Current Report Filing (8-k)

September 20 2017 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

September 20, 2017

Date of Report (Date of earliest event reported)

GSE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-14785

|

52-1868008

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

1332 Londontown Blvd.,

|

|

|

|

Sykesville, Maryland

|

|

21784

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(410) 970-7800

|

|

(Registrant's telephone number, including area code)

|

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 20, 2017, GSE Systems, Inc. ("

GSE

"), through its wholly-owned subsidiary GSE Performance Solutions, Inc. ("

Performance Solutions

"), entered into a stock purchase agreement (the "

Absolute Purchase Agreement

") with Richard and Cynthia Linton (and certain trusts owned thereby) and Absolute Consulting, Inc. ("

Absolute

"). Pursuant to the Absolute Purchase Agreement, Performance Solutions purchased 100% of the equity interests in Absolute for $8.75 million in cash, subject to customary pre- and post-closing working capital adjustments. The transactions contemplated by the Absolute Purchase Agreement closed simultaneously with its execution and delivery.

Absolute is a provider of technical consulting and staffing solutions to the global nuclear power industry. Located in Navarre, Florida, Absolute Consulting has established long-term relationships with blue-chip customers primarily in the nuclear power industry. During the twelve months ending December 31, 2016, Absolute generated revenue of approximately $40 million, of which over 80% came from the nuclear power industry.

The Absolute Purchase Agreement contains customary representations, warranties, covenants, and indemnification provisions subject to certain limitations. An indemnification escrow of $1.0 million was funded at the closing and is available to GSE and Performance Solutions to satisfy indemnification claims until September 20, 2019.

The foregoing description of the Absolute Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Absolute Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

T

he transactions contemplated by the Absolute Purchase Agreement were consummated on September 20, 2017. Following these transactions, GSE's pro forma total cash is approximately $15 million. The information set forth in Item 1.01 above with respect to the Absolute Purchase Agreement and Absolute Transaction, and in Item 7.01 below with respect to the Comapny's investor presentation, is hereby incorporated by reference into this Item 2.01.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On September 20, 2017, GSE Performance Solutions issued a press release announcing the closing of the Absolute Business Acquisition. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In addition, the Company intends to make available to the public, including through its website, an investor presentation that, among other things, includes a description of the Absolute Acquisition. A copy of the investor presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(a)

Financial Statements of Business Acquired

To the extent required by this Item, financial statements related to the transactions contemplated by the Absolute Purchase Agreement will be filed as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date this Current Report is required to be filed.

(b)

Pro Forma Financial Information.

To the extent required by this Item, pro forma financial information related to the transactions contemplated by the Absolute Purchase Agreement will be filed as part of an amendment to this Current Report on Form 8-K not later than 71 calendar days after the date this Current Report is required to be filed.

(d)

Exhibits

The following materials are filed as exhibits to this Current Report on Form 8-K.

|

2.1

|

Stock Purchase Agreement

|

|

99.1

|

Press Release

|

|

99.2

|

Investor Presentation dated September 20, 2017

|

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GSE SYSTEMS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Daniel W. Pugh

|

|

|

|

Daniel W. Pugh

|

|

|

|

Secretary, Senior Vice President, General Counsel and Risk Management Officer

|

Date: September 20, 2017

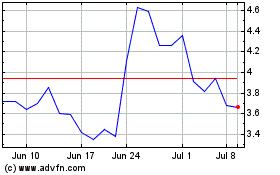

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Mar 2024 to Apr 2024

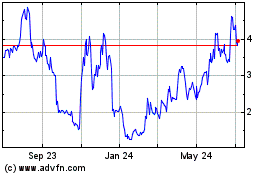

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Apr 2023 to Apr 2024