Cigna Corporation (NYSE:CI) (the “Company”) announced today the

results as of 5:00 p.m., New York City time, on September 18, 2017

(the “Early Tender Date”) of its previously announced offers to

purchase for cash (the “Tender Offers”) up to $1,000,000,000

aggregate principal amount (the “Aggregate Maximum Principal

Amount”) of its outstanding 8.300% Notes due 2023, 7.650% Notes due

2023, 7.875% Debentures due 2027, 8.300% Step Down Notes due 2033,

6.150% Notes due 2036, 5.875% Notes due 2041 and 5.375% Notes due

2042 (collectively, the “Securities”), upon the terms and subject

to the conditions set forth in the Offer to Purchase dated

September 5, 2017 and the related Letter of Transmittal

(collectively, the “Offer to Purchase”).

The Company has been advised by the tender agent that, as of the

Early Tender Date, the amounts set forth in the table below of each

series of Securities had been validly tendered and not validly

withdrawn. The amount of each series of Securities that is to be

accepted for purchase as of the Early Tender Date will be

determined in accordance with the acceptance priority levels and

the proration procedures described in the Offer to Purchase. It is

expected that all of the 8.300% Step Down Notes due 2033, 6.150%

Notes due 2036, 5.875% Notes due 2041 and 5.375% Notes due 2042

validly tendered and not validly withdrawn will be accepted for

purchase and will not be subject to proration and the 7.875%

Debentures due 2027 validly tendered and not validly withdrawn will

be subject to a proration factor of approximately 20%. The Company

will not accept any 8.300% Notes due 2023 or 7.650% Notes due 2023

for purchase.

The “Total Consideration” payable per $1,000 principal amount of

each series of Securities validly tendered and accepted for

purchase was determined by the Dealer Managers based on a spread

over a reference U.S. Treasury Security, as set forth in the table

below, in accordance with standard market practice as of 2:00 p.m.,

New York City time, on September 18, 2017. The Total Consideration

payable by the Company per $1,000 principal amount of Securities

accepted for purchase has been set at $1,276.86 for its 8.300%

Notes due 2023, $1,258.99 for its 7.650% Notes due 2023, $1,391.90

for its 7.875% Debentures due 2027, $1,480.26 for its 8.300% Step

Down Notes due 2033, $1,319.29 for its 6.150% Notes due 2036,

$1,314.38 for its 5.875% Notes due 2041 and $1,253.19 for its

5.375% Notes due 2042.

The following table summarizes the material pricing terms and

early results for the Tender Offers:

Title of Security

CUSIPNumbers

Principal Amount

Tendered

AcceptancePrioritylevel

EarlyTenderPayment(a)

FixedSpread(bps)

Reference U.S.Treasury

Security

ReferenceYield(DeterminedonSeptember18,

2017, at2:00 p.m.)

TotalConsideration(a),

(b)

8.300% StepDown NotesDue 2033

125509BE8 $37,786,000 1

$30 115

3.000% U.S.Treasury Notesdue May 2047

2.810% $1,480.26

6.150% NotesDue 2036

125509BH1 $309,502,000 2

$30 98

3.000% U.S.Treasury Notesdue May 2047

2.810% $1,319.29

5.875% NotesDue 2041

125509BQ1 $179,477,000 3

$30 100

3.000% U.S.Treasury Notesdue May 2047

2.810% $1,314.38

5.375% NotesDue 2042

125509BT5 $432,718,000 4

$30 95

3.000% U.S.Treasury Notesdue May 2047

2.810% $1,253.19

7.875%DebenturesDue 2027

125509AZ2 $206,799,000 5

$30 90

2.250% U.S.Treasury Notesdue August

2027

2.238% $1,391.90

8.300% NotesDue 2023

125509AG4 $1,535,000 6

$30 85

1.625% U.S.Treasury Notesdue August

2022

1.832% $1,276.86

7.650% NotesDue 2023

125509AH2 $44,177,000 7

$30 70

1.625% U.S.Treasury Notesdue August

2022

1.832% $1,258.99

___________________________________

(a) Per $1,000 principal amount. (b) Total Consideration is

based on the Fixed Spread for the applicable series of Securities

to the yield of the Reference U.S. Treasury Security for that

series as of 2:00 p.m., New York City time, on September 18, 2017.

The Total Consideration excludes accrued and unpaid interest on the

Securities accepted for purchase.

It is anticipated that payment for the Securities that were

validly tendered and accepted for purchase as of the Early Tender

Date will be made on September 19, 2017.

The Tender Offers will expire at 11:59 p.m., New York City time,

on October 2, 2017, unless extended or earlier terminated. Because

the Tender Offers have been fully subscribed as of the Early Tender

Date, holders who tender Securities after the Early Tender Date

will not have any of their Securities accepted for purchase.

Additional Information

HSBC Securities (USA) Inc., J.P. Morgan Securities LLC and MUFG

Securities Americas Inc. are the Dealer Managers for the Tender

Offers. D.F. King & Co., Inc. has been appointed as the tender

agent and information agent for the Tender Offers.

Persons with questions regarding the Tender Offers should

contact HSBC Securities (USA) Inc. at (212) 525-5552 (collect) or

(888) HSBC-4LM (toll-free), J.P. Morgan Securities LLC at (212)

834-8553 (collect) or (866) 834-4666 (toll-free) and MUFG

Securities Americas Inc. at (212) 405-7481 (collect) or (877)

744-4532 (toll-free). Holders who would like additional copies of

the Offer to Purchase may contact the information agent, D.F. King

& Co., Inc. by calling toll-free at (800) 628-8532 (banks and

brokers may call collect at (212) 269-5550) or email

ci@dfking.com.

This press release is not an offer to sell or a solicitation of

an offer to buy any security. The Tender Offers are being made

solely pursuant to the Offer to Purchase.

The Tender Offers do not constitute, and the Offer to Purchase

may not be used in connection with, an offer or solicitation by

anyone in any jurisdiction in which such offer or solicitation is

not permitted by law or in which the person making such offer or

solicitation is not qualified to do so or to any person to whom it

is unlawful to make such offer or solicitation.

About Cigna

Cigna Corporation (NYSE: CI) is a global health service company

dedicated to helping people improve their health, well-being and

sense of security. All products and services are provided

exclusively by or through operating subsidiaries of Cigna

Corporation, including Connecticut General Life Insurance Company,

Cigna Health and Life Insurance Company, Life Insurance Company of

North America and Cigna Life Insurance Company of New York. Such

products and services include an integrated suite of health

services, such as medical, dental, behavioral health, pharmacy,

vision, supplemental benefits, and other related products including

group life, accident and disability insurance. Cigna maintains

sales capability in 30 countries and jurisdictions, and has more

than 95 million customer relationships throughout the world. To

learn more about Cigna®, including links to follow us on Facebook

or Twitter, visit www.cigna.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking statements.

Forward-looking statements are based on our current expectations

and projections about future trends, events and uncertainties.

These statements are not historical facts. Forward-looking

statements may include, among others, statements concerning an

anticipated financing and other statements regarding our future

beliefs, expectations, plans, intentions, financial condition or

performance. You may identify forward-looking statements by the use

of words such as “believe,” “expect,” “plan,” “intend,”

“anticipate,” “estimate,” “predict,” “potential,” “may,” “should,”

“will” or other words or expressions of similar meaning, although

not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and

uncertainties, both known and unknown, that could cause actual

results to differ materially from those expressed or implied in

forward-looking statements. The discussions in our Annual Report on

Form 10-K for the year ended December 31, 2016 and our Quarterly

Reports on Form 10-Q for the quarterly periods ended March 31, 2017

and June 30, 2017, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections therein, as such discussions may be updated

from time to time in our periodic filings with the SEC incorporated

by reference in the Offer to Purchase, include both expanded

discussion of these factors and additional risk factors and

uncertainties that could affect the matters discussed in the

forward-looking statements. You should not place undue reliance on

forward-looking statements that speak only as of the date they are

made, are not guarantees of future performance or results, and are

subject to risks, uncertainties and assumptions that are difficult

to predict or quantify. The Company undertakes no obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, except as may be

required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170919005562/en/

Cigna CorporationWill McDowell, 215-761-4198

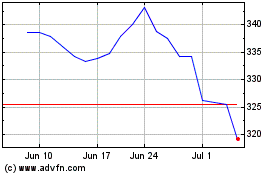

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

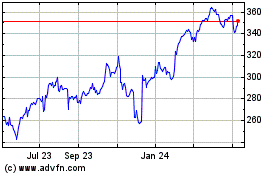

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024