Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on September 8, 2017

Registration No. 333-219508

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EQT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Pennsylvania

(State or other jurisdiction of

incorporation or organization)

|

|

1311

(Primary Standard Industrial

Classification Code Number)

|

|

25-0464690

(IRS Employer

Identification No.)

|

625 Liberty Avenue, Suite 1700

Pittsburgh, Pennsylvania 15222

(412) 553-5700

(Address, including Zip Code, and Telephone Number, Including

Area Code, of Registrant's Principal Executive Offices)

Lewis B. Gardner, Esq.

General Counsel and Vice President, External Affairs

EQT Corporation

625 Liberty Avenue, Suite 1700

Pittsburgh, Pennsylvania 15222

Telephone: (412) 553-5700

(Name, Address, including Zip Code, and Telephone Number, including

Area Code, of Agent for Service)

|

|

|

|

|

|

|

With a copy to:

|

Steven A. Cohen

Victor Goldfeld

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

|

|

William E. Jordan

Senior Vice President, General Counsel and Corporate Secretary

Rice Energy Inc.

2200 Rice Drive

Canonsburg, Pennsylvania 15317

(724) 271-7200

|

|

Stephen M. Gill

Douglas E. McWilliams

Vinson & Elkins LLP

1001 Fannin Street, Suite 2500

Houston, Texas 77002

(713) 758-2222

|

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement is declared effective and upon completion of the merger described in the joint proxy statement/prospectus contained herein.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General

Instruction G, please check the following box.

o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the

"Securities Act"), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering.

o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

(Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

Emerging growth company

o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

o

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange

Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the SEC, acting pursuant to said section 8(a), may determine.

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities

and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This joint proxy statement/prospectus shall

not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful.

PRELIMINARY—SUBJECT TO COMPLETION—DATED SEPTEMBER 8, 2017

MERGER PROPOSED—YOUR VOTE IS IMPORTANT

Dear Shareholders of EQT Corporation and Stockholders of Rice Energy Inc.:

On

June 19, 2017, EQT Corporation ("EQT"), Eagle Merger Sub I, Inc., an indirect, wholly owned subsidiary of EQT ("Merger Sub"), and Rice Energy Inc. ("Rice")

entered into an Agreement and Plan of Merger (the "merger agreement"), providing for the merger of Merger Sub with and into Rice, with Rice surviving the merger as an indirect, wholly owned subsidiary

of EQT (the "merger"). Following the effective time of the merger, the surviving corporation will merge with and into an indirect, wholly owned limited liability company subsidiary of EQT, with the

limited liability company subsidiary surviving the second merger as an indirect wholly owned subsidiary of EQT.

In

connection with the transactions contemplated by the merger agreement, EQT will issue shares of common stock of EQT to stockholders of Rice (the "share issuance"). Under the rules of

the New York Stock Exchange ("NYSE"), EQT is required to obtain shareholder approval of the share issuance. Accordingly, EQT will hold a special meeting of shareholders (the "EQT special meeting") to

vote on the share issuance (the "share issuance proposal"). At the EQT special meeting, EQT will also propose that its shareholders approve proposals (i) to amend and restate EQT's Restated

Articles of Incorporation to provide that the number of members of the board of directors of EQT (the "EQT board") be not less than five nor more than thirteen (the "charter amendment proposal") and

(ii) to approve the adjournment of the EQT special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the share issuance proposal

(the "EQT adjournment proposal"). Approval of each of these proposals requires the affirmative vote of a majority of the votes cast on each such proposal by holders of EQT's common stock. The EQT

special meeting will be held on [ ] at [ ], at [ ] local time.

The

EQT board unanimously recommends that EQT shareholders vote "

FOR

" the share issuance proposal, "

FOR

" the

charter amendment proposal and "

FOR

" the EQT adjournment proposal

.

In

addition, Rice will hold a special meeting of stockholders (the "Rice special meeting") to vote on a proposal to adopt the merger agreement (the "merger agreement proposal") and

approve related matters as described in the attached joint proxy statement/prospectus. Under the laws of the State of Delaware, the approval of Rice's stockholders must be obtained before the merger

can be completed. Approval of the merger agreement proposal requires the affirmative vote of holders of a majority in voting power of the outstanding shares of Rice stock, in person or by proxy,

entitled to vote on the merger agreement proposal. At the Rice special meeting, Rice will also propose that its stockholders approve proposals (i) to approve, on an advisory (non-binding)

basis, the compensation that may be paid or become payable to Rice's named executive officers in connection with the merger (the "advisory compensation proposal") and (ii) to approve the

adjournment of the Rice special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to adopt the merger agreement (the "Rice adjournment proposal").

Approval of each of the advisory compensation proposal and the Rice adjournment proposal requires the affirmative vote of the holders of a majority in voting power of the shares of Rice stock, present

in person or represented by proxy at the Rice special meeting and entitled to vote on the proposals. The Rice special meeting will be held on [ ] at

[ ], at [ ] local time.

Rice's board of directors unanimously recommends that Rice stockholders vote

"

FOR

" the adoption of the merger agreement, "

FOR

" the advisory compensation proposal and

"

FOR

" the Rice adjournment proposal

.

If

the merger is completed, each outstanding share of Rice common stock (with certain exceptions described in the accompanying joint proxy statement/prospectus) will convert into the

right to receive 0.37 of a share of EQT common stock and $5.30 in cash, without interest and subject to applicable withholding taxes. Although the number of shares of EQT common stock that Rice

stockholders will receive is fixed, the market value of the merger consideration will fluctuate with the market price of EQT common stock and will not be known at the time that Rice stockholders vote

to adopt the merger agreement or at the time EQT shareholders vote to approve the share issuance. Based on the closing price of EQT's common stock on the NYSE on June 16, 2017, the last trading

day before the public announcement of the merger, the 0.37 exchange ratio together with the $5.30 in cash represented approximately $27.04 in value for each share of Rice common stock. Based on EQT's

closing price on [ ], 2017 of $[ ], the 0.37 exchange ratio together with the $5.30

in cash represented approximately

$[ ] in value for each share of Rice common stock. Based upon the estimated number of shares of capital stock as well as the outstanding equity of the parties that

will be outstanding immediately prior to the consummation of the merger, we estimate that, upon consummation of the transaction, existing EQT shareholders will hold approximately 65% and former Rice

stockholders will hold approximately 35% of the outstanding common stock of EQT.

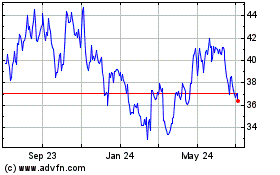

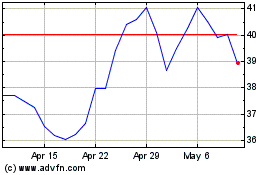

We urge you to obtain current market quotations for EQT (trading symbol "EQT") and Rice (trading

symbol "RICE").

The obligations of EQT and Rice to complete the merger are subject to the satisfaction or waiver of a number of conditions set forth in the

merger agreement, a copy of which is included as Annex A to the attached joint proxy statement/prospectus. The attached joint proxy statement/prospectus describes the EQT special meeting, the

Rice special meeting, the merger, the documents and agreements related to the merger, the share issuance and other related matters. It also contains or references information about EQT and Rice and

certain related agreements and matters.

Please carefully read this entire joint proxy

statement/prospectus, including "Risk Factors," beginning on page 34, for a discussion of the risks relating to the proposed merger.

You also can obtain information

about EQT and Rice from documents that each has filed with the Securities and Exchange Commission.

|

|

|

|

Sincerely,

|

|

|

Steven T. Schlotterbeck

|

|

Daniel Rice IV

|

|

President, Chief Executive Officer and Director

|

|

Chief Executive Officer and Director

|

|

EQT Corporation

|

|

Rice Energy Inc.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with

the merger described in this joint proxy statement/prospectus or determined if this joint proxy statement/prospectus is accurate or complete. Any representation to the contrary is a criminal

offense.

This

document is dated [ ], 2017 and is first being mailed to shareholders of record of EQT and stockholders of record of Rice on or

about

[ ], 2017.

Table of Contents

EQT CORPORATION

625 Liberty Avenue, Suite 1700

Pittsburgh, Pennsylvania 15222

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON [ ]

This is a notice that a special meeting of shareholders (the "EQT special meeting") of EQT Corporation ("EQT") will be held on

[ ] at [ ], at

[ ] local time. This special meeting will be held for the following

purposes:

-

1.

-

to

approve the issuance of shares of common stock of EQT, no par value, to shareholders of Rice Energy Inc. ("Rice") in connection with the Agreement and Plan

of Merger, dated as of June 19, 2017 (as it may be amended from time to time, the "merger agreement"), by and among EQT, Eagle Merger Sub I, Inc., an indirect wholly owned subsidiary of

EQT, and Rice (the "share issuance proposal");

-

2.

-

to

approve an amendment and restatement of EQT's Restated Articles of Incorporation in the form attached to this joint proxy statement/prospectus as Annex B to

provide that the number of members of the board of directors of EQT (the "EQT board") be not less than five nor more than thirteen (the "charter amendment proposal"); and

-

3.

-

to

approve the adjournment of the EQT special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the

share issuance proposal (the "EQT adjournment proposal").

This joint proxy statement/prospectus describes the proposals listed above in more detail. Please refer to the attached document, including the merger agreement

and all other annexes and any documents incorporated by reference, for further information with respect to the business to be transacted at the EQT special meeting. You are encouraged to read the

entire document carefully before voting. In particular, see the section titled "The Merger" beginning on page 56 for a description of the transactions contemplated by the merger agreement,

including the share issuance contemplated by the share issuance proposal, and the section titled "Risk Factors" beginning on page 34 for an explanation of the risks associated with the merger

and the other transactions contemplated by the merger agreement, including the share issuance.

The EQT board unanimously (i) determined the merger agreement and the other agreements and transactions contemplated thereby, including, without

limitation, the merger and the share issuance, are fair to and in the best interests of EQT and its shareholders, (ii) approved and declared advisable the merger agreement and the transactions

contemplated thereby, including the share issuance and the charter amendment and (iii) approved the execution, delivery and performance of the merger agreement. The EQT board recommends that

EQT shareholders vote "

FOR

" the share issuance proposal, "

FOR

" the charter amendment proposal and

"

FOR

" the EQT adjournment proposal

.

The

EQT board has fixed [ ], 2017 as the record date for determination of EQT shareholders entitled to receive notice of, and to vote

at, the EQT

special meeting or any adjournments or postponements thereof. Only holders of record of EQT common stock at the close of business on the record date are entitled to receive notice of, and to vote at,

the EQT special meeting.

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES THAT YOU OWN.

The merger between EQT and Rice cannot be completed without

the approval

of the share issuance proposal by the affirmative vote of a majority of the votes cast on the proposal by holders of EQT's common stock.

Table of Contents

Whether or not you expect to attend the EQT special meeting in person, we urge you to submit a proxy to have your shares voted as promptly as possible by either:

(1) logging onto the website shown on your proxy card and following the instructions to vote online; (2) dialing the toll-free number shown on your proxy card and following the

instructions to vote by phone; or (3) signing and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the EQT special

meeting. Even if you plan to attend the EQT special meeting in person, we request that you complete, sign, date and return the enclosed proxy card and thus ensure that your shares of EQT common stock

will be represented at the EQT special meeting if you are unable to attend

.

If

your shares are held in the name of a broker, bank, trustee or other nominee, please follow the instructions on the voting instruction form furnished by such broker, bank, trustee or

other nominee, as appropriate. If your shares are held through EQT's Employee Savings Plan or EQT's 2014 Long-Term Incentive Plan, you will receive a separate voting direction card. If you have any

questions concerning the share issuance proposal or the other transactions contemplated by the merger agreement or this joint proxy statement/prospectus, would like additional copies or need help

voting your shares of EQT common stock, please contact EQT's proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th floor

New York, New York 10022

Shareholders May Call Toll-Free: (877) 717-3930

Banks & Brokers May Call Collect: (212) 750-5833

|

|

|

|

|

|

|

By order of the Board of Directors

|

|

|

|

Nicole King Yohe

|

|

|

|

Corporate Secretary

|

Table of Contents

RICE ENERGY INC.

2200 Rice Drive

Canonsburg, PA 15317

(724) 271-7200

NOTICE OF 2017 SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON [ ]

This is a notice that a special meeting of stockholders (the "Rice special meeting") of Rice Energy Inc. ("Rice") will be held on

[ ], at [ ], local time,

at [ ]. This special meeting will be held for the following purposes:

-

1.

-

to

adopt the Agreement and Plan of Merger, dated as of June 19, 2017 (as it may be amended from time to time, the "merger agreement"), a copy of which is

attached as Annex A to the joint proxy statement/prospectus of which this notice is a part, among Rice, EQT Corporation ("EQT"), and Eagle Merger Sub I, Inc. ("Merger Sub"), an indirect

wholly owned subsidiary of EQT, pursuant to which Merger Sub will merge with and into Rice (the "merger"), and immediately thereafter Rice will merge with and into another wholly owned indirect

subsidiary of EQT with such indirect subsidiary surviving as a wholly owned subsidiary of EQT, and each outstanding share of Rice common stock (with certain exceptions described in the accompanying

joint proxy statement/prospectus) will be converted into the right to receive 0.37 of a share of common stock, no par value, of EQT, and $5.30 in cash, without interest and subject to applicable

withholding taxes, pursuant to the merger agreement;

-

2.

-

to

approve, on an advisory (non-binding) basis, the compensation that may be paid or become payable to Rice's named executive officers in connection with the merger;

and

-

3.

-

to

approve the adjournment of the Rice special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to adopt the

merger agreement.

This joint proxy statement/prospectus describes the proposals listed above in more detail, as well as other matters contemplated in connection with the proposed

merger. Please refer to the attached document, including the merger agreement and all other annexes and including any documents incorporated by reference, for further information with respect to the

business to be transacted at the Rice special meeting. You are encouraged to read the entire document carefully before voting.

Rice's board of directors (the "Rice board") unanimously determined that it is advisable and in the best interests of Rice's stockholders to enter into the merger

agreement, and unanimously approved the merger agreement and the transactions contemplated by the merger agreement, including the merger, and resolved to recommend adoption of the merger agreement by

Rice's stockholders and that the adoption of the merger agreement be submitted to a vote at a meeting of Rice's stockholders. The Rice board recommends that Rice stockholders vote

"

FOR

" the adoption of the merger agreement, "

FOR

" the approval on an advisory (non-binding) basis of the

compensation that may be paid or become payable to Rice's named executive officers in connection with the merger and "

FOR

" the adjournment of the Rice

special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to adopt the merger agreement.

[ ],

2017 has been fixed as the record date for determination of Rice stockholders entitled to receive notice of, and to vote at, the Rice special

meeting or any adjournments or postponements thereof. Only holders of record of Rice common stock and Rice Class A Preferred Stock at the close of business on the record date are entitled to

receive notice of, and to vote at, the Rice special meeting.

Table of Contents

A

complete list of registered Rice stockholders entitled to vote at the Rice special meeting will be available for inspection at the principal place of business of Rice at 2200 Rice

Drive, Canonsburg, Pennsylvania 15317, during regular business hours for a period of no less than 10 days before the Rice special meeting and at the place of the Rice special meeting during the

meeting.

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES THAT YOU OWN.

The merger between Rice and EQT cannot be completed

without the adoption

of the merger agreement by the affirmative vote, in person or by proxy, of holders of a majority in voting power of the outstanding shares of Rice stock entitled to vote on the merger agreement

proposal as of the record date for the Rice special meeting.

Whether or not you expect to attend the Rice special meeting in person, we urge you to submit a proxy to have your shares voted as promptly as possible by either:

(1) logging onto the website shown on your proxy card and following the instructions to vote online; (2) dialing the toll-free number shown on your proxy card and following the

instructions to vote by phone; or (3) signing and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the Rice special

meeting. If your shares are held in a Rice plan or in the name of a broker, bank or other nominee, please follow the instructions on the voting instruction form furnished by the plan trustee or

administrator, or such broker, bank or other nominee, as appropriate.

If

you have any questions concerning the merger agreement or the merger contemplated by the merger agreement or this joint proxy statement/prospectus, would like additional copies or

need help voting your shares of Rice common stock, please contact Rice's proxy solicitor:

105 Madison Avenue

New York, New York 10016

RICE@mackenziepartners.com

Call Collect: (212) 929-5500

or

Toll-Free: (800) 322-2885

|

|

|

|

|

|

|

By order of the Board of Directors

|

|

|

|

William E. Jordan

|

|

|

|

Senior Vice President, General Counsel and

Corporate Secretary

|

Table of Contents

ADDITIONAL INFORMATION

Both EQT and Rice file annual, quarterly and current reports, proxy statements and other business and financial information with the Securities

and Exchange Commission (the "SEC"). You may read and copy any materials that either EQT or Rice files with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Room 1580,

Washington, D.C. 20549. Please call the SEC at (800) 732-0330 for further information on the Public Reference Room. In addition, EQT and Rice file reports and other business and financial

information with the SEC electronically, and the SEC maintains a website located at http://www.sec.gov containing this information. You can also obtain these documents, free of charge, from EQT at

http://ir.eqt.com or from Rice at http://investors.riceenergy.com. The information contained on, or that may be accessed through, EQT's and Rice's websites is not incorporated by reference into, and

is not a part of, this joint proxy statement/prospectus.

EQT

has filed a registration statement on Form S-4 of which this joint proxy statement/prospectus forms a part with respect to the shares of EQT common stock to be issued

in the merger. This joint proxy statement/prospectus constitutes the prospectus of EQT filed as part of the registration statement. As permitted by SEC rules, this joint proxy statement/prospectus

does not contain all of the information included in the registration statement or in the exhibits or schedules to the registration statement. You may read and copy the registration statement,

including any amendments, schedules and

exhibits in the SEC's reading room at the address set forth above or at the SEC's website mentioned above. Statements contained in this joint proxy statement/prospectus as to the contents of any

contract or other documents referred to in this joint proxy statement/prospectus are not necessarily complete. In each case, you should refer to the copy of the applicable agreement or other document

filed as an exhibit to the registration statement.

This joint proxy statement/prospectus incorporates important business and financial information about EQT and Rice from

documents that are not attached to this joint proxy statement/prospectus. This information is available to you without charge upon your request. You can obtain the documents incorporated by reference

into this joint proxy statement/prospectus free of charge by requesting them in writing or by telephone from the appropriate company or its proxy solicitor at the following addresses and telephone

numbers:

|

|

|

|

|

For EQT shareholders:

|

|

For Rice stockholders:

|

EQT Corporation

625 Liberty Avenue, Suite 1700

Pittsburgh, Pennsylvania 15222

(412) 553-5700

Attention: Corporate Secretary

|

|

Rice Energy Inc.

2200 Rice Drive

Canonsburg, Pennsylvania 15317

(832) 708-3437

Attention: Investor Relations

|

Innisfree M&A Incorporated

501 Madison Avenue, 20th floor

New York, New York 10022

Shareholders May Call Toll-Free: (877) 717-3930

Banks & Brokers May Call Collect: (212) 750-5833

|

|

MacKenzie Partners, Inc.

105 Madison Avenue

New York, New York 10016

RICE@mackenziepartners.com

Call Collect: (212) 929-5500

or

Toll-Free: (800) 322-2885

|

If you would like to request any documents, please do so by [ ], 2017 in order to receive them before the EQT special

meetings or the Rice special meeting, as applicable.

For a more detailed description of the information incorporated by reference into this joint proxy statement/prospectus and how you may obtain it, see "Where You Can Find More

Information" beginning on page 202.

Table of Contents

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This joint proxy statement/prospectus, which forms part of a registration statement on Form S-4 (Registration No. 333-219508)

filed with the SEC by EQT, constitutes a prospectus of EQT under the Securities Act of 1933, as amended, with respect to the shares of EQT common stock to be issued to Rice stockholders in connection

with the merger. This joint proxy statement/prospectus also constitutes a joint proxy statement for both Rice and EQT under the Securities Exchange Act of 1934, as amended. It also constitutes a

notice of meeting with respect to the special meeting of EQT shareholders and a notice of meeting with respect to the special meeting of Rice stockholders.

You

should rely only on the information contained in or incorporated by reference into this joint proxy statement/prospectus. No one has been authorized to provide you with information

that is different from that contained in, or incorporated by reference into, this joint proxy statement/prospectus. This joint proxy statement/prospectus is dated

[ ], 2017, and you should assume that the information contained in this joint proxy statement/prospectus is accurate only as of

such date. You should also assume

that the information incorporated by reference into this joint proxy statement/prospectus is only accurate as of the date of such information.

This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy

in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction. Information contained in this joint proxy statement/prospectus regarding

EQT has been provided by EQT and information contained in this joint proxy statement/prospectus regarding Rice has been provided by Rice.

TABLE OF CONTENTS

i

ii

iii

iv

Table of Contents

QUESTIONS AND ANSWERS

The following are some questions that you, as a shareholder of EQT Corporation ("EQT") or a stockholder of Rice

Energy Inc. ("Rice"), may have regarding the merger, the issuance of shares of EQT common stock to Rice stockholders in connection with the merger and other matters being considered at the

special meetings of EQT's shareholders and Rice's stockholders (the "EQT special meeting" and the "Rice special meeting," respectively) and the answers to those questions. EQT and Rice urge you to

carefully read the remainder of this joint proxy statement/prospectus because the information in this section does not provide all the information that might be important to you with respect to the

merger, the issuance of shares of EQT common stock in connection with the merger and the other matters being considered at the EQT special meeting and the Rice special meeting. Additional important

information is also contained in the annexes to and the documents incorporated by reference into this joint proxy statement/prospectus.

-

Q:

-

Why am I receiving this document?

-

A:

-

EQT,

Rice and Eagle Merger Sub I, Inc., an indirect, wholly owned subsidiary of EQT ("Merger Sub"), have entered into an Agreement and Plan of Merger, dated as

of June 19, 2017 (as it may be amended from time to time, the "merger agreement"), providing for the merger of Merger Sub with and into Rice, with Rice surviving the merger as an indirect

wholly owned subsidiary of EQT (the "merger"). Following the effective time of the merger (the "effective time," and the date of the effective time the "closing date"), the surviving corporation in

the merger will merge with and into an indirect wholly owned limited liability company subsidiary of EQT, with the limited liability company subsidiary surviving the second merger as an indirect

wholly owned subsidiary of EQT (the "post-closing merger" and together with the merger, the "mergers").

In

order to complete the merger, EQT shareholders must approve the proposal to issue EQT common stock, no par value (the "EQT common stock"), to the Rice stockholders pursuant to the merger agreement

(the "share issuance proposal") and Rice stockholders must approve the proposal to adopt the merger agreement (the "merger agreement proposal"), and all other conditions to the merger must be

satisfied or waived.

EQT

and Rice will hold separate special meetings to obtain these approvals and other related matters, including, in the case of EQT, a vote to amend and restate EQT's Restated Articles of

Incorporation (the "EQT articles") in the form attached to this joint proxy statement/prospectus as Annex B to provide that the number of members of EQT's board of directors (the "EQT board")

be not less than five nor more than thirteen (the "charter amendment proposal") and, in the case of Rice, a vote to approve, on an advisory (non-binding) basis, the compensation that may be paid or

become payable to Rice's named executive officers in connection with the merger (the "compensation proposal").

This

joint proxy statement/prospectus, which you should read carefully, contains important information about the merger, the share issuance and other matters being considered at the EQT special

meeting and the Rice special meeting.

-

Q:

-

What will Rice stockholders receive for their shares of Rice common stock in the merger?

-

Q:

-

At the effective time, each share of Rice common stock, par value $0.01 per share (the "Rice common stock") issued and

outstanding immediately prior to the effective time (other than shares of Rice common stock (1) (a) held in treasury by Rice or (b) owned by EQT, Merger Sub or EQT Investments

Holdings, LLC, the intermediate subsidiary of EQT that holds all of Merger Sub's outstanding capital stock, which will automatically be canceled and cease to exist, (2) held by any

wholly owned subsidiary of EQT (other than Merger Sub or EQT Investments Holdings, LLC) or any wholly owned subsidiary of Rice, which will automatically be converted into a number of shares of

EQT common stock equal to the sum of (x) the stock consideration and (y) the quotient

1

Table of Contents

of

the cash consideration and the last reported sale price of EQT common stock on the New York Stock Exchange (the "NYSE") (as reported in The Wall Street Journal) on the closing date, or

(3) held by any holder of record who is entitled to demand and properly demands appraisal of such shares pursuant to and in compliance with the Delaware General Corporate Law (the

"DGCL") (the shares of Rice common stock described in clauses (1) through (3) together, "excluded shares")), will be cancelled and converted automatically into the right

to receive (i) 0.37 shares of EQT common stock (the "exchange ratio") in book-entry form (the "stock consideration") (with cash in lieu of fractional shares, if any) and (ii) $5.30 in

cash, without interest and subject to applicable withholding taxes (the "cash consideration" and, together with the stock consideration, the "merger consideration").

In

addition, Rice will take all actions as may be necessary so that at the effective time, each outstanding restricted stock unit award or performance stock unit award in respect of Rice common stock

will be treated as described in "The Merger—Interests of Certain Rice Directors and Executive Officers in the Merger."

For

additional information regarding the consideration to be received in the merger, see the section entitled "The Merger—Effects of the Merger."

-

Q:

-

If I am a Rice stockholder, how will I receive the merger consideration to which I am entitled?

-

A:

-

As

soon as practicable after the effective time (but no later than the second business day after the closing date), an exchange agent will mail to each holder of

record of Rice common stock (whose shares were converted into the right to receive the merger consideration pursuant to the merger agreement) a letter of transmittal and instructions for use in

effecting the surrender of certificates of Rice common stock ("Rice stock certificates") and book-entry shares representing the shares of Rice common stock ("Rice book-entry shares") in exchange for

the merger consideration. Upon receipt by the exchange agent of (i) either Rice stock certificates or Rice book-entry shares and (ii) a signed letter of transmittal and such other

documents as may be required pursuant to such instructions, the holder of such shares will be entitled to receive the merger consideration in exchange therefor.

-

Q:

-

Who will own EQT immediately following the transactions?

-

A:

-

EQT

and Rice estimate that, upon completion of the merger, EQT shareholders as of immediately prior to the merger will hold approximately 65% and Rice stockholders

will hold approximately 35% of the outstanding common stock of EQT.

-

Q:

-

How important is my vote?

-

A:

-

Your

vote "

FOR

" each proposal presented at the EQT special meeting and/or the Rice special meeting is very important,

and you are encouraged to submit a proxy as soon as possible.

Approval

of the share issuance proposal requires the affirmative vote of a majority of the votes cast on the proposal by holders of EQT's common stock. Any abstention by an EQT shareholder will have

the same effect as a vote against the share issuance proposal. The failure of any EQT shareholder to submit a vote and any broker non-vote will not be counted in determining the votes cast in

connection with this proposal and therefore will have no effect on the outcome of the share issuance proposal. Approval of the charter amendment proposal requires the affirmative vote of a majority of

the votes cast on the proposal by holders of EQT's common stock. Failure to vote, abstentions and broker non-votes will not be counted as votes cast "for" or "against" the charter amendment proposal

and will have no effect on the outcome of the charter amendment proposal. Approval of the proposal to adjourn the EQT special meeting, if necessary or appropriate, to solicit additional proxies in

favor of the share issuance proposal if there are not sufficient votes at

2

Table of Contents

the

time of such adjournment to approve the share issuance (the "EQT adjournment proposal") requires the affirmative vote of a majority of the votes cast on the proposal by holders of EQT's common

stock. Failure to vote, abstentions and broker non-votes will not be counted as votes cast "for" or "against" the EQT adjournment proposal and will have no effect on the outcome of the charter

amendment proposal.

Approval

of the merger agreement proposal requires the affirmative vote of holders of a majority in voting power of the outstanding shares of Rice stock, in person or by proxy, entitled to vote on the

merger agreement proposal. Any abstention by a Rice stockholder, the failure of any Rice stockholder to submit a vote and any broker non-vote will have the same effect as voting against the merger

agreement proposal. Adoption of the compensation proposal requires the affirmative vote of the holders of a majority in voting power of the shares of Rice stock, present in person or represented by

proxy at the Rice special meeting and entitled to vote on the compensation proposal. Abstentions are considered shares present and entitled to vote and will have the same effect as votes "against" the

compensation proposal. Broker non-votes (if any) will have no effect on the outcome of the compensation proposal. Since the compensation proposal is non-binding, if the merger agreement is approved by

Rice stockholders and the merger is completed, the compensation that is the subject of the compensation proposal, which includes amounts EQT or Rice are contractually obligated to pay, would still be

paid regardless of the outcome of the non-binding advisory vote. Approval of the proposal to adjourn the Rice special meeting, if necessary or appropriate, to solicit additional proxies in favor of

the merger agreement proposal if there are not sufficient votes at the time of such adjournment to adopt the merger agreement (the "Rice adjournment proposal") requires the affirmative vote of the

holders of a majority in voting power of the shares of Rice stock, present in person or represented by proxy at the Rice special meeting and entitled to vote on the Rice adjournment proposal.

Abstentions are considered shares present and entitled to vote and will have the same effect as votes "against" the Rice adjournment proposal. Broker non-votes (if any) will have no effect on the

outcome of the Rice adjournment proposal.

-

Q:

-

How do the EQT board and the Rice board recommend that I vote?

-

A:

-

The

EQT board unanimously (i) determined the merger agreement and the other agreements and transactions contemplated thereby, including, without limitation,

the merger and the share issuance, are fair to and in the best interests of EQT and its shareholders, (ii) approved and declared advisable the merger agreement and the transactions contemplated

thereby, including the share issuance and the charter amendment and (iii) approved the execution, delivery and performance of the merger agreement. For a detailed description of the various

factors considered by the EQT board, see the section titled "The Merger—Recommendation of the EQT Board and Reasons for the Merger."

Accordingly,

the EQT board unanimously recommends that EQT shareholders vote "

FOR

" the share issuance proposal,

"

FOR

" the charter amendment proposal and "

FOR

" the EQT adjournment proposal.

Rice's

board of directors (the "Rice board"), after considering the various factors described under "The Merger—Recommendation of the Rice Board and Reasons for the Merger," the

comprehensive process conducted by the Rice board and the alternatives to the merger (including remaining as a stand-alone company), has unanimously determined that it is advisable and in the best

interests of Rice's stockholders to enter into the merger agreement, and unanimously approved the merger agreement and the transactions contemplated by the merger agreement, including the merger, and

resolved to recommend the adoption of the merger agreement by Rice's stockholders and that the adoption of the merger agreement be submitted to a vote at a meeting of Rice's stockholders.

3

Table of Contents

Accordingly,

the Rice board recommends that you vote "

FOR

" the merger agreement proposal, "

FOR

" the

compensation proposal and "

FOR

" the Rice adjournment proposal.

-

Q:

-

Will the EQT common stock received at the time of completion of the merger be traded on an

exchange?

-

A:

-

Yes.

It is a condition to the consummation of the merger that the shares of EQT common stock to be issued to Rice stockholders in connection with the merger be

authorized for listing on the NYSE, subject to official notice of issuance.

-

Q:

-

How will EQT shareholders be affected by the merger?

-

A:

-

Upon

completion of the merger, each EQT shareholder will hold the same number of shares of EQT common stock that such shareholder held immediately prior to completion

of the merger. As a result of the merger, EQT shareholders will own shares in a larger company with more assets. However, because in connection with the merger, EQT will be issuing additional shares

of EQT common stock to Rice stockholders in exchange for their shares of Rice common stock, each outstanding share of EQT common stock immediately prior to the merger will represent a smaller

percentage of the aggregate number of shares of EQT common stock outstanding after the merger.

-

Q:

-

What are the U.S. federal income tax consequences of the merger?

-

A:

-

It

is intended that the merger and the post-closing merger, taken together, qualify as a "reorganization" within the meaning of Section 368(a) of the Internal

Revenue Code of 1986, as amended (the "Code"). It is a condition to each of EQT's and Rice's obligation to complete the mergers that it receive a written opinion from its counsel, Wachtell, Lipton,

Rosen & Katz and Vinson & Elkins LLP, respectively, to the effect that the mergers, taken together, will qualify as a "reorganization" within the meaning of Section 368(a)

of the Code. Accordingly, assuming the receipt and accuracy of such opinions, a U.S. holder (as defined under "The Merger—Material U.S. Federal Income Tax Consequences") of shares of Rice

common stock that receives shares of EQT common stock and cash in exchange for shares of Rice common stock pursuant to the merger generally will recognize gain (but not loss) in an amount equal to the

lesser of (i) the amount by which the sum of the fair market value of the EQT common stock and cash received by the U.S. holder exceeds such U.S. holder's adjusted tax basis in its shares of

Rice common stock surrendered and (ii) the amount of cash received by such U.S. holder. Holders of Rice common stock that are not U.S. holders and that receive shares of EQT common stock and

cash pursuant to the merger may be subject to U.S. withholding tax with respect to cash received.

Holders of Rice common stock should read the section entitled "The Merger—Material U.S. Federal Income Tax Consequences" for a more complete discussion of the U.S.

federal income tax consequences of the mergers. Tax matters can be complicated, and the tax consequences to a particular holder will depend on such holder's particular facts and circumstances. Rice

stockholders should consult their own tax advisors to determine the specific consequences to them of receiving EQT common stock and cash pursuant to the

merger.

-

Q:

-

When do EQT and Rice expect to complete the merger?

-

A:

-

EQT

and Rice currently expect to complete the merger in the second half of fiscal year 2017. However, neither EQT nor Rice can predict the actual date on which the

merger will be completed, nor can the parties assure that the merger will be completed, because completion is subject to conditions beyond either company's control. See the sections entitled "The

Merger—Regulatory Approvals" and "The Merger Agreement—Conditions to Completion of the Merger."

4

Table of Contents

-

Q:

-

What happens if the merger is not completed?

-

A:

-

If

the merger agreement is not adopted by Rice's stockholders, the share issuance is not approved by EQT's shareholders or the merger is not completed for any other

reason, Rice's stockholders will not receive any payment for shares of Rice common stock they own. Instead, Rice will remain an independent public company, Rice common stock will continue to be listed

and traded on the NYSE and registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and Rice will continue to file periodic reports with the SEC on account of Rice's

common stock.

Under

specified circumstances, Rice and/or EQT may be required to reimburse the other party's expenses or pay a termination fee upon termination of the merger agreement, as described under "The Merger

Agreement—Expenses and Termination Fees Relating to the Termination of the Merger Agreement."

-

Q:

-

When and where is the EQT special meeting?

-

A:

-

The

EQT special meeting will be held on [ ], at [ ], local time, at

[ ].

-

Q:

-

When and where is the Rice special meeting?

-

A:

-

The

Rice special meeting will be held on [ ], at [ ], local time, at

[ ].

-

Q:

-

How many votes may I cast?

-

A:

-

Each

share of EQT common stock entitles its holder of record to one vote on each matter considered at the EQT special meeting. Only EQT shareholders who held shares

of EQT common stock at the close of business on [ ], 2017 are entitled to vote at the EQT special meeting and any adjournment or postponement of the EQT special

meeting, so long as such shares remain outstanding on the date of the EQT special meeting.

Each

outstanding share of Rice common stock entitles its holder of record to one vote on each matter considered at the Rice special meeting; each 1/1000th of an outstanding share of Rice

Class A Preferred Stock, par value $0.01 per share (the "Rice preferred stock" and together with the Rice common stock, "Rice stock") entitles its holder of record to one vote on each matter

considered at the Rice special meeting. Only Rice stockholders who held shares of record at the close of business on [ ], 2017 are entitled to vote at the Rice

special meeting and any adjournment or postponement of the Rice special meeting, so long as such shares remain outstanding on the date of the Rice special meeting.

-

Q:

-

Who can vote at each of the EQT special meeting and the Rice special meeting?

-

A:

-

All

holders of shares of EQT common stock who hold such shares of record at the close of business on [ ], 2017, the record date

for the EQT special meeting, are entitled to receive notice of and to vote at the EQT special meeting.

All

holders of shares of Rice common stock and Rice preferred stock who hold such shares of record at the close of business on [ ], 2017, the record date for the

Rice special meeting, are entitled to receive notice of and to vote at the Rice special meeting.

5

Table of Contents

-

Q:

-

What are the record dates in connection with each of the EQT special meeting and the Rice special

meeting?

-

A:

-

The

record date for the determination of shareholders entitled to notice of and to vote at the EQT special meeting is [ ], 2017.

The record date for the determination of stockholders entitled to notice of and to vote at the Rice special meeting is [ ], 2017.

-

Q:

-

What constitutes a quorum at each of the EQT special meeting and the Rice special meeting?

-

A:

-

In

order for business to be conducted at the EQT and Rice special meetings, a quorum must be present. A quorum at the EQT special meeting requires the presence, in

person or by proxy, of holders of a majority of the issued and outstanding shares of EQT common stock entitled to vote at the EQT special meeting. A quorum at the Rice special meeting requires the

presence, in person or by proxy, of holders of a majority in voting power of the outstanding shares of Rice stock entitled to vote at the Rice special meeting.

-

Q:

-

What do I need to do now?

-

A:

-

After

you have carefully read and considered the information contained or incorporated by reference into this joint proxy statement/prospectus, please submit your

proxy via the Internet or by telephone in accordance with the instructions set forth on the enclosed proxy card, or complete, sign, date and return the enclosed proxy card in the postage-prepaid

envelope provided as soon as possible so that your shares will be represented and voted at the EQT special meeting or the Rice special meeting, as applicable.

Additional

information on voting procedures can be found under the section titled "EQT Special Meeting" and under the section titled "Rice Special Meeting."

-

Q:

-

How will my proxy be voted?

-

A:

-

If

you submit your proxy via the Internet, by telephone or by completing, signing, dating and returning the enclosed proxy card, your proxy will be voted in

accordance with your instructions.

Additional

information on voting procedures can be found under the section titled "EQT Special Meeting" and under the section titled "Rice Special Meeting."

-

Q:

-

Who will count the votes?

-

A:

-

The

votes at the EQT special meeting will be counted by three independent judges of election appointed by the EQT board. The votes at the Rice special meeting will be

counted by an independent inspector of election appointed by the Rice board.

-

Q:

-

May I vote in person?

-

A:

-

Yes.

If you are a shareholder of record of EQT at the close of business on [ ], 2017 or a stockholder of record of Rice at the

close of business on [ ], 2017, you may attend your special meeting and vote your shares in person, in lieu of submitting your proxy by Internet, telephone or by

completing, signing, dating and returning the enclosed proxy card.

If

you are a beneficial holder of EQT common stock or Rice common stock, you are also invited to attend the EQT special meeting or the Rice special meeting, as applicable. However, because you are not

the shareholder or stockholder of record, you may not vote your shares in person at the EQT

special meeting or the Rice special meeting, as applicable, unless you request and obtain a valid "legal proxy" from your bank, broker or nominee.

6

Table of Contents

-

Q:

-

What must I bring to attend my special meeting?

-

A:

-

Only

EQT's shareholders of record, or Rice's stockholders of record, as of the close of business on the applicable record date, beneficial owners of EQT common stock

or Rice common stock as of the applicable record date, holders of valid proxies for the EQT special meeting or Rice special meeting, and invited guests of EQT or Rice may attend the applicable special

meeting. All attendees should be prepared to present government-issued photo identification (such as a driver's license or passport) for admittance. The additional items, if any, that attendees must

bring depend on whether they are shareholders or stockholders of record, beneficial owners or proxy holders.

Additionally,

EQT shareholders planning to attend the EQT special meeting will need an admission ticket. Holders of shares in registered name or through EQT's Employee Savings Plan or EQT's 2014

Long-Term Incentive Plan (the "EQT 2014 LTIP") can obtain an admission ticket by checking the appropriate box on their proxy card or direction card, or by writing to EQT's Corporate Secretary at 625

Liberty Avenue, Suite 1700, Pittsburgh, Pennsylvania 15222, Attn: Corporate Secretary. Beneficial owners holding through a broker, bank or other holder of record, must write to EQT's

Corporate Secretary at 625 Liberty Avenue, Suite 1700, Pittsburgh, Pennsylvania 15222, Attn: Corporate Secretary AND must include proof of your ownership of EQT common stock as of the record

date, such as a copy of your brokerage account statement or an omnibus proxy, which you can obtain from your broker, bank or other holder of record, and EQT will send you an admission ticket for the

special meeting.

Additional

information on attending the EQT special meeting and the Rice special meeting can be found under the section titled "EQT Special Meeting" and under the section titled "Rice Special

Meeting."

-

Q:

-

What should I do if I receive more than one set of voting materials for the EQT special meeting or the Rice special

meeting?

-

A:

-

You

may receive more than one set of voting materials for the EQT special meeting or the Rice special meeting or both, including multiple copies of this joint proxy

statement/prospectus and multiple proxy cards or voting instruction forms. For example, if you hold your EQT common stock or Rice common stock in more than one brokerage account, you will receive a

separate voting instruction form for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one

proxy card. Please submit each separate proxy or voting instruction form that you receive by following the instructions set forth in each separate proxy or voting instruction form.

-

Q:

-

What's the difference between holding shares as a shareholder or stockholder of record and holding shares as a beneficial

owner?

-

A:

-

If

your shares of EQT common stock or Rice common stock are registered directly in your name with EQT's transfer agent, Computershare, or Rice's transfer agent,

American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, to be the shareholder of record, in the case of EQT, or the stockholder of record, in the

case of Rice. If you are a shareholder or stockholder of record, then this joint proxy statement and your proxy card have been sent directly to you by EQT or Rice, as applicable.

If

your shares of EQT common stock or Rice common stock are held through a bank, broker or other nominee, you are considered the beneficial owner of the shares of EQT common stock or Rice common stock

held in "street name." In that case, this proxy statement has been forwarded to you by your bank, broker or other nominee who is considered, with respect to those shares, to be the shareholder of

record. As the beneficial owner, you have the right to direct your bank, broker or other nominee how to vote your shares by following their instructions for voting, and

7

Table of Contents

you

are also invited to attend the EQT special meeting or the Rice special meeting, as applicable. However, because you are not the shareholder or stockholder of record, you may not vote your shares

in person at the EQT special meeting or the Rice special meeting, as applicable, unless you request and obtain a valid "legal proxy" from your bank, broker or nominee.

-

Q:

-

If my shares are held in "street name" by my broker, bank or other nominee, will my broker, bank or other nominee automatically vote my shares

for me?

-

A:

-

No.

If your shares are held in the name of a broker, bank or other nominee, you will receive separate instructions from your broker, bank or other nominee describing

how to vote your shares. The availability of Internet or telephonic voting will depend on the nominee's voting process. Please check with your broker, bank or other nominee and follow the voting

procedures provided by your broker, bank or other nominee on your voting instruction form.

You

should instruct your broker, bank or other nominee how to vote your shares. Under the rules applicable to broker-dealers, your broker, bank or other nominee does not have discretionary authority

to vote your shares on any of the proposals scheduled to be voted on at the EQT special meeting or the Rice special meeting. A broker non-vote will have no effect on the outcome of the share issuance

proposal or the charter amendment proposal, but will have the same effect as a vote "against" the adoption of the merger agreement proposal.

Additional

information on voting procedures can be found under the section titled "EQT Special Meeting" and under the section titled "Rice Special Meeting."

-

Q:

-

How do I vote shares of EQT common stock held through EQT's Employee Savings Plan?

-

A:

-

If

you hold shares through EQT's Employee Savings Plan, you will receive a separate voting direction card. The trustee of the EQT Employee Savings Plan will vote your

shares in accordance with the instructions on your returned direction card.

If

you do not return a direction card or if you return a direction card with no instructions, the trustee will vote your shares in proportion to the way other plan participants voted their shares.

Please note that the direction cards have an earlier return date than the proxy cards. Please review your direction card for the date by which your instructions must be received in order for your

shares to be voted.

In

the case of Internet or telephone voting, you should have your direction card in hand and retain the card until you have completed the voting process. If you vote by Internet or telephone, you do

not need to return the direction card by mail.

-

Q:

-

How do I vote restricted shares of EQT common stock held through EQT's 2014 Long-Term Incentive

Plan?

-

A:

-

Employees

of EQT holding restricted shares through the EQT 2014 LTIP will receive a separate voting direction card. The administrator of the EQT 2014 LTIP (or its

designee) will vote your restricted shares in accordance with the instructions on your returned direction card.

If

you return a direction card with no instructions, the administrator or its designee will vote your shares as recommended by the EQT board. If you do not return a direction card, your shares will

not be voted. Please note that the direction cards have an earlier return date than the proxy cards. Please review your direction card for the date by which your instructions must be received in order

for your shares to be voted.

8

Table of Contents

In

the case of Internet or telephone voting, you should have your direction card in hand and retain the card until you have completed the voting process. If you vote by Internet or telephone, you do

not need to return the direction card by mail.

-

Q:

-

What do I do if I am an EQT shareholder and I want to revoke my proxy?

-

A:

-

Shareholders

of record may revoke their proxies at any time before their shares are voted at the EQT special meeting in any of the following

ways:

-

•

-

sending a written notice of revocation to EQT at 625 Liberty Avenue, Suite 1700, Pittsburgh, Pennsylvania 15222, Attention: Corporate

Secretary, which must be received before their shares are voted at the EQT special meeting;

-

•

-

properly submitting a later-dated, new proxy card, which must be received before their shares are voted at the EQT special meeting (in which

case only the later-dated proxy is counted and the earlier proxy is revoked);

-

•

-

submitting a proxy via the Internet or by telephone at a later date, which must be received by 11:59 p.m. Eastern Time on

[ ] (in which case only the later-dated proxy is counted and the earlier proxy is revoked); or

-

•

-

attending the EQT special meeting and voting in person. Attendance at the EQT special meeting will not, however, in and of itself, constitute a

vote or revocation of a prior proxy.

Beneficial

owners of EQT common stock may change their voting instruction by submitting new voting instructions to the brokers, banks or other nominees that hold their shares of record or by

requesting a "legal proxy" from such broker, bank or other nominee and voting in person at the EQT special meeting.

Additional

information can be found under the section titled "EQT Special Meeting."

-

Q:

-

What do I do if I am a Rice stockholder and I want to revoke my proxy?

-

A:

-

Stockholders

of record may revoke their proxies at any time before their shares are voted at the Rice special meeting in any of the following

ways:

-

•

-

sending a written notice of revocation to Rice at 2200 Rice Drive, Canonsburg, Pennsylvania 15317, Attention: Investor Relations, which

must be received before their shares are voted at the Rice special meeting;

-

•

-

properly submitting a later-dated, new proxy card, which must be received before their shares are voted at the Rice special meeting (in which

case only the later-dated proxy is counted and the earlier proxy is revoked);

-

•

-

submitting a proxy via the Internet or by telephone at a later date, which must be received

by [11:59 p.m.] Eastern Time on [ ] (in which case only the later-dated proxy is counted and the earlier proxy is revoked);

or

-

•

-

attending the Rice special meeting and voting in person. Attendance at the Rice special meeting will not, however, in and of itself, constitute

a vote or revocation of a prior proxy.

Beneficial

owners of Rice common stock may change their voting instruction by submitting new voting instructions to the brokers, banks or other nominees that hold their shares of record or by

requesting a "legal proxy" from such broker, bank or other nominee and voting in person at the EQT special meeting.

Additional

information can be found under the section entitled "Rice Special Meeting."

9

Table of Contents

-

Q:

-

What happens if I sell or otherwise transfer my shares of EQT common stock before the EQT special

meeting?

-

A:

-

The

record date for shareholders entitled to vote at the EQT special meeting is [ ], 2017, which is earlier than the date of the

EQT special meeting. If you sell or otherwise transfer your shares after the record date but before the EQT special meeting, unless special arrangements (such as provision of a proxy) are made between

you and the person to whom you transfer your shares and each of you notifies us in writing of such special arrangements, you will retain your right to vote such shares at the EQT special meeting but

will otherwise transfer ownership of your shares of EQT common stock.

-

Q:

-

What happens if I sell or otherwise transfer my shares of Rice common stock before the Rice special

meeting?

-

A:

-

The

record date for stockholders entitled to vote at the Rice special meeting is [ ], 2017, which is earlier than the date of the

Rice special meeting. If you sell or otherwise transfer your shares after the record date but before the Rice special meeting, unless special arrangements (such as provision of a proxy) are made

between you and the person to whom you transfer your shares and each of you notifies us in writing of such special arrangements, you will retain your right to vote such shares at the Rice special

meeting but will otherwise transfer ownership of your shares of Rice common stock.

-

Q:

-

What happens if I sell or otherwise transfer my shares of Rice common stock before the completion of the

merger?

-

A:

-

Only

holders of shares of Rice common stock at the effective time will become entitled to receive the merger consideration. If you sell your shares of Rice common

stock prior to the completion of the merger, you will not become entitled to receive the merger consideration by virtue of the merger.

-

Q:

-

Do any of the officers or directors of Rice have interests in the merger that may differ from or be in addition to my interests as a Rice

stockholder?

-

A:

-

In

considering the recommendation of the Rice board that Rice stockholders vote to adopt the merger agreement proposal, to approve the compensation proposal and to

approve the Rice adjournment proposal, Rice stockholders should be aware that some of Rice's directors and executive officers have interests in the merger that may be different from, or in addition

to, the interests of Rice stockholders generally. The Rice board was aware of and considered these potential interests, among other matters, in evaluating and negotiating the merger agreement and the

transactions contemplated therein, in approving the merger and in recommending the adoption of the merger and the approval of the compensation proposal and the Rice adjournment proposal.

For

more information and quantification of these interests, please see "The Merger—Interests of Certain Rice Directors and Executive Officers in the Merger."

-

Q:

-

Where can I find voting results of the EQT special meeting and the Rice special meeting?

-

A:

-

Rice

and EQT intend to announce their respective preliminary voting results at each of the Rice and EQT special meetings and publish the final results in Current

Reports on Form 8-K that will be filed with the SEC following the Rice special meeting and the EQT special meeting, respectively. All reports that Rice and EQT file with the SEC are publicly

available when filed. See the section titled "Where You Can Find More Information."

10

Table of Contents

-

Q:

-

Do EQT shareholders and Rice stockholders have dissenters' rights or appraisal rights, as

applicable?

-

A:

-

EQT

shareholders are not entitled to dissenters' rights in connection with the merger. Rice stockholders are entitled to appraisal rights in connection with the

merger under Section 262 of the DGCL, provided they satisfy the special criteria and conditions set forth in Section 262 of the DGCL. Rice common stock held by stockholders that do not

vote for approval of the merger and make a demand for appraisal in accordance with Delaware law will not be converted into EQT common stock, but will be converted into the right to receive from the

combined company consideration determined in accordance with Delaware law. For further information relating to appraisal rights and dissenters' rights see the sections in this joint proxy

statement/prospectus titled "The Merger—Appraisal Rights and Dissenters' Rights" and "Appraisal Rights and Dissenters' Rights."

-

Q:

-

How can I find more information about EQT and Rice?

-

A:

-

You

can find more information about EQT and Rice from various sources described in the section titled "Where You Can Find More Information."

-

Q:

-

Who can answer any questions I may have about the EQT special meeting, the Rice special meeting, the merger, or the transactions contemplated

by the merger agreement, including the share issuance?

-

A:

-

If

you have any questions about the EQT special meeting, the Rice special meeting, the merger, the share issuance, or how to submit your proxy, or if you need

additional copies of this joint proxy statement/prospectus or documents incorporated by reference herein, the enclosed proxy card or voting instructions, you should contact:

|

|

|

|

|

For EQT shareholders:

|

|

For Rice stockholders:

|

|

EQT Corporation

625 Liberty Avenue, Suite 1700

Pittsburgh, Pennsylvania 15222

(412) 553-5700

Attention: Corporate Secretary

|

|

Rice Energy Inc.

2200 Rice Drive

Canonsburg, Pennsylvania 15317

(832) 708-3437

Attention: Investor Relations

|

|

Innisfree M&A Incorporated

501 Madison Avenue, 20th floor

New York, New York 10022

Shareholders May Call Toll-Free: (877) 717-3930

Shareholders May Call Collect: (212) 750-5833

|

|

MacKenzie Partners, Inc.

105 Madison Avenue

New York, New York 10016

RICE@mackenziepartners.com

Call Collect: (212) 929-5500

or

Toll-Free: (800) 322-2885

|

11

Table of Contents

SUMMARY

The following summary highlights selected information described in more detail elsewhere in this joint proxy

statement/prospectus and the documents incorporated by reference into this joint proxy statement/prospectus and may not contain all the information that may be important to you. To understand the

merger and the matters being voted on by Rice stockholders and EQT shareholders at their respective special meetings more fully, and to obtain a more complete description of the legal terms of the

merger agreement and the agreements related thereto, you should carefully read this entire document, including the annexes, and the documents to which EQT and Rice refer you. Each item in this summary

includes a page reference directing you to a more complete description of that topic. See "Where You Can Find More Information."

The Parties (see pages 41 and 42)

EQT Corporation

EQT Corporation conducts its business through three business segments: EQT Production, EQT Gathering and EQT Transmission. EQT Production is the

largest natural gas producer in the Appalachian Basin, based on average daily sales volumes, with 13.5 Tcfe of proved natural gas, natural gas liquids ("NGLs") and crude oil reserves across

approximately 3.6 million gross acres, including approximately 790,000 gross acres in the Marcellus play, as of December 31, 2016. EQT Gathering and EQT Transmission provide gathering,

transmission and storage services for EQT's produced gas, as well as for independent third parties across the Appalachian Basin, through EQT's ownership and control of EQT Midstream

Partners, LP ("EQM") (NYSE: EQM), a publicly traded limited partnership formed by EQT to own, operate, acquire and develop midstream assets in the Appalachian Basin.

In

2015, EQT formed EQT GP Holdings, LP ("EQGP") (NYSE: EQGP), a Delaware limited partnership, to own EQT's partnership interests, including the incentive distribution

rights ("IDRs"), in EQM. As of June 30, 2017, EQT owned the entire non-economic general partner interest and 239,715,000 common units, which represented a 90.1% limited partner interest, in

EQGP. As of June 30,

2017, EQGP's only cash-generating assets were the following EQM partnership interests: 21,811,643 EQM common units, representing a 26.6% limited partner interest in EQM; 1,443,015 EQM general partner

units, representing a 1.8% general partner interest in EQM; and all of EQM's IDRs, which entitle EQGP to receive 48.0% of all incremental cash distributed in a quarter after $0.5250 has been

distributed in respect of each common unit and general partner unit of EQM for that quarter. EQT is the ultimate parent company of EQGP and EQM.

Eagle Merger Sub I, Inc.

Merger Sub is an indirect, wholly owned subsidiary of EQT. Merger Sub was formed by EQT solely in contemplation of the merger, has not conducted

any business and has no assets, liabilities or other obligations of any nature other than as set forth in the merger agreement. Its principal executive offices are located at c/o EQT Corporation, 625

Liberty Avenue, Suite 1700, Pittsburgh, Pennsylvania 15222 and its telephone number is (412) 553-5700.

Rice Energy Inc.

Rice Energy Inc. is an independent natural gas and oil company focused on the acquisition, exploration and development of natural gas,

oil and NGL properties in the Appalachian Basin. Rice operates in three business segments, which are managed separately due to their distinct operational differences. The Exploration and Production

segment is engaged in the acquisition, exploration and development of natural gas, oil and NGLs. The Rice Midstream Holdings segment is engaged in the gathering and compression of natural gas

production in Belmont and Monroe Counties, Ohio. The Rice Midstream Partners segment is engaged in the gathering and compression of natural gas production in Washington and Greene Counties,

Pennsylvania, and in the provision of water services to

12

Table of Contents

support

the well completion services of Rice and third parties in Washington and Greene Counties, Pennsylvania and in Belmont County, Ohio.

EQT Special Meeting (see page 43)

Date, Time and Place.

The EQT special meeting will be held on [ ] at [ ],

at [ ] local time.

Purpose.

The EQT special meeting is being held to consider and vote on the following proposals:

-

•

-

Proposal 1.

To approve the

issuance of shares of EQT common stock to Rice stockholders in connection with the merger agreement (referred to previously in this joint proxy statement/prospectus as the share issuance proposal).

-

•

-

Proposal 2.

To approve an

amendment and restatement of the EQT articles in the form attached to this joint proxy statement/prospectus as Annex B to provide that the number of members of the EQT board be not less than

five nor more than thirteen (referred to previously in this joint proxy statement/prospectus as the charter amendment proposal).

-

•

-

Proposal 3.

To approve the