Statement of Changes in Beneficial Ownership (4)

September 15 2017 - 6:19AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Givolon Ltd

|

2. Issuer Name

and

Ticker or Trading Symbol

CENTURY ALUMINUM CO

[

CENX

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O ESTERA TRUST (JERSEY) LIMITED,, 13-14 ESPLANADE

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/14/2017

|

|

(Street)

ST HELIER, Y9 JE1 1EE

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Total Return Swap (obligation to sell)

(1)

(7)

|

$18.0308

(2)

(3)

(4)

|

9/14/2017

|

|

J/K

(2)

(3)

(4)

|

|

1

|

|

12/31/2022

(2)

(3)

(4)

|

12/31/2022

(2)

(3)

(4)

|

Common Stock

|

27500000

(2)

(3)

(4)

|

(2)

(3)

(4)

|

1

|

D

(8)

|

|

|

Call Option (obligation to sell)

(1)

(7)

|

$2.7046

(5)

(6)

|

9/14/2017

|

|

J

(5)

(6)

|

|

1

|

|

9/14/2017

(5)

(6)

|

12/31/2022

(5)

(6)

|

Common Stock

|

27500000

(5)

(6)

|

$15.3261

(5)

(6)

|

1

|

D

(8)

|

|

|

Explanation of Responses:

|

|

(1)

|

On September 14, 2017 (the "Effective Date"), Givolon Limited ("Givolon"), a wholly-owned subsidiary of Glencore AG at such time, purchased from Glencore AG 27,500,000 shares of common stock ("Common Stock") of Century Aluminum Company (the "Specified Shares") for the aggregate price of $495,845,625, or $18.03075 per share. Subsequently on the Effective Date, Glencore AG sold to Ryfold Limited ("Ryfold") 100% of the equity interests in Givolon for the aggregate purchase price of $100 (the "Givolon Sale").

|

|

(2)

|

On the Effective Date, Glencore AG and Givolon entered into an ISDA Master Agreement in the form of the 1992 ISDA Master Agreement (Multi-currency - Cross Border) together with a related Schedule thereto (the "Master Agreement") and a related Total Return Swap Confirmation, pursuant to which Glencore AG received economic exposure to a number of shares of Common Stock equal to the Specified Shares at a reference price equal to $18.03075 per share of Common Stock, under a stock-settled total return swap (the "Century TRS").

|

|

(3)

|

The Century TRS is scheduled to expire and settle on December 31, 2022 (following expiration of the Century Call Option (defined below)) (the "Expiration Date").

|

|

(4)

|

Under the Century TRS, (i) with respect to the period of time prior to the settlement of the Century TRS, (A) Glencore AG will be obligated to pay certain fees to Givolon, and (B) Givolon will be obligated to pay to Glencore AG an amount equal to any dividends and other distributions that would have been paid by Century Aluminum Company on a number of shares equal to the Specified Shares; and (ii) at settlement of the Century TRS, (A) Givolon will be obligated to deliver a number of shares equal to the Specified Shares to Glencore AG, and (B) Glencore AG will be obligated to pay to Givolon $18.03075 for each such share.

|

|

(5)

|

On the Effective Date, Glencore AG and Givolon entered into a Century Call Option Confirmation pursuant to the Master Agreement, pursuant to which Glencore AG acquired an American-style call option that gives Glencore AG the right to purchase from Givolon, at any time prior to the expiration thereof, a number of shares of Common Stock equal to the Specified Shares at a price equal to $2.70462 per share of Common Stock (the "Century Call Option"). Glencore AG paid Givolon a premium of $15.32613 per share for the Century Call Option.

|

|

(6)

|

The Century Call Option is scheduled to expire on the Expiration Date, prior to the time the Century TRS is scheduled to settle.

|

|

(7)

|

Under the terms of the Century TRS and the Century Call Option, the Century TRS is scheduled to expire and settle after expiration of the Century Call Option, so that Glencore AG will acquire a number of shares equal to the Specified Shares under the Century TRS even if Glencore AG does not exercise the Century Call Option. In addition, the Century TRS will automatically terminate, with no remaining obligations on the part of either party, upon exercise of the Century Call Option. As a result, under the Century TRS and the Century Call Option, Glencore AG has the right to acquire and Givolon has the obligation to deliver to Glencore AG an aggregate number of shares equal to the Specified Shares. Givolon has granted to Glencore AG the irrevocable right to vote and to direct the voting of the Specified Shares.

|

|

(8)

|

The Specified Shares and Givolon's interests in the Century TRS and the Century Call Option were held indirectly by each of Glencore AG (Givolon's sole shareholder), Glencore AG's parent, Glencore International AG and its parent, Glencore plc, prior to the Givolon Sale, and are held indirectly by each of Ryfold, Ryfold's parent, The Ryfold Trust, and Estera Trust (Jersey) Limited solely in its capacity as trustee of The Ryfold Trust, following the Givolon Sale.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Givolon Ltd

C/O ESTERA TRUST (JERSEY) LIMITED,

13-14 ESPLANADE

ST HELIER, Y9 JE1 1EE

|

|

X

|

|

|

Signatures

|

|

GIVOLON LIMITED By: /s/ Brendan Dowling, Director

|

|

9/14/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

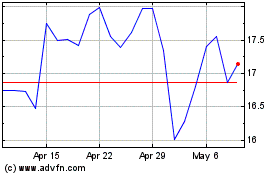

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

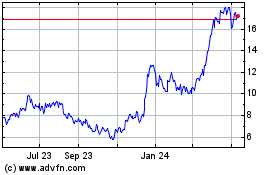

Century Aluminum (NASDAQ:CENX)

Historical Stock Chart

From Apr 2023 to Apr 2024