GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-33958

|

|

20-8099512

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

|

|

|

|

|

|

(Address of Principal Executive Offices) (Zip Code)

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (855) 855-4253

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

On September 5, 2017, Mills Pharmaceuticals, LLC (“MPI”), a wholly owned subsidiary of Galena Biopharma, Inc. (“Galena”) and BioVascular, Inc. (“BVI”), entered into an amendment (“Amendment”) of the Exclusive License Agreement between MPI and BVI dated December 20, 2013 (the “License Agreement”), pursuant to which parties agreed to resolve their outstanding disputes over the License Agreement and to modify the certain terms of the License Agreement, including but not limited to, (i) eliminating the 3% royalty rate on annual net sales of $50 million and the 4% royalty now applies to annual net sales of up to $100 million, (ii) making an advance payment of $350,000 for the milestone related to the initiation of the Phase 3 clinical trial payable in two tranches with the first payment of $200,000 payable on or before October 31, 2017 and the second payment of $150,000 payable 30 days after the “Effective Time” as that term is defined in the Agreement and Plan of Merger and Reorganization dated August 7, 2017 by and among Galena Biopharma, Inc., Sellas Intermediate Holdings I, Inc., Sellas Intermediate Holdings II, Inc., Galena Bermuda Merger Sub, Ltd., and SELLAS Life Sciences Group Ltd. but no later than December 31, 2017, (iii) adding a payment for a sublicense by MPI to a third party of 25% of any cash received for upfront fees or milestone payments if the sublicense is executed prior to first patient enrolled in the Phase 3 clinical trial and 17.5% of any cash received for upfront fees or milestone payments if the sublicense is executed after the first patient is enrolled in the Phase 3 clinical trial, and (iv) if the first patient is not enrolled in the Phase 3 clinical trial by December 31, 2018, BVI shall have the right to terminate the License Agreement and the advance payment shall not be repaid to MPI. Under the terms of a consent among Comerica Bank, BVI and MPI dated September 5, 2017, Comerica Bank shall receive $100,000 of the $350,000 advance payment from MPI.

BVI also withdrew its notice of termination as of September 5, 2017.

The preceding summary does not purport to be complete and is qualified in its entirety by reference to the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Additional Information about the Proposed Merger between Galena Biopharma, Inc. and SELLAS Life Sciences Group Ltd and Where to Find It

In connection with the proposed merger, Galena Biopharma, Inc. and SELLAS Life Sciences Group Ltd intend to file relevant materials with the Securities and Exchange Commission, or the SEC, including a registration statement on Form S-4 that will contain a proxy statement /prospectus /information statement.

Galena and SELLAS will mail the final proxy statement / prospectus / information statement to their respective stockholders.

Investors and stockholders of Galena and SELLAS are urged to read these materials when they become available because they will contain important information about Galena, SELLAS and the proposed merger.

The proxy statement /prospectus /information statement and other relevant materials (when they become available), and any other documents filed by Galena with the SEC, may be obtained free of charge at the SEC web site at

www.sec.gov

. In addition, copies of the documents filed with the SEC by Galena will be available free of charge on the Company’s website at

www.galenabiopharma.com

(under “Investors” - “Financials”) or by directing a written request to: Galena Biopharma, Inc., 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583, Attention: Investor Relations or by email to:

ir@galenabiopharma.com

. Investors and stockholders are urged to read the proxy statement /prospectus /information statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed merger.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities in connection with the proposed merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

Galena and its directors and executive officers and SELLAS and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Galena in connection with the proposed transaction. Information regarding the special interests of these directors and executive officers in the proposed merger will be included in the proxy statement /prospectus /information statement referred to above.

Additional information regarding the directors and executive officers of Galena is also included in Galena’s proxy statement for its 2017 Annual Meeting of Stockholders, which was filed with the SEC on April 20, 2017. These documents are available free of charge at the SEC’s web site (

www.sec.gov

) and from Investor Relations at Galena at the addresses provided above.

Forward-Looking Statements

This Form 8-K contains statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “estimate,” “may,” “should,” “anticipate,” “will” and similar statements of a future or forward looking nature identify forward-looking statements for purposes of the federal securities laws and otherwise. Forward-looking statements are neither historical facts nor assurances of future performance. All statements, other than statements of historical facts, included in this Form 8-K regarding strategy, future operations, future financial position, prospects, plans and objectives of management are forward-looking statements. Examples of such statements include, but are not limited to, statements relating to the the proposed merger.Galena may not actually achieve the plans disclosed in the forward-looking statements and you should not place undue reliance on these forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, risks and uncertainties associated with stockholder approval of and the ability to consummate the proposed merger through the process being conducted by Galena and SELLAS. Additional risks and uncertainties relating to Galena and its business can be found under the caption “Risk Factors” and elsewhere in the Company’s SEC filings and reports, including in Galena’s Annual Report on Form 10-K, filed with the SEC on March 15, 2017 and the Quarterly Report on Form 10-Q, filed with the SEC on August 14, 2017 and in subsequently filed Form 10-Qs. Galena and SELLAS each disclaims any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made.

Item 8.01 Other Events.

On September 11, 2017, Galena issued a press release relating to the Amendment. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

Exhibit Index

|

|

|

|

|

|

Exhibit No

.

|

Description

|

|

10.1

|

|

|

99.1

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GALENA BIOPHARMA, INC.

|

|

|

|

|

|

|

|

Date:

|

|

September 11, 2017

|

|

|

|

By:

|

|

/s/ Thomas J. Knapp

|

|

|

|

|

|

|

|

|

|

Thomas J. Knapp

Interim General Counsel and Corporate Secretary

|

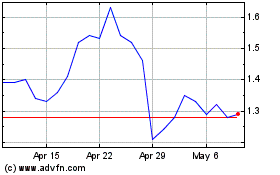

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

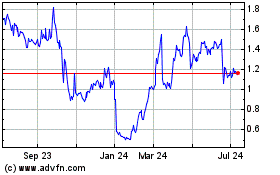

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024