Securities Registration (foreign Private Issuer) (f-1/a)

September 13 2017 - 5:27PM

Edgar (US Regulatory)

As submitted to the Securities and Exchange Commission on September 13, 2017

No. 333-220433

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective

Amendment No. 1 to

Form

F-1

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Azul S.A.

(Exact name of

Registrant as specified in its charter)

|

|

|

|

|

|

|

Federative Republic of Brazil

|

|

4512

|

|

Not applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer Identification No.)

|

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP

06460-040,

Brazil.

+55 (11) 4831 2880

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

10

East 40th Street, 10th Floor

New York, NY 10016

(212)

947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

|

|

|

|

|

Stuart K. Fleischmann, Esq.

Shearman & Sterling LLP

599 Lexington Avenue

New

York, NY 10022

|

|

Filipe B. Areno, Esq.

J. Mathias von Bernuth, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Av. Brigadeiro Faria Lima, 3311, 7

th

Floor

São Paulo, SP,

04538-133,

Brazil

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes

effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to

Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate by a check mark whether the registrant is an emerging growth company as defined in Rule 405 of the

Securities Act of 1933. Emerging growth company. ☐

If an emerging growth company that prepares its financial statements in

accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the

Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update

issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF

REGISTRATION FEE

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

|

Proposed Maximum

Aggregate Offering Price

(1)

|

|

Amount of

registration fee

|

|

Preferred shares including in the form of

ADSs

(2)(3)

|

|

US$404,168,423

|

|

US$46,843

|

|

(1)

|

Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. Any additional registration fees will be paid subsequently on a

pay-as-you-go

basis.

|

|

(2)

|

Includes preferred shares in the form of ADSs, which the underwriters may purchase solely to cover options to purchase additional shares, if any, and preferred shares which are to be offered in an offering outside the

United States but which may be resold from time to time in the United States in transactions requiring registration under the Securities Act.

|

|

(3)

|

A separate Registration Statement on Form

F-6

(Reg. No. 333-215925) has been previously filed for the registration of ADSs issuable upon deposit of the preferred shares registered

hereby. Each ADS represents three preferred share.

|

The Registrant

hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This

Pre-Effective

Amendment No. 1 to Form

F-1

Registration Statement (Registration

No. 333-220433)

of Azul S.A. is being filed solely to include exhibits to the registration statement not previously filed and to update the Exhibit Index accordingly.

Accordingly, Part I, the form of prospectus, has been omitted from this filing.

PART II INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

Item 6.

|

Indemnification of Directors and Officers

|

Under Brazilian Law, any provision, whether

contained in the bylaws of a company or in any agreement, exempting any officer or director against any liability which by law or otherwise would attach to them in respect of negligence, misfeasance, breach of duty or trust, is void. A company may,

however, indemnify an officer or director against any liability incurred by them in defending any proceedings, whether criminal or civil, in which a judgment is given in their favor. We have entered into indemnity agreements with two of our

independent directors pursuant to which we agree to indemnify and hold each of them harmless for certain losses arising out of their respective positions as directors excluding any willful misconduct, fraud or severe negligence.

|

Item 7.

|

Recent Sales of Unregistered Securities

|

None.

|

|

(a)

|

The following documents are filed as part of this registration statement:

|

The exhibit index

attached hereto is incorporated herein by reference.

|

|

(b)

|

Financial Statement Schedules

|

No financial statement schedules are provided because the

information called for is not applicable or is shown in the financial statements or notes thereto.

The undersigned Registrant hereby undertakes that:

|

|

(1)

|

For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a

form of prospectus filed by the Registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective.

|

|

|

(2)

|

For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise,

the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

|

|

(4)

|

The Registrant will provide to the Underwriters at the closing specified in the Underwriting Agreement ADSs and Preferred Shares in such denominations and registered in such names as required by the Underwriters to

permit prompt delivery to each purchaser.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”), the registrant certifies that it has

reasonable grounds to believe that it meets all of the requirements for filing this pre-effective amendment No. 1 to the Registration Statement on Form F-1 and has duly caused this pre-effective amendment to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of Barueri, São Paulo, Brazil, on this 13

th

day of September, 2017.

|

|

|

|

|

Azul S.A.

|

|

|

|

|

|

|

/s/ John Peter Rodgerson

|

|

|

|

John Peter Rodgerson

Chief Executive

Officer

|

POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act, this pre-effective amendment No. 1 to the Registration Statement on Form F-1 has been

signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

|

|

Chief Executive Officer

|

|

September 13, 2017

|

|

John Peter Rodgerson

|

|

|

|

|

|

|

|

|

|

*

|

|

Chief Financial Officer

|

|

September 13, 2017

|

|

Alexandre Wagner Malfitani

|

|

|

|

|

|

|

|

|

|

*

|

|

Controller

|

|

September 13, 2017

|

|

Mariana Cambiaghi Lourenço

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

David Gary Neeleman

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

José Mario Caprioli dos Santos

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Sérgio Eraldo de Salles Pinto

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Carolyn Luther Trabuco

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Gelson Pizzirani

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Renan Chieppe

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Decio Luiz Chieppe

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Michael Lazarus

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

John Ray Gebo

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Henri Courpron

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Haoming Xie

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Neng Li

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

September 13, 2017

|

|

Stewart Gordon Smith

|

|

|

|

|

|

|

|

|

|

*

|

|

Authorized U.S. Representative

|

|

September 13, 2017

|

|

Colleen A. De Vries

SVP on behalf of Cogency Global Inc.

|

|

|

|

|

|

|

|

|

|

*By

|

|

/s/ John Peter Rodgerson

|

|

|

|

John Peter Rodgerson

Attorney-in-Fact

Pursuant to Power of Attorney

|

EXHIBIT INDEX

Exhibit

|

|

|

|

|

Exhibit

Number

|

|

Exhibit

|

|

|

|

|

1.1**

|

|

Form of Underwriting Agreement

|

|

|

|

|

3.1*

|

|

By-laws of the Registrant

Estatuto Social

(English Translation) (previously filed as Exhibit 3.1 of Pre-Effective Amendment No. 2 to our

registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 16, 2017 and incorporated by reference herein).

|

|

|

|

|

4.1*

|

|

Form of Deposit Agreement among the Registrant, Citibank N.A., as depositary, and all Holders and Beneficial Owners of American Depositary Shares

issued thereunder, including the form of American Depositary Receipt annexed thereto as Exhibit A. (previously filed as Exhibit 4.1 of our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on April 3, 2017 and

incorporated by reference herein).

|

|

|

|

|

4.2*

|

|

Shareholders’ Agreement, dated September 1, 2017, among TRIP Participações S.A., TRIP Investimentos Ltda., Rio Novo Locações

Ltda., Calfinco Inc., Hainan Airlines Holding Co., Ltd. and David Gary Neeleman and as intervening and consenting party, Azul S.A. (previously filed on Form 6-K (File No. 001-38049) as filed with the SEC on September 5, 2017 and incorporated by

reference herein).

|

|

|

|

|

4.3*

|

|

Fifth Amended and Restated Registration Rights Agreement, dated as of August 3, 2016, among Azul S.A. and the signatories thereunder. (previously

filed as Exhibit 4.3 of our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on February 6, 2017 and incorporated by reference herein).

|

|

|

|

|

4.4*

|

|

Shareholders’ Agreement among TRIP Participações S.A., TRIP Investimentos Ltda., Rio Novo Locações Ltda., Calfinco

Inc., Hainan Airlines Holding Co., Ltd. and David Gary Neeleman and as intervening and consenting party, Azul S.A. (previously filed as Exhibit 4.4 of our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on February 6,

2017 and incorporated by reference herein).

|

|

|

|

|

5.1*

|

|

Form of Opinion of Pinheiro Neto Advogados, Brazilian legal counsel of the Registrant, as to the legality of the preferred shares

|

|

|

|

|

10.1*

|

|

Purchase Agreement COM0041-08, dated as of March 11, 2008, between Embraer – Empresa Brasileira de Aeronáutica S.A. and Canela Investments

LLC, including Amendment No. 1, dated as of April 30, 2008; Amendment No. 2, dated as of July 31, 2008; Amendment No. 3, dated as of October 21, 2008; Amendment No. 4, dated as of August 31, 2008; Amendment No. 5, dated as of November 25, 2008;

Amendment No. 6, dated as of December 12, 2008; Amendment No. 7, dated as of December 23, 2008, Amendment No. 8; dated as of March 12, 2009; Amendment No. 9, dated as of October 30, 2009; Amendment No. 10, dated as of December 21, 2009; Amendment

No. 11, dated as of October 26, 2010; Amendment No. 12, dated as of September 30, 2011, Amendment No. 13; dated as of November 9, 2011; Amendment No. 14, dated as of December 1, 2011; Amendment No. 15, dated as of January 20, 2012; Amendment No. 16,

dated as of May 2, 2012; Amendment No. 17, dated as of July 11, 2012; Amendment No. 18, dated as of December 28, 2012; Amendment No. 19, dated as of April 9, 2013, Amendment No. 20; dated as of May 29, 2013; Amendment No. 21, dated as of June 26,

2013; Amendment No. 22, dated as of March 13, 2014; Amendment No. 23, dated as of April 1, 2014, Amendment No. 24; dated as of April 29, 2014; Amendment No. 25, dated as of May 23, 2014; Amendment No. 26, dated as of July 30, 2014; and Amendment No.

27, dated as of September 24, 2015. (previously filed as Exhibit 10.1 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

EX-1

|

|

|

|

|

|

|

|

10.2*

|

|

Sale and Purchase Contract, dated as of December

14, 2010, between Avions de Transport Régional and Canela Investments LLC, including the Amendment No. 1, dated as of December 22, 2011; and Amendment No. 2, dated as of December

4, 2012. (previously filed as Exhibit 10.2 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

|

|

|

|

10.3*

|

|

Global Maintenance Agreement, dated as of March 9, 2015, between Azul Linhas Aéreas Brasileiras S.A. and Avions de Transport Régional,

G.I.E., including Amendment No. 1, dated as of January 6, 2016. (previously filed as Exhibit 10.3 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and

incorporated by reference herein).

|

|

|

|

|

10.4*

|

|

General Terms Agreement No. 1-1190636254, dated as of September 25, 2008, between GE Engine Services Distribution, LLC and Canela Investments,

LLC. (previously filed as Exhibit 10.4 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

|

|

|

|

10.5†*

|

|

OnPoint Overhaul Engine Services Agreement, dated as of September 25, 2009, between GE Engine Services LLC., GE CELMA Ltda. and Azul Linhas Aéreas

Brasileiras S.A., including Amendment No. 1, dated as of May, 2010; Amendment No. 2, dated as of September 25, 2009; Amendment No. 3, dated as of August 13, 2010; Amendment No. 4, dated as of September 22, 2010; Amendment No. 5, dated as of

November 10, 2010; Amendment No. 6, dated as of January 31, 2011; Amendment No. 7, dated as of October 19, 2011; Amendment No. 8, dated as of May 15, 2012; Amendment No. 9, dated as of December 15, 2012; Amendment No. 10, dated as of March 28, 2013;

Amendment No. 11, dated as of June 13, 2013; Amendment No. 12, dated as of June 13, 2013; Amendment No. 13, dated as of September 17, 2013; Amendment No. 14, dated as of December 30, 2014; Amendment No. 15, dated as of December 30, 2014; Amendment

No. 16, dated as of January 31, 2011; Amendment No. 17, dated as of December 18, 2015, between GE Engine Services, Inc., GE CELMA Ltda., Azul S.A., Azul Linhas Aéreas Brasileiras S.A. and TRIP Linhas Aéreas S.A.; and Amendment No. 18,

dated as of May 18, 2016. (previously filed as Exhibit 10.5 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

|

|

|

|

10.6*

|

|

Contract for Sale and Other Covenants, dated as of May 25, 2016, between Petrobras Distribuidora S.A. and Azul Linhas Aéreas Brasileiras

S.A. (previously filed as Exhibit 10.6 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

|

|

|

|

10.7*

|

|

First Amendment to the Investment Agreement, dated as of August 15, 2012, between Azul S.A., Trip Participações S.A., Trip Investimentos

Ltda. and Rio Novo Locações Ltda. (including the restated version of the Investment Agreement as Exhibit I); the Second Amendment to the Investment Agreement, dated as of December 27, 2013; the Third Amendment to the Investment

Agreement, dated as of October 22, 2014; the Fourth Amendment to the Investment Agreement, dated as of June 26, 2015, between Azul S.A., Trip Participações S.A., Trip Investimentos Ltda., Rio Novo Locações Ltda. and

Calfinco, Inc.; and the Fifth Amendment to the Investment Agreement, dated as of August 3, 2016, between Azul S.A., Trip Participações S.A., Trip Investimentos Ltda., Rio Novo Locações Ltda., Calfinco, Inc. and Hainan

Airlines Holding Co. Ltd. (previously filed as Exhibit 10.7 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

EX-2

|

|

|

|

|

|

|

|

10.8*

|

|

General Terms Agreement No. 1-4207092154, dated as of January

13, 2016, between CFM International Inc. and Azul Linhas Aéreas Brasileiras S.A. (previously filed as Exhibit 10.8 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3,

2017 and incorporated by reference herein).

|

|

|

|

|

10.9*

|

|

A320 NEO Purchase Agreement, dated as of October 24, 2014, between Airbus S.A.S. and Azul Finance LLC., including Amendment No. 1 to the A320

NEO Purchase Agreement, dated as of December 21, 2015. (previously filed as Exhibit 10.19 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No. 333-215908) as filed with the SEC on March 3, 2017 and incorporated by

reference herein).

|

|

|

|

|

10.10†*

|

|

Purchase Agreement COM0384-14, dated as of December 30, 2014, between Embraer S.A. and Azul Finance 2 LLC., including Amendment No. 1, dated

as of September 4, 2015; Amendment No. 2, dated as of March 2, 2016; and Amendment No. 3, dated as of March 31, 2016. (previously filed as Exhibit 10.10 of Pre-Effective Amendment No. 1 to our registration statement on Form F-1 (File No.

333-215908) as filed with the SEC on March 3, 2017 and incorporated by reference herein).

|

|

|

|

|

10.11†

|

|

Lease and Flight Hours Services Agreement on A320 Neo Aircraft, dated as of [July 5], 2017, between Azul Linhas Aéreas Brasileiras S.A. and Airbus SAS.

|

|

|

|

|

10.12†

|

|

Amendment No. 19, dated as of March 31, 2017, to the OnPoint Overhaul Engine Services Agreement, dated as of September

25, 2009, between GE Engine Services LLC., GE CELMA Ltda. and Azul Linhas Aéreas Brasileiras S.A.

|

|

|

|

|

10.13†

|

|

Amendment No. 4, dated as of December 22, 2016, to the Purchase Agreement COM0384-14, dated as of December 30, 2014, between Embraer S.A. and Azul Finance 2 LLC.

|

|

|

|

|

21.1*

|

|

Subsidiaries of the Registrant

|

|

|

|

|

23.1*

|

|

Consent of Ernst & Young Auditores Independentes S. S.

|

|

|

|

|

23.2*

|

|

Consent of Pinheiro Neto Advogados, Brazilian legal counsel of the Registrant (included in Exhibit 5.1)

|

|

|

|

|

24.1*

|

|

Powers of Attorney (included on signature page to the Registration Statement)

|

|

(**)

|

To be filed by amendment.

|

|

†

|

Portions of the exhibit will be omitted pursuant to the request for confidential treatment.

|

EX-3

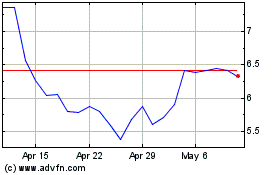

Azul (NYSE:AZUL)

Historical Stock Chart

From Mar 2024 to Apr 2024

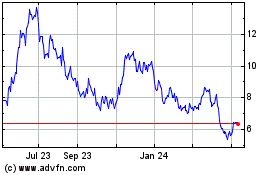

Azul (NYSE:AZUL)

Historical Stock Chart

From Apr 2023 to Apr 2024