FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of September 2017

Commission File Number: 001-15002

ICICI Bank

Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing

the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate

below the file number assigned to the registrant in

connection with Rule 12g 3-2(b):

Not Applicable

Table of Contents

|

Item

|

|

|

|

|

|

1.

2.

|

Other news

Communication

being sent to the reserved category of ICICI Bank Shareholders

|

Item 1

OTHER NEWS

Subject:

Proposed IPO of our Subsidiary, ICICI Lombard General Insurance Company Limited (“ICICI Lombard”)

IBN

ICICI

Bank Limited (the ‘Bank’) Report on Form 6-K

Pursuant

to the provisions of the Indian Listing Regulations notified by SEBI, we have disclosed the following information to the stock

exchanges in India.

This is further

to the communication dated September 7, 2017 vide which we had informed about the reservation of up to 4,312,359 equity shares

of ICICI Lombard for purchase by ICICI Bank Shareholders (the

“ICICI Bank Shareholders Reservation Portion”)

who fall under the category of individuals and HUFs who are the public equity shareholders of ICICI Bank Limited (excluding such

other persons not eligible under applicable laws, rules, regulations and guidelines and American depository receipt holders of

ICICI Bank Limited) as on the date of the Red Herring Prospectus filed by ICICI Lombard with the Registrar of Companies,

Maharashtra, at Mumbai i.e. September 6, 2017.

In this connection,

we enclose a copy of the communication being sent to the reserved category of ICICI Bank Shareholders informing them about the

above.

This is for

your information and records.

|

ICICI

Bank Limited

ICICI Bank

Towers

Bandra-Kurla

Complex

Mumbai 400

051, India.

|

Tel.:

(91-22) 2653 1414

Fax: (91-22)

2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012

|

Regd.

Office: ICICI Bank Tower,

Near Chakli

Circle,

Old Padra Road

Vadodara 390007.

India

|

|

|

|

|

Item 2

ICICI

BANK LIMITED

CIN:

L65190GJ1994PLC021012

Registered

Office:

ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara 390 007,

Ph:

0265-6722286

Corporate

Office:

ICICI Bank Towers, Bandra-Kurla Complex, Mumbai 400 051

Ph:

022-26538900,

Fax:

022-26531230,

Website:

www.icicibank.com

,

Email:

investor@icicibank.com

September

8, 2017

Dear

ICICI Bank Shareholders,

Sub:

Public offer of shares of ICICI Lombard General Insurance Company Limited – Reservation for ICICI Bank Shareholders (as defined

below)

ICICI

Lombard General Insurance Company Limited (

“ICICI General”

) is a subsidiary of ICICI Bank Limited (the

“Bank”

).

ICICI General is proposing an initial public offer of upto 86,247,187 equity shares of

₹

10 each (the

“Equity Shares”

) of ICICI General through an offer for sale by the Bank and FAL Corporation (the

“Offer”

). The Bank is offering for sale up to 31,761,478 Equity Shares in the Offer at a price to be determined

through book building process.

Please

note that the Offer includes a reservation of upto 4,312,359 Equity Shares for purchase by ICICI Bank Shareholders (the

“ICICI

Bank Shareholders Reservation Portion”

) who fall under the category of individuals and HUFs who are the public equity

shareholders of the Bank (excluding such other persons not eligible under applicable laws, rules, regulations and guidelines and

American depository receipt holders of the Bank) as on the date of the red herring prospectus dated September 6, 2017 (the

“Red

Herring Prospectus”

) filed by ICICI General with the Registrar of Companies, Maharashtra, at Mumbai i.e., September 6,

2017. The Offer less the ICICI Bank Shareholders Reservation Portion would constitute the Net Offer.

The Bid/Offer Opening Date

is September 15, 2017 (Friday) and the Bid/Offer Closing Date is September 19, 2017 (Tuesday). The price band has been fixed between

₹

651 to

₹

661 per Equity Share.

The

sole/first Bidder shall be an ICICI Bank Shareholder. Further, a Bidder Bidding in the ICICI Bank Shareholders Reservation Portion

(subject to the Bid being up to

₹

200,000) can also Bid under the

Net Offer and such Bids will not be treated as multiple Bids. To clarify, an ICICI Bank Shareholder Bidding in the ICICI Bank Shareholders

Reservation Portion above

₹

200,000 cannot Bid in the Net Offer

as such Bids will be treated as multiple Bids.

Bids by ICICI Bank Shareholders not having a valid and active Client ID with

an authorised depository participant (demat account) or valid PAN or not having their PAN previously recorded with their Depository

Participant/register of shareholders maintained with ICICI Bank, are liable to be rejected.

Further, multiple Bid-cum-Application

Forms are liable to be rejected in the event (i) an ICICI Bank Shareholder holding multiple demat accounts makes such multiple

applications; and (ii) an ICICI Bank Shareholder, being first holder of a joint demat account makes such multiple applications

individually and jointly.

For

further details in relation to the ICICI Bank Shareholders Reservation Portion, you may please refer to

“Offer Procedure

- Bids by ICICI Bank Shareholders”

on page 440 of the Red Herring Prospectus and for any details and assistance on the

ICICI Bank Shareholders Reservation Portion, please call ICICI Securities Limited at +91 22 4070 1330 and/or +91 22 4070 1412.

Please

note that this communication is neither a solicitation to participate in the Offer, nor does it assure any allocation or allotment

of Equity Shares (either partial/complete) against applications made in the Offer.

Capitalised

words used but not defined herein under shall have the same meaning as ascribed to such terms in the Red Herring Prospectus.

For

ICICI Bank Limited

/s/

P. Sanker

P.

Sanker

Senior General Manager

(Legal)

& Company Secretary

This

announcement is not an offer of securities for sale in the United States. The Equity Shares have not been and will not be registered

under the US Securities Act of 1933 (“U.S. Securities Act”) or any state securities laws in the United States and

may not be offered or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the U.S. Securities Act and in accordance with any applicable United States state securities

laws. There is no intention to register the Equity Shares in the United States or to make a public offering of the securities

in the United States.

ICICI

Lombard General Insurance Company Limited is proposing, subject to receipt of requisite approvals, market conditions and other

considerations, to make an initial public offer of its equity shares and has filed the red herring prospectus with the Registrar

of Companies, Mumbai on September 6, 2017 (the

“Red Herring Prospectus”

). The Red Herring Prospectus is available

on the website of SEBI as well as on websites of the GCBRLMs and the BRLMs at

http://www.ml-india.com

,

www.icicisecurities.com

,

www.iiflcap.com

,

www.india.clsa.com

,

www.edelweissfin.com

, and

www.jmfl.com

. Investors should note

that investment in equity shares involves a high degree of risk and for details relating to such risk, see “Risk Factors”

of the Red Herring Prospectus. This announcement is only for distribution and circulation in India and may not be distributed

in any other jurisdiction including in the United States.

The

IRDAI does not undertake any responsibility for the financial soundness of ICICI General or for the correctness of any of the

statements made or opinions expressed in this connection. Any approval by the IRDAI under the Insurance Regulatory and Development

Authority of India (Issuance of Capital by Indian Insurance Companies transacting other than Life Insurance Business) Regulations,

2015 shall not in any manner be deemed to be or serve as a validation of the representations by ICICI General in the offer document.

The Offer has not been recommended or approved by IRDAI, nor does IRDAI guarantee the accuracy or adequacy of the contents / information

in the offer document. It is to be distinctly understood that the offer document should not in any way be deemed or construed

to have been approved or vetted by IRDAI.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorised.

|

|

|

|

For ICICI Bank Limited

|

|

|

|

|

|

|

Date:

|

September 12, 2017

|

|

By:

|

/s/ Shanthi Venkatesan

|

|

|

|

|

|

Name :

|

Ms. Shanthi

Venkatesan

|

|

|

|

|

|

Title :

|

Deputy General Manager

|

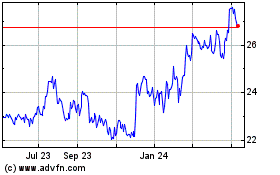

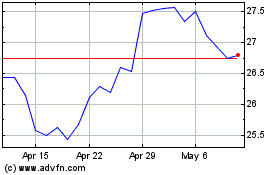

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icici Bank (NYSE:IBN)

Historical Stock Chart

From Apr 2023 to Apr 2024