Coffee Holding Co., Inc. Reports Results for Three and Nine

Months Ended July 31, 2017 and Announces Stock Repurchase

Program

STATEN ISLAND, NY-(Marketwired - Sep 13, 2017) - Coffee Holding

Co., Inc. (NASDAQ: JVA) (the "Company") today announced its

operating results for the three and nine months ended July 31,

2017:

Net sales totaled $17,979,068 for the three months ended July

31, 2017, an increase of $624,535, or 3.6% from $17,354,533 for the

three months ended July 31, 2016. The increase in net sales

reflects our gain of approximately $4,000,000 in sales of both

branded and private label coffee to both new and existing

customers, partially offset by reduced wholesale transactions with

our largest wholesale green coffee customer of approximately

$3,400,000.

Cost of sales for the three months ended July 31, 2017 was

$14,903,594, or 82.9% of net sales, as compared to $14,203,343, or

81.9% of net sales, for the three months July 31, 2016. Cost of

sales consists primarily of the cost of green coffee and packaging

materials and realized and unrealized gains or losses on hedging

activity. The increase in cost of sales reflects the change in the

product mix due to our reduced wholesale transactions with our

largest wholesale green coffee customer.

Gross profit for the three months ended July 31 2017 was

$3,075,474, a decrease of $75,716 from $3,151,190 for the three

months ended July 31, 2016. Gross profit as a percentage of net

sales decreased to 17.1% for the three months ended July 31, 2017

from 18.1% for the three months ended July 31, 2016. Although we

experienced improved margins on our wholesale and roasted business

during the quarter, the decrease in gross profits was due in part

to the purchase price paid for our acquisition of Comfort Foods,

Inc., or CFI.

Total operating expenses increased by $1,027,420 to $2,895,643

for the three months ended July 31, 2017 from $1,868,223 for the

three months ended July 31, 2016. The quarter ended July 31, 2017

included approximately $208,409 of selling and administrative

expenses from our subsidiary Sonofresco, LLC, or SONO, and

approximately $444,530 of selling and administrative expenses from

our subsidiary CFI which were not fully included in the July 31,

2016 numbers since the SONO transaction was completed in late June

2016 and the CFI transaction occurred in 2017. Also, we incurred

increases in shipping expenses of $175,481, salary expense of

$42,169 and medical insurance expense of $22,946. These increases

were the result of our reinvestment in our growth and expansion

strategy.

The Company had net income of $32,800 or $0.01 per share basic

and diluted, for the three months ended July 31, 2017 compared to

net income of $755,518, or $0.12 per share basic and diluted for

the three months ended July 31, 2016. The decrease in net income

was due primarily to the reasons described above.

Additionally, the Company's Board of Directors has approved a

share repurchase program pursuant to which the Company may

repurchase up to $2 million in value of its outstanding common

stock, par value, $0.001 per share, from time to time on the open

market and in privately negotiated transactions subject to market

conditions, share price and other factors (the "Share Repurchase

Program"). The Company intends to fund the Share Repurchase Program

with available cash and from future cash flow from operations.

The timing and amount of any shares repurchased will be

determined based on the Company's evaluation of market conditions

and other factors and the program may be discontinued or suspended

at any time. Repurchases will be made in accordance with the rules

and regulations promulgated by the Securities and Exchange

Commission and certain other legal requirements to which the

Company may be subject. Repurchases may be made, in part, under a

Rule 10b5-1 plan, which allows stock repurchases when the Company

might otherwise be precluded from doing so.

"We are pleased to report to our shareholders a sales increase

during our third fiscal quarter of 2017. Our revenue grew by

approximately 3.5% to approximately $18 million compared to

approximately $17.4 million for the same period in 2016. This

revenue figure includes a decrease in sales of approximately $3.4

million during the quarter to our former largest wholesale green

coffee customer demonstrating that we have successfully offset all

of the lost revenue from one customer by increasing our sales of

branded, private label and green coffee sales to existing and new

customers.

Sales of our flagship brand, Café Caribe, continue to improve,

especially in the Texas market as our customer base in the region

continues to grow along with the increased number of stores which

now carry our brand. Sales of our private label grew by nearly 100%

during the quarter from our last fiscal quarter. Sales of green

coffee to our smaller, regional roaster clientele remained steady,

reflecting the continuing sales growth of higher end, 100% Arabica

micro brewed specialty beverages favored by the millennial coffee

drinking demographic.

As our increased efforts in key areas of our business are now

reflected in our revenues, I believe we have turned the page on our

previous declines in revenue caused by the reduced sales to our

former largest green coffee customer.

Once the integration of our most recent acquisition, Comfort

Foods, Inc. in North Andover, Massachusetts, is completed, we

expect to return to a profitable position as our overall gross

margins continue to improve in conjunction with the changes in our

overall sales mix, due in part to our efforts to replace our lower

margin business with increased sales of our roasted product

offerings.

Lastly, as we believe the public market is not reflecting the

true value of our company, we have decided to initiate a share

repurchase program whereby we may repurchase up to $2 million of

our outstanding shares in the open market. Going forward, our focus

will continue to be on growing our revenues over the next several

years."

About Coffee Holding

Coffee Holding Co., Inc. is a leading integrated wholesale

coffee roaster and dealer in the United States and one of the few

coffee companies that offers a broad array of coffee products

across the entire spectrum of consumer tastes, preferences and

price points. Coffee Holding has been a family-operated business

for three generations and has remained profitable through varying

cycles in the coffee industry and the economy. The Company's

private label and branded coffee products are sold throughout the

United States, Canada and abroad to supermarkets, wholesalers, and

individually owned and multi-unit retail customers.

Any statements that are not historical facts contained in this

release are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995, including the

Company's outlook on future margin performance and its share

repurchase program. Forward-looking statements include statements

with respect to our beliefs, plans, objectives, goals,

expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks,

uncertainties and other factors, which may be beyond our control,

and which may cause our actual results, performance or achievements

to be materially different from future results, performance or

achievements expressed or implied by such forward-looking

statements. All statements other than statements of historical fact

are statements that could be forward-looking statements. We have

based these forward-looking statements upon information available

to management as of the date of this release and management's

expectations and projections about certain future events. It is

possible that the assumptions made by management for purposes of

such statements may not materialize. Such statements may involve

risks and uncertainties, including but not limited to those

relating to product demand, pricing, market acceptance, hedging

activities, the effect of economic conditions, intellectual

property rights, the outcome of competitive products, risks in

product development, the results of financing efforts, the ability

to complete transactions, and other factors discussed from time to

time in the Company's Securities and Exchange Commission filings.

The Company undertakes no obligation to update or revise any

forward-looking statement for events or circumstances after the

date on which such statement is made.

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

JULY 31, 2017 AND OCTOBER 31, 2016

July 31, October 31,

2017 2016

------ ------

(Unaudited)

- ASSETS -

CURRENT ASSETS:

Cash $ 2,687,724 $ 3,227,981

Accounts receivable, net of allowances of

$144,000 for 2017 and 2016 10,418,086 13,517,892

Inventories 15,663,719 14,276,290

Prepaid green coffee 280,254 435,577

Prepaid expenses and other current assets 621,877 535,456

Prepaid and refundable income taxes 797,939 481,977

Due from broker 778,556 134,722

Deferred income tax asset - 81,545

------ ------

TOTAL CURRENT ASSETS 31,248,155 32,691,440

Machinery and equipment, at cost, net of

accumulated depreciation of $5,377,379 and

$4,819,828 for 2017 and 2016, respectively 2,526,486

2,269,863

Customer list and relationships, net of

accumulated amortization of $64,625 and $50,250

for the periods ended July 31, 2017 and 2016,

respectively 375,375 219,750

Trademarks 180,000 180,000

Goodwill 2,377,407 1,017,905

Equity method investments 95,528 95,598

Deposits and other assets 535,750 549,337

------ ------

TOTAL ASSETS $ 37,338,701 $ 37,023,893

============ ============

- LIABILITIES, REDEEMABLE COMMON STOCK AND

STOCKHOLDERS' EQUITY -

CURRENT LIABILITIES:

Accounts payable and accrued expenses $ 3,254,991 $

4,062,573

Line of credit 7,406,325 6,958,375

Deferred income tax liabilities 60,785 -

Income taxes payable - 1,050

------ ------

TOTAL CURRENT LIABILITIES 10,722,101 11,021,998

Deferred income tax liabilities 203,600 167,470

Deferred rent payable 238,088 231,216

Deferred compensation payable 509,170 489,668

------ ------

TOTAL LIABILITIES 11,672,959 11,910,352

============ ============

Redeemable common stock:

Common stock subject to possible redemption,

at $200,004; 38,364 shares issued and

outstanding at redemption value as of July

31, 2017 and October 31, 2016 200,004 200,004

STOCKHOLDERS' EQUITY:

Coffee Holding Co., Inc. stockholders' equity:

Preferred stock, par value $.001 per share;

10,000,000 shares authorized; no shares

issued and outstanding - -

Common stock, par value $.001 per share;

30,000,000 shares authorized, 6,494,680

shares issued; 5,821,554 and 5,824,938

shares outstanding as of July 31 2017 and

October 31, 2016, respectively 6,456 6,456

Additional paid-in capital 15,904,109 15,904,109

Retained earnings 12,288,547 11,878,228

Less: Treasury stock, 634,762 and 631,378

common shares, at cost as of July 31, 2017

and October 31, 2016, respectively (3,265,419) (3,249,590)

------ ------

Total Coffee Holding Co., Inc.

Stockholders' Equity 25,133,697 24,539,203

Noncontrolling interest 532,045 374,334

------ ------

TOTAL EQUITY 25,665,742 24,913,537

------ ------

TOTAL LIABILITIES, REDEEMABLE COMMON STOCK AND

STOCKHOLDERS' EQUITY $ 37,338,701 $ 37,023,893

============ ============

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

THREE AND NINE MONTHS ENDED JULY 31, 2017 AND 2016

(Unaudited)

Nine Months Ended Three Months Ended

July 31, July 31,

------------ ------------

2017 2016 2017 2016

------ ------ ------ ------

NET SALES $55,398,538 $61,566,868 $17,979,068 $17,354,533

COST OF SALES (including

$4.8 and $7.4 million

of related party costs

for the nine months

ended July 31, 2017 and

2016, respectively.

Including $2.6 and $1.9

million for the three

months ended July 31,

2017 and 2016,

respectively.) 46,469,896 52,455,081 14,903,594 14,203,343

------ ------ ------ ------

GROSS PROFIT 8,928,642 9,111,787 3,075,474 3,151,190

------ ------ ------ ------

OPERATING EXPENSES:

Selling and

administrative 7,517,062 5,170,915 2,716,393 1,704,373

Officers' salaries 527,090 491,550 179,250 163,850

------ ------ ------ ------

TOTAL 8,044,152 5,662,465 2,895,643 1,868,223

------ ------ ------ ------

INCOME FROM OPERATIONS 884,490 3,449,322 179,831 1,282,967

------ ------ ------ ------

OTHER INCOME (EXPENSE)

Interest income 29,381 30,889 5,993 9,890

Loss from equity

method investment (71) (1,049) (322) (805)

Interest expense (192,317) (116,114) (68,079) (42,671)

------ ------ ------ ------

TOTAL (163,007) (86,304) (62,408) (33,586)

------ ------ ------ ------

INCOME BEFORE PROVISION

FOR INCOME TAXES AND

NON-CONTROLLING

INTEREST IN SUBSIDIARY 721,483 3,363,018 117,423 1,249,381

Provision for income

taxes 153,453 1,236,319 23,911 448,399

------ ------ ------ ------

NET INCOME BEFORE NON-

CONTROLLING INTEREST IN

SUBSIDIARY 568,030 2,126,699 93,512 800,982

Less: Net income

attributable to the

non-controlling

interest (157,711) (100,811) (60,712) (45,464)

------ ------ ------ ------

NET INCOME ATTRIBUTABLE

TO COFFEE HOLDING CO.,

INC. $ 410,319 $ 2,025,888 $ 32,800 $ 755,518

=========== =========== =========== ===========

Basic and diluted

earnings per share $ .07 $ .33 $ .01 $ .12

=========== =========== =========== ===========

Weighted average common

shares outstanding:

Basic and diluted 5,861,777 6,117,610 5,859,918 6,056,420

=========== =========== =========== ===========

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS ENDED JULY 31, 2017 AND 2016

(Unaudited)

2017 2016

------ ------

OPERATING ACTIVITIES:

Net income $ 568,030 $ 2,126,699

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 573,447 425,977

Unrealized (gain) on commodities (643,834) (591,566)

Loss on equity method investments 70 1,049

Deferred rent 6,872 6,872

Deferred income taxes 178,460 890,750

Changes in operating assets and liabilities:

Accounts receivable 3,684,724 (4,766,640)

Inventories (270,523) 1,432,701

Prepaid expenses and other current assets (53,740) (262,707)

Prepaid green coffee 155,323 58,310

Prepaid and refundable income taxes (315,962) 931,250

Accounts payable and accrued expenses (1,434,462)

(1,554,385)

Deposits and other assets 59,640 31,558

Income taxes payable (1,050) 925

------ ------

Net cash provided by (used in) operating

activities 2,506,995 (1,269,207)

------ ------

INVESTING ACTIVITIES:

Purchase of business net of cash acquired (2,893,275)

(856,904)

Purchases of machinery and equipment (586,098) (661,591)

------ ------

Net cash used in investing activities (3,479,373)

(1,518,495)

------ ------

FINANCING ACTIVITIES:

Advances under bank line of credit 4,512,950 5,204,254

Payment of dividend - (100,000)

Purchase of treasury stock (15,829) (839,927)

Principal payments under bank line of credit (4,065,000)

(3,500,000)

------ ------

Net cash provided by financing activities 432,121 764,327

------ ------

NET DECREASE IN CASH (540,257) (2,023,375)

CASH, BEGINNING OF PERIOD 3,227,981 3,853,816

------ ------

CASH, END OF PERIOD $ 2,687,724 $ 1,830,441

============ ============

SUPPLEMENTAL DISCLOSURE OF CASH FLOW DATA:

Interest paid $ 189,933 $ 111,060

------ ------

Income taxes paid $ 281,538 $ 26,582

============ ============

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS ENDED JULY 31, 2017 AND 2016

(Unaudited)

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES:

On February 23, 2017 Coffee Holding Co., Inc. acquired the

assets of Comfort Foods, Inc.:

Accounts receivable $ 584,918

Inventory 1,116,906

Equipment 229,597

Prepaid expenses 32,681

Customer lists 170,000

Goodwill 1,359,502

Other asset 26,551

Less: liabilities 626,880

Net cash paid $ 2,893,275

Contact Information

Company Contact Coffee Holding Co., Inc. Andrew Gordon President

& CEO 718-832-0800

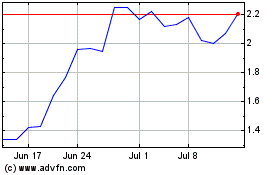

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Apr 2023 to Apr 2024