Liberty All-Star® Growth Fund, Inc. August 2017 Update

September 18 2017 - 12:53PM

Below is the August 2017 Monthly Update for the Liberty All-Star®

Growth Fund, Inc. (NYSE:ASG)

| |

|

|

|

| Liberty

All-Star Growth Fund |

Monthly Update |

|

| |

Ticker: ASG |

August, 2017 |

|

| Investment Approach |

|

| |

|

|

Fund Style: All-Cap Growth |

|

| |

|

| Fund Strategy: Combines three growth style

investment managers, each with a distinct capitalization focus

(small-, mid- and large-cap)selected and continuously monitored by

the Fund’s Investment Advisor. |

|

| |

|

|

|

| |

|

|

Investment Managers: |

|

|

| |

Weatherbie Capital,

LLC |

|

|

| |

Small-Cap

Growth |

|

|

| |

Congress Asset

Management Company, LLP |

|

|

| |

Mid-Cap

Growth |

|

|

| |

Sustainable Growth

Advisers, LP |

|

|

| |

Large-Cap

Growth |

|

|

| |

|

|

|

| |

|

|

|

| |

|

| Top 20 Holdings at Month-End |

|

|

| |

(29.2% of equity

portfolio) |

|

|

|

|

(Rank from previous month) |

|

|

|

1 |

J.B. Hunt Transport Services, Inc. (3) |

2.0 |

% |

|

|

2 |

IPG Photonics Corp. (1) |

2.0 |

% |

|

|

3 |

FirstService Corp. (5) |

1.8 |

% |

|

|

4 |

Wayfair, Inc., Class A (10) |

1.6 |

% |

|

|

5 |

Signature Bank (6) |

1.5 |

% |

|

|

6 |

Visa, Inc., Class A (12) |

1.5 |

% |

|

|

7 |

Salesforce.com, Inc. (14) |

1.4 |

% |

|

|

8 |

Portola Pharmaceuticals, Inc. (16) |

1.4 |

% |

|

|

9 |

Facebook, Inc., Class A (8) |

1.4 |

% |

|

|

10 |

Insulet Corp. (24) |

1.4 |

% |

|

|

11 |

The Middleby Corp. (2) |

1.4 |

% |

|

|

12 |

Alphabet, Inc., Class C (17) |

1.4 |

% |

|

|

13 |

Ecolab, Inc. (18) |

1.3 |

% |

|

|

14 |

The Priceline Group, Inc. (20) |

1.3 |

% |

|

|

15 |

Paylocity Holding Corp. (27) |

1.3 |

% |

|

|

16 |

NIKE, Inc., Class B (7) |

1.3 |

% |

|

|

17 |

UnitedHealth Group, Inc. (21) |

1.3 |

% |

|

|

18 |

FleetCor Technologies, Inc. (15) |

1.3 |

% |

|

|

19 |

Stamps.com, Inc. (4) |

1.3 |

% |

|

|

20 |

Cerner Corp. (22) |

1.3 |

% |

|

| |

Holdings

are subject to change. |

|

|

| |

|

Monthly Performance |

|

|

Performance |

NAV |

Market Price |

Discount |

|

Beginning of month value |

$5.39 |

$4.99 |

-7.4% |

|

Distributions |

– |

– |

|

|

End of month value |

$5.34 |

$4.97 |

-6.9% |

|

Performance for month |

-0.93% |

-0.40% |

|

|

Performance year-to-date |

18.66% |

26.82% |

|

| |

|

|

|

| The net asset value (NAV) of a closed-end fund is the market

value of the underlying investments (i.e., stocks and bonds) in the

Fund’s portfolio, minus liabilities, divided by the total number of

Fund shares outstanding. However, the Fund also has a market

price; the value at which it trades on an exchange. If the market

price is above the NAV the Fund is trading at a premium. If

the market price is below the NAV the Fund is trading at a

discount. Performance returns for the Fund are total returns, which

includes dividends, and are net of management fees and other Fund

expenses. Returns are calculated assuming that a shareholder

reinvested all distributions. Past performance cannot predict

future investment results. Performance will fluctuate with changes

in market conditions. Current performance may be lower or higher

than the performance data shown. Performance information shown does

not reflect the deduction of taxes that shareholders would pay on

Fund distributions or the sale of Fund shares. Shareholders must be

willing to tolerate significant fluctuations in the value of their

investment. An investment in the Fund involves risk, including loss

of principal. Sources of distributions to shareholders may include

ordinary dividends, long-term capital gains and return of capital.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon the Fund’s investment experience during

its fiscal year and may be subject to changes based on tax

regulations. If a distribution includes anything other than net

investment income, the fund provides a Section 19(a) notice of the

best estimate of its distribution sources at that time. These

estimates may not match the final tax characterization (for the

full year’s distributions) contained in shareholders’ 1099-DIV

forms after the end of the year. |

| |

|

|

|

|

|

|

|

|

| Net Assets at Month-End ($millions) |

|

|

|

Total |

$142.5 |

|

|

|

Equities |

$142.0 |

|

|

|

Percent Invested |

99.6% |

|

|

| |

|

|

|

Sector Breakdown (% of equity portfolio)* |

|

|

|

|

Information Technology |

|

|

32.0% |

|

|

|

Consumer Discretionary |

|

|

19.4% |

|

|

|

Health Care |

|

|

17.3% |

|

|

|

Industrials |

|

|

13.9% |

|

|

|

Financials |

|

|

6.1% |

|

|

|

Real Estate |

|

|

3.7% |

|

|

|

Materials |

|

|

3.1% |

|

|

|

Consumer Staples |

|

|

2.8% |

|

|

|

Energy |

|

|

1.7% |

|

|

|

Total Market Value |

|

|

100.0% |

|

|

| *Based

on Standard & Poor's and MSCI Barra Global Industry

Classification Standard (GICS). |

|

|

|

|

|

|

|

|

|

New Holdings |

|

Holdings Liquidated |

|

| Barnes

Group, Inc. |

|

Kansas City Southern |

|

| Charles

River Laboratories International, Inc. |

|

Scripps Networks Interactive, Inc. |

|

|

McCormick & Co., Inc. |

|

|

| The TJX

Companies, Inc. |

|

|

|

|

|

|

|

|

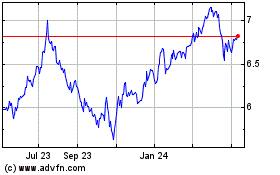

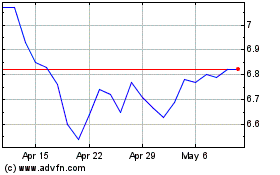

The Liberty All-Star Funds

1-800-241-1850

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty All Star Equity (NYSE:USA)

Historical Stock Chart

From Apr 2023 to Apr 2024