Current Report Filing (8-k)

September 06 2017 - 4:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 6, 2017

VERTEX PHARMACEUTICALS INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

MASSACHUSETTS

(State or other jurisdiction of incorporation)

|

000-19319

(Commission File Number)

|

04-3039129

(IRS Employer Identification No.)

|

50 Northern Avenue

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip Code)

(617) 341-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 6, 2017, Tom Graney agreed to become our Senior Vice President, Chief Financial Officer, effective September 13, 2017. Ian Smith, our current chief financial officer, will remain the company’s Executive Vice President and Chief Operating Officer.

Mr. Graney, age 52, has served as chief financial officer and senior vice president of finance and corporate strategy for Ironwood Pharmaceuticals, Inc. since August 2014. From January 2010 to August 2014, Mr. Graney served as worldwide vice president of finance and chief financial officer of Ethicon, Inc., a maker of surgical medical devices and subsidiary of Johnson and Johnson. From 1994 to 2010, Mr. Graney served in various roles of increasing responsibility at Johnson & Johnson, including most recently as vice president of finance for J&J Global Supply Chain. Mr. Graney serves on the board of directors of AC Immune SA, a biopharmaceutical company. Mr. Graney holds a Bachelor of Science degree in accounting from the University of Delaware and an M.B.A. in marketing, finance and international business from the Leonard N. Stern School of Business at New York University.

In connection with Mr. Graney’s appointment, we entered into an employment agreement and a change of control agreement with Mr. Graney.

Mr. Graney’s initial salary is $550,000 per year, and he will participate in our annual cash bonus and equity programs. Pursuant to his employment agreement, Mr. Graney received a sign-on cash bonus in the amount of $150,000 and on his start date Mr. Graney will receive a restricted stock unit grant for shares of common stock with a fair market value equal to $1,500,000 pursuant to the company’s 2013 Stock and Option Plan.

If Mr. Graney terminates his employment for good reason or we terminate his employment without cause at any time, he will receive 12 months of severance pay at an annual rate equal to his base salary plus his target bonus. Pursuant to the change of control agreement, if we terminate Mr. Graney’s employment without cause on a date within the 90 days prior to or the 12 months after a change of control or he terminates his employment within 30 days of an event giving rise to a right to terminate for good reason and the event occurs on a date within the 90 days prior to or the 12 months after a change of control, he will receive (i) an amount equal to his base salary and target bonus amount, (ii) a final, pro-rated performance bonus for the year in which his employment terminates, and (iii) full vesting of his outstanding options and restricted stock awards.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VERTEX PHARMACEUTICALS INCORPORATED

|

|

|

(Registrant)

|

|

|

|

|

Date: September 6, 2017

|

/s/ Michael J. LaCascia

|

|

|

Michael J. LaCascia

Senior Vice President and General Counsel

|

|

|

|

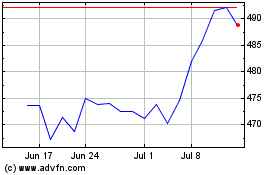

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

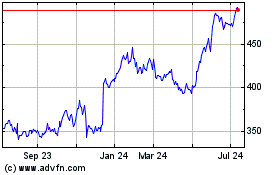

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024