Walgreens Again Trims Deal for Rite Aid But Finally Gains Approval -- Update

September 19 2017 - 10:41AM

Dow Jones News

By Austen Hufford

Walgreens Boots Alliance Inc. received regulatory approval for

its deal to buy thousands of stores from Rite Aid Corp., but only

after the number of stores to be purchased was again trimmed to

allay antitrust concerns.

Walgreens will now buy 1,932 Rite Aid stores for $4.38 billion,

a far cry from the original $9.4 billion deal for about 4,600

stores, struck in 2015. In June, the two companies scrapped plans

to merge, agreeing instead that Walgreens would seek to buy about

2,200 Rite Aid stores.

Shares of Rite Aid fell 4.6% to $2.61 in morning trading.

Walgreens shares fell 0.5% to $82.17.

Rite Aid said Tuesday that the latest deal, for about 250 fewer

stores than had been agreed in June, followed discussions between

the two companies and the Federal Trade Commission.

Walgreens will gain stores located primarily in the northeast

and southern U.S.

Rite Aid will continue as a stand-alone company, operating about

2,600 stores, six distribution centers and its pharmacy-benefit

manager, EnvisionRx.

The deal has been approved by the boards of both companies and

doesn't require a shareholder vote. Store transfers will start in

October, with the goal of completing the transition in the spring

of next year.

Walgreens also paid a $325 million termination fee to Rite

Aid.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 19, 2017 10:26 ET (14:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

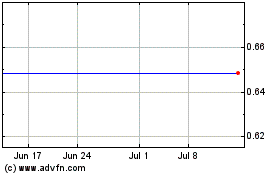

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024