SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

TO

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

ReWalk

Robotics Ltd.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

Options to Purchase Ordinary Shares, par

value 0.01 NIS per share

(Title of Class of Securities)

M8216Q-10-1

(CUSIP Number of Class of Securities (Underlying

Ordinary Shares))

ReWalk Robotics, Inc.

200 Donald Lynch Blvd

Marlborough, MA 01752

(508) 251-1154

(Name, Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on

Behalf of Filing Person)

Copies to:

|

Colin J. Diamond

White & Case LLP

1221 Avenue of the Americas

New York, New York 10020

Tel: (212) 819-820

|

|

Aaron M. Lampert, Adv.

Ephraim Peter Friedman, Adv.

Goldfarb Seligman & Co.

98 Yigal Alon Street

Tel Aviv 6789141, Israel

Tel: +972 (3) 608-9999

|

CALCULATION OF REGISTRATION FEE

|

Transaction

valuation*

|

|

Amount

of filing fee**

|

|

$220,000

|

|

$25.50

|

|

|

*

|

Estimated

solely for purposes of determining the applicable filing fee pursuant to Rule 0-11 of the Securities Exchange Act of 1934, as

amended (“

Rule 0-11

”). This amount assumes that options to purchase an aggregate of 980,483 ordinary

shares of ReWalk Robotics Ltd. having an aggregate value of $220,000 will be exchanged for new restricted share units and cancelled

pursuant to this offer. The aggregate value of such securities was calculated based on the Black-Scholes option pricing model

as of August 31, 2017.

|

|

|

**

|

The amount of the filing

fee, calculated in accordance with the Rule 0-11 under the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory

No. 1 for fiscal year 2017 (until September 30, 2017), equals $115.90 for each $1,000,000 of the value of the transaction. The

transaction valuation set forth above was calculated for the sole purpose of determining the filing fee, and should not be used

or relied upon for any other purpose.

|

|

|

¨

|

Check the box if any part

of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid:

|

|

Not applicable.

|

|

Filing party:

|

|

Not applicable.

|

|

Form or Registration No.:

|

|

Not applicable.

|

|

Date filed:

|

|

Not applicable.

|

|

|

¨

|

Check the box if the filing

relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions

to which the statement relates:

|

|

¨

|

third party tender offer

subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject

to Rule 13e-4.

|

|

|

¨

|

going-private transaction

subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D

under Rule 13d-2.

|

Check the following box if the

filing is a final amendment reporting the results of the tender offer:

¨

If applicable, check the appropriate

box(es) below to designate the appropriate rule provision(s) relied upon:

¨

Rule

13e-4(i) (Cross-Border Issuer Tender Offer)

¨

Rule

14d-1(d) (Cross-Border Third-Party Tender Offer)

|

|

Item 1.

|

Summary Term Sheet.

|

The information set forth under the heading

“Summary Term Sheet” in the document entitled “Offer to Exchange Certain Outstanding Options for Restricted

Share Units,” dated September 6, 2017 (as amended from time to time, the “

Offer to Exchange

”), and

attached hereto as Exhibit (a)(1)(A), is incorporated herein by reference.

|

|

Item 2.

|

Subject Company Information.

|

The name of the issuer is ReWalk Robotics Ltd., an Israeli company

(“

ReWalk

,” the “

Company

,” “

we

” or “

us

”). Our principal

executive offices are located at 3 Hatnufa Street, Floor 6, Yokneam Ilit 2069203, Israel, and our telephone number is +972 (4)

959-0123. The information set forth in the Offer to Exchange under the heading “The Exchange Offer—9. Information about

the Company; Summary Financial Information” is incorporated herein by reference.

This Tender Offer Statement on Schedule TO relates to an offer

by the Company (the “

Exchange Offer

”) made to certain employees and consultants of the Company and its subsidiaries

ReWalk Robotics, Inc., a Delaware company, and ReWalk Robotics GmbH, a German company, for the right to exchange certain of their

outstanding options to purchase ordinary shares, par value NIS 0.01 per share, granted under the ReWalk Robotics Ltd. 2014 Incentive

Compensation Plan (the “

2014 Plan

”), for new restricted share units (the “

New RSUs

”), also

to be granted under the 2014 Plan. Outstanding stock options, whether vested or unvested, may be tendered for exchange pursuant

to this Exchange Offer only if (i) they were granted an exercise price above $6.35, the 52-week high closing price of our ordinary

shares at the time of the commencement of this Exchange Offer as reported on The NASDAQ Stock Market LLC, (ii) they will not expire

before the expiration of the Exchange Offer

and

(iii) they are held by persons who are, on the date of commencement and

expiration of this Offer to Exchange, residents of the United States, Israel, Germany or the United Kingdom and are not otherwise

ineligible to participate in the Exchange Offer. Eligible holders must be employed by us or our subsidiaries or providing services

to us or our subsidiaries on the date the Exchange Offer commences and must remain employed or continue providing services through

the date the New RSUs are granted.

As of August 31, 2017, Eligible Options to purchase an aggregate

of 980,483 ordinary shares were outstanding. The information set forth in the Offer to Exchange under the headings “Summary

Term Sheet,” “Risks Related to the Exchange Offer” and the headings under “The Exchange Offer” titled

“1. Number of Options; Expiration Date,” “5. Acceptance of Options for Exchange and Grant of New RSUs”

and “8. Source and Amount of Consideration; Terms of New RSUs” is incorporated herein by reference.

|

|

(c)

|

Trading Market and Price.

|

The information set forth in the Offer to Exchange under the

heading “The Exchange Offer—7. Price Range of Ordinary Shares” is incorporated herein by reference.

|

|

Item 3.

|

Identity and Background of Filing Person.

|

The information set forth under Item 2(a) above and in the

Offer to Exchange under the heading “The Exchange Offer—10. Interests of Directors and Officers; Transactions and

Arrangements Concerning the Eligible Options” is incorporated herein by reference. The Company is both the filing

person and the subject company.

|

|

Item 4.

|

Terms of the Transaction.

|

The information set forth in the Offer to Exchange under “Summary

Term Sheet,” “Risks Related to the Exchange Offer” and the headings under “The Exchange Offer” titled

“1. Number of Options; Expiration Date,” “2. Purpose of the Exchange Offer,” “3. Procedures for Surrendering

Eligible Options,” “4. Change in Election; Withdrawal of Participation,” “5. Acceptance of Options for

Exchange and Grant of New RSUs,” “6. Conditions of the Exchange Offer,” “8. Source and Amount of Consideration;

Terms of New RSUs,” “9. Information About the Company; Summary Financial Information,” “11. Status of Options

Acquired in the Exchange Offer; Accounting Consequences of the Exchange Offer,” “12. Legal Matters; Regulatory Approvals,”

“13. Material Income Tax Consequences” and “14. Extension of the Exchange Offer; Termination; Amendment”

is incorporated herein by reference.

The information set forth in the Offer to Exchange under

the heading “The Exchange Offer—10. Interests of Directors and Officers; Transactions and Arrangements Concerning

the Eligible Options” is incorporated herein by reference.

|

|

Item 5.

|

Past Contacts, Transactions, Negotiations and Agreements.

|

|

|

(e)

|

Agreements Involving the Subject Company’s Securities.

|

The information set forth in the Offer to Exchange under

the heading “Summary Term Sheet” and under the headings under “The Exchange Offer” titled “8.

Source and Amount of Consideration; Terms of New RSUs” and “10. Interests of Directors and Officers; Transactions

and Arrangements Concerning the Eligible Options” is incorporated herein by reference. The 2014 Plan, pursuant to which

the Eligible Options were granted, is filed herewith as Exhibit (d)(1)(A) and incorporated herein by reference.

|

|

Item 6.

|

Purposes of the Transaction and Plans or Proposals.

|

The Exchange Offer is being conducted for compensatory purposes

as described in the Offer to Exchange. The information set forth in the Offer to Exchange under the headings “Summary Term

Sheet” and “The Exchange Offer—2. Purpose of the Exchange Offer” is incorporated herein by reference.

|

|

(b)

|

Use of Securities Acquired.

|

The information set forth in the Offer to Exchange under the

headings “The Exchange Offer—2. Purpose of the Exchange Offer,” “The Exchange Offer—5. Acceptance

of Options for Exchange and Grant of New RSUs” and “The Exchange Offer—11. Status of Options Acquired in the

Exchange Offer; Accounting Consequences of the Exchange Offer” is incorporated herein by reference.

The information set forth in the Offer to Exchange under the

heading “The Exchange Offer—2. Purpose of the Exchange Offer” is incorporated herein by reference.

|

|

Item 7.

|

Source and Amount of Funds or Other Consideration.

|

The information set forth in the Offer to Exchange under the

headings “The Exchange Offer—8. Source and Amount of Consideration; Terms of New RSUs” and “The Exchange

Offer—15. Fees and Expenses” is incorporated herein by reference.

The information set forth in the Offer to Exchange under the

headings “The Exchange Offer—6. Conditions of the Exchange Offer” and “The Exchange Offer—14. Extension

of the Exchange Offer; Termination; Amendment” is incorporated herein by reference.

Not applicable.

|

|

Item 8.

|

Interest in Securities of the Subject Company.

|

|

|

(a)

|

Securities Ownership.

|

The information set forth in the Offer to Exchange under

the heading “The Exchange Offer—10. Interests of Directors and Officers; Transactions and Arrangements Concerning

the Eligible Options” is incorporated herein by reference.

|

|

(b)

|

Securities Transactions.

|

The information set forth in the Offer to Exchange under

the heading “The Exchange Offer—10. Interests of Directors and Officers; Transactions and Arrangements Concerning

the Eligible Options” is incorporated herein by reference.

|

|

Item 9.

|

Person/Assets, Retained, Employed, Compensated or Used.

|

|

|

(a)

|

Solicitations or Recommendations.

|

Not applicable.

|

|

Item 10.

|

Financial Statements.

|

|

|

(a)

|

Financial Information.

|

The information set forth in the Offer to Exchange under

the headings “The Exchange Offer—9. Information About the Company; Summary Financial Information” and

“The Exchange Offer—Additional Information” is incorporated herein by reference. The Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2016, as amended on Form 10-K/A, can also be accessed

electronically through the website of the Securities and Exchange Commission (the “

SEC

”) at

http://www.sec.gov.

|

|

(b)

|

Pro Forma Information.

|

Not applicable.

|

|

Item 11.

|

Additional Information.

|

|

|

(a)

|

Agreements, Regulatory Requirements and Legal Proceedings.

|

The information set forth in the Offer to Exchange under the

headings “Risks Related to the Exchange Offer,” “The Exchange Offer—10. Interests of Directors and Officers;

Transactions and Arrangements Concerning the Options” and “The Exchange Offer—12. Legal Matters; Regulatory Approvals”

is incorporated herein by reference.

|

|

(c)

|

Other Material Information.

|

Not applicable.

The Exhibit Index included in this Schedule TO is incorporated

herein by reference.

|

|

Item 13.

|

Information Required by Schedule 13E-3.

|

Not applicable.

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

REWALK ROBOTICS LTD.

|

|

|

|

|

|

|

By:

|

/s/ Kevin Hershberger

|

|

|

|

Name: Kevin Hershberger

|

|

|

|

Title: Chief Financial Officer

|

Date: September 6, 2017

EXHIBIT INDEX

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Exchange Certain Outstanding Options for Restricted

Share Units, dated September 6, 2017.

|

|

|

|

|

|

(a)(1)(B)

|

|

Form of e-mail to be sent to eligible employees and consultants upon commencement of the Exchange Offer.

|

|

|

|

|

|

(a)(1)(C)

|

|

Form of notice of election to participate in the Exchange Offer.

|

|

|

|

|

|

(a)(1)(D)

|

|

Form of notice of withdrawal from participation in the Exchange Offer.

|

|

|

|

|

|

(a)(1)(E)

|

|

Form of e-mail regarding confirmation of receipt of notice of election.

|

|

|

|

|

|

(a)(1)(F)

|

|

Form of e-mail regarding confirmation of receipt of notice of withdrawal.

|

|

|

|

|

|

(a)(1)(G)

|

|

Form of reminder e-mail to eligible employees and consultants

regarding the Exchange Offer.

|

|

|

|

|

|

(a)(1)(H)

|

|

Form of email to be sent to grantees of New RSUs providing notice of award of New RSUs.

|

|

|

|

|

|

(a)(1)(I)

|

|

Employee Presentation.

|

|

|

|

|

|

(a)(2)

|

|

Not applicable.

|

|

|

|

|

|

(a)(3)

|

|

Not applicable.

|

|

|

|

|

|

(a)(4)

|

|

Not applicable.

|

|

|

|

|

|

(a)(5)

|

|

Not applicable.

|

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

|

(d)(1)(A)

|

|

ReWalk Robotics Ltd. Incentive Compensation Plan

(incorporated by reference to Exhibit 10.16 to the Company’s registration statement on Form F-1/A (File No. 333-197344), filed with the SEC on August 20, 2014).**

|

|

|

|

|

|

(d)(1)(B)

|

|

Amended and Restated Shareholders’ Rights Agreement, dated July 14, 2014, among the Company and the other parties named therein (incorporated by reference to Exhibit 10.9 to the Company’s registration statement on Form F-1/A (File No. 333-197344), filed with the SEC on July 16, 2014).

|

|

|

|

|

|

(d)(1)(C)

|

|

Form of warrant issued in connection with the Company’s follow-on offering (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 31, 2016).

|

|

|

|

|

|

(d)(1)(D)

|

|

Loan Agreement, dated December 30, 2015, between the Company and Kreos Capital V (Expert Fund) Limited (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on January 4, 2016).

|

|

|

|

|

|

(d)(1)(E)

|

|

Warrant, dated December 30, 2015, between the Company and Kreos Capital V (Expert Fund) Limited (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on January 4, 2016).

|

|

|

|

|

|

(d)(1)(F)

|

|

First Amendment, dated June 9, 2017, to Loan Agreement, dated December 30, 2015, between ReWalk Robotics Ltd. and

Kreos Capital V (Expert Fund) Limited

(incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on August

3

, 2017)

.

|

|

|

|

|

|

(d)(1)(G)

|

|

Secured Convertible Promissory Note, dated June 9, 2017, issued to Kreos Capital V (Expert Fund) Limited (incorporated by reference to Exhibit 4.1 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on August 3, 2017).

|

|

|

|

|

|

(d)(1)(H)

|

|

2014 Incentive Compensation Plan Form of Option Award Agreement for employees and executives (incorporated by reference to Exhibit 10.18 to the Company’s Annual Report on Form 10-K filed with the SEC on February 29, 2016, as amended on May 6, 2016).**

|

|

(d)(1)(I)

|

|

2014 Incentive Compensation Plan Form of Restricted Stock Unit Award Agreement for employees and executives (incorporated by reference to Exhibit 10.19 to the Company’s Annual Report on Form 10-K filed with the SEC on February 29, 2016, as amended on May 6, 2016).**

|

|

|

|

|

|

(d)(1)(J)

|

|

2014 Incentive Compensation Plan Form of Restricted Stock Unit Award Agreement for non-Israeli non-employee directors (incorporated by reference to Exhibit 10.20 to the Company’s Annual Report on Form 10-K filed with the SEC on February 29, 2016, as amended on May 6, 2016).**

|

|

|

|

|

|

(d)(1)(K)

|

|

2014 Incentive Compensation Plan Form of Option Award Agreement for Israeli non-employee directors (incorporated by reference to Exhibit 10.21 to the Company’s Annual Report on Form 10-K filed with the SEC on February 17, 2017, as amended on April 27, 2017).**

|

|

|

|

|

|

(d)(1)(L)

|

|

2014 Incentive Compensation Plan Form of Option Award Agreement for non-Israeli non-employee directors (incorporated by reference to Exhibit 10.22 to the Company’s Annual Report on Form 10-K filed with the SEC on February 17, 2017, as amended on April 27, 2017).**

|

|

|

|

|

|

(d)(1)(M)

|

|

Equity Distribution Agreement, dated May 10, 2016, between the Company and Piper Jaffray & Co., as Agent (incorporated by reference to Exhibit 1.1 to the Company’s Current Report on Form 8-K filed with the SEC on May 10, 2016).

|

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

|

(h)

|

|

Not applicable.

|

|

|

**

|

Management

contract or compensatory plan, contract or arrangement.

|

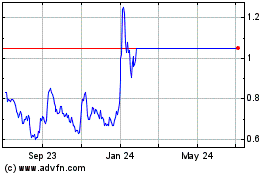

ReWalk Robotics (NASDAQ:RWLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

ReWalk Robotics (NASDAQ:RWLK)

Historical Stock Chart

From Apr 2023 to Apr 2024