roles as a former executive officer of Schering-Plough, President of Pharmacia's Global Prescription business and a licensed pharmacist, and now with Humacyte, Ms. Cox brings to the Board substantial expertise in healthcare, particularly the pharmaceutical and international aspects of our business. She has worked in the global pharmaceutical industry for over 30 years, giving her relevant experience with large, multinational healthcare companies in the areas of manufacturing operations, management, regulatory compliance, executive leadership, strategic planning and global markets. She also brings to the Board valuable perspectives and insights from her service on the boards of directors of Celgene and Texas Instruments, including on Texas Instruments' Compensation Committee and her former service as its Lead Director.

|

|

|

|

|

|

|

|

|

|

Calvin Darden

|

Age

67

|

Director since

2005

|

|

Senior Vice President of U.S. Operations of United Parcel Service, Inc. (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Target Corporation, an operator of large-format general merchandise discount stores (since 2003); Coca-Cola Enterprises, Inc., a marketer, manufacturer and distributor of nonalcoholic beverages in selected international markets (2004 - 2016)

|

ü

Operations

ü

Distribution / Supply Chain

ü

Executive Leadership

ü

Strategic Planning

ü

Labor Relations

ü

International

|

Mr. Darden was Senior Vice President of U.S. Operations of United Parcel Service, Inc. ("UPS"), an express carrier and package delivery company, from January 2000 until 2005. During his 33-year career with UPS, he served in a number of senior leadership positions, including developing the corporate quality strategy for UPS and leading the business and logistics operations for its Pacific Region, the largest region of UPS at that time.

Skills and Qualifications of Particular Relevance to Cardinal Health

A former executive officer of UPS, Mr. Darden has expertise in supply chain networks and logistics that contributes to the Board’s understanding of this important aspect of our business. He has over 30 years of relevant experience in the areas of operations, distribution and supply chain, executive leadership, efficiency and quality control, strategic planning, human resources and labor relations. Drawing upon his past experience as a member of Coca-Cola Enterprises' board of directors, Mr. Darden provides the Board with a valuable understanding of distribution operations in international markets. He also brings to the Board valuable perspectives and insights from his service on Target’s board of directors, including its Compensation Committee, and his prior service on Coca-Cola Enterprises’ Human Resources and Compensation Committee.

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

5

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce L. Downey

|

Age

69

|

Director since

2009

|

|

Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc. (retired); Partner of NewSpring Health Capital II, L.P.

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Momenta Pharmaceuticals, Inc., a biotechnology company (since 2009)

|

ü

Healthcare

ü

Regulatory / Public Policy

ü

Operations

ü

International

ü

Financial Expertise

ü

Executive Leadership

ü

Strategic Planning

|

Mr. Downey was Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc., a global generic pharmaceutical manufacturer, from 1994 to 2008. Mr. Downey has served on a part-time basis as a Partner of NewSpring Health Capital II, L.P., a venture capital firm, since 2009.

Skills and Qualifications of Particular Relevance to Cardinal Health

Having spent 14 years as Chairman and Chief Executive Officer of Barr Pharmaceuticals, Mr. Downey brings to the Board substantial global healthcare experience in the areas of manufacturing operations, management, regulatory compliance, finance, executive leadership, strategic planning, human resources and corporate governance. He also offers valuable experience in the pharmaceutical and international aspects of our businesses. Mr. Downey brings to the Board valuable perspectives and insights from his service on Momenta Pharmaceuticals’ board of directors, including its Audit Committee, and from his prior service as Chairman of Barr Pharmaceutical's board of directors. Before his career at Barr Pharmaceuticals, Mr. Downey was a practicing attorney for 20 years, having worked in both private practice and with the U.S. Department of Justice.

|

|

|

|

|

|

|

|

|

|

Patricia A. Hemingway Hall

|

Age

64

|

Director since

2013

|

|

President and Chief Executive Officer of Health Care Service Corporation (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

ManpowerGroup, Inc., a workforce solutions company (since 2011)

|

ü

Healthcare

ü

Regulatory / Public Policy / Government

ü

Operations

ü

Financial Expertise

ü

Executive Leadership

ü

Strategic Planning

ü

Technology

|

Ms. Hemingway Hall served as President and Chief Executive Officer of Health Care Service Corporation, a mutual health insurer ("HCSC"), from 2008 until 2015. Previously, she held several leadership positions at HCSC, including President and Chief Operating Officer from 2007 to 2008 and Executive Vice President of Internal Operations from 2006 to 2007.

Skills and Qualifications of Particular Relevance to Cardinal Health

As retired President and Chief Executive Officer of HCSC, the largest customer-owned health insurer in the United States and fourth largest overall operating through Blue Cross and Blue Shield Plans in Texas, Illinois, Montana, New Mexico and Oklahoma, Ms. Hemingway Hall brings to the Board valuable experience regarding evolving healthcare payment models at a time of change and reform in the healthcare industry. She has worked in the healthcare industry for over 30 years, first as a registered nurse and most recently in health insurance, and has relevant experience in the areas of healthcare reform, operations, management, regulatory compliance, government relations, finance, executive leadership, strategic planning, technology and human resources. In addition, Ms. Hemingway Hall provides the Board with a deep understanding of operations, management and technology from her experience in previous roles at HCSC. She also brings to the Board valuable perspectives and insights from her service on ManpowerGroup's board of directors, including its Audit Committee.

|

|

|

|

|

|

|

6

|

Cardinal Health

|

2017 Proxy Statement

|

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Clayton M. Jones

|

Age

68

|

Director since

2012

|

|

Chairman, President and Chief Executive Officer of Rockwell Collins, Inc. (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Deere & Company, an agricultural and construction machinery manufacturer (since 2007); Motorola Solutions, Inc., a data communications and telecommunications equipment provider (since 2015); Rockwell Collins, Inc. (2001 - 2014)

|

ü

Operations

ü

Executive Leadership

ü

Strategic Planning

ü

Technology

ü

Financial Expertise

ü

International

ü

Regulatory / Public Policy / Government

|

Mr. Jones served as Chairman of the Board of Rockwell Collins, Inc., a multinational aviation electronics and communications equipment company, from 2002 through 2014, and as Chief Executive Officer from 2001 until his retirement in 2013. He previously served as president of Rockwell Collins and corporate officer and senior vice president of Rockwell International, which he joined in 1979.

Skills and Qualifications of Particular Relevance to Cardinal Health

As retired Chairman, President and Chief Executive Officer of Rockwell Collins, Mr. Jones brings to the Board relevant experience in highly regulated industries as well as in the areas of manufacturing operations, management, finance, executive leadership, strategic planning, information technology, human resources, corporate governance, international markets and government contracting. He provides the Board with a valuable understanding of commercial operations in international markets. As a former member of the President's National Security Telecommunications Advisory Committee and a current member of The Business Council, Mr. Jones provides insights in regulatory affairs, government and public policy matters. He also brings to the Board valuable perspectives and insights from his service on Motorola Solutions' board of directors, including its Audit Committee, and Deere & Company's board of directors, as well as from his previous service as Chairman of Rockwell Collins' board of directors.

|

|

|

|

|

|

|

|

|

|

Gregory B. Kenny

|

Age

64

|

Director since

2007

|

|

President and Chief Executive Officer of General Cable Corporation (retired)

|

|

Independent Lead Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Ingredion Incorporated, a corn refining and ingredient company (since 2005); AK Steel Holding Corporation, an integrated producer of flat-rolled, carbon and electrical stainless steels and tubular products (since January 2016); General Cable Corporation (1997 - 2015)

|

ü

Executive Leadership

ü

Operations

ü

Strategic Planning

ü

International

ü

Financial Expertise

|

Mr. Kenny served as President and Chief Executive Officer of General Cable Corporation, a global manufacturer of aluminum, copper and fiber-optic wire and cable products, from 2001 until 2015. Prior to that, he was President and Chief Operating Officer of General Cable from 1999 to 2001 and Executive Vice President and Chief Operating Officer from 1997 to 1999. Mr. Kenny previously also served in executive level positions at Penn Central Corporation, where he was responsible for corporate business strategy, and in diplomatic service as a Foreign Service Officer with the United States Department of State.

Skills and Qualifications of Particular Relevance to Cardinal Health

Mr. Kenny brings to the Board significant experience in the areas of Board and executive leadership, manufacturing operations, strategic planning, management, finance, human resources, corporate governance and international markets. He provides the Board with a deep understanding of strategic and financial implications impacting a global business with manufacturing and distribution operations. He also draws upon his Board governance and leadership experience as previous Chair of our Human Resources and Compensation Committee and current Chair of our Nominating and Governance Committee, and as Ingredion's Lead Director and Corporate Governance and Nominating Committee Chair. As our independent Lead Director, Mr. Kenny has promoted strong independent leadership on our Board and a robust, deliberative decision making process among independent directors. In addition, Mr. Kenny brings to the Board valuable perspectives and insights from his service on AK Steel's Board of Directors and his prior service on General Cable's and IDEX's board of directors.

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

7

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Nancy Killefer

|

Age

63

|

Director since

2015

|

|

Senior Partner, Public Sector Practice, McKinsey & Company, Inc. (retired)

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

The Advisory Board Company, a provider of software and solutions to the healthcare and education industries (since 2013); Avon Products, Inc., a global manufacturer and marketer of beauty products (since 2013); CSRA, Inc., a provider of information technology services to the U.S. federal government (since 2015); Computer Sciences Corporation, a global provider of information technology services (2013 - 2015)

|

ü

Strategic Planning

ü

Healthcare

ü

Regulatory / Public Policy / Government

ü

Technology

ü

Executive Leadership

ü

Financial Expertise

|

Ms. Killefer served as Senior Partner of McKinsey & Company, Inc., a global management consulting firm, from 1992 until 2013. She joined McKinsey in 1979 and held a number of key leadership roles, including serving as a member of the firm's governing board. Ms. Killefer founded McKinsey's Public Sector Practice in 2007 and served as its managing partner until her retirement. She also served as Assistant Secretary for Management, Chief Financial Officer and Chief Operating Officer for the United States Department of Treasury from 1997 to 2000.

Skills and Qualifications of Particular Relevance to Cardinal Health

Having served in key leadership positions in both the public and private sectors and provided strategic counsel to healthcare and consumer-based companies during her 30 years with McKinsey, Ms. Killefer brings to the Board substantial experience in the areas of strategic planning, including healthcare strategy, marketing and brand building, executive leadership and information technology. Her extensive experience as a partner of a global consulting firm and as a chief financial officer of a government agency provides valuable insight in these areas as well as in government relations and public policy. Ms. Killefer also brings to the Board valuable perspectives and insights from her service on the boards of directors of The Advisory Board, Avon Products (including its Compensation and Management Development Committee), and CSRA, Inc. (including her role as independent Chairman since August 2016).

|

|

|

|

|

|

|

|

|

|

David P. King

|

Age

61

|

Director since

2011

|

|

Chairman, President and Chief Executive Officer of Laboratory Corporation of America Holdings

|

|

Independent Director

|

Director Qualification Highlights

|

|

Other Public Boards:

Laboratory Corporation of America Holdings (since 2007)

|

ü

Healthcare

ü

Regulatory / Public Policy

ü

Strategic Planning

ü

Operations

ü

Executive Leadership

ü

Financial Expertise

ü

International

|

Mr. King has served as President and Chief Executive Officer of Laboratory Corporation of America Holdings, a global healthcare diagnostics company ("LabCorp"), since 2007, and as Chairman of LabCorp since 2009. Previously he held other senior positions with LabCorp, including Executive Vice President and Chief Operating Officer, Executive Vice President, Strategic Planning and Corporate Development, and Senior Vice President, General Counsel and Chief Compliance Officer.

Skills and Qualifications of Particular Relevance to Cardinal Health

Having spent 16 years in senior executive roles with LabCorp, including the past ten years as its Chief Executive Officer, Mr. King brings to the Board substantial experience in the areas of healthcare, operations, management, regulatory compliance, finance, executive leadership, strategic planning, human resources, corporate governance and global healthcare markets. He also brings to the Board valuable perspectives and insights from his position as Chairman of LabCorp’s board of directors. Prior to LabCorp, Mr. King was a practicing attorney for 17 years, having worked in both private practice focusing on healthcare and with the U.S. Department of Justice.

The Board recommends that you vote FOR the election of these director nominees.

|

|

|

|

|

|

|

8

|

Cardinal Health

|

2017 Proxy Statement

|

|

|

|

|

|

|

|

|

Proposal 1—Election of Directors

|

|

|

Our director nominees possess relevant experience, skills and qualifications that contribute to a well-functioning Board that effectively oversees the company's strategy and management. A chart of director skills and expertise is provided below:

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

9

|

Corporate Governance

Board of Directors

Our Board of Directors currently consists of 11 members, 10 of whom are independent. Our Board is led by Chairman and Chief Executive Officer George S. Barrett, independent Lead Director Gregory B. Kenny (who also chairs the Nominating and Governance Committee), Audit Committee Chair Clayton M. Jones, and Human Resources and Compensation Committee Chair David P. King.

The Board held eight meetings during fiscal 2017. During fiscal 2017, each director attended 75% or more of the meetings of the Board and Board committees on which he or she served. All of our directors attended the 2016 Annual Meeting of Shareholders. Absent unusual circumstances, each director is expected to attend the Annual Meeting of Shareholders.

Board Leadership Structure

For a number of years, our Board has been led by a Chairman of the Board (who is also the Chief Executive Officer), a strong independent Lead Director, and active, independent chairs of the Audit, Nominating and Governance and Human Resources and Compensation Committees.

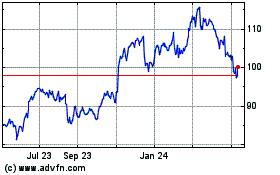

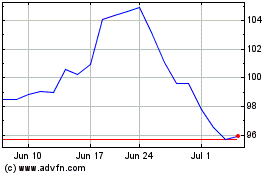

Our Board is responsible for selecting the Chairman of the Board and the Chief Executive Officer and has determined that its current leadership structure effectively promotes strong Board governance and oversight. The combined Chairman and Chief Executive Officer structure has allowed us to focus on long-term shareholder value and respond effectively to rapidly evolving industry changes and market dynamics, as well as to acquisition opportunities and competitive market pressures. Under this leadership structure, our Board has continued to provide effective, independent oversight of strategic decisions, management and regulatory compliance. The effectiveness of this structure has been demonstrated by strong performance over the past several years, including compound annual non-GAAP diluted EPS growth rate of 13.4% and total shareholder return (TSR) of 272%

†

since August 31, 2009.

The Board believes that our Chief Executive Officer is best suited to serve as Chairman because of his unique knowledge of our businesses, the healthcare industry and our shareholders. This structure fosters effective decision-making and alignment between the Board and management, enables a single person to speak on behalf of the Board and the company to our customers, vendors, employees, shareholders and regulators, and provides strong leadership and a powerful "tone from the top" to focus on our compliance and reputation, growth and long-term success.

The Board ensures rigorous independent leadership through an active, engaged independent Lead Director with clearly defined responsibilities, who is elected annually by the independent directors. In selecting a Lead Director, the independent directors look for robust leadership skills, including fostering open dialogue among independent directors, candid input to management, an understanding of our strategy and businesses, and substantial governance experience and understanding. The independent Lead Director:

|

|

|

|

•

|

works closely with the Chairman in developing the agenda, materials and schedule for Board meetings and approves the agenda and information sent to the Board;

|

|

|

|

|

•

|

consults with and advises the Chairman on matters arising between Board meetings relating to our business, strategy, operations or governance;

|

|

|

|

|

•

|

leads the Board's annual self-evaluation in coordination with the Nominating and Governance Committee;

|

|

|

|

|

•

|

reviews the results of the evaluation of individual directors with those directors;

|

|

|

|

|

•

|

contributes to the annual performance assessment of the Chief Executive Officer;

|

|

|

|

|

•

|

participates in engagement with major shareholders;

|

|

|

|

|

•

|

sets the agenda for and leads all executive sessions of independent directors;

|

|

|

|

|

•

|

serves as a liaison between the Chairman and the independent directors; and

|

|

|

|

|

•

|

has the authority to call additional executive sessions of the independent directors.

|

___________

|

|

|

|

†

|

Total shareholder return over the period from August 31, 2009, when Mr. Barrett became Chairman and Chief Executive Officer, through June 30, 2017 expressed as a percentage, calculated based on changes in stock price assuming reinvestment of dividends.

|

|

|

|

|

|

|

|

10

|

Cardinal Health

|

2017 Proxy Statement

|

|

Mr. Kenny, who has served as Lead Director since November 2014, has been actively engaged in Board leadership and shareholder engagement. Over the past year, Mr. Kenny has met regularly with Mr. Barrett and worked closely with him in developing Board agendas, schedules and topics, including discussions regarding long-term strategies and capital deployment. He has chaired regular executive sessions of the independent directors and met with Mr. Barrett regarding matters arising from these meetings. He has frequently gathered feedback and input from independent directors and provided it to Mr. Barrett and other members of management. Mr. Kenny has devoted significant time

to understanding our businesses and strategy, and has access to members of senior management. Mr. Kenny also leads the annual evaluation of the Board and the individual evaluation of each director. In addition, Mr. Kenny participated in the Human Resources and Compensation Committee's meeting to review Mr. Barrett's annual performance and compensation. Finally, during the year, Mr. Kenny held governance discussions with several large investors and attended a major healthcare investor conference with management, where he also met with many of our investors.

Committees of the Board of Directors

The Board has an Audit Committee, a Nominating and Governance Committee and a Human Resources and Compensation Committee (the "Compensation Committee"). Each member of these Committees is independent under our Corporate Governance Guidelines and under applicable Committee independence rules.

The charter for each committee is available on our website at www.cardinalhealth.com under “About Us—Corporate—Investor Relations—Corporate Governance—Board Committees and Charters.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

|

|

|

|

|

|

|

Audit Committee

|

|

|

|

|

|

Members:

|

|

The Audit Committee’s primary duties are to:

|

|

Clayton M. Jones (Chair)

|

|

•

oversee the integrity of our financial statements, including reviewing annual and quarterly financial statements and earnings releases and the effectiveness of our internal and disclosure controls;

•

appoint the independent auditor and oversee its qualifications, independence and performance, including pre-approving all services by the independent auditor;

•

review our internal audit plan and oversee our internal audit department;

•

approve the appointment of our Chief Legal and Compliance Officer and oversee our ethics and compliance program and our compliance with applicable legal and regulatory requirements; and

•

oversee our major financial and information technology risk exposures and our process for assessing and managing risk through our enterprise risk management program.

The Board has determined that each member of the Audit Committee is an “audit committee financial expert” for purposes of the SEC rules.

|

|

David J. Anderson*

|

|

|

Bruce L. Downey

|

|

|

Patricia A. Hemingway Hall

|

|

|

Meetings in fiscal 2017:

8

*Mr. Anderson served on the Audit Committee until December 2016 and was re-appointed to the Committee on September 14, 2017 after his employment with Alexion ended.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominating and Governance Committee

|

|

|

|

|

|

Members:

|

|

The Nominating and Governance Committee’s primary duties are to:

|

|

Gregory B. Kenny (Chair)

|

|

•

identify, review and recommend candidates for the Board, including recommending criteria to the Board for potential Board candidates and assessing the qualifications, attributes, skills, contributions and independence of individual directors and director candidates;

•

make recommendations to the Board concerning the structure, composition and functions of the Board and its committees;

•

advise the Board on Board leadership and leadership structure;

•

review our corporate governance guidelines and practices and recommend changes;

•

conduct the annual Board evaluation and oversee the process for the evaluation of each director; and

•

oversee our policies and practices regarding political expenditures.

|

|

Colleen F. Arnold

|

|

|

Patricia A. Hemingway Hall

|

|

|

Meetings in fiscal 2017:

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

11

|

|

|

|

|

|

|

|

Human Resources and Compensation Committee

|

|

|

|

|

|

Members:

|

|

The Compensation Committee’s primary duties are to:

•

approve compensation for the Chief Executive Officer, establish relevant performance goals, and evaluate his performance;

•

approve compensation for our other executive officers and oversee their evaluations;

•

make recommendations to the Board with respect to the adoption of, and administer, equity and incentive compensation plans;

•

review our non-management directors’ compensation program and recommend changes to the Board;

•

oversee the management succession process for the Chief Executive Officer and senior executives;

•

oversee workplace diversity initiatives and progress;

•

oversee and assess material risks related to compensation arrangements; and

•

assess the independence of Compensation Committee’s consultant and evaluate its performance.

The Compensation Discussion and Analysis, which begins on page 22, discusses how the Compensation Committee makes compensation-related decisions regarding our named executive officers.

The Compensation Committee acts as the administrator of our incentive plans and delegates to our officers authority to administer the plans with respect to participants who are not officers subject to Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act").

|

|

David P. King (Chair)

|

|

|

Carrie S. Cox

|

|

|

Calvin Darden

|

|

|

Nancy Killefer

|

|

|

Meetings in fiscal 2017:

6

|

|

|

|

|

|

Director Independence

The Board has established director independence standards based on the NYSE Rules. These standards can be found within our Corporate Governance Guidelines on our website at

www.cardinalhealth.com

under “About Us—Corporate—Investor Relations—Corporate Governance—Corporate Governance Documents." These standards address, among other things, employment and compensation relationships, relationships with our auditor and customer and business relationships.

The Board assesses director independence annually, and as needed, based on the recommendations of the Nominating and Governance Committee.

The Board has determined that each of Messrs. Anderson, Darden, Downey, Jones, Kenny and King, and each of Mmes. Arnold, Cox, Hemingway Hall and Killefer, is independent. Mr. Anderson ceased to be independent in December 2016 when he became Chief Financial Officer of Alexion, which supplies pharmaceuticals to us in the ordinary course of its business. Mr. Anderson again became independent after his employment with Alexion ended.

In determining that Mr. King is independent, the Nominating and Governance Committee considered that he is Chairman, President and Chief Executive Officer of LabCorp. We sell medical and laboratory products to LabCorp in the ordinary course of business. LabCorp's payments to us were less than 1% of our, and less than 2% of LabCorp's, revenue for each of the last three years.

Director Qualification Standards

The Nominating and Governance Committee considers and reviews with the Board the appropriate skills and characteristics for Board members. These include business experience, qualifications, attributes and skills, including healthcare industry and knowledge, as well as financial, international, operations, and technology experience, independence (including independence from the interests of a particular group of shareholders), judgment, integrity, ability to commit sufficient time and attention to the activities of the Board and the absence of potential conflicts with our interests.

The Nominating and Governance Committee considers these skills and qualifications when assessing the composition of the Board as a whole, and seeks diversity of skills, experience and backgrounds on the Board. The Nominating and Governance Committee assesses the effectiveness of this process based on its review of qualifications in the Director skills matrix on page 9. This assessment is ongoing and occurs both during the Committee's regular meetings as well as during the Board's annual self-assessment process.

|

|

|

|

|

|

|

12

|

Cardinal Health

|

2017 Proxy Statement

|

|

The Nominating and Governance Committee is responsible for identifying, reviewing and recommending candidates for the Board and is working with a firm that was retained to assist in identifying and selecting independent director candidates.

The Board is

responsible for selecting candidates for election as directors based on the recommendation of the Nominating and Governance Committee.

Board Diversity

Our Corporate Governance Guidelines provide that the Board should be diverse, engaged and independent. In developing and recommending criteria for identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including ethnic and gender

diversity. We believe the composition of our Board appropriately reflects a diversity of skills, professional and personal backgrounds and experiences and 45% of our Board members are ethnically or gender diverse.

Board Performance Assessment

For several years, our Board has had a rigorous self-evaluation process, which has included individual director evaluations. This process is overseen by the Nominating and Governance Committee and led by our independent Lead Director.

Our Board uses an outside facilitator with corporate governance experience who interviews each director to obtain his or her feedback regarding the Board's performance as well as feedback on each director. Based on the feedback, which is compiled anonymously, the Board identifies follow-up items and provides feedback to management.

The Board evaluation process includes an assessment of both Board process and substance, including:

|

|

|

|

•

|

the Board's effectiveness, structure, composition and culture;

|

|

|

|

|

•

|

quality of Board discussions, including time devoted to discussion and presentations;

|

|

|

|

|

•

|

the Board's performance in oversight of strategy, succession planning, business performance, regulatory compliance, risk management and other key areas; and

|

|

|

|

|

•

|

agenda topics for future meetings.

|

The outside facilitator also compiles feedback regarding each individual director, which the Lead Director provides to each director in individual discussion. The Board believes this annual process supports its effectiveness and continuous improvement.

Resignation Policy for Incumbent Directors Not Receiving Majority Votes

Our Corporate Governance Guidelines require any incumbent director who is not re-elected by shareholders in an uncontested election to promptly tender a resignation to the Chairman of the Board. Within 90 days following the certification of the shareholder

vote, the Nominating and Governance Committee will recommend to the Board whether to accept the resignation. Thereafter, the Board will promptly act and publicly disclose its decision and the rationale behind the decision.

We actively engage with our shareholders throughout the year so that management and the Board can better understand shareholder perspectives on governance, executive compensation and other topics that are important to them, and to assess emerging issues that may help shape our practices and enhance our corporate disclosures. We strive for a collaborative approach to shareholder engagement and value the variety of shareholders' perspectives received.

During the past three years, our independent Lead Director has participated in outreach discussions with our large shareholders. In addition, as in past years, we held regular discussions with our largest shareholders and solicited feedback from our top 50 investors on corporate governance matters. During fiscal 2017 we contacted governance professionals from our largest shareholders collectively representing more than 50% of our outstanding shares during fiscal 2017. An overview of our engagement process is below.

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

13

|

After considering feedback from shareholders in recent years, we have:

|

|

|

|

•

|

adopted a proxy access right for shareholders;

|

|

|

|

|

•

|

enhanced our disclosures regarding the Board's role in strategy and risk oversight;

|

|

|

|

|

•

|

formalized additional responsibilities for the independent Lead Director and enhanced our disclosure about the Lead Director’s role and activities;

|

|

|

|

|

•

|

formalized our annual individual director evaluation process and expanded our disclosure about the annual Board evaluation process;

|

|

|

|

|

•

|

enhanced our executive compensation clawback provision;

|

|

|

|

|

•

|

provided more detailed disclosure in the Proxy Summary and the Compensation Discussion and Analysis Executive Summary; and

|

|

|

|

|

•

|

added a chart of director qualifications and experience in the proxy statement.

|

Strategy and Risk Oversight

Board’s Oversight of Strategy and Capital Deployment

The Board regularly discusses our strategy in light of company performance, developments in the rapidly changing healthcare industry and the general business and global economic environment, and reviews and approves our capital deployment, including dividends, share repurchase plans and significant acquisitions. At two of its in-person meetings each year, the Board conducts dedicated strategy sessions with in-depth discussions with senior management on the healthcare industry and environmental factors and reviews specific businesses and new business opportunities. These strategy sessions have included external speakers such as business partners and advisors, as well as off-site visits to company facilities and customer locations. The Board also discusses risks related to our strategies, including those resulting from possible competitor, customer and supplier actions, the changing healthcare environment and new technologies. The collective backgrounds, skills and experiences of our directors, including broad healthcare experience, contribute

to robust discussions regarding strategic planning and risk oversight.

As an example, our Board discussed the possible acquisition of the Patient Recovery Business from Medtronic plc over a number of meetings beginning in the fall of 2016, when we learned that these assets might be for sale. We devoted significant portions of two in-person Board meetings to a detailed review and discussion of the possible acquisition and related capital deployment, and had several Board updates between these meetings. The Board approved the acquisition at a special meeting in April 2017.

Board’s Role in Risk Oversight

Management has day-to-day responsibility for assessing and managing risks, and the Board is responsible for risk oversight. We have developed an enterprise risk management process, which our Audit Committee oversees and our Chief Legal and Compliance Officer administers. Under this process, management identifies and prioritizes enterprise risks and develops systems to assess, monitor and mitigate those risks. Management reviews and discusses with the Board significant risks identified through the process. The Audit Committee also is responsible for

|

|

|

|

|

|

|

14

|

Cardinal Health

|

2017 Proxy Statement

|

|

discussing with management our major financial risk exposures, our ethics and compliance programs, and compliance with legal and regulatory requirements. The Board and Audit Committee receive regular updates on the effectiveness of our compliance programs, including our healthcare regulatory compliance, anti-corruption and controlled substance anti-diversion program, as well as updates on potential information system and cyber security

exposures and mitigation strategies. In connection with its risk oversight role, the Audit Committee meets regularly with representatives from our independent registered public accounting firm and our Chief Financial Officer, Chief Legal and Compliance Officer and the head of our internal audit function.

|

|

|

|

|

|

|

|

|

|

|

|

The Opioid Epidemic and Risk Management

As a pharmaceutical distributor, we provide a safe and secure channel for transporting prescription medications of all types, including opioid pain medications, from manufacturers approved by the Food and Drug Administration to licensed pharmacies. Our role is to ensure medications of all kinds—oncology, blood pressure, antibiotic, pain and other medications—are available to pharmacies that are licensed by their state and regulated by the Drug Enforcement Administration to dispense these medications to patients with valid medical prescriptions. As a pharmaceutical distributor, we do not manufacture, market, promote or dispense these medications, and we do not interact with patients, diagnose medical conditions, write prescriptions or otherwise practice medicine. As part of our safe and secure distribution channel, we maintain a rigorous anti-diversion program to prevent opioid pain medications from being diverted for improper uses.

Our Board is highly engaged in oversight of our anti-diversion program and is committed to helping with the complex national opioid abuse public health crisis. Our anti-diversion program includes state-of-the-art controls designed to prevent diversion of pain medication from legitimate uses. The Board regularly reviews and discusses with management the effectiveness of our anti-diversion program, which focuses on our regulatory obligation to detect and report suspicious orders. The Board also monitors and discusses the causes of, and our role in helping to address, this national epidemic. In 2014, in response to a shareholder demand, the Board appointed a committee of independent directors to conduct a review of our anti-diversion program utilizing independent counsel. The committee found, among other things, that we had implemented and maintained a robust system of controls to detect and report suspicious orders and that our Board was well informed of those controls. Since that review, the Board has continued to actively focus on the effectiveness of our anti-diversion program and to support its continued enhancements through regular reviews with management.

|

|

Ethics and Compliance Program

The Board has adopted written

Standards of Business Conduct

that outline our corporate values and standards of integrity and behavior. The Standards of Business Conduct are designed to foster a culture of integrity, drive compliance with legal and regulatory requirements and protect and promote the reputation of our company. The full text of the

Standards of Business Conduct

is posted on our website at

www.cardinalhealth.com

under “About Us—Our Business—Ethics and Compliance.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

Our Chief Legal and Compliance Officer has responsibility to implement and maintain an effective ethics and compliance program. He also provides quarterly updates on our ethics and compliance program to the Audit Committee and an update to the full Board at least once a year. He reports to the Chair of the Audit Committee and to the Chief Executive Officer and meets in separate executive sessions quarterly with the Audit Committee.

Management Succession Planning

The Board is actively engaged in our talent management program. The Compensation Committee oversees the process for succession planning for the Chief Executive Officer and senior executives, and management provides an organizational update at each quarterly Compensation Committee meeting. The Board

maintains an emergency succession plan as well as a long-term succession plan for the position of Chief Executive Officer.

The Board holds a formal succession planning and talent review session annually, which includes succession planning for other senior management positions. These talent review and

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

15

|

succession planning discussions take into account desired leadership skills, key capabilities and experience in light of our current and evolving business and strategic direction, and include identification and development of internal candidates. Directors also have exposure to leaders through Board presentations and

discussions, as well as through informal events and interactions with key talent throughout the year, both in small group and one-on-one settings. In addition, the Board regularly discusses management talent and succession in its executive sessions.

Certain Relationships and Related Transactions

Related Person Transactions Policy

The Board follows a written policy that the Audit Committee must approve or ratify any "related person transactions" (transactions exceeding $120,000 in which we are a participant and any related person has a direct or indirect material interest). "Related persons" include our directors, nominees for election as a director, persons controlling over 5% of our common shares, executive officers and the immediate family members of each of these individuals.

Once a related person transaction is identified, the Audit Committee will review all of the relevant facts and circumstances and determine whether to approve the transaction. The Audit Committee will take into account such factors as it considers appropriate, including the material terms of the transaction, the nature of the related person’s interest in the transaction, the significance of the transaction to the related person and us, the nature of the related person’s relationship with us and whether the transaction would be likely to impair the judgment of a director or executive officer to act in our best interest.

If advance approval of a transaction is not feasible, the Audit Committee will consider the transaction for ratification at its next regularly scheduled meeting. The Audit Committee Chairman may

pre-approve or ratify any related person transactions in which the aggregate amount is expected to be less than $1 million.

Related Person Transactions

Since July 1, 2016, there have been no transactions, and there are no currently proposed transactions, involving an amount exceeding $120,000 in which we were or are to be a participant and in which any related person had or will have a direct or indirect material interest, except as described below.

Mr. Anderson served as Chief Financial Officer of Alexion, a biotechnology company, from December 11, 2016 until July 31, 2017, and as an employee of Alexion until August 31, 2017. When Mr. Anderson joined Alexion, we had a pre-existing commercial relationship with Alexion which was negotiated at arm's length and in the ordinary course of business, and has continued since Mr. Anderson ended his employment with Alexion. From July 1, 2016 through July 31, 2017, we purchased for distribution to our customers approximately $394 million of Alexion product. Mr. Anderson has not been involved in any decisions or activities directly associated with the transactions between Alexion and us. These transactions were approved by our Audit Committee in accordance with the Related Person Transactions Policy.

Corporate Governance Guidelines

You can find the full text of our Corporate Governance Guidelines on our website at

www.cardinalhealth.com

under “About Us—Corporate—Investor Relations—Corporate Governance—Corporate Governance Documents.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

|

|

|

|

|

|

|

16

|

Cardinal Health

|

2017 Proxy Statement

|

|

Proposal 2—Ratification of Ernst & Young LLP as Independent Auditor

The Audit Committee of the Board of Directors is directly responsible for the appointment, compensation, retention and oversight of our independent auditor and approves the audit engagement letter with Ernst & Young LLP and its audit fees. The Audit Committee has appointed Ernst & Young LLP as our independent auditor for fiscal 2018 and believes that the continued retention of Ernst & Young LLP as our independent auditor is in the best interest of Cardinal Health and its shareholders. Ernst & Young LLP has served as our independent auditor since 2002. In accordance with SEC rules, lead audit partners are subject to rotation requirements, which limit the number of consecutive years an individual partner may serve us. The Audit Committee oversees the rotation of the audit partners. The Audit Committee Chairman interviews candidates for audit partner and the Audit Committee discusses them.

While not required by law, we are asking our shareholders to ratify the appointment of Ernst & Young LLP as our independent auditor for fiscal 2018 at the Annual Meeting as a matter of good corporate

governance. If shareholders do not ratify this appointment, the Audit Committee will consider whether it is appropriate to appoint another audit firm. Even if the appointment is ratified, the Audit Committee in its discretion may appoint a different audit firm at any time during the fiscal year if it determines that such a change would be in the best interest of the company and its shareholders. Our Audit Committee approved, and our shareholders ratified, the appointment of Ernst & Young LLP as our independent auditor for fiscal 2017.

We expect representatives of Ernst & Young LLP to be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and to respond to appropriate questions from shareholders.

The Board recommends that you vote FOR the proposal to ratify the appointment of Ernst & Young LLP as our independent auditor for fiscal 2018.

Audit Committee Report and Audit Matters

Audit Committee Report

The Audit Committee is responsible for monitoring the integrity of Cardinal Health’s financial

statements; the independent auditor’s qualifications, independence and performance; Cardinal Health’s internal audit function; Cardinal Health’s ethics and compliance program and its compliance with legal and regulatory requirements; and Cardinal Health’s processes for assessing and managing risk. As of the date of the report, the Audit Committee consisted of three members of the Board of Directors. Mr. Anderson was subsequently re-appointed to the Audit Committee on September 14, 2017. The Board of Directors has determined that each current Committee member is an “audit committee financial expert” for purposes of the SEC rules and is independent. The Audit Committee’s activities are governed by a written charter, most recently revised by the Board of Directors in November 2016. The charter is available on Cardinal Health’s website at

www.cardinalhealth.com

under “About Us—Corporate—Investor Relations—Corporate Governance—Board Committees and Charters."

Management has primary responsibility for the financial statements and for establishing and maintaining the system of internal control over financial reporting. Management also is responsible for reporting on the effectiveness of Cardinal Health’s internal control over financial reporting. Cardinal Health’s independent auditor, Ernst & Young LLP, is responsible for performing an independent audit of Cardinal Health’s consolidated financial statements and for issuing a report on the financial statements and a report on the effectiveness of Cardinal Health’s internal control over financial reporting based on its audit.

The Audit Committee reviewed and discussed the audited financial statements for the fiscal year ended June 30, 2017 with management and with Ernst & Young LLP. The Audit Committee also reviewed and discussed with management and Ernst & Young LLP the effectiveness of Cardinal Health’s internal control over financial reporting as well as management's report and Ernst & Young LLP's report on the subject. The Audit Committee discussed with Ernst & Young LLP the matters related to the conduct of its audit that are required to be communicated by auditors to audit committees under applicable requirements of the Public Company

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

17

|

|

|

|

|

|

|

|

Audit Committee Report and Audit Matters

|

|

|

Accounting Oversight Board (the "PCAOB") and matters related to Cardinal Health’s financial statements, including critical accounting estimates and judgments. The Audit Committee received from Ernst & Young LLP the written disclosures and letter regarding Ernst & Young LLP’s independence from Cardinal Health required by applicable PCAOB requirements and discussed Ernst & Young LLP’s independence.

The Audit Committee meets regularly with Ernst & Young LLP, with and without management present, to review the overall scope and plans for Ernst & Young LLP’s audit work and to discuss the results of its examinations, the evaluation of Cardinal Health’s internal control over financial reporting and the overall quality of Cardinal Health’s accounting and financial reporting. In addition, the Audit Committee annually considers the performance of Ernst & Young LLP.

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended June 30, 2017 be included in Cardinal Health’s Annual Report on Form 10-K for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors on August 8, 2017.

Clayton M. Jones, Chairman

Bruce L. Downey

Patricia A. Hemingway Hall

Fees Paid to Independent Accountants

The following table sets forth the fees billed to us by Ernst & Young LLP for services in fiscal 2017 and 2016.

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year

Ended

June 30, 2017

($)

|

Fiscal Year

Ended

June 30, 2016

($)

|

|

Audit fees (1)

|

9,546,537

|

|

|

9,722,883

|

|

|

|

Audit-related fees (2)

|

2,722,451

|

|

|

3,780,485

|

|

|

|

Tax fees (3)

|

841,082

|

|

|

980,523

|

|

|

|

All other fees

|

—

|

|

|

—

|

|

|

|

Total fees

|

13,110,070

|

|

|

14,483,891

|

|

|

|

|

|

|

(1)

|

Audit fees include fees paid to Ernst & Young LLP related to the annual audit of our consolidated financial statements, the annual audit of the effectiveness

|

of our internal control over financial reporting, the review of financial statements included in our Quarterly Reports on Form 10-Q and statutory audits of various international subsidiaries. Audit fees also include fees for services performed by Ernst & Young LLP that are closely related to the audit and in many cases could only be provided by our independent accountant, such as comfort letters and consents related to SEC registration statements.

|

|

|

|

(2)

|

Audit-related fees include fees for services related to acquisitions and divestitures, audit-related research and assistance, internal control reviews, service auditor’s examination reports and employee benefit plan audits.

|

|

|

|

|

(3)

|

Tax fees include fees for tax compliance and other tax-related services. The aggregate fees billed to us by Ernst & Young LLP for tax compliance and other tax-related services for fiscal 2017 were $797,514 and $43,568, respectively, and for fiscal 2016 were $546,722 and $433,801, respectively.

|

Audit Committee Audit and Non-Audit Services Pre-Approval Policy

The Audit Committee must pre-approve the audit and permissible non-audit services performed by our independent accountants in order to help ensure that the accountants remain independent from Cardinal Health. The Audit Committee has adopted a policy governing this pre-approval process.

Under the policy, the Audit Committee annually pre-approves certain services and assigns specific dollar thresholds for these types of services. If a proposed service is not included in the annual pre-approval, the Audit Committee must separately pre-approve the service before the engagement begins.

The Audit Committee has delegated pre-approval authority to the Chairman of the Audit Committee for proposed services up to $500,000. Proposed services exceeding $500,000 require full Audit Committee approval.

All audit and non-audit services provided for us by Ernst & Young LLP for fiscal 2017 and 2016 were pre-approved by the Audit Committee.

|

|

|

|

|

|

|

18

|

Cardinal Health

|

2017 Proxy Statement

|

|

Proposal 3—Advisory Vote to Approve the Compensation of Our Named Executive Officers

In accordance with Section 14A of the Exchange Act, we are asking our shareholders to approve, on a non-binding advisory basis, the compensation of our named executive officers, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in this proxy statement.

We urge shareholders to read the Compensation Discussion and Analysis beginning on page 22 of this proxy statement, which describes in more detail how our executive compensation program operates and is designed to achieve our compensation objectives, as well as the Summary Compensation Table and related compensation tables, notes and narrative appearing on pages 30 through 41, which provide detailed information on the compensation of our named executive officers.

The Compensation Committee and the Board believe that the executive compensation program described in the Compensation Discussion and Analysis is designed to support our long-term growth, with accountability for key annual results. We tie most of executive pay to performance based on financial, operational and individual performance, and we believe that our compensation programs are competitive in the marketplace.

While we took important actions to strengthen our market position, increase our scale, add new, long-term drivers of growth and improve the overall balance of our integrated portfolio in fiscal 2017, we did not achieve the earnings goal under our annual

incentive plan, largely as a result of a challenging generic pharmaceutical pricing environment. Our named executives other than Mr. Barrett received payouts at 25% of their respective targets. Mr. Barrett declined to be considered for an annual incentive payout, and the Compensation Committee did not award him a payout. The payouts demonstrate strong alignment between our pay and our performance.

Although this advisory vote is not binding on the Board, the Board and the Compensation Committee will review and consider the voting results when evaluating our executive compensation program.

The Board has adopted a policy providing for annual say-on-pay advisory votes. Accordingly, subject to the outcome of Proposal 4 and the decision of the Board, the next say-on-pay advisory vote will be held at our 2018 Annual Meeting of Shareholders.

The Board recommends that you vote FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in this proxy statement.

Proposal 4—Advisory Vote on Frequency of Future Advisory Votes to Approve Executive Compensation

In accordance with Section 14A of the Exchange Act, we are asking shareholders to vote on whether future advisory votes on executive compensation (like Proposal 3 above) should occur once every one, two or three years. This vote is not binding on the Board. Based on input from shareholders, the Board has determined that holding an advisory vote on executive compensation every year is most appropriate for us at this time, and recommends that shareholders vote to hold such votes every year. Holding an annual advisory vote provides us with more direct and immediate insight into our shareholders’ views on our executive compensation program.

Although this advisory vote is not binding on the Board, we will carefully review the voting results on this proposal. Notwithstanding the Board’s recommendation and the outcome of

the shareholder vote, the Board may in the future decide to vary its practice on the frequency of advisory votes on executive compensation based on factors such as discussions with shareholders.

You may specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. You are not voting to approve or disapprove the Board’s recommendation.

The Board recommends that you vote to conduct future advisory votes to approve executive compensation every ONE YEAR.

|

|

|

|

|

|

|

|

Cardinal Health

|

2017 Proxy Statement

|

19

|

Share Ownership Information

Beneficial Ownership

The table below sets forth certain information regarding the beneficial ownership of our common shares by and the percentage of our outstanding common shares represented by such ownership for:

|

|

|

|

•

|

each person known by us to own beneficially more than 5% of our outstanding common shares;

|

|

|

|

|

•

|

our executive officers named in the Summary Compensation Table on page 30; and

|

|

|

|

|

•

|

all executive officers and directors as a group.

|

A person has beneficial ownership of shares if the person has voting or investment power over the shares or the right to acquire such power in 60 days. Investment power means the power to direct the sale or other disposition of the shares. Except as otherwise described in the notes below, information on the number of shares beneficially owned is as of September 11, 2017, and the listed beneficial owners have sole voting and investment power.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

Common Shares

|

Additional Restricted and

Performance Share

Units (11)

|

|

Number

Beneficially

Owned

|

Percent

of

Class

|

|

Wellington Management Group LLP (1)

|

40,120,566

|

|

|

12.7

|

|

|

—

|

|

|

|

BlackRock, Inc. (2)

|

23,919,543

|

|

|

7.6

|

|

|

—

|

|

|

|

The Vanguard Group (3)

|

22,358,098

|

|

|

7.1

|

|

|

—

|

|

|

|

Barrow, Hanley, Mewhinney & Strauss, LLC (4)

|

21,364,753

|

|

|

6.8

|

|

|

—

|

|

|

|

State Street Corporation (5)

|

16,617,021

|

|

|

5.3

|

|

|

—

|

|

|

|

David J. Anderson (6)(7)

|

7,785

|

|

|

*

|

|

|

—

|

|

|

|

Colleen F. Arnold (7)

|

7,511

|

|

|

*

|

|

|

19,569

|

|

|

|

George S. Barrett (8)

|

1,752,605

|

|

|

*

|

|

|

86,199

|

|

|

|

Donald M. Casey Jr. (8)

|

313,002

|

|

|

*

|

|

|

99,090

|

|

|

|

Carrie S. Cox (7)

|

6,758

|

|

|

*

|

|

|

16,306

|

|

|

|

Calvin Darden (7)

|

12,972

|

|

|

*

|

|

|

19,608

|

|

|

|

Bruce L. Downey (7)

|

16,975

|

|

|

*

|

|

|

18,387

|

|

|

|

Jon L. Giacomin (8)

|

148,271

|

|

|

*

|

|

|

24,684

|

|

|

|

Patricia A. Hemingway Hall (7)

|

6,323

|

|

|

*

|

|

|

2,612

|

|

|

|

Clayton M. Jones (7)

|

6,323

|

|

|

*

|

|

|

6,018

|

|

|

|

Michael C. Kaufmann (8)(9)

|

486,626

|

|

|

*

|

|

|

47,990

|

|

|

|

Gregory B. Kenny (7)

|

12,492

|

|

|

*

|

|

|

19,584

|

|

|

|

Nancy Killefer (7)

|

4,295

|

|

|

*

|

|

|

—

|

|

|

|

David P. King (7)

|

8,975

|

|

|

*

|

|

|

9,446

|

|

|

|

Craig S. Morford (8)

|

142,510

|

|

|

*

|

|

|

108,768

|

|

|

|

All Executive Officers and Directors as a Group (18 Persons)(10)

|

3,071,048

|

|

|

*

|

|

|

521,343

|

|

|

|

|

|

|

*

|

Indicates beneficial ownership of less than 1% of the outstanding shares.

|

|

|

|

|

(1)

|