By Jennifer Smith

Shoppers like to complain that holiday decorations appear

earlier and earlier. This year, so are the job ads.

The holiday hiring binge is accelerating for retailers such as

Target Corp. and Macy's Inc., which hire thousands of workers to

process surging online orders. E-commerce sites double or even

quadruple their warehouse staff. Online giant Amazon.com Inc. adds

to the hiring frenzy, as do logistics companies and

package-delivery services like United Parcel Service Inc. and FedEx

Corp. Some firms posted their first holiday job listings as early

as July.

But with unemployment at near-record lows, employers are going

the extra mile to ensure they have enough workers come December.

Companies are bumping up pay, loosening disciplinary policies and

even operating bus routes.

"It's the tightest labor market we've ever seen," said Sean

McCartney, executive vice president of operation services at

Radial, which handles online orders for e-commerce companies and

national chains such as Dick's Sporting Goods Inc. and Aéropostale

Inc.

Some big retailers are doing the bulk of their hiring in

warehouses that handle online orders, a sign they expect more

shoppers to visit their websites instead of stores. Last year,

online retail sales jumped 12.6% in November and December, compared

with a 7% decline at department stores, according to the National

Retail Federation.

Wal-Mart Stores Inc. plans to bring on about 5,000 seasonal

workers for its e-commerce operations. The discounter isn't hiring

extra help at its stores, where it plans to give existing employees

more hours.

Macy's plans to add 18,000 seasonal workers at distribution

centers that replenish store merchandise and fulfill online orders

-- a 20% boost compared with last year. Overall seasonal hiring is

down slightly at the retailer, which closed dozens of stores after

disappointing sales in 2016.

Radial is bringing on 27,000-plus seasonal workers, 35% more

than last year. The company began advertising for some jobs in

July, about a month earlier than usual. It's offering more flexible

schedules, including shorter shifts that allow working parents to

clock in between school drop-off and pickup.

Radial is also planning to provide bus service for employees in

some rural locations, such as central Kentucky, and in some

"hypercompetitive" East Coast markets, Mr. McCartney said.

XPO Logistics Inc., whose e-commerce clients include Inditex

SA's Zara, plans to add 6,000 seasonal workers, up 20% from last

year.

Companies are racing to open up warehouses within easy reach of

millions of consumers who expect to get e-commerce orders in two

days or less. This year Amazon alone announced plans for more than

two dozen new U.S. fulfillment centers.

Amazon's arrival can shake up local warehouse labor markets

because the retailer often pays better than rivals, offering

between $11 to $14 an hour for full-time warehouse workers,

depending on the location.

In Cranbury Township, a New Jersey town near Interstate 95,

help-wanted ads for warehouse workers are posted along roadsides

and at local businesses. Amazon is opening a 900,000-square-foot

fulfillment center there, joining nearby facilities serving

Wayfair.com, Home Depot Inc., Petco Animal Supplies Inc. and Crate

and Barrel, among others. "It's your time, Cranbury, NJ," reads one

Amazon flier.

"There's a lot of warehouses here.... There's a lot of trucks,"

said Paul Corneetz, 70 years old, who lives in neighboring Monroe

Township. "Even ads on the turnpike for distribution centers."

Amazon hasn't announced its seasonal hiring plans. Last month,

the company held a nationwide job fair to fill 50,000 positions,

mostly at fulfillment centers.

"I don't think it's a coincidence that the nationwide hire day

coincided with the extreme front-end of peak-season hiring," said

Doug Hammond, president of in-house services for Randstad US, a

subsidiary of Dutch recruiting firm Randstad Holding NV. "They want

to secure that labor."

This year average pay for entry-level warehouse workers is

expected to hit $13.68 an hour during peak season, up 10% compared

with nonpeak wages and a nearly 5% increase from 2016, according to

logistics staffing firm ProLogistix.

UPS began recruiting a few weeks earlier than usual and is

providing bus service for seasonal workers in markets such as

Chicago, Boston, Seattle, and Louisville, Ky., where labor

competition is particularly tight, said Paul Tanguay, the company's

global director of recruitment strategies.

The company plans to add 95,000 seasonal workers, about the same

level as the previous two years, for positions from package

handlers and delivery helpers to drivers who run big-rigs loaded

with packages from one facility to another. FedEx expects to hire

more than 50,000 for the peak, close to last year's total.

UPS has also been adding automated equipment and opening up new

facilities aimed at handling both holiday surges and the growing

volume of e-commerce packages outside of peak season.

Parcel carriers and courier firms that deliver online purchases

to consumers' doorsteps have been ramping up hiring since the

spring. The number of people employed in the sector rose 31,000

over the past year, according to Labor Department data for August.

Warehouse hiring is also at near-record levels, accounting for

951,000 jobs in August

Some employers are relaxing screening or disciplinary policies

as workers become harder to find. Companies might rehire employees

who were dismissed for minor infractions, or give a second chance

to employees who miss shifts, said Brian Devine, senior vice

president at ProLogistix.

Kenco Logistics, a third-party logistics provider based in

Chattanooga, Tenn., whose customers include industrial, consumer

goods and e-commerce clients, is considering various

"second-strike" options to reduce turnover.

"Our number one reason for losing people is they can't show up

for work on time every day," said David Caines, the company's chief

operating officer.

But leniency has its limits, even during the holiday rush. "You

don't want to cross a line and be so lax that things get out of

control," Mr. Caines said.

--Suzanne Kapner contributed to this article.

(END) Dow Jones Newswires

September 20, 2017 14:03 ET (18:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

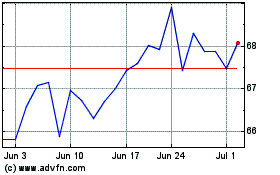

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

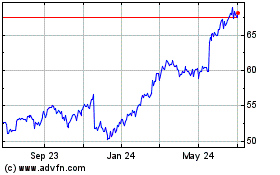

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024