Additional Proxy Soliciting Materials (definitive) (defa14a)

September 12 2017 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Definitive Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Sec. 240.14a-11(c) or sec. 240.14a-12

|

|

GIGA-TRONICS INCORPORATED

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

N/A

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

[X]

|

Fee not required.

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Giga-tronics Incorporated

CEO Letter

Fiscal 2017

September 8, 2017

To Our Shareholders,

Giga-tronics made good progress toward completing its transformation into an Electronic Warfare (EW) focused Company during fiscal 2017. We entered the year still with a mix of new and legacy products in our San Ramon, California facility, but ended the year with substantially all our focus on RADAR filters and Threat Emulation Systems while headed to a new right-sized facility in Dublin, California. Although the facility move, which was completed in May of 2017, was certainly a distraction, it allowed the Company to reduce its six year aggregate lease liability by half versus remaining in place and is projected to save approximately $500,000 annually in facility related costs. Also, we had been in our San Ramon facility for over 24 years and were able to eliminate surplus items and start fresh in a modern environment that shows well when hosting visitors. I sense the improved morale and excitement as we become the new Giga-tronics. Mr. Suresh Nair, Co-CEO of Giga-tronics, was instrumental in making the move a success and we’re both very pleased with the performance of our teams during the entire process.

Net sales for fiscal 2017 were $16.3 million as compared to $14.6 million in the prior year. This was primarily due to growth in RADAR filter shipments from our Microsource division. We received a $4.5 million contract for new F15 filters in April 2016. The Company completed shipping all the units associated with this order within fiscal year 2017 and now anticipates receiving a multi-year follow-on order for additional F15 RADAR filters. We also received an NRE contract for $1.9 million in July of 2016 to address an obsolescence issue that threatened production of F15 filters within 18-24 months. In addition, we began the first production shipments in August 2016 of our $10 million backlog of F16 filters. All totaled, our Microsource division ended the year with $8.3 million in net sales as compared to $5.9 million in the prior year, a 40% increase.

Our Giga-tronics division finished fiscal 2017 with $8.0 million in net sales as compared to $8.7 million in the prior year, an 8% decrease. However, these numbers mask the change in mix from legacy products to the Company’s new Advanced Signal Generator (ASG). Overall, our ASG sales grew substantially during fiscal 2017 to $5.2 million as compared to $1.8 million in the prior fiscal year. We entered the year with approximately $1.0 million in ASG backlog. In June, the Company received a $3.3 million direct order from the US Navy for two Threat Emulation Systems, which is a combination of our ASG hardware, third party hardware and the software licensed to us from the aerospace contractor announced in December of 2015. It required six months to build, ship and receive acceptance from the customer for these systems because they are the most complex products ever manufactured by Giga-tronics. The product expands the capabilities that we can offer our customers, and we are optimistic we’ll see additional orders based on the capabilities we have delivered. We also received a follow-on $542,000 order from the US Navy in July 2016 for additional ASG hardware and a $400,000 order in December from our first international customer for ASG hardware. Also in December, we received an order for $762,000 from a major US prime contractor, who designs flight worthy EW equipment for the services.

Conversely, our legacy products, which comprise Power Meter, Signal Generator and Switch product lines, experienced a 58% decline in net sales to $2.9 million in fiscal 2017 as compared to $6.9 million in fiscal 2016. This decline was associated with the sale of our Switch product line to Astronics in June and completion of the transfer of the Power Meter product line to Spanawave that began in the fourth quarter of 2016. We are disappointed to report that the dispute between Giga-tronics and Spanawave that arose in August of 2016 regarding the acquisition of the legacy T&M business remains unresolved.

Another major change that occurred during fiscal year 2017 relates to the management of Giga-tronics. Mr. Suresh Nair joined the Company in April of 2016 as our Vice President of Operations. Suresh’s deep background in lean manufacturing learned through years at General Motors and at the Danaher Corporation allowed him to make immediate improvements to the Company’s operational efficiencies, inventory management and customer support. In August of 2016, Dr. Joey Thompson, a director of the Company since 2012, was appointed by the board of directors as Acting CEO allowing me to devote more time to resolving open technical issues with the ASG product and to managing the engineering department. And during the year, we added two experienced individuals to the customer facing team; one with extensive knowledge of RADAR and threat emulation applications to help us speak more credibly to our customers and the other experienced in technical marketing to drive awareness in the marketplace of the new focus at Giga-tronics. Additionally, both individuals will be instrumental in defining the Company’s future EW investment roadmap. Also, during the year, two long standing board members retired; Mr. Garrett Garrettson and Mr. Ken Harvey stepped down after many years of service to Giga-tronics. At the same time, we were joined by a new board member, Mr. Jamie Weston, of Spring Mountain Capital (“SMC”), who represents the Company’s single largest shareholder via SMC’s investment in Alara. Jim Cole, a director of the Company since 1994 decided not to stand for reelection for fiscal year 2018. We are grateful to Garry, Ken and Jim for their service to Giga-tronics and its shareholders. During the first quarter of fiscal 2018, Dr. Thompson announced his intention to return to the role of Executive Chairman of the board. In response, the board of directors named Suresh Nair and myself as Co-CEOs of Giga-tronics. Suresh and I offer complementary skills to help guide Giga-tronics going forward. Suresh is very strong in operations and will take on the day-to-day management of the Company along with maintaining ownership of operations and I will continue to provide the longer term guidance to the Company’s strategy along with ownership of the engineering organization. I’m very pleased to be working side by side with Suresh in leading Giga-tronics.

Looking ahead, there’s no question the major challenge facing the Company is to grow our top line revenue. We’ve done a good job in controlling costs and right-sizing the Company in both headcount and in a new, smaller facility, but now we need to grow the Advanced Signal Generator product line revenue so it can begin to generate cash from operations. While the recent emphasis on serving the US Navy by delivering complex systems has helped increase ASG revenue this fiscal year, the larger average selling prices have led to greater variability in quarter to quarter bookings. Between the fourth quarter of fiscal 2017 and the first quarter of fiscal 2018, the Company did not book any new ASG orders, which has precipitated a poor start to the new fiscal year. While we have since received a $1.8 million order in July of 2017 from the US Navy for a third Threat Emulation System, the Company’s management believes it is necessary to offer a simpler, lower priced, more general purpose threat emulator that will have broader appeal and a shorter sales cycle. We believe this should help reduce the quarter-to-quarter variability in future bookings and help smooth out and grow our ASG revenue. We expect to have this simpler solution ready for market by April of 2018.

In light of the lower than anticipated ASG bookings during fiscal 2017, the variability between quarters and our limited working capital, the board of directors announced in June of 2017 that it is in the process of reviewing the Company’s strategic alternatives. More detailed information, including cautionary statements and references to uncertainties, with respect to operating results and management’s efforts to maintain liquidity can be found in the accompanying Annual Report on Form 10-K.

While, this has been a challenging year for Giga-tronics, both Suresh and I are very excited about the opportunities we have to grow our market position within the Electronic Warfare segment and we are both fully committed to returning the Company to profitability. We look forward to updating you regarding our progress in the quarters ahead.

Sincerely,

John Regazzi

Co-CEO

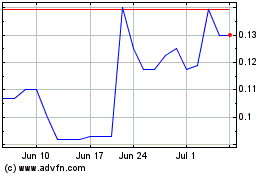

Giga Tronics (QB) (USOTC:GIGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

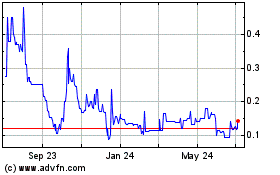

Giga Tronics (QB) (USOTC:GIGA)

Historical Stock Chart

From Apr 2023 to Apr 2024