Current Report Filing (8-k)

September 12 2017 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 7, 2017

MARATHON

PATENT GROUP, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

001-36555

|

|

01-0949984

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

11100

Santa Monica Blvd., Ste. 380

Los

Angeles, CA

|

|

90025

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (703) 232-1701

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

1.01

|

Entry

into Material Definitive Agreements

|

On

September 7, 2017, Marathon Patent Group, Inc., (the “

Company

”) entered into a Lock-up Agreement with the Company’s

Chief Executive Officer (the “

Lock-up Agreement

”). The Lock-Up Agreement also amends the Amended and Restated

Retention Agreement, dated August 30, 2017 (the “

Amended and Restated Agreement

”, and together with the Lock-up

Agreement, the “

Agreements

”). Under the Agreements, 3,000,000 restricted shares of common stock issuable

to the Chief Executive Officer and Chief Financial Officer of the Company (the “

Retention Shares

”) in connection

with their agreements also become subject to a lock-up provision under which the Company and the executives have agreed that (1)

the date of issuance of the Retention Shares shall be the earlier of the date of shareholder approval of the 2017 Equity Incentive

Plan or December 31, 2017, and (2) the holder of such Retention Shares may not, directly or indirectly (i) offer, sell,

offer to sell, contract to sell, hedge, pledge, sell any option or contract to purchase, purchase any option or contract to sell,

grant any option, right or warrant to purchase or sell (or announce any offer, sale, offer of sale, contract of sale, hedge, pledge,

sale of any option or contract to purchase, purchase of any option or contract of sale, grant of any option, right or warrant

to purchase or other sale or disposition), or otherwise transfer or dispose of (or enter into any transaction or device that is

designed to, or could be expected to, result in the disposition by any person at any time in the future), any Retention Shares,

beneficially owned, within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, by the undersigned

on the date of the Lock-up Agreement or thereafter acquired or (ii) enter into any swap or other agreement or any

transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of any Retention

Shares, whether or not any such swap or transaction described in clause (i) or (ii) above is to be settled by delivery of any

securities; provided, however, on the 30th day following the date of a Qualifying Transaction (as defined in the Agreements) and

on each succeeding monthly (30 day) period following the date of issuance, 16.67% of such Retention Shares shall no longer be

subject to such restrictions. Other than the foregoing, the material terms of the Amended and Restated Agreement remain in full

force and effect.

The

foregoing description of the terms of the Lock-up Agreement is qualified in its entirety by reference to the full text of the

form of the Lock-up Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K.

|

Item

9.01

|

Financial

Statements and Exhibits

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

Date:

September 12, 2017

|

|

MARATHON

PATENT GROUP, INC.

|

|

|

|

|

|

|

By:

|

/s/

Doug Croxall

|

|

|

Name:

|

Doug

Croxall

|

|

|

Title:

|

Chief

Executive Officer

|

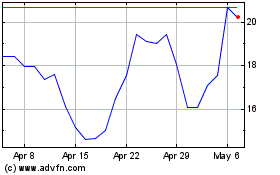

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024