Liberty All-Star® Equity Fund Increases Annual Distribution Rate 25 Percent

September 18 2017 - 4:19PM

Business Wire

The Board of Trustees (the “Board”) of Liberty All-Star Equity

Fund (the “Fund”) (NYSE: USA) has approved an increase in the

Fund’s distribution policy from an annual rate of approximately 8

percent (2.0 percent quarterly) of net asset value (“NAV”) to

approximately 10 percent (2.5 percent quarterly). The increase will

be effective for the Fund’s fourth quarter distribution which will

be declared on November 6, 2017.

The Board believes this increase in the distribution rate may

enhance long-term shareholder value by providing a consistent

method of distributing the Fund’s assets at NAV while increasing

liquidity and reducing the discount at which shares currently trade

to NAV. This 25 percent increase in the distribution rate from 8 to

10 percent restores the rate to the level when the distribution

policy was first adopted in 1988.

William Parmentier, President of the Fund, said, “This action by

the Board balances the interests of all shareholders by increasing

the controlled distribution of Fund assets at NAV without

disrupting the Fund’s disciplined investment process for our many

long-term shareholders.”

A portion of the Fund’s distributions may be treated as paid

from sources other than net income, including but not limited to

short-term capital gain, long-term capital gain and return of

capital. The final determination of the source of all distributions

in 2017 for tax reporting purposes, including the percentage of

qualified dividend income, will be made after year-end. If the

Fund’s net investment income and net realized capital gains for any

year exceed the amount distributed under the distribution policy,

the Fund may, in its discretion, retain and not distribute capital

gains and pay income tax thereon to the extent of such excess.

The Fund does not continuously issue shares and trades in the

secondary market, investors wishing to buy or sell shares need to

place orders through an intermediary or broker. The share price of

a closed-end fund is based on the market’s value. The Fund’s shares

are listed on the New York Stock Exchange under the ticker symbol

USA. ALPS Advisors, Inc. is the investment advisor of the Fund, a

multi-managed, closed-end investment company with more than $1.2

billion in net assets as of September 15, 2017.

Past performance cannot predict future results.An investment in

the Fund involves risk, including loss of principal. ALPS Portfolio

Solutions Distributor, Inc. – FINRA Member Firm

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170918006410/en/

Liberty All-Star Equity Fund, Inc. (USA)Bill Parmentier,

1-800-241-1850www.all-starfunds.com

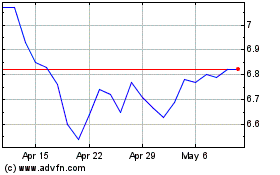

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Mar 2024 to Apr 2024

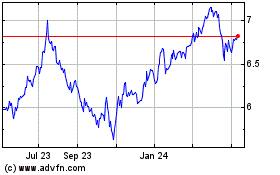

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Apr 2023 to Apr 2024