Amended Current Report Filing (8-k/a)

September 08 2017 - 4:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2017

Commercial Metals Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-4304

|

|

75-0725338

|

|

(State or other jurisdiction of

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

incorporation)

|

|

|

|

Identification No.)

|

|

|

|

|

|

6565 N. MacArthur Blvd.

Irving, Texas

|

|

75039

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (214) 689-4300

(Former name or former address, if changed since last report): Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On June 15, 2017, Commercial Metals Company (the “Company”) filed a Current Report on Form 8-K (the “Original

Report”) to report, among other things, its plan to exit its International Marketing and Distribution segment and its estimate of costs associated therewith. The Company is filing this Amendment No. 1 to Current Report on Form 8-K/A to

update its estimate of the exit costs previously disclosed in Item 2.05 of the Original Report.

Item 2.05 Costs Associated with Exit or

Disposal Activities

Depending upon a number of factors, the Company currently estimates that it will record pre-tax, non-cash charges associated with

the entire exit of its International Marketing and Distribution segment in the fourth quarter of fiscal 2017 in the range of $30 to $35 million as well as approximately $5 million in cash charges. Further, the Company will report CMC Cometals as a

discontinued operation in the Company’s statement of earnings beginning in the fourth quarter of fiscal 2017.

All of the above charges, the nature

of such charges and the effect of such charges are estimates and are subject to change.

Forward-Looking Statements

Statements in this Form 8-K about the Company’s estimated charges related to its exit from the International Marketing and Distribution segment constitute

forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These and any other forward-looking statements in this Form 8-K generally can be identified by phrases

such as we, the Company, CMC or its management expects, anticipates, believes, estimates, intends, plans to, ought, could, will, should, likely, appears or other similar words or phrases. There are inherent risks and uncertainties in any

forward-looking statements. Although the Company believes that its estimates and expectations are reasonable, the Company can give no assurance that these estimates and expectations will prove to have been correct, and actual results may vary

materially. Except as required by law, the Company undertakes no obligation to update, amend or clarify any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or

circumstances or otherwise.

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: September 8, 2017

|

|

|

|

|

COMMERCIAL METALS COMPANY

|

|

|

|

|

By:

|

|

/s/ Mary Lindsey

|

|

|

|

Name: Mary Lindsey

|

|

|

|

Title: Senior Vice President and Chief Financial Officer

|

-3-

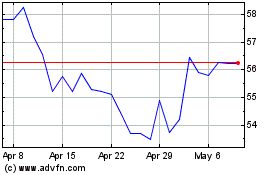

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Apr 2023 to Apr 2024