Report of Foreign Issuer (6-k)

September 15 2017 - 4:05PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of September 2017

001-37353

(Commission

File Number)

BIONDVAX

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

14

Einstein St.

Ness

Ziona

Israel

74036

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form 20-F

or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T

Rule 101(b)(1): ____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T

Rule 101(b)(7): ____

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-N/A

On September 13, 2017,

BiondVax Pharmaceuticals Ltd. (“BiondVax” or the “Company”) entered into an Underwriting Agreement with

Joseph Gunner & Co., LLC, as representative of the several underwriters named therein (the “Underwriters”), relating

to an underwritten public offering of 1,500,000 American Depositary Shares, each representing forty (40) or of the Company’s

ordinary shares, NIS 0.0000001 par value each (“ADSs”), at a public offering price of $6.00 per ADS. Under the terms

of the Underwriting Agreement, the Company granted the Underwriters a 45-day option to purchase up to an aggregate pf 166,667 additional

ADSs, which option has been exercised in full (the “Overallotment Option”). The gross proceeds to the Company from the

offering, prior to deducting underwriting discounts and commissions and other estimated offering expenses payable by the Company

are expected to be $10.0 million, including full exercise of Overallotment Option. The offering is expected to close on September

18, 2017.

The

offering is being made pursuant to the Company’s effective shelf registration statement on Form F-3 (Registration No. 333-214439)

previously filed with the Securities and Exchange Commission (“SEC”), including the prospectus dated December 15, 2016,

as supplemented by a preliminary prospectus supplement filed with the SEC on September 13, 2017.

The Underwriting

Agreement contains representations, warranties and covenants of the Company that are customary for transactions of this type and

customary conditions to closing. Additionally, the Company has agreed to provide the Underwriters with customary indemnification

rights under the Underwriting Agreement. The foregoing description of the Underwriting agreement is qualified in its entirety

by reference to the Underwriting Agreement, a copy of which is furnished as Exhibit 1.1 to this Form 6-K and is incorporated herein

by reference. A copy of the opinion of Pearl Cohen Zedek Latzer Baratz, Israeli Counsel to the Company relating to the ordinary

shares underlying the ADSs to be issued in this offering is furnished as Exhibit 5.1 to this Form 6-K and is incorporated by reference

herein.

A copy of the opinion

of Pearl Cohen Zedek Latzer Baratz, LLP, U.S. counsel to the Company, relating to the ADSs to be issued in this offering is furnished

as Exhibit 5.2 to this Form 6-K and is incorporated by reference herein.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

BiondVax

Pharmaceuticals Ltd.

|

|

|

|

|

|

Date:

September 15, 2017

|

By:

|

/s/

Ron Babecoff

|

|

|

|

Ron

Babecoff

|

|

|

|

Chief

Executive Officer

|

3

BiondVax Pharmaceuticals (NASDAQ:BVXV)

Historical Stock Chart

From Mar 2024 to Apr 2024

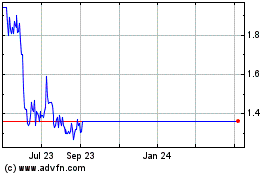

BiondVax Pharmaceuticals (NASDAQ:BVXV)

Historical Stock Chart

From Apr 2023 to Apr 2024