- Revenue increased 12 percent

year-over-year to $116 million.

- Gross margin increased 250 basis points

over last year; non-GAAP gross margin increased 210 basis points

over last year.

- Net cash provided by operating

activities was $11.2 million for the three months ended August 4,

2017.

- Increased Fiscal Year 2018 Revenue

guidance to be in the range of $462 to $465 million; Non-GAAP

Revenue guidance to be in the range of $463 to $466 million.

SecureWorks (NASDAQ: SCWX), a leading provider of

intelligence-driven information security solutions, today announced

financial results for its second quarter of fiscal 2018, which

ended August 4, 2017.

“We delivered solid performance this quarter driven by

double-digit revenue growth, continued gross margin expansion, a

narrowing of our net loss and strong operating cash flow,” said

Michael R. Cote, Chief Executive Officer of SecureWorks. “Our

solutions unlock the value of our clients’ cybersecurity

investments, simplify their complex security operations and amplify

their defenses by protecting components of their security

ecosystem. Looking ahead, we remain confident in our position as a

leader in the estimated $20 billion global managed security

services market1 and in our ability to improve sales momentum as

the changes we made to our sales organization take hold in the

second half of the fiscal year.”

Business and operational highlights for the second quarter of

fiscal 2018 include the following:

- SecureWorks was noted as a Leader in

the recent IDC MarketScape: Worldwide Managed Security Service 2017

Vendor Assessment report for “threat intelligence and advanced

threat detection services that are highly sophisticated” and

“Customer feedback [which] included praise for SecureWorks’ portal

improvements, for the breadth of reports, and for the flexibility

of services.”2

- The Company began bundling its Red

Cloak® agent with Server Monitoring, thereby providing advanced

analytics to significantly enhance visibility into potential

threats, and dramatically improving our clients’ security posture

through threat detection and response. This added functionality,

which allows SecureWorks to gather additional security-specific

telemetry, is available for both on-premises and AWS cloud servers

that operate on the Windows platform.

- Shortly after the end of the second

quarter, the Company joined forces with Carbon Black to deliver

managed Advanced Endpoint Threat Prevention (AETP). This fully

managed service features strong endpoint threat prevention via Cb

Defense, a powerful Next-Generation Antivirus (NGAV) product.

SecureWorks Threat Intelligence, backed by its advanced analyst

team and built on the Counter Threat Platform™, adds context and

actionable intelligence to help clients understand and respond to

threats faster. Preventing threats and quickly identifying those

that cannot be prevented are key factors in reducing business risk

and the cost of a breach for clients.

- The company has expanded its program to

orchestrate threat prevention to include certain products from Palo

Alto Networks®, Cisco Systems® and Juniper Networks® as a part of

the SecureWorks managed solution portfolio. This solution delivers

SecureWorks’ proprietary intelligence to market-leading network

security control points, providing proactive protection from

emerging threats.

- At this year’s annual Black Hat

conference, SecureWorks’ Counter Threat Unit released a new threat

analysis detailing an intricate, year-long cyber-espionage campaign

which used targeted spearphishing and social engineering. By

combining robust threat intelligence with its powerful technology,

SecureWorks alerted its clients to this campaign in early

2017.

- The Company teamed up with the National

Health Information Sharing and Analysis Center (NH-ISAC) to provide

critical cybersecurity services to its member organizations as part

the NH-ISAC’s CYBERFIT® services.

____________________

1 Source: Frost & Sullivan estimates the global managed

security services market will grow an average of 16 percent over

the next four years, reaching approximately $20 billion by 2020. 2

Source: “IDC MarketScape: Worldwide Managed Security Services 2017

Vendor Assessment.” Doc # US41320917, Aug 2017

Second Quarter Fiscal 2018 Financial Results

Highlights

- Revenue increased 12.0 percent to

$116.1 million from $103.7 million in the second quarter of fiscal

2017. Non-GAAP revenue increased 11.9 percent to $116.3 million

from $103.9 million in the second quarter of fiscal 2017.

- Gross margin was 51.5 percent, up from

49.0 percent in the second quarter of fiscal 2017. Non-GAAP gross

margin increased to 54.7 percent from 52.6 percent in the second

quarter of fiscal 2017. The increase in GAAP and non-GAAP gross

margins was mainly driven by efficiencies as the Company continues

to leverage its global service delivery model and improve its

technology and processes.

- Operating loss was $18.7 million

compared to $20.0 million in the second quarter of fiscal 2017;

non-GAAP operating loss was $7.8 million compared to $9.6 million

in the second quarter of last year.

- Net loss was $12.1 million, or $0.15

per share, compared to a net loss of $12.1 million, or $0.15 per

share, in the second quarter of fiscal 2017. Non-GAAP net loss was

$5.4 million, or $0.07 per share, compared to a non-GAAP net loss

of $5.6 million, or $0.07 per share, in the second quarter of

fiscal 2017.

- Adjusted EBITDA loss was $4.6 million,

compared to an adjusted EBITDA loss of $7.0 million in the second

quarter of fiscal 2017.

- Cash used by operating activities for

the six months ended August 4, 2017 was $8.4 million and cash

provided by operating activities in second quarter of fiscal 2018

was $11.2 million.

- The number of weighted average shares

outstanding during the second quarter was approximately 80.353

million.

- Monthly recurring revenue as of August

4, 2017 increased 8.4 percent to $32.3 million from $29.8 million

as of July 29, 2016. The Company’s monthly recurring revenue metric

represents the monthly value of its subscription contracts,

including operational backlog, as of period end.

Third Quarter and Full Fiscal Year 2018 Guidance

Based on current market conditions, second quarter performance

and the continued investment in its sales organization, the Company

expects the following results for the third quarter ending on

November 3, 2017 and the full fiscal year ending on February 2,

2018:

For the third quarter, the Company expects:

- Revenue to be in the range of $115 to

$116 million on both a GAAP and non-GAAP basis.

- Net loss per share to be in the range

of $0.17 to $0.19 and non-GAAP net loss per share to be in the

range of $0.09 to $0.10.

- Approximately 80.362 million weighted

average shares to be outstanding during the third quarter of fiscal

2018.

For fiscal year 2018, the Company now expects the following

results, updating previously announced full year guidance:

- Revenue to be in the range of $462 to

$465 million and non-GAAP revenue to be in the range of $463 to

$466 million.

- Net loss to be in the range of $52 to

$54 million and adjusted EBITDA loss to be in the range of $21 to

$25 million.

- Net loss per share to be in the range

of $0.65 to $0.68 and non-GAAP net loss per share to be in the

range of $0.29 to $0.32.

In addition, the Company affirmed the following previously

provided guidance:

- Monthly recurring revenue to be in the

range of $34.4 to $36.4 million at the end of the fourth quarter of

fiscal 2018.

- Approximately 80.286 million weighted

average shares to be outstanding during fiscal year 2018.

- Capital expenditures to be

approximately $18 to $20 million.

Conference Call Information

As previously announced, the Company will hold a conference call

to discuss its second quarter performance and outlook for its third

quarter and full fiscal year 2018 on September 6, 2017, at 8:00

a.m. ET. A live audio webcast of the conference call will be

accessible on the company’s website at

http://investors.secureworks.com. The webcast will be archived at

the same location for one year.

Non-GAAP Financial Measures

The press release presents information about the Company’s

non-GAAP revenue, non-GAAP gross margin, non-GAAP research and

development expenses, non-GAAP sales and marketing expenses,

non-GAAP general and administrative expenses, non-GAAP operating

loss, non-GAAP net loss, non-GAAP net loss per share and adjusted

EBITDA, which are non-GAAP financial measures provided as a

supplement to the results provided in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”). A reconciliation of each of the foregoing historical and

forward-looking non-GAAP financial measures to the most directly

comparable historical and forward-looking GAAP financial measure is

provided below for each of the fiscal periods indicated.

Special Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. In some cases,

you can identify these statements by such forward-looking words as

“anticipate,” “believe,” “confidence,” “could,” “estimate,”

“expect,” “guidance,” “intend,” “may,” “plan,” “potential,”

“outlook,” “should,” “will” and “would,” or similar words or

expressions that refer to future events or outcomes. Such

forward-looking statements include, but are not limited to, the

statements in this press release with respect to the Company’s

expectations concerning its GAAP and non-GAAP revenue and GAAP and

non-GAAP net loss per share for the third quarter of fiscal 2018

and for full year fiscal 2018, net loss and adjusted EBITDA loss

for full year fiscal 2018, capital expenditures for full year

fiscal 2018, weighted average shares outstanding during the third

quarter of fiscal 2018 and full year fiscal 2018, and monthly

recurring revenue at the end of the fourth quarter of fiscal 2018,

all of which reflect the Company’s current analysis of existing

trends and information. These forward-looking statements represent

the Company’s judgment only as of the date of this press

release.

Actual results and events in future periods may differ

materially from those expressed or implied by these forward-looking

statements because of risks, uncertainties and other factors,

including those relating to: the Company’s ability to achieve or

maintain profitability; the Company’s ability to enhance its

existing solutions and technologies and to develop or acquire new

solutions and technologies; the rapidly evolving market in which

the Company operates; the Company’s reliance on personnel with

extensive information security expertise; fluctuations in the

Company’s quarterly results and other operating measures; intense

competition in the Company’s markets; the Company’s ability to

attract new clients, retain existing clients and increase its

annual contract values; the Company’s reliance on its largest

client and on clients in the financial services industry; the

Company’s ability to manage its growth effectively; the Company’s

ability to maintain high-quality client service and support

functions; the Company’s service level agreements with clients

requiring credits for service failures or inadequacies; the

Company’s ability to continue expansion of its sales force; the

Company’s long and unpredictable sales cycles; risks associated

with the Company’s international sales and operations; the

Company’s ability to expand its key distribution relationships; the

Company’s technology alliance partnerships; real or perceived

defects, errors or vulnerabilities in the Company’s solutions or

the failure of its solutions to prevent a security breach; the

ability of the Company’s solutions to interoperate with its

clients’ IT infrastructure; the Company’s ability to use

third-party technologies; the effect of evolving information

security and data privacy laws and regulations on the Company’s

business; the Company’s ability to maintain and enhance its brand;

risks associated with the Company’s acquisition of other

businesses; the Company’s recognition of revenue ratably over the

terms of its managed security and threat intelligence contracts;

the effect of timing differences between the expensing of sales

commissions paid to the Company’s strategic and distribution

partners and the recognition of associated revenues; estimates or

judgments relating to the Company’s critical accounting policies;

the Company’s exposure to fluctuations in currency exchange rates;

the effect of governmental export or import controls on the

Company’s business; the Company’s compliance with the Foreign

Corrupt Practices Act and similar laws; the Company’s ability to

maintain effective disclosure controls and procedures; the effect

of natural disasters and other catastrophic events on the Company’s

ability to serve its clients; the Company’s reliance on patents to

protect its intellectual property rights; the Company’s ability to

protect, maintain or enforce its non-patented intellectual property

rights and proprietary information; claims by third parties of

infringement of their proprietary technology by the Company; the

Company’s use of open source technology; and risks related to the

Company’s relationship with Dell Technologies Inc. and Dell Inc.

and control of the Company by Dell Technologies Inc.

This list of risks, uncertainties and other factors is not

complete. The Company discusses these matters more fully, as well

as certain risk factors that could affect the Company’s business,

financial condition, results of operations and prospects, under the

caption “Risk Factors” in the Company’s annual report on Form 10-K

for the fiscal year ended February 3, 2017, as well as in the

Company’s other SEC filings. Any or all forward-looking statements

the Company makes may turn out to be wrong and can be affected by

inaccurate assumptions the Company might make or by known or

unknown risks, uncertainties and other factors, including those

identified in this press release. Accordingly, you should not place

undue reliance on the forward-looking statements made in this press

release, which speak only as of its date. The Company does not

undertake to update, and expressly disclaims any obligation to

update, any of its forward-looking statements, whether as a result

of circumstances or events that arise after the date the statements

are made, new information or otherwise.

About SecureWorks

SecureWorks® (NASDAQ: SCWX) is a leading global cybersecurity

company that keeps organizations safe in a digitally connected

world. We combine visibility from thousands of clients, artificial

intelligence and automation from our industry-leading SecureWorks

Counter Threat Platform™, and actionable insights from our team of

elite researchers and analysts to create a powerful network effect

that provides increasingly strong protection for our clients. By

aggregating and analyzing data from any source, anywhere, we

prevent security breaches, detect malicious activity in real time,

respond rapidly to incidents, and predict emerging threats. We

offer our clients a cyber-defense that is Collectively Smarter.

Exponentially Safer.™ www.secureworks.com

(Tables Follow)

SECUREWORKS CORP. Condensed Consolidated Statements of

Operations and Related Financial Highlights (in thousands, except

per share data and percentages) (unaudited)

Three Months

Ended Six Months Ended August 4, July 29,

August 4, July 29, 2017 2016

2017 2016 Net revenue $ 116,123 $ 103,653 $ 229,716 $

203,446 Cost of revenue 56,325 52,907

110,267 102,756 Gross margin

59,798 50,746 119,449

100,690 Research and development 19,693 17,373 39,172 34,970

Sales and marketing 37,620 31,820 74,789 62,082 General and

administrative 21,138 21,600

44,542 42,685 Total operating expenses

78,451 70,793 158,503

139,737 Operating loss (18,653 ) (20,047 ) (39,054 ) (39,047

) Interest and other, net (425 ) 851

(1,074 ) 1,216 Loss before income taxes (19,078 )

(19,196 ) (40,128 ) (37,831 ) Income tax benefit (6,960 )

(7,145 ) (13,774 ) (14,153 ) Net loss $

(12,118 ) $ (12,051 ) $ (26,354 ) $ (23,678 ) Net loss per

common share (basic and diluted) $ (0.15 ) $ (0.15 ) $ (0.33 ) $

(0.31 )

Weighted-average common shares outstanding

(basic and diluted)

80,353 80,009 80,205 75,169

Percentage of Total

Net Revenue Gross margin 51.5 % 49.0 % 52.0 % 49.5 % Research

and development 17.0 % 16.8 % 17.1 % 17.2 % Sales and marketing

32.4 % 30.7 % 32.6 % 30.5 % General and administrative 18.2 % 20.8

% 19.4 % 21.0 % Operating expenses 67.6 % 68.3 % 69.0 % 68.7 %

Operating loss (16.1 %) (19.3 %) (17.0 %) (19.2 %) Loss before

income taxes (16.4 %) (18.5 %) (17.5 %) (18.6 %) Net loss (10.4 %)

(11.6 %) (11.5 %) (11.6 %) Effective tax rate 36.5 % 37.2 % 34.3 %

37.4 % Note: Percentage growth rates are calculated based on

underlying data in thousands

SECUREWORKS CORP. Condensed Consolidated Statements of

Financial Position (in thousands) (unaudited)

August

4, February 3, 2017 2017

Assets:

Current assets: Cash and cash equivalents $ 97,780 $ 116,595

Accounts receivable, net 122,664 113,546 Inventories, net 1,170

1,947 Other current assets 51,004 51,947 Total

current assets 272,618 284,035 Property and equipment, net 32,779

31,153 Goodwill 416,487 416,487 Purchased Intangible assets, net

248,053 261,921 Other non-current assets 6,091 5,704

Total assets $ 976,028 $ 999,300

Liabilities and

Stockholders’ Equity:

Current liabilities: Accounts payable $ 23,847 $ 24,119 Accrued and

other 56,287 59,704 Short-term deferred revenue 133,811

119,909 Total current liabilities 213,945 203,732 Long-term

deferred revenue 14,644 14,752 Other non-current liabilities

74,993 89,392 Total liabilities 303,582 307,876

Stockholders’ equity

672,446 691,424

Total liabilities and stockholders’

equity

$ 976,028 $ 999,300

SECUREWORKS CORP.

Condensed Consolidated Statements of Cash Flows (in thousands)

(unaudited)

Six Months Ended

August 4, July 29, 2017 2016 Cash flows

from operating activities: Net loss $ (26,354 ) $ (23,678 )

Adjustments to reconcile net loss to net cash used in operating

activities Depreciation and amortization 20,666 19,422 Change in

fair value of convertible notes - 132 Stock-based compensation

expense 7,158 3,365

Effects of exchange rate changes on

monetary assets and liabilities denominated in foreign

currencies

1,456 (1,129 ) Income tax benefit (15,098 ) (14,153 ) Provision for

doubtful accounts 2,591 1,340 Excess tax benefit from share-based

payments - (221 ) Changes in assets and liabilities: Accounts

receivable (12,491 ) 15,388 Net transactions with parent 7,653

(21,032 ) Inventories 778 25 Other assets 606 109 Accounts payable

(269 ) 4,720 Deferred revenue 13,819 2,651 Accrued and other

liabilities (8,930 ) (8,519 ) Net cash used in

operating activities (8,415 ) (21,580 ) Cash flows from investing

activities: Capital expenditures (8,376 ) (7,930 )

Net cash used in investing activities (8,376 ) (7,930 ) Cash flows

from financing activities: Proceeds from IPO, net - 99,604 Capital

contribution from parent, net - 9,547 Excess tax benefit from

share-based payment - 221 Principal payments on financing

arrangement with Dell Financial Services (800 ) - Taxes paid on

vested restricted shares (1,224 ) - Net cash

(used in) provided by financing activities (2,024 ) 109,372 Net

(decrease) increase in cash and cash equivalents (18,815 ) 79,862

Cash and cash equivalents at beginning of the period 116,595

33,422 Cash and cash equivalents at end of the

period $ 97,780 $ 113,284

Non-GAAP Financial Measures

This press release presents information about the Company’s

non-GAAP revenue, non-GAAP gross margin, non-GAAP research and

development expenses, non-GAAP sales and marketing expenses,

non-GAAP general and administrative expenses, non-GAAP operating

loss, non-GAAP net loss, non-GAAP net loss per share and adjusted

EBITDA, which are non-GAAP financial measures provided as a

supplement to the results provided in accordance with GAAP. The

Company believes these non-GAAP financial measures provide useful

information to help evaluate its operating results by facilitating

an enhanced understanding of its operating performance and enabling

more meaningful period-to-period comparisons. There are limitations

to the use of the non-GAAP financial measures presented in the

press release. These non-GAAP financial measures may not be

comparable to similarly titled measures of other companies. Other

companies, including companies in SecureWorks’ industry, may

calculate non-GAAP financial measures differently than the Company

does, limiting the usefulness of those measures for comparative

purposes.

A reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP financial measure is provided below for

each of the periods indicated. Investors are encouraged to review

the reconciliations in conjunction with the presentation of the

non-GAAP financial measures for each of the periods presented. In

future fiscal periods, the Company may exclude such items and may

incur income and expenses similar to these excluded items.

Accordingly, the exclusion of these items and other similar items

in this non-GAAP presentation should not be interpreted as implying

that these items are non-recurring, infrequent or unusual.

The Company excludes the following items from one or more of its

non-GAAP financial measures:

Impact of purchase accounting. The impact of purchase accounting

consists primarily of purchase accounting adjustments related to a

change in the basis of deferred revenue for the going-private

transaction of Dell Inc. (“Dell”), an indirect parent of the

Company, that was completed on October 29, 2013. The Company

believes it is useful to exclude such purchase accounting

adjustments related to the foregoing transactions as this deferred

revenue generally results from multi-year service contracts under

which deferred revenue is established upon sale and revenue is

recognized over the term of the contract. Pursuant to the fair

value provisions applicable to the accounting for business

combinations, GAAP requires this deferred revenue to be recorded at

its fair value, which is typically less than the book value. In

presenting non-GAAP earnings, the Company adds back the reduction

in revenue that results from this revaluation on the expectation

that a significant majority of these service contracts will be

renewed in the future and therefore the revaluation is not helpful

in predicting its ongoing revenue trends. The Company believes that

this non-GAAP financial adjustment is useful to investors because

it allows investors to (1) evaluate the effectiveness of the

methodology and information used by management in its financial and

operational decision-making, and (2) compare past and future

reports of SecureWorks’ financial results, as the revenue reduction

related to acquired deferred revenue will not recur when related

service contracts are renewed in future periods.

Amortization of intangible assets. Amortization of intangible

assets consists of amortization of customer relationships and

acquired technology. In connection with Dell’s going-private

transaction, all of the Company’s tangible and intangible assets

and liabilities were accounted for and recognized at fair value on

the transaction date. Accordingly, for periods after October 29,

2013, amortization of intangible assets consists of amortization

associated with intangible assets recognized in connection with

Dell’s going-private transaction.

Stock-based compensation. Non-cash stock-based compensation

relates to awards under both the Dell Technologies and SecureWorks

equity plans. We exclude such expenses when assessing the

effectiveness of our operating performance since they do not

necessarily correlate with the underlying operating performance of

the business.

Other expenses. Other expenses include professional fees

incurred by the Company in connection with the Company’s initial

public offering and amounts expensed in the settlement of a legal

matter. The Company excludes these expenses for the purpose of

calculating the non-GAAP financial measures because it believes

these items are outside the ordinary course of business and do not

contribute to a meaningful evaluation of its current operating

performance or comparisons to its past operating performance.

Aggregate adjustment for income taxes. The aggregate adjustment

for income taxes is the estimated combined income tax effect for

the adjustments mentioned above. The tax effects are determined

based on the tax jurisdictions where the above items were

incurred.

As the excluded items can have a material impact on earnings,

management compensates for this limitation by relying primarily on

GAAP results and using non-GAAP financial measures supplementally.

The non-GAAP financial measures are not meant to be considered as

indicators of performance in isolation from or as a substitute for

revenue, gross margin, research and development expenses, sales and

marketing expenses, general and administrative expenses, operating

loss or net loss prepared in accordance with GAAP, and should be

read only in conjunction with financial information presented on a

GAAP basis.

(Tables Follow)

SECUREWORKS CORP. Reconciliation of GAAP to Non-GAAP

Financial Measures (in thousands, except per share data)

(unaudited)

Three Months Ended Six Months Ended August 4,

July 29, August 4, July 29, 2017

2016 2017 2016 GAAP revenue $ 116,123 $

103,653 $ 229,716 $ 203,446 Impact of purchase accounting

146 221 292 442

Non-GAAP revenue $ 116,269 $ 103,874 $ 230,008

$ 203,888 GAAP gross margin $ 59,798 $ 50,746 $

119,449 $ 100,690 Amortization of intangibles 3,411 3,411 6,821

6,821 Impact of purchase accounting 156 356 312 617 Stock-based

compensation expense 217 156 441

175 Non-GAAP gross margin $ 63,582 $

54,669 $ 127,023 $ 108,303 GAAP

research and development expenses $ 19,693 $ 17,373 $ 39,172 $

34,970 Stock-based compensation expense (759 ) (688 )

(1,573 ) (770 ) Non-GAAP research and development

expenses $ 18,934 $ 16,685 $ 37,599 $ 34,200

GAAP sales and marketing expenses $ 37,620 $ 31,820 $

74,789 $ 62,082 Stock-based compensation expense (411 )

(362 ) (625 ) (405 ) Non-GAAP sales and

marketing expenses $ 37,209 $ 31,458 $ 74,164

$ 61,677 GAAP general and administrative expenses $

21,138 $ 21,600 $ 44,542 $ 42,685 Amortization of intangibles

(3,523 ) (3,523 ) (7,047 ) (7,047 ) Impact of purchase accounting

(256 ) (177 ) (512 ) (406 ) Stock-based compensation expense (2,143

) (1,799 ) (4,519 ) (2,015 ) Other - -

- (1,164 ) Non-GAAP general and administrative

expenses $ 15,216 $ 16,101 $ 32,464 $ 32,053

GAAP operating loss $ (18,653 ) $ (20,047 ) $ (39,054

) $ (39,047 ) Amortization of intangibles 6,934 6,934 13,868 13,868

Impact of purchase accounting 412 533 824 1,023 Stock-based

compensation expense 3,530 3,005 7,158 3,365 Other -

- - 1,164 Non-GAAP

operating loss $ (7,777 ) $ (9,575 ) $ (17,204 ) $ (19,627 )

GAAP net loss $ (12,118 ) $ (12,051 ) $ (26,354 ) $ (23,678 )

Amortization of intangibles 6,934 6,934 13,868 13,868 Impact of

purchase accounting 412 533 824 1,023 Stock-based compensation

expense 3,530 3,005 7,158 3,365 Other - - - 1,164 Aggregate

adjustment for income taxes (4,122 ) (3,997 )

(7,356 ) (7,419 ) Non-GAAP net loss $ (5,364 ) $ (5,576 ) $

(11,860 ) $ (11,677 ) GAAP net loss per share $ (0.15 ) $

(0.15 ) $ (0.33 ) $ (0.31 ) Amortization of intangibles 0.09 0.09

0.17 0.18 Impact of purchase accounting 0.01 0.01 0.01 0.01

Stock-based compensation expense 0.04 0.04 0.09 0.04 Other - - -

0.02 Aggregate adjustment for income taxes (0.05 )

(0.06 ) (0.09 ) (0.10 ) Non-GAAP net income loss per

share * $ (0.07 ) $ (0.07 ) $ (0.15 ) $ (0.16 ) * Sum of

reconciling items may differ from total due to rounding of

individual components GAAP net loss $ (12,118 ) $ (12,051 )

$ (26,354 ) $ (23,678 ) Interest and other, net 425 (851 ) 1,074

(1,216 ) Income tax benefit (6,960 ) (7,145 ) (13,774 ) (14,153 )

Depreciation and amortization 10,405 9,796 20,666 19,422

Stock-based compensation expense 3,530 3,005 7,158 3,365 Impact of

purchase accounting 146 221 292 442 Other - -

- 1,164 Adjusted EBITDA $ (4,572

) $ (7,025 ) $ (10,938 ) $ (14,654 )

SECUREWORKS CORP.

Reconciliation of GAAP to Non-GAAP Financial Measures (unaudited)

Three Months Ended Six Months Ended August

4, July 29, August 4, July 29, 2017

2016 2017 2016

Percentage of

Total Net Revenue

GAAP gross margin 51.5 % 49.0 % 52.0 % 49.5 % Non-GAAP adjustment

3.2 % 3.6 % 3.2 % 3.6 % Non-GAAP gross margin 54.7 % 52.6 % 55.2 %

53.1 % GAAP research and development expenses 17.0 % 16.8 %

17.1 % 17.2 % Non-GAAP adjustment (0.7 %) (0.7 %) (0.8 %) (0.4 %)

Non-GAAP research and development expenses 16.3 % 16.1 % 16.3 %

16.8 % GAAP sales and marketing expenses 32.4 % 30.7 % 32.6

% 30.5 % Non-GAAP adjustment (0.4 %) (0.4 %) (0.4 %) (0.2 %)

Non-GAAP sales and marketing expenses 32.0 % 30.3 % 32.2 % 30.3 %

GAAP general and administrative expenses 18.2 % 20.8 % 19.4

% 21.0 % Non-GAAP adjustment (5.1 %) (5.3 %) (5.3 %) (5.3 %)

Non-GAAP general and administrative expenses 13.1 % 15.5 % 14.1 %

15.7 % GAAP operating loss (16.1 %) (19.3 %) (17.0 %) (19.2

%) Non-GAAP adjustment 9.4 % 10.1 % 9.5 % 9.6 % Non-GAAP operating

loss (6.7 %) (9.2 %) (7.5 %) (9.6 %) GAAP net loss (10.4 %)

(11.6 %) (11.5 %) (11.6 %) Non-GAAP adjustment 5.8 % 6.2 % 6.3 %

5.9 % Non-GAAP net loss (4.6 %) (5.4 %) (5.2 %) (5.7 %)

SECUREWORKS CORP. Reconciliation of GAAP to

Non-GAAP Financial Measures (in millions, except per share data)

(unaudited)

Low End of

Guidance High End of Guidance Three Months Ending

Full Year Ending Three Months Ending Full Year

Ending October 3, 2017 February 2, 2018

October 3, 2017 February 2, 2018 GAAP revenue

$ 115 $ 462 $ 116 $ 465 Impact of purchase accounting -

1 - 1 Non-GAAP

revenue $ 115 $ 463 $ 116 $ 466

GAAP net loss per share $ (0.19 ) $ (0.68 ) $ (0.17 ) $ (0.65 )

Amortization of intangibles 0.09 0.35 0.09 0.35 Impact of purchase

accounting 0.01 0.02 0.01 0.02 Stock-based compensation expense

0.05 0.19 0.05 0.19 Aggregate adjustment for income taxes

(0.05 ) (0.20 ) (0.05 ) (0.20 )

Non-GAAP net loss per share *

$ (0.10 ) $ (0.32 ) $ (0.09 ) $ (0.29 ) GAAP net loss $ (54

) $ (52 ) Interest and other, net 2 2 Income tax benefit (30 ) (29

) Depreciation and amortization 41 41 Stock-based compensation

expense 15 15 Impact of purchase accounting 2

2

Adjusted EBITDA *

$ (25 ) $ (21 )

* Sum of reconciling items may differ from

total due to rounding of individual components

Sum of quarterly guidance may differ from full year guidance due to

rounding

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170906005330/en/

SecureWorksInvestor

Inquiries:Rebecca Gardy, 404-417-4803Investor Relations

Officerrgardy@secureworks.comorMedia

Inquiries:Elizabeth W. Clarke, 404-486-4492Director of

Media Relationseclarke@secureworks.com

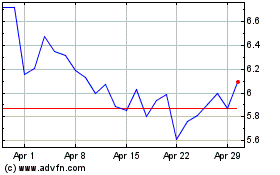

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

From Mar 2024 to Apr 2024

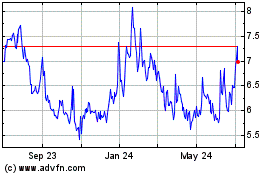

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

From Apr 2023 to Apr 2024