Statement of Changes in Beneficial Ownership (4)

September 14 2017 - 6:26PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

WHITMAN MARGARET C

|

2. Issuer Name

and

Ticker or Trading Symbol

Hewlett Packard Enterprise Co

[

HPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

CEO

|

|

(Last)

(First)

(Middle)

C/O HEWLETT PACKARD ENTERPRISE COMPANY, 3000 HANOVER STREET

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/13/2017

|

|

(Street)

PALO ALTO, CA 94304

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

9/13/2017

|

|

M

|

|

124519

|

A

|

$4.97

|

892118

|

D

|

|

|

Common Stock

|

9/13/2017

|

|

S

|

|

124519

(1)

|

D

|

$13.08

|

767599

|

D

|

|

|

Common Stock

|

9/14/2017

|

|

M

|

|

124533

|

A

|

$4.97

|

892132

|

D

|

|

|

Common Stock

|

9/14/2017

|

|

S

|

|

124533

(1)

|

D

|

$13.1967

(2)

|

767599

|

D

|

|

|

Common Stock

|

|

|

|

|

|

|

|

66

(3)

|

I

|

By Living Trust

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Employee Stock Option (right to buy)

(5)

|

$4.97

|

9/13/2017

|

|

M

|

|

|

124519

|

12/6/2014

(6)

|

1/2/2021

(7)

|

Common Stock

|

124519

|

$0

|

373573

|

D

|

|

|

Employee Stock Option (right to buy)

(5)

|

$4.97

|

9/14/2017

|

|

M

|

|

|

124533

|

12/6/2014

(6)

|

1/2/2021

(7)

|

Common Stock

|

124533

|

$0

|

249040

|

D

|

|

|

Restricted Stock Units

(5)

|

(4)

|

|

|

|

|

|

|

(8)

|

(8)

|

Common Stock

|

(8)

|

|

109915.713

(8)

|

D

|

|

|

Restricted Stock Units

(5)

|

(4)

|

|

|

|

|

|

|

(9)

|

(9)

|

Common Stock

|

(9)

|

|

593740.15

(9)

|

D

|

|

|

Restricted Stock Units

(5)

|

(4)

|

|

|

|

|

|

|

(10)

|

(10)

|

Common Stock

|

(10)

|

|

251049.234

(10)

|

D

|

|

|

Restricted Stock Units

(5)

|

(4)

|

|

|

|

|

|

|

(11)

|

(11)

|

Common Stock

|

(11)

|

|

447757.66

(11)

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

The sales reported on this Form 4 were effectuated pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on 03/13/17.

|

|

(2)

|

The price in Column 4 is a weighted average price. The prices actually paid ranged from $13.13 to $13.25. Upon request, the reporting person will provide to the Issuer, any security holder of the Issuer, or the SEC staff information regarding the number of shares purchased at each price within the range.

|

|

(3)

|

There is no reportable change since the last filing. This is a reiteration of holdings only.

|

|

(4)

|

Each restricted stock unit represents a contingent right to receive one share of Issuer's common stock.

|

|

(5)

|

As reported in the Registration Statement on Form 10 filed by Issuer with the SEC, in connection with the spin-off of Seattle SpinCo, Inc. on 09/01/17, equity-based awards granted by Issuer, prior to the spin-off were converted to adjust the award in a manner intended to preserve the aggregate intrinsic value of the original award as measured immediately before and immediately after the spin-off, subject to rounding. The adjusted equity award is otherwise subject to the same terms and conditions that applied to the original award immediately prior to the spin-off, unless otherwise noted. The reporting person's equity-based awards reflect that conversion adjustment.

|

|

(6)

|

This option became exercisable beginning on this date.

|

|

(7)

|

This option is no longer exercisable beginning on this date.

|

|

(8)

|

As previously reported, on 12/10/14 the reporting person was granted 104,390 restricted stock units ("RSUs"), 34,796 of which vested early on 09/17/15, 62,583 of which vested on 12/10/16, and 105,320 of which will vest on 12/10/17. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Unvested RSUs in this footnote, and the amount in column 9 reflect the conversion adjustment noted in footnote (5) above.

|

|

(9)

|

As previously reported, on 11/02/15 the reporting person was granted 517,598 RSUs, 172,532 of which vested on 11/02/16, 290,350 of which will vest on 11/02/17, and 290,352 of which will vest on 11/02/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Unvested RSUs in this footnote, and the amount in column 9 reflect the conversion adjustment noted in footnote (5) above.

|

|

(10)

|

As previously reported, on 12/09/15 the reporting person was granted 218,855 RSUs, 72,951 of which vested on 12/09/16, and 122,768 of which will vest on each of 12/09/17 and 12/09/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Unvested RSUs in this footnote, and the amount in column 9 reflect the conversion adjustment noted in footnote (5) above.

|

|

(11)

|

As previously reported, on 12/07/16 the reporting person was granted 263,371 RSUs, 147,739 of which will vest on each of 12/07/17 and 12/07/18, and 147,741 of which will vest on 12/17/19. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. Unvested RSUs in this footnote, and the amount in column 9 reflect the conversion adjustment noted in footnote (5) above.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

WHITMAN MARGARET C

C/O HEWLETT PACKARD ENTERPRISE COMPANY

3000 HANOVER STREET

PALO ALTO, CA 94304

|

X

|

|

CEO

|

|

Signatures

|

|

Derek Windham as Attorney-in-Fact for Margaret C. Whitman

|

|

9/14/2017

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

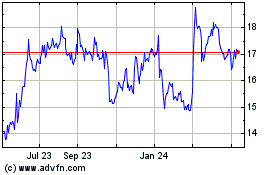

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

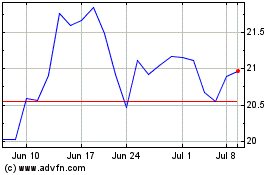

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Apr 2023 to Apr 2024