Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

FINANCIAL GRAVITY COMPANIES, INC.

(Exact name of registrant

as specified in its charter)

|

Nevada

|

|

8742

|

|

20-4057712

|

|

(State of Incorporation)

|

|

(Primary Standard

Industrial Classification Number)

|

|

(IRS Employer

Identification Number)

|

800 N. Watters Road

Suite 120

Allen, Texas 75013

469-342-9100

(Address, including zip code, and telephone

number, including area code,

of registrant's principal executive offices)

Please send copies of all communications

to:

BRUNSON CHANDLER & JONES, PLLC

175 South Main Street, Suite 1410

Salt Lake City, Utah 84111

801-303-5730

(Address, including zip code, and telephone,

including area code)

Approximate date of proposed sale to the

public:

From time to time after the effective date of this registration statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box.

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

x

|

|

|

|

|

Emerging growth company

|

o

|

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

securities to be registered

|

|

Amount of

shares of

common stock

to be

registered

(1)

|

|

|

Proposed

Maximum

Offering

Price Per

Share (2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

6,000,000

|

|

|

|

$0.80

|

|

|

|

$4,800,000

|

|

|

|

$556.32

|

|

|

(1)

|

In accordance with Rule 416(a),

this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from

stock splits, stock dividends or similar transactions.

|

|

(2)

|

Based on the lowest traded price

of the Company’s common stock during the ten consecutive trading day period immediately preceding the filing of this

Registration Statement of $0.80. The shares offered hereunder may be sold by the selling stockholder from time to time in

the open market, through privately negotiated transactions, via a combination of these methods at market prices prevailing

at the time of sale, or at negotiated prices.

|

|

(3)

|

The fee is calculated by multiplying the aggregate offering amount by

.0001159, pursuant to Section 6(b) of the Securities Act of 1933.

|

We hereby amend this registration

statement on such date or dates as may be necessary to delay our effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall, thereafter, become effective in accordance with Section 8(a)

of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting

pursuant to Section 8(a) may determine.

PRELIMINARY

PROSPECTUS SUBJECT TO COMPLETION DATED SEPTEMBER ____, 2017

The information

in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted

Financial Gravity Companies, Inc.

6,000,000 Common Shares

The selling stockholder identified in this

prospectus may offer an indeterminate number of shares of the Company’s common stock, which will consist of up to 6,000,000

shares of common stock to be sold by the selling stockholder, GHS Investments LLC (“GHS”), pursuant to an Equity Financing

Agreement (the “Financing Agreement”) dated May 23, 2017. If issued presently, the 6,000,000 shares of common stock

registered for resale by GHS would represent 16.84% of the Company’s issued and outstanding shares of common stock as of

August 17, 2017.

The selling stockholder may sell all or

a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing market prices at the time of sale,

at varying prices, or at negotiated prices.

We will not receive any proceeds from the

sale of the shares of our common stock by GHS. However, we will receive proceeds from our initial sale of shares to GHS pursuant

to the Financing Agreement. We will sell shares of our common stock to GHS at a price equal to 80% of the average of the lowest

two (2) trading prices of our common stock during the ten (10) consecutive trading day period beginning on the date on which we

deliver a put notice to GHS (the “Market Price”).

GHS is an underwriter within the meaning

of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such

broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions

or discounts under the Securities Act of 1933.

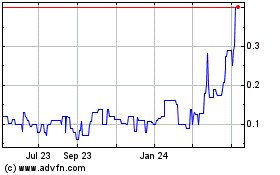

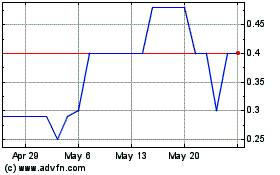

Our common stock is traded on OTC Markets

under the symbol “FGCO”. On August 2, 2017, the last reported sale price for our common stock was $0.80 per share.

Prior to this offering, there has been

a very limited market for our securities. While our common stock is quoted on the OTC Markets, there has been negligible trading

volume. There is no guarantee that an active trading market for our common stock will develop.

This offering is highly speculative

and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire

investment. See “Risk Factors” beginning on page 5. Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is September __, 2017.

Table of Contents

The following table of contents has been

designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

We have not authorized any person to give you any supplemental

information or to make any representations for us. You should not rely upon any information about our company that is not contained

in this prospectus. Information contained in this prospectus may become stale. You should not assume the information contained

in this prospectus or any prospectus supplement is accurate as of any date other than their respective dates, regardless of the

time of delivery of this prospectus, any prospectus supplement or of any sale of the shares. Our business, financial condition,

results of operations, and prospects may have changed since those dates. The selling stockholder is offering to sell and is seeking

offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted.

In this prospectus, “Financial Gravity”

the “Company,” “we,” “us,” and “our” refer to Financial Gravity Companies, Inc.,

a Nevada corporation.

SUMMARY INFORMATION

You should carefully read all information

in the prospectus, including the financial statements and their explanatory notes under the Financial Statements section of this

prospectus prior to making an investment decision.

Company Organization

Financial Gravity Companies, Inc. was incorporated

under the laws of the State of Nevada on December 5, 2005. Its principal executive offices are located at 800 N. Watters Rd., Suite

120, Allen, Texas 75013. The Company’s telephone number is 469-342-9100. The Company’s stock symbol is FGCO.

Our Business

The Company was incorporated in Nevada

on December 5, 2005 as Kat Racing, Inc. On January 4, 2013, the Articles of Incorporation were amended to change the name of the

Company to Prairie West Oil & Gas, Ltd. On July 26, 2013, the Articles of Incorporation were amended to change the name of

the Company to Pacific Oil Company. On October 31, 2016, following a reverse merger transaction (the “Merger”), the

Articles of Incorporation were amended to change the name of the Company to Financial Gravity Companies, Inc.

The accounting acquirer (legal acquiree)

in the Merger, Financial Gravity Holdings, Inc. (“Financial Gravity Holdings”), was incorporated in Texas on September

29, 2014. On the effective date of the Merger, the business of Financial Gravity Holdings became the only business of Pacific Oil

Company (currently named Financial Gravity Companies, Inc.).

Also pursuant to the Merger, each of the

shares of Financial Gravity Holdings common stock issued and outstanding prior to the Merger was automatically converted into and

exchangeable for an equivalent number of fully paid and non-assessable shares of Company common stock.

The accounting acquirer (legal acquiree)

in the reverse merger transaction, Financial Gravity Holdings, is now a subsidiary of the Company. Business Legacy, Inc., founded

in 2002, and Pollock Advisory Group, founded in 2007, were added on September 29, 2014, as subsidiaries. During fiscal year 2015,

the Company acquired as additional subsidiaries, Cloud9b2b, LLC and SASH Corporation (dba Metro Data Processing). During fiscal

year 2016, the Company acquired an additional subsidiary, Tax Coach Software, LLC. The Company and its subsidiaries deliver a wide

range of accounting, tax planning and management services to high net worth individuals and businesses nationwide.

Organic growth has come in four key areas.

|

|

·

|

Tax Services, including Tax Blueprints and ongoing Tax Operating system services

|

|

|

·

|

Wealth Management Services

|

|

|

·

|

Other Products and Services (Insurance and other miscellaneous products and services).

|

All future growth is expected to come from

these four key areas, as well as through organic growth, acquisitions, and strategic alliances.

Products and Services

The following outline briefly describes Financial Gravity’s

various subsidiaries and the products and services they offer:

Financial Gravity Operations,

Inc.

- Financial Gravity Operations manages operational expenses for the shared services of the subsidiaries.

Financial Gravity Tax, Inc. formerly

Business Legacy, Inc.

- Financial Gravity Tax is a bookkeeping, tax planning and payroll service provider for small

companies and individuals.

Financial Gravity Wealth, Inc. formerly

Pollock Advisory Group, Inc.

- Financial Gravity Wealth is a registered investment advisor and provides asset management

services.

Financial Gravity Business, LLC formerly

Cloud9b2b, LLC

- Financial Gravity Business provides business consulting services to Small Business Owners that identify

way to leverage a business’ current assets (people, platforms and processes) and reduce exposure to risk, both short-term

and long-term, while simplifying the business and increasing profitability.

Financial Gravity Ventures, LLC

formerly Cloud9Accelerator, LLC

- Financial Gravity Ventures holds acquired companies and business assets until they are

integrated into the main stream Financial Gravity business structure.

Sash Corporation dba Metro Data

Processing

- Metro Data Processing provides payroll services, software and support solutions to business owners.

Tax Coach Software, LLC

- Tax

Coach Software provides three primary services including monthly subscriptions to the “TaxCoach” software system, coaching

and email marketing services.

GHS Equity Financing Agreement and Registration

Rights Agreement

Summary of the Offering

|

Shares currently outstanding:

|

|

35,637,900

|

|

|

|

|

|

Shares being offered:

|

|

6,000,000

|

|

|

|

|

|

Offering Price per share:

|

|

The selling stockholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices, or at negotiated prices.

|

|

|

|

|

|

Use of Proceeds:

|

|

The Company will not receive any proceeds from the sale of the shares of our common stock by the selling stockholder. However, we will receive proceeds from our initial sale of shares to GHS, pursuant to the Financing Agreement. The proceeds from the initial sale of shares will be used for the purpose of working capital and for potential acquisitions.

|

|

|

|

|

|

OTC Markets Symbol:

|

|

FGCO

|

|

|

|

|

|

Risk Factors:

|

|

See “Risk Factors” beginning on page 5 and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

|

Financial Summary

The tables and information below are

derived from our consolidated financial statements for the nine months ended June 30, 2017 and the audited consolidated

financial statements for the 12 months ended September 30, 2016. Our total stockholders’ equity as of June 30, 2017 was

$2,065,589. Our total stockholder’s equity as of September 30, 2016 was $1,724,436. As of June 30, 2017, we had cash on

hand of $154,468.

|

|

|

June 30,

2017

|

|

|

September 30,

2016

|

|

|

Cash

|

|

$

|

154,468

|

|

|

$

|

132,803

|

|

|

Total Assets

|

|

$

|

2,135,384

|

|

|

$

|

2,100,243

|

|

|

Total Liabilities

|

|

$

|

395,086

|

|

|

$

|

375,807

|

|

|

Total Stockholder’s Equity (Deficit)

|

|

$

|

1,740,298

|

|

|

$

|

1,724,436

|

|

Statement of Operations

|

|

|

Nine Months Ended

June 30,

2017

|

|

|

Year Ended

September 30,

2016

|

|

|

Revenue

|

|

$

|

2,560,113

|

|

|

$

|

2,756,999

|

|

|

Total Expenses

|

|

$

|

3,238,229

|

|

|

$

|

4,883,663

|

|

|

Net Loss for the Period

|

|

$

|

(720,502

|

)

|

|

$

|

(2,135,139

|

)

|

|

Net Loss per Share

|

|

$

|

(0.02

|

)

|

|

$

|

(0.07

|

)

|

Special

Information Regarding Forward-Looking Statements

Some of the statements in this prospectus

are “forward-looking statements.” These forward-looking statements involve certain known and unknown risks, uncertainties

and other factors which may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by these forward-looking statements. These factors include, among others, the

factors set forth herein under “Risk Factors.” The words “believe,” “expect,” “anticipate,”

“intend,” “plan,” and similar expressions identify forward-looking statements. We caution you not to place

undue reliance on these forward-looking statements. We undertake no obligation to update and revise any forward-looking statements

or to publicly announce the result of any revisions to any of the forward-looking statements in this document to reflect any future

or developments.

RISK FACTORS

This investment has a high degree of

risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in

this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be

harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risks Related to our Company

Our limited operating history may

not serve as an adequate basis to judge our future prospects and results of operations.

Financial Gravity has a relatively limited

operating history. Our limited operating history and the unpredictability of the wealth management industry make it difficult for

investors to evaluate our business. An investor in our securities must consider the risks, uncertainties and difficulties frequently

encountered by companies in rapidly evolving markets.

We will need

additional financing to implement our business plan.

The Company will

need additional financing to fully implement its business plan in a manner that not only continues to expand an already established

direct-to-consumer approach, but also allows the Company to establish a stronger brand name in all the areas in which it operates.

In particular, the Company will need additional financing to:

|

|

·

|

Effectuate its business plan and further develop its product and service lines;

|

|

|

·

|

Expand its facilities, human resources, and infrastructure; and

|

|

|

·

|

Increase its marketing efforts and lead generation.

|

There are no assurances that additional

financing will be available on favorable terms, or at all. If additional financing is not available, the Company will need to reduce,

defer or cancel development programs, planned initiatives and overhead expenditures. The failure to adequately fund its capital

requirements could have a material adverse effect on the Company’s business, financial condition and results of operations.

Moreover, the sale of additional equity securities to raise financing will result in additional dilution to the Company’s

stockholders, and incurring additional indebtedness could involve the imposition of covenants that restrict the Company’s

operations.

Our products and services are subject

to changes in applicable laws and regulations.

The Company’s business is particularly

subject to changing federal and state laws and regulations related to the provision of financial services to consumers. The Company’s

continued success depends in part on its ability to anticipate and respond to these changes, and the Company may not be able to

respond in a timely or commercially appropriate manner. If the Company fails to adjust its products and services in response to

changing legal and/or regulatory requirements, the ability to deliver its products and services may be hindered, which in turn

could have an adverse effect on the Company’s business, financial condition and results of operations.

We may continue

to encounter substantial competition in our business.

The Company

believes that existing and new competitors will continue to improve their products and services, as well as introduce new products

and services with competitive price and performance characteristics. The Company expects that it must continue to innovate, and

to invest in product development and productivity improvements, to compete effectively in the several markets in which the Company

participates. The Company’s competitors could develop a more efficient product or service or undertake more aggressive and

costly marketing campaigns than those implemented by the Company, which could adversely affect the Company’s marketing strategies

and have an adverse effect on the Company's business, financial condition and results of operations.

Important factors

affecting the Company's current ability to compete successfully include:

|

|

·

|

lead generation and marketing costs;

|

|

|

·

|

service delivery protocols;

|

|

|

·

|

branded name advertising; and

|

|

|

·

|

product and service pricing.

|

In periods of reduced demand for the Company's

products and services, the Company can either choose to maintain market share by reducing product and service pricing to meet the

competition, or maintain its product and service pricing, which would likely sacrifice market share. Sales and overall profitability

may be reduced in either case. In addition, there can be no assurance that additional competitors will not enter the Company's

existing markets, or that the Company will be able to continue to compete successfully against its competition.

We may not

successfully manage our growth

.

Our success will

depend upon the expansion of our operations and the effective management of our growth, which will place a significant strain on

our management and on our administrative, operational and financial resources. To manage this growth, we must expand our facilities,

augment our operational, financial and management systems, and hire and train additional qualified personnel. If we are unable

to manage our growth effectively, our business would be harmed.

We rely on key executive officers,

and their knowledge of our business and technical expertise would be difficult to replace.

We are highly dependent on our executive

officers. If one or more of the Company's senior executives or other key personnel are unable or unwilling to continue in their

present positions, the Company may not be able to replace them easily or at all, and the Company’s business may be disrupted.

Competition for senior management personnel is intense, the pool of qualified candidates is very limited, and we may not be able

to retain the services of our senior executives or attract and retain high-quality senior executives in the future. Such failure

could have a material adverse effect on the Company's business, financial condition and results of operations.

We may never pay dividends to our

common stockholders.

The Company currently intends to retain

its future earnings to support operations and to finance expansion; accordingly, the Company does not anticipate paying any cash

dividends in the foreseeable future.

The declaration, payment and amount of

any future dividends on common stock will be at the discretion of the Company's Board of Directors, and will depend upon, among

other things, earnings, financial condition, capital requirements, level of indebtedness and other considerations the Board of

Directors considers relevant. There is no assurance that future dividends will be paid on common stock or, if dividends are paid,

the amount thereof.

Our common stock is quoted through

the OTC Markets, which may have an unfavorable impact on our stock price and liquidity.

The Company’s common stock

is quoted on the OTC Markets, which is a significantly more limited market than the New York Stock Exchange or NASDAQ. The trading

volume may be limited by the fact that many major institutional investment funds, including mutual funds, follow a policy of not

investing in OTC Markets stocks and certain major brokerage firms restrict their brokers from recommending OTC Markets stocks because

they are considered speculative and volatile.

The trading volume of the Company’s

common stock has been and may continue to be limited and sporadic. As a result, the quoted price for the Company’s common

stock on the OTC Markets may not necessarily be a reliable indicator of its fair market value.

Additionally, the securities of small capitalization

companies may trade less frequently and in more limited volume than those of more established companies. The market for small capitalization

companies is generally volatile, with wide price fluctuations not necessarily related to the operating performance of such companies.

Our common

stock is subject to price volatility unrelated to our operations.

The market price

of the Company’s common stock could fluctuate substantially due to a variety of factors, including market perception of the

Company’s ability to achieve its planned growth, operating results of the Company and of other companies in the same industry,

trading volume in the Company’s common stock, changes in general conditions in the economy and the financial markets or other

developments affecting the Company or its competitors.

Our common

stock is classified as a “penny stock.”

Rule 3a51-1 of the Securities Exchange

Act of 1934 establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that

has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited

number of exceptions which are not available to us. It is likely that the Company’s common stock will be considered to be

a penny stock for the immediately foreseeable future.

For any transaction involving a penny stock,

unless exempt, the penny stock rules require that a broker or dealer approve a person’s account for transactions in penny

stocks and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and

quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the

broker or dealer must obtain financial information and investment experience and objectives of the investor, make a reasonable

determination that transactions in penny stocks are suitable for that person, and make a reasonable determination that that person

has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also provide

disclosure to its customers, prior to executing trades, about the risks of investing in penny stocks in both public offerings and

in secondary trading, the commissions payable to both the broker-dealer and the registered representative, and the rights and remedies

available to an investor in cases of fraud in penny stock transactions.

Because of these

regulations, broker-dealers may not wish to furnish the necessary paperwork and disclosures and/or may encounter difficulties in

their attempt to buy or sell shares of the Company’s common stock, which may in turn affect the ability of Company stockholders

to sell their shares.

Accordingly, the penny stock classification

adversely affects any market liquidity for the Company’s common stock, and subjects the shares to certain risks associated

with trading in penny stocks. These risks include difficulty for investors in purchasing or disposing of shares, difficulty in

obtaining accurate bid and ask quotations, difficulty in establishing the market value of the shares, and a lack of securities

analyst coverage.

Because we may never earn revenues from

our operations, our business may fail and investors may lose all of their investment in our company.

In addition to other information in this

current report, the following risk factors should be carefully considered in evaluating our business because such factors may have

a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk

factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional

risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business,

operating results, liquidity and financial condition. If any such risks occur, our business, operating results, liquidity,

and financial condition could be materially affected in an adverse manner. Under such circumstances, the trading price of our securities

could decline, and you may lose all or part of your investment.

We have limited revenues from

operations. We have yet to generate positive earnings and there can be no assurance we will ever operate

profitably. Our company has a limited operating history and has yet to launch its first commercial product. The

success of our company is significantly dependent on uncertain events, with respect to supply chain, system development, and

operation of the system on the scale we currently envision. If our business plan is not successful and we are not able to

operate profitably, our stock may become worthless and investors may lose all of their investment in our

Company. Should any of the following material risks occur, our business may experience catastrophic and

unrecoverable losses, as said risks may harm our current business operations, as well as any future results of operations,

resulting in the trading price of our common stock declining and a partial or complete loss of your

investment. It is important to note these risks are not the only ones we face. Additional risks not

presently known or that we currently consider to be immaterial may also impair our business operations and trading price of

our common stock.

We may not achieve profitability

or positive cash flow.

Our ability to achieve and maintain profitability

and positive cash flow will be dependent upon such factors as our ability to deliver quality risk management and custom app development

services. Based upon current plans, we expect to incur operating losses in future periods because we expect to incur expenses that

will exceed revenues for an unknown period of time. We cannot guarantee that we will be successful in generating sufficient revenues

to support operations in the future.

We have limited operating capital

and we may have to seek additional financing.

If we are unable to fund our operations

and, therefore, not be able to sustain future operations or support the manufacturing of additional systems, we may be required

to delay, reduce and/or cease our operations and/or seek bankruptcy protection.

We cannot assure anyone with any

degree of certainty that any necessary additional financing will be available on terms favorable to us, now or at any point

in the future. It may be a significant challenge to raise additional funds and there can be no assurance as to the

availability of additional financing or the terms upon which additional financing may be available. Even if we raise

sufficient capital through additional equity or debt financings, strategic alternatives or otherwise, there can be no

assurance the revenue or capital infusion will be sufficient to enable us to develop our business to a level where it will be

profitable or generate positive cash flow.

If we raise additional funds through the

issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted,

and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders; and if we

incur additional debt, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest

on such indebtedness, thus limiting funds available for our business activities. The terms of any debt securities issued could

also impose significant restrictions on our operations.

If we and

our suppliers cannot obtain financing under favorable terms, and our clients are not able

to receive the requisite guarantees for payment to us, our business may be negatively impacted.

Markets for stock are highly volatile.

As a result of market volatility

in the U.S. and in international stock markets since 2008, a high degree of uncertainty

has been seen in the markets,

which may result in an increase in the return required by investors, with

respect to their expectations for the financing of our projects. Current and ongoing global conditions could lead to an

extended recession in the U.S. and around the world. We currently have no revenue producing assets, which may have

a materially adverse impact on our business and financial conditions and results, which places our investors at risk.

Capital and credit markets continue to

be unpredictable and the availability of funds from those markets is extremely uncertain. Further, arising from concerns

about the stability of financial markets generally and the solvency of borrowers specifically, the cost of accessing the credit

markets has increased as many lenders have raised interest rates, enacted tighter lending standards or altogether ceased to provide

funding to borrowers. Due to these capital and credit market conditions, we cannot be certain that funding will be available to

us in amounts or on terms that we believe are acceptable.

The market price of our common stock may

be adversely affected by market conditions affecting the stock markets in general, including price and trading fluctuations on

OTC Markets. Market conditions may result in volatility in the level of, and fluctuations in, the market prices of stocks

generally and, in turn, our common stock and sales of substantial amounts of our common stock in the market, in each case being

unrelated or disproportionate to changes in our operating performance.

The overall weakness in the economy has

recently contributed to the extreme volatility of the markets which may have an effect on the market price of our common stock.

Our stock price has been and could remain volatile, which could further adversely affect the market price of our stock, our ability

to raise additional capital and/or cause us to be subject to securities class action litigation.

We may also be subject to additional securities

class action litigation as a result of volatility in the price of our common stock, which could result in substantial costs and

a significant diversion of management’s time and attention and intellectual and capital resources and could harm our stock

price, business, prospects, and results of operations.

Sales of a significant number of shares

of our common stock could depress the market price of our common stock, which could happen in the public market at any time. These

sales, or the market perception that the holders of a large number of shares intend to sell shares, could reduce the market price

of our common stock. Should industry analysts choose not to publish or any time discontinue reporting on us, our business or our

market, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline. Also,

the trading market for our common stock will be influenced by the research and reports that industry or securities analysts may

publish about us, our business, our market or our competitors. If any of the analysts who may cover us change their recommendation

regarding our stock adversely, or provide more favorable relative recommendations about our competitors, our stock price would

likely decline.

We may become subject to litigation.

There is the potential that we could be

party to disputes for which an adverse outcome could result in us incurring significant expenses, being liable for damages, and

subject to indemnification claims. In connection with any disputes or litigation in which we are involved, we may be forced

to incur costs and expenses in connection with defending ourselves or in connection with the payment of any settlement or judgment

or compliance with any injunctions in connection, therewith, if there is an unfavorable outcome. The expense of defending

litigation may be significant, as is the amount of time to resolve lawsuits unpredictable and defending ourselves may divert management’s

attention from the day-to-day operations of our business, which could adversely affect our business, results of operations, financial

condition, and cash flows. Additionally, an unfavorable outcome in any such litigation could have a material adverse

effect on our business, results of operations, financial condition and cash flows.

Product liability or defects could also

negatively impact our results of operations. The risk of product liability claims and associated adverse publicity is

possible in the development, manufacturing, marketing, and sale of our product offerings. Any liability for damages

resulting from malfunctions or design defects could be substantial and could materially adversely affect our business, financial

condition, results of operations and prospects.

Also, a highly-publicized problem, whether

actual or perceived, could adversely affect the market’s perception of our product, resulting in a decline in demand for

our product and could divert the attention of our management, having a materially adverse effect our business, financial condition,

results of operations and prospects.

Our success depends on attracting

and retaining key personnel.

Our future plans could be harmed if we

are unable to attract or retain key personnel, and our future success will depend, in part, on our ability to attract and retain

qualified management and technical personnel. Equally, our success depends on the ability of our management and employees

to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and

adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such

investments. Further, no assurance can be given that our key personnel will continue their association or employment

with us or that replacement personnel with comparable skills can be found. We have sought to and will continue to ensure that management

and any key employees are appropriately compensated, however, their services cannot be guaranteed. If we are unable to attract

and retain key personnel, our business may be adversely affected.

We do not know whether we will be successful

in hiring or retaining qualified personnel, and our inability to hire qualified personnel on a timely basis, or the departure of

key employees, could materially and adversely affect our development and profitable commercialization plans, our business prospects,

results of operations, and financial condition.

Should we fail to maintain an

effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud, which

could harm our brand and operating results. Our compliance with the annual internal control report requirement for each

fiscal year will depend on the effectiveness of our financial reporting and data systems and controls. Inferior

internal controls could cause investors to lose confidence in our reported financial information, which could have a negative

effect on the trading price of our stock and our access to capital. In addition, our internal control systems rely on people

trained in the execution of the controls. Loss of these people or our inability to replace them with similarly skilled and

trained individuals or new processes in a timely manner could adversely impact our internal control mechanisms.

The requirements of being a public company

may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members

and officers. Compliance with these rules and regulations increase our legal and financial compliance costs, make some

activities more difficult, time-consuming or costly and increase demand on our systems and resources.

Protecting our intellectual property

is necessary to protect our brand.

We may not be able to protect important

intellectual property and we could incur substantial costs defending against claims that our products infringe on the proprietary

rights of others. Our ability to compete effectively will depend, in part, on our ability to protect our proprietary

system-level technologies, systems designs, and manufacturing processes.

We will rely on patents, trademarks,

and other policies and procedures related to confidentiality to protect our intellectual property. However, some of our

intellectual property is not covered by any patent or patent application. We could incur substantial costs in prosecuting or

defending patent infringement suits or otherwise protecting our intellectual property rights. While we have attempted to

safeguard and maintain our proprietary rights, we do not know whether we have been or will be completely successful in doing

so. Moreover, patent applications and enforcement, thereof, filed in foreign countries may be subject to laws, rules and

procedures that are substantially different from those of the United States, and any resulting foreign patents may be

difficult and expensive to enforce. We could incur substantial costs in prosecuting or defending trademark

infringement suits.

Further, our competitors may independently

develop or patent technologies or processes that are substantially equivalent or superior to ours. In the event we are

found to be infringing third party patents, we could be required to pay substantial royalties and/or damages, and we do not know

whether we will be able to obtain licenses to use such patents on acceptable terms, if at all.

Failure to obtain needed licenses could

delay or prevent the development, manufacture, or sale of our products, and could necessitate the expenditure of significant resources

to develop or acquire non-infringing intellectual property.

Asserting, defending and maintaining

our intellectual property rights could be difficult and costly and failure to do so may diminish our ability to compete

effectively and may harm our operating results. As a result, we may need to pursue legal action in the future to enforce our

intellectual property rights, to protect our trade secrets and domain names, and to determine the validity and scope of the

proprietary rights of others. If third parties prepare and file applications for trademarks used or registered by

us, we may oppose those applications and be required to participate in proceedings to determine the priority of rights to the

trademark.

Similarly, competitors may have filed applications

for patents, may have received patents and may obtain additional patents and proprietary rights relating to products or technology

that block or compete with ours. We may have to participate in interference proceedings to determine the priority of

invention and the right to a patent for the technology.

Confidentiality agreements to which we

are party may be breached, and we may not have adequate remedies for any breach. Also, our trade secrets may also be

known without breach of such agreements or may be independently developed by competitors. Inability to maintain the

proprietary nature of our technology and processes could allow our competitors to limit or eliminate any competitive advantages

we may have.

As part of our business strategy, we intend

to consider acquisitions of companies, technologies and products that we believe could improve our ability to compete in our core

markets or allow us to enter new markets. Acquisitions, involve numerous risks, any of which could harm our business,

including, difficulty in integrating the technologies, products, operations and existing contracts of a target company and realizing

the anticipated benefits of the combined businesses; difficulty in supporting and transitioning customers, if any, of the target

company; inability to achieve anticipated synergies or increase the revenue and profit of the acquired business; potential disruption

of our ongoing business and distraction of management; the price we pay or other resources that we devote may exceed the value

we realize; or the value we could have realized if we had allocated the purchase price or other resources to another opportunity

and inability to generate sufficient revenue to offset acquisition costs.

If we finance acquisitions by issuing equity

securities, our existing stockholders may be diluted; and as a result, if we fail to properly evaluate acquisitions or investments,

we may not achieve the anticipated benefits of any such acquisitions, and we may incur costs in excess of what we anticipate.

Risks associated with our Common

Stock

If we issue additional shares in

the future our existing shareholders will experience dilution.

Our certificate of incorporation authorizes

the issuance of up to 300,000,000 shares of common stock with a par value of $0.001. Our board of directors may choose to issue

some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of

any such shares will result in a reduction of the book value and market price of the outstanding shares of our common stock. If

we issue any such additional shares, such issuance will cause a reduction in the proportionate ownership and voting power of all

current shareholders. Further, such issuance may result in a change of control of our corporation.

Trading on the OTC Markets may be

volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to

resell their shares.

Our common stock is quoted on OTC Markets.

Trading in stock quoted on OTC Markets is often thin and characterized by wide fluctuations in trading prices due to many factors

that may have little to do with our operations or business prospects. This volatility could depress the market price of our common

stock for reasons unrelated to operating performance. Moreover, OTC Markets is not a stock exchange, and trading of securities

on the OTC Markets is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock

exchange like the American Stock Exchange. Accordingly, our shareholders may have difficulty reselling any of their shares.

Our stock is a penny stock. Trading

of our stock may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which

may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The Securities

and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has

a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions.

Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who

sell to persons other than established customers and “accredited investors”. The term “accredited investor”

refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or

annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to

a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form

prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market.

The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of

the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny

stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information,

must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing

before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock

not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable

investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may

have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny

stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe

the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

FINRA sales practice requirements may also limit a stockholder's

ability to buy and sell our stock.

In addition to the “penny stock”

rules promulgated by the Securities and Exchange Commission (see above for a discussion of penny stock rules), FINRA rules require

that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment

is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers

must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and

other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend

that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on

the market for our shares.

Risks Related to the Offering

Our existing stockholders may experience

significant dilution from the sale of our common stock pursuant to the GHS Financing Agreement.

The sale of our common stock to GHS Investments

LLC in accordance with the Financing Agreement may have a dilutive impact on our shareholders. As a result, the market price of

our common stock could decline. In addition, the lower our stock price is at the time we exercise our put options, the more shares

of our common stock we will have to issue to GHS in order to exercise a put under the Financing Agreement. If our stock price decreases,

then our existing shareholders would experience greater dilution for any given dollar amount raised through the offering.

The perceived risk of dilution may cause

our stockholders to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk

of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common

stock. By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive

price declines in our common stock. GHS is not permitted to engage in short sales involving our common stock, or to engage in other

activities that could manipulate the market for our common stock, during the period commencing May 23, 2017 and continuing through

the termination of the Financing Agreement.

The issuance of shares pursuant

to the GHS Financing Agreement may have a significant dilutive effect.

The number of shares we issue pursuant

to the GHS Financing Agreement could have a significant dilutive effect upon our existing shareholders. Although the number of

shares that we may issue pursuant to the Financing Agreement will vary based on our stock price (the higher our stock price, the

fewer shares we have to issue), there may be a potential dilutive effect to our shareholders, based on different potential future

stock prices, if the full amount of the Financing Agreement is realized. Dilution is impacted by the number of shares of common

stock put to GHS, and the stock price which GHS is bound to pay for such shares, which is discounted to reflect a purchase price

of 80% of the average of the lowest two (2) trading prices during the pricing period.

GHS Investments LLC will pay less

than the then-prevailing market price of our common stock which could cause the price of our common stock to decline.

Our common stock to be issued under the

GHS Financing Agreement will be purchased at a twenty percent (20%) discount. Stated more precisely, GHS will pay eighty percent

(80%) of the average of the lowest two (2) trading prices during the ten consecutive trading days immediately preceding each notice

to GHS of an election to exercise our "put" right.

GHS has a financial incentive to sell our

shares immediately upon receiving them, to realize the profit between the discounted price and the then-current market price. If

GHS sells our shares, the price of our common stock may decrease. If our stock price decreases, GHS may have further incentive

to sell such shares to maximize its proceeds of sale. Accordingly, the discounted sales price in the Financing Agreement may cause

the price of our common stock to decline.

We may not have access to the full

amount under the Financing Agreement.

On August 2, 2017, the lowest traded price

of the Company’s common stock during the ten consecutive trading day period immediately preceding the filing of this Registration

Statement was $0.80. At that price, we would be able to sell shares to GHS under the Financing Agreement at the discounted price

of $0.64. At that discounted price, the 6,000,000 shares registered for issuance to GHS under the Financing Agreement would, if

sold by us to GHS, result in aggregate proceeds to the Company of $4,800,000. There is no assurance the price of our common stock

will remain the same as the current market price, or increase.

Unless an active trading market

develops for our securities, investors may not be able to sell their shares.

We are a reporting company and our common

shares are quoted on OTC Markets (OTC Pink) under the symbol “FGCO”. However, there is not currently an active trading

market for our common stock; and an active trading market may never develop or, if it does develop, may not be maintained. Failure

to develop or maintain an active trading market will have a generally negative effect on the price of our common stock, and you

may be unable to sell your common stock or any attempted sale of such common stock may have the effect of lowering the market price,

and therefore, your investment may be partially or completely lost.

Since our common stock is thinly

traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the

price paid.

Since our common stock is thinly traded

its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors,

many of which are beyond our control, including (but not necessarily limited to):

|

|

·

|

the trading volume of our shares;

|

|

|

·

|

the number of securities analysts, market-makers and brokers following our common stock;

|

|

|

·

|

new products or services introduced or announced by us or our competitors;

|

|

|

·

|

actual or anticipated variations in quarterly operating results;

|

|

|

·

|

conditions or trends in our business industries;

|

|

|

·

|

announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures

or capital commitments;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

sales of our common stock; and

|

|

|

·

|

general stock market price and volume fluctuations of publicly-traded, and particularly microcap,

companies.

|

Investors may have difficulty reselling

shares of our common stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets

often experience significant price and volume changes that are not related to the operating performance of individual companies,

and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause

the market price of our common stock to decline regardless of how well we perform as a company. In addition, there is a history

of securities class action litigation following periods of volatility in the market price of a company’s securities. Although

there is no such litigation currently pending or threatened against us, such a suit against us could result in the incursion of

substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business.

Moreover, and as noted below, our shares are currently traded on the OTC Link (OTC Pink tier) and, further, are subject to the

penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to potential manipulation by market-makers,

short-sellers and option traders.

USE OF PROCEEDS

The Company will use the proceeds from

the sale of the shares of common stock sold to GHS, for general corporate and working capital purposes, acquisitions of assets,

businesses or operations, or for other purposes that the Board of Directors, in good faith, deems to be in the best interest of

the Company.

DETERMINATION OF OFFERING PRICE

We have not set an offering price for the

shares registered hereunder, as the only shares being registered are those sold pursuant to the GHS Financing Agreement. GHS may

sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the

time of sale, at varying prices, or at negotiated prices.

DILUTION

Not applicable. The shares registered under

this registration statement are not being offered for purchase. The shares are being registered on behalf of the selling shareholder

pursuant to the GHS Financing Agreement.

SELLING SECURITY HOLDER

The selling stockholder identified in this

prospectus may offer and sell up to 6,000,000 shares of our common stock, which consists of shares of common stock to be initially

purchased by GHS pursuant to the Financing Agreement. If issued presently, the shares of common stock registered for resale by

GHS would represent 16.84% of our issued and outstanding shares of common stock as of August 17, 2017.

We may require the selling stockholder

to suspend the sales of the shares of our common stock being offered pursuant to this prospectus upon the occurrence of any event

that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires

the changing of statements in those documents in order to make statements in those documents not misleading.

The selling stockholder identified in

the table below may from time to time offer and sell under this prospectus any or all of the shares of common stock described

under the column “Shares of Common Stock Being Offered” in the table below.

GHS will be deemed to be an underwriter

within the meaning of the Securities Act. Any profits realized by the selling stockholder may be deemed to be underwriting commissions.

Information

concerning the selling stockholder may change from time to time and, if necessary, we will amend or supplement this prospectus

accordingly. We cannot give an estimate as to the number of shares of common stock that will actually be held by the selling stockholder

upon termination of this offering, because the selling stockholder may offer some or all of the common stock under the offering

contemplated by this prospectus or acquire additional shares of common stock. The total number of shares that may be sold hereunder

will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution” in this

prospectus.

The manner in which the selling stockholder

acquired or will acquire shares of our common stock is discussed below under “The Offering.”

The following table sets forth the name

of the selling stockholder, the number of shares of our common stock beneficially owned by such stockholder before this offering,

the number of shares to be offered for such stockholder’s account and the number and (if one percent or more) the percentage

of the class to be beneficially owned by such stockholder after completion of the offering. The number of shares owned are those

beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial

ownership for any other purpose. Under such rules, beneficial ownership includes any shares of our common stock as to which a person

has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within

60 days of August 17, 2017, through the exercise of any option, warrant or right, through conversion of any security or pursuant

to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and

such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person

holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person.

Beneficial ownership percentages are calculated based on 35,637,900 shares of our common stock outstanding as of August 17, 2017.

Unless otherwise set forth below, (a) the

persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite

the selling stockholder’s name, subject to community property laws, where applicable, and (b) no selling stockholder had

any position, office or other material relationship within the past three years, with us or with any of our predecessors or affiliates.

The number of shares of common stock shown as beneficially owned before the offering is based on information furnished to us or

otherwise based on information available to us at the timing of the filing of the registration statement of which this prospectus

forms a part.

|

|

|

Shares Owned by the Selling Stockholder before the

|

|

Shares of Common Stock Being

|

|

Number of Shares to be Owned by Selling Stockholder After

the Offering and Percent of Total Issued and Outstanding Shares

|

|

Name of Selling Stockholder

|

|

Offering (1)

|

|

Offered

|

|

# of Shares(2)

|

|

% of Class (2)

|

|

GHS Investments LLC (3)

|

|

0

|

|

6,000,000 (4)

|

|

0

|

|

0%

|

Notes:

|

|

(1)

|

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules

and generally includes voting or investment power with respect to shares of common stock. Shares of common stock subject to options,

warrants and convertible debentures currently exercisable or convertible, or exercisable or convertible within 60 days, are counted

as outstanding. The actual number of shares of common stock issuable upon the conversion of the convertible debentures is subject

to adjustment depending on, among other factors, the future market price of our common stock, and could be materially less or more

than the number estimated in the table.

|

|

|

(2)

|

Because the selling stockholder may offer and sell all or only some portion of the 6,000,000 shares

of our common stock being offered pursuant to this prospectus and may acquire additional shares of our common stock in the future,

we can only estimate the number and percentage of shares of our common stock that the selling stockholder will hold upon termination

of the offering.

|

|

|

(3)

|

Mark Grober exercises voting and dispositive power with

respect to the shares of our common stock that are beneficially owned by GHS Investments LLC.

|

|

|

(4)

|

Consists of up to 6,000,000 shares of common stock to be sold by GHS pursuant to the Financing

Agreement.

|

THE OFFERING

On May 23, 2017, we entered into an Equity

Financing Agreement (the “Financing Agreement”) with GHS Investments LLC (“GHS”). Although we are not required

to sell shares under the Financing Agreement, the Financing Agreement gives us the option to sell to GHS, up to $11,000,000 worth

of our common stock, in increments, over the period ending twenty-four (36) months after the date this Registration Statement is

deemed effective. $11,000,000 was stated to be the total amount of available funding in the Financing Agreement, because this was

the maximum amount that GHS agreed to offer us in funding. There is no assurance the market price of our common stock will increase

in the future. The number of common shares that remain issuable may not be sufficient, dependent upon the share price, to allow

us to access the full amount contemplated under the Financing Agreement. If the bid/ask spread remains the same we will not be

able to place puts for the full commitment under the Financing Agreement. Based on the lowest traded price of our common stock

during the ten (10) consecutive trading day period preceding August 2, 2017 of $0.80, the registration statement covers the offer

and possible sale of $4,800,000 worth of our shares.

The purchase price of the common stock

will be set at eighty percent (80%) of the average of the lowest two (2) trading prices of the common stock during the ten consecutive

trading day period immediately preceding the date on which the Company delivers a put notice to GHS. In addition, there is an ownership

limit for GHS of 9.99%.

GHS is not permitted to engage in short

sales involving our common stock, or to engage in other activities that could manipulate the market for our common stock, during

the period commencing May 23, 2017 and continuing through the termination of the Financing Agreement. In accordance with Regulation

SHO, however, sales of our common stock by GHS after delivery of a put notice of such number of shares reasonably expected to be

purchased by GHS under a put will not be deemed short sales.

In order for the Company’s exercise

of a put to be effective, we must deliver the documents, instruments and writings required under the Financing Agreement. GHS is

not required to purchase the put shares unless:

|

|

·

|

Our registration statement with respect to the resale of the shares of common stock delivered in

connection with the applicable put shall have been declared effective;

|

|

|

·

|

we shall have obtained all material permits and qualifications required by any applicable state

for the offer and sale of the registrable securities; and

|

|

|

·

|

we shall have filed all requisite reports, notices, and other documents with the SEC in a timely

manner.

|

As we draw down on the equity line of credit

reflected in the Financing Agreement, shares of our common stock will be sold into the market by GHS. The sale of these shares

could cause our stock price to decline. In turn, if our stock price declines and we issue more puts, more shares will come into

the market, which could cause a further drop in our stock price. The Company determines when and whether to issue a put to GHS,

so the Company will know precisely both the stock price used as the reference point, and the number of shares issuable to GHS upon

such exercise. You should be aware that there is an inverse relationship between the market price of our common stock and the number

of shares to be issued under the equity line of credit. We have no obligation to utilize the full amount available under the equity

line of credit.

Neither the Financing Agreement nor any

of our rights or GHS’s rights thereunder may be assigned to any other person.

PLAN OF DISTRIBUTION

The selling stockholder may, from time

to time, sell any or all of its shares of Company common stock on OTC Markets or any other stock exchange, market or trading facility

on which the shares of our common stock are traded, or in private transactions. These sales may be at fixed prices, prevailing

market prices at the time of sale, at varying prices, or at negotiated prices. The selling stockholder may use any one or more

of the following methods when selling shares:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares

at a stipulated price per share; or

|

|

|

·

|

a combination of any such methods of sale.

|

Additionally, broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales.

Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the

purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus,

in the case of an agency transaction not in excess of a customary brokerage commissions in compliance with FINRA Rule 2440; and

in the case of a principal transaction, a markup or markdown in compliance with FINRA IM-2440.

GHS is an underwriter within the meaning

of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933 in connection with such sales. Any commissions received by such broker-dealers

or agents, and any profit on the resale of the shares purchased by them, may be deemed to be underwriting commissions or discounts

under the Securities Act of 1933. GHS has informed us that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the Company’s common stock. Pursuant to a requirement by FINRA, the maximum

commission or discount to be received by any FINRA member or independent broker-dealer may not be greater than 8% of the gross

proceeds received by us for the sale of any securities being registered pursuant to Rule 415 promulgated under the Securities Act

of 1933.

Discounts, concessions, commissions and

similar selling expenses, if any, attributable to the sale of shares will be borne by the selling stockholder. The selling stockholder

may agree to indemnify any agent, dealer, or broker-dealer that participates in transactions involving sales of the shares if liabilities

are imposed on that person under the Securities Act of 1933.

We are required to pay certain fees and

expenses incurred by us incident to the registration of the shares covered by this prospectus. We have agreed to indemnify the

selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act of

1933. We will not receive any proceeds from the resale of any of the shares of our common stock by the selling stockholder. We

will receive proceeds from the sale of our common stock to GHS under the Financing Agreement. Neither the Financing Agreement with

GHS nor any rights of the parties under the Financing Agreement with GHS may be assigned or delegated to any other person.

We have entered into an agreement with

GHS to keep this prospectus effective until GHS (i) has sold all of the common shares purchased by it under the Financing Agreement

and (ii) has no further right to acquire any additional shares of common stock under the Financing Agreement.

The resale shares will be sold only through

registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the

resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from

the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations

under the Securities Exchange Act of 1934, any person engaged in the distribution of the resale shares may not simultaneously engage