UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the

Registrant ☒ Filed by a party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

The Manitowoc Company, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

☒

|

|

No fee required

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEC 1913 (11-01)

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control

number.

|

The Manitowoc Company, Inc. Announces Plan for

Reverse Stock Split

MANITOWOC, Wis.

– The Manitowoc Company, Inc.

(NYSE: MTW)

, a leading global manufacturer of cranes and lifting solutions, announced today that it plans to undertake a reverse stock split of Manitowoc’s common stock at a ratio of 1-for-4 and a

reduction in the number of authorized shares of its common stock from 300,000,000 shares to 75,000,000 shares.

The reverse stock split will reduce the

number of shares of Manitowoc’s common stock outstanding and is expected to increase the per share trading price of the common stock, which may improve marketability and facilitate its trading.

When the reverse stock split becomes effective, each four shares of Manitowoc’s common stock will automatically be changed into one share of common

stock. Manitowoc does not anticipate issuing fractional shares as a result of the reverse stock split; shareholders entitled to receive fractional shares as a result of the reverse stock split will receive cash payments in lieu of such shares.

The reverse stock split will not change the proportionate equity interests or voting rights of holders of common stock, subject to the treatment of fractional

shares.

Manitowoc will hold a special meeting of shareholders in the fourth quarter of 2017 to seek approval of a proposal to authorize the reverse stock

split and authorized share reduction. The affirmative vote of the holders of two-thirds of the shares entitled to vote at the special meeting is required to adopt and approve such proposal. Holders of record of Manitowoc’s common stock as of

the close of business on September 29, 2017, will be entitled to notice of and to vote at the special meeting. Manitowoc has filed a preliminary proxy statement regarding the special meeting with the U.S. Securities and Exchange Commission (the

“SEC”).

The reverse stock split is subject to market and other customary conditions, including shareholder approval. Manitowoc reserves the

right, at its sole discretion, to abandon the reverse stock split and authorized share reduction at any time prior to filing the applicable articles of amendment with the Wisconsin Department of Financial Institutions.

About The Manitowoc Company, Inc.

Founded in 1902, The

Manitowoc Company, Inc. is a leading global manufacturer of cranes and lifting solutions with manufacturing, distribution, and service facilities in 20 countries. Manitowoc is recognized as one of the premier innovators and providers of crawler

cranes, tower cranes, and mobile cranes for the heavy construction industry, which are complemented by a slate of industry-leading aftermarket product support services. In 2016, Manitowoc’s net sales totaled $1.6 billion, with over half

generated outside the United States.

Important Information about the Reverse Stock Split Proposal

This communication may be deemed to be solicitation material in connection with the proposal to be submitted to Manitowoc’s shareholders at its special

meeting seeking approval to effect a reverse stock split and a reduction in the number of authorized shares of its common stock (the “Reverse Split Proposal”). In connection with the Reverse Split Proposal, Manitowoc has filed a

preliminary proxy statement on Schedule 14A with the SEC. Shareholders are urged to read the preliminary proxy statement and all other relevant documents filed with the SEC when they become available, including the definitive proxy statement,

because they will contain important information about the Reverse Split Proposal.

Shareholders will be able to obtain the documents when available free of charge at the SEC’s website,

www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC when available at Manitowoc’s website, www.manitowoc.com. Information contained on such websites or that can be accessed through such websites

does not constitute a part of this press release.

Participants in the Solicitation

Manitowoc and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Manitowoc’s shareholders in

respect to the Reverse Split Proposal. Information about the directors and executive officers of Manitowoc is set forth in Manitowoc’s preliminary proxy statement, which was filed with the SEC on September 14, 2017. Investors may obtain

additional information regarding the interests of Manitowoc and its directors and executive officers in the Reverse Split Proposal by reading the preliminary proxy statement and, when it becomes available, the definitive proxy statement relating to

the special meeting.

Forward-looking Statements

This press release includes “forward-looking statements” intended to qualify for the safe harbor from liability under the Private Securities

Litigation Reform Act of 1995. Any statements contained in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the

current expectations of the management of Manitowoc and are subject to uncertainty and changes in circumstances. Forward-looking statements include, without limitation, statements typically containing words such as “intends,”

“expects,” “anticipates,” “targets,” “estimates,” and words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and

uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results and developments to differ materially include, among others:

|

•

|

|

the possibility that shareholder approval for the amendment to effect the reverse stock split and the authorized share reduction will not be obtained;

|

|

•

|

|

the possibility that the reverse stock split and the authorized share reduction may not have its intended effects;

|

|

•

|

|

the possibility that factors unrelated to the reverse stock split and the authorized share reduction may impact the per share trading price of Manitowoc’s common stock; and

|

|

•

|

|

risks and other factors cited in Manitowoc’s filings with the United States Securities and Exchange Commission.

|

Manitowoc undertakes no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Forward-looking statements only speak as of the date on which they are made. Information on the potential factors that could affect Manitowoc’s actual results of operations is included in its filings with the Securities and Exchange Commission,

including but not limited to its Annual Report on Form 10-K for the fiscal year ended December 31, 2016.

The Manitowoc Company, Inc.

Reverse Stock Split

Frequently Asked Questions

September 14, 2017

|

1.

|

What is a reverse stock split?

|

A reverse stock split reduces the number of outstanding shares by a

fixed ratio. In our proposed 1-for-4 reverse stock split, shareholders would get 1 share for every 4 they own. A reverse stock split does not change a shareholder’s proportionate ownership of a company’s stock.

|

2.

|

What is the proposal that Manitowoc’s shareholders will be voting on?

|

The Manitowoc Board of

Directors has recommended that Manitowoc’s shareholders authorize the Board of Directors to proceed with a reverse stock split of Manitowoc’s common stock at a ratio of 1-for-4 and a corresponding reduction in the number of authorized

shares of its common stock from 300,000,000 to 75,000,000 shares.

Manitowoc will hold a special meeting of shareholders in the fourth quarter of

2017 to seek approval of a proposal to authorize the reverse stock split and authorized share reduction. The affirmative vote of the holders of two-thirds of the shares entitled to vote at the special meeting is required to adopt and approve such

proposal. Holders of record of Manitowoc’s common stock as of the close of business on September 29, 2017, will be entitled to notice of and to vote at the special meeting.

Manitowoc has filed a preliminary proxy statement with the U.S. Securities and Exchange Commission, and Manitowoc plans to file a definitive proxy statement

in due course. Please read the preliminary proxy statement and the definitive proxy statement, when available, for information regarding how to vote on the reverse stock split proposal and other important information.

|

3.

|

Why is Manitowoc seeking to implement a reverse stock split?

|

Although a stock’s trading price is

affected by multiple factors, a reverse stock split is likely to increase the per share trading price of Manitowoc’s common stock as a result of the reduction in the number of shares outstanding. An increase in the trading price may improve the

marketability of Manitowoc’s common stock, which may facilitate trading in Manitowoc’s common stock.

For example, some investors may prefer to

invest in stocks that trade at a per share price range more typical of companies listed on the NYSE, and certain institutional investors are prohibited from purchasing stocks that trade below certain minimum price levels. Also, brokerage commissions

paid by investors, as a percentage of a total transaction, tend to be higher for lower-priced stocks. An increased trading price for Manitowoc’s common stock as a result of a reverse stock split may help reduce these concerns.

|

4.

|

Why is Manitowoc seeking to implement an authorized share reduction?

|

As a matter of Wisconsin law, the

implementation of the reverse stock split does not require a reduction in the total number of authorized shares of Manitowoc’s common stock. However, if the proposed reverse stock split is approved and implemented, the authorized number of

shares of our common stock also would be reduced to 75,000,000 shares, proportionate to the reverse stock split ratio. If this proportionate reduction did not occur, then the proposed reverse stock split would approximately quadruple the ratio of

authorized shares to outstanding shares of Manitowoc common stock, which some shareholders and proxy advisory firms might find objectionable.

|

5.

|

Will a reverse stock split affect the value of my investment?

|

Although a stock’s trading price is

affected by multiple factors, a reverse stock split should not by itself change the total value of your shares. For example if the reverse stock split is approved, absent other factors, a shareholder who owns 400 shares today with a value of

$8/share would own 100 shares with a value of $32/share after the reverse stock split—in each case, the same total value of $3,200. As always, the trading price of Manitowoc’s common stock is subject to market fluctuations and other

factors.

|

6.

|

When would the reverse stock split become effective?

|

If shareholders authorize the proposed reverse

stock split and authorized share reduction at the special meeting, the effective time will be the date and time set forth in the articles of amendment that are filed with the Wisconsin Department of Financial Institutions, which is expected to be

shortly after such filing is made with the Department.

Even if shareholders authorize the reverse stock split and authorized share reduction, Manitowoc

may delay the filing of the articles of amendment or abandon the reverse stock split and the authorized share reduction if the Board of Directors determines that such action is in the best interests of Manitowoc and its shareholders.

|

7.

|

How will Manitowoc treat fractional shares?

|

Manitowoc does not anticipate issuing fractional shares as

a result of the reverse stock split, and shareholders entitled to receive fractional shares as a result of the reverse stock split will receive cash payments in lieu of such shares.

* * *

Important Information about the Reverse Stock Split Proposal

This communication may be deemed to be solicitation material in connection with the proposal to be submitted to Manitowoc’s shareholders at its special

meeting seeking approval to effect a reverse stock split and a reduction in the number of authorized shares of its common stock (the “Reverse Split Proposal”). In connection with the Reverse Split Proposal, Manitowoc has filed a

preliminary proxy statement on Schedule 14A with the SEC. Shareholders are urged to read the preliminary proxy statement and all other relevant documents filed with the SEC when they become available, including the definitive proxy statement,

because they will contain important information about the Reverse Split Proposal.

2

Shareholders will be able to obtain the documents when available free of charge at the SEC’s website,

www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC when available at Manitowoc’s website, www.manitowoc.com. Information contained on such websites or that can be accessed through such websites

does not constitute a part of this communication.

Participants in the Solicitation

Manitowoc and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Manitowoc’s shareholders in

respect to the Reverse Split Proposal. Information about the directors and executive officers of Manitowoc is set forth in Manitowoc’s preliminary proxy statement, which was filed with the SEC on September 14, 2017. Investors may obtain

additional information regarding the interests of Manitowoc and its directors and executive officers in the Reverse Split Proposal by reading the preliminary proxy statement and, when it becomes available, the definitive proxy statement relating to

the special meeting.

Forward-Looking Statements

This press release includes “forward-looking statements” intended to qualify for the safe harbor from liability under the Private Securities

Litigation Reform Act of 1995. Any statements contained in this press release that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the

current expectations of the management of Manitowoc and are subject to uncertainty and changes in circumstances. Forward-looking statements include, without limitation, statements typically containing words such as “intends,”

“expects,” “anticipates,” “targets,” “estimates,” and words of similar import. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and

uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results and developments to differ materially include, among others:

|

•

|

|

the possibility that shareholder approval for the amendment to effect the reverse stock split and the authorized share reduction will not be obtained;

|

|

•

|

|

the possibility that the reverse stock split and the authorized share reduction may not have its intended effects;

|

|

•

|

|

the possibility that factors unrelated to the reverse stock split and the authorized share reduction may impact the per share trading price of Manitowoc’s common stock; and

|

|

•

|

|

risks and other factors cited in Manitowoc’s filings with the United States Securities and Exchange Commission.

|

Manitowoc undertakes no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Forward-looking statements only speak as of the date on which they are made. Information on the potential factors that could affect Manitowoc’s actual results of operations is included in its filings with the Securities and Exchange Commission,

including but not limited to its Annual Report on Form 10-K for the fiscal year ended December 31, 2016.

3

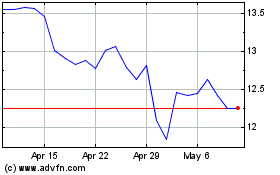

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

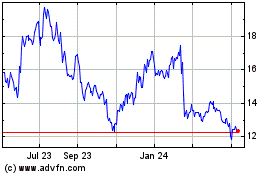

Manitowoc (NYSE:MTW)

Historical Stock Chart

From Apr 2023 to Apr 2024