Alibaba-Backed Chinese Logistics Firm Best Slashes IPO Plans

September 19 2017 - 11:29AM

Dow Jones News

By Austen Hufford

Chinese logistics company Best Inc. on Tuesday slashed the size

of its planned initial public offering.

The company, backed by technology giants Alibaba Group Holding

Ltd. and Foxconn Technology Group, now expects to offer 45 million

American depositary shares at a price of $10 to $11 each, down from

earlier plans to sell 53.56 million shares at $13 to $15

apiece.

Best said Alibaba has indicated an interest in purchasing up to

$150 million worth of shares. Best now estimates it will receive

net proceeds of about $447.3 million from the offering, down from

$713 million it expected previously.

Chinese logistics companies that support the country's rapidly

growing e-commerce industry have attracted billions of dollars from

investors.

Founded in 2007 by Johnny Chou, Google China's former

co-president, Best has grown quickly by building a warehouse and

distribution network across China. The company provides products

for sourcing for convenience stores and domestic and international

delivery services for China's online shoppers.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 19, 2017 11:14 ET (15:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

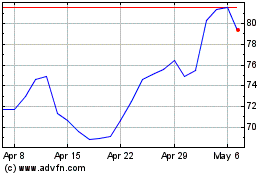

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

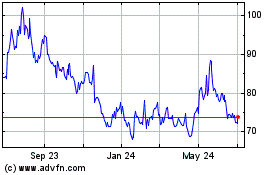

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024