PHI Group Update from CEO Henry Fahman September 14, 2017

September 14 2017 - 11:00AM

InvestorsHub NewsWire

Dear PHI Group Valued Shareholders,

In my last update, I covered our continuing efforts to manage and

eliminate convertible debt in our Company. This is very important

to our business from the standpoint of appreciation of our equity

in the marketplace.

At the same time, we have had a significant number of transactions,

which we have announced through the newswires and posted on our

website and social media. (USOTC:

PHIL)

I understand that investors are looking for us to quantify these

transactions. It is important that we do so to illustrate the value

proposition in ownership of our Company’s stock. It is not easy to

place specific valuations on some of the business transactions we

have not completed but over the course of more updates, I will

cover valuations as best I can while remaining within the bounds of

the law and regulations as put forth by the regulatory

agencies.

American Pacific Resources, Inc. Mining Claims and HYMAX HD

Processing Technology

I will begin with our most recently announced definitive Agreement of Purchase and Sale

to acquire a 51% interest in twenty-one mining claims over an area

of 400 acres in Granite Mining District, Grant County, Oregon

through our wholly owned subsidiary, American Pacific Resources,

Inc. (APR).

The precious metals on this property have long been considered

inaccessible and economically unfeasible because of the money,

time, effort and overall difficulty to extract the metals. However,

through APR, we have the technology to economically extract these

precious metals through HYMAX HD processing technology. Without

this technology, these metals would remain in the ground for

eternity.

The potential valuation of this property considering the precious

metals which include gold, silver, platinum, and palladium could be

as high as $3,000,000,000 at current prices. For the next

three years, we expect to generate $6 million in revenue from 6,300

ounces of gold that will be recovered in 2017, $53 million from

54,750 ounces in 2018 and $107 million from 109,500 ounces

2019. These numbers can be higher if we increase the scales

of operation.

Abundant Farms

In the first quarter of this year, we announced the definitive

contract to acquire a 408-acre farm in Holmes County, Florida,

U.S.A. for Abundant Farms, Inc., a wholly owned organic farming

subsidiary of PHI Group. The 408-acre farm includes equipment,

buildings, barns, water rights and everything needed to go into

production. We plan to close this purchase in the winter or

sooner in order to start cultivating for the next growing

season.

Abundant Farms plans to use a combination of proprietary enhanced

bioavailable nutrient and natural symbiotic immune systems without

chemical pesticides and synthetic fertilizers, together with

innovative water conditioning mechanism provided by PHI EZ Water

Tech to initially grow select plants that can be used for medicinal

purposes like bitter melon (momordica charantia), turmeric (curcuma

longa) and saffron (crocus sativus). All these plants

have great medicinal attributes and command much higher prices than

regular crops. For bitter melon alone, we expect to generate

$18 million in revenues and $4.3 million in net profit in 2018, $36

million revenues and $9.8 million net profit in 2019, and $53

million revenues and $14.5 million net profit in 2020. For

turmeric, the estimated revenues and net profits will be $1.2

million and $817,000 for 2018, $24.4million and $16.8 for 2019, and

$48.9 and $33.7 in 2020, respectively.

Abundant Farms will continue to purchase and lease more farmland as

well as cooperate through joint venture agreements with landowners

to increase its capacity in the U.S. and selective countries in the

future. The Company’s PHI Group Regional Center will also

provide opportunities for international investors to participate in

its organic farming project through the EB-5 Investor Visa

Program.

PHI EZ Water Tech

PHI EZ Water Tech, a majority-owned subsidiary

of PHI Group, has completed the designs of proprietary water

treatment systems and will start producing the units for sale to

the agriculture market.

Developed by Dr. Martin Nguyen, a

Vietnamese-American scientist, these water treatment systems are

environmentally friendly, cost-effective and require no energy to

operate. They have been proven to greatly benefit the health of

livestock and quality of plants, induce seed germination and

increase crop yields.

These systems are among a series of

products developed by Dr. Nguyen using quantum technology in a

combination of disciplines including applied physics, applied water

science, biological system engineering and agricultural economics.

Incorporating complex electromagnetic force, advanced oxidation,

electrocoagulation and ultrasound, they can reduce water

consumption by up to 30% and fertilizer usage by 30%-50% while

boosting crop yields by 30%-50%. The water produced from

these systems is also good for human health and able to stabilize

water environments to increase yields for aquatic and wet paddy

farming.

PHI EZ Water Tech expects to generate $12.5 million in revenues and

$3.4 in net profits in 2018. For 2019 the estimated revenues

and profits will be $25 and $6.8 million, respectively.

Over the coming weeks, I will continue to update investors on

additional transactions as they progress and will make every effort

to quantify what these transactions mean for the Company and its

investors.

Thank you for your time and I appreciate your patience while we

build our Company. I will keep you informed…

Best regards and blessings,

Henry Fahman

CEO

PHI GROUP, INC.

henry@phiglobal.com

Safe

Harbor

This update

contains forward-looking statements that are subject to certain

risks and uncertainties that may cause actual results to differ

materially from those projected on the basis of such

forward-looking statements pursuant to the “safe-harbor” provisions

of the Private Securities Litigation Reform Act of

1995.

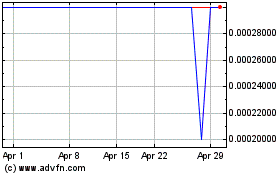

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

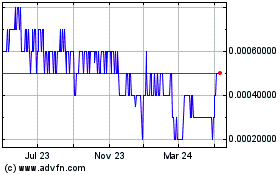

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Apr 2023 to Apr 2024