Buenaventura Reaches Commercial Production at Tambomayo

September 05 2017 - 8:01AM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced that the processing plant at the Tambomayo project

located in Arequipa, which was commissioned in December of 2016,

has successfully completed the ramp up process. Tambomayo has

stably operated at 1,500 TPD (full capacity) over a period

exceeding two weeks.

Chief Executive Officer Victor Gobitz reiterated that the

commissioning and ramp up of the plant had been completed on

schedule and commercial operation was reached by September 1, 2017,

“This achievement is further demonstration of the skills and

dedication of our team and the ability to deliver on our promises,”

he said.

As announced in April, Tambomayo´s guidance for 2017 is 60k –

90k gold ounces and 1.6M – 1.9M silver ounces and for a full year

of production Tambomayo will produce 120k – 150k gold ounces and 3M

– 4M silver ounces.

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious metals Company and a major holder of

mining rights in Peru. The Company is engaged in the mining,

processing, development and exploration of gold and silver and

other metals via wholly owned mines, as well as through its

participation in joint exploration projects.

Buenaventura currently operates several mines in Peru

(Orcopampa*, Uchucchacua*, Mallay*, Julcani*, Tambomayo*, El

Brocal, La Zanja and Coimolache) and is developing the San Gabriel

Project.

The Company owns 43.65% of Minera Yanacocha S.R.L (a partnership

with Newmont Mining Corporation), an important precious metal

producer and 19.58% of Sociedad Minera Cerro Verde, an important

Peruvian copper producer.

For a printed version of the Company’s 2016 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning the Company’s, Yanacocha’s and Cerro Verde’s costs and

expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to the Company’s, Yanacocha’s and Cerro Verde’s future

financial performance. Actual results could differ materially from

those projected in the forward-looking statements as a result of a

variety of factors discussed elsewhere in this Press Release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170905005762/en/

Compañia de Minas Buenaventura S.A.A.In

Lima:Carlos Galvez, 511-419-2540Chief Financial

OfficerorRodrigo Echecopar, 511-419 2591Investor

Relations

Coordinatorrodrigo.echecopar@buenaventura.peorIn

NY:Barbara Cano,

646-452-2334barbara.cano@mbsvalue.comorCompany

Website: www.buenaventura.com.pe

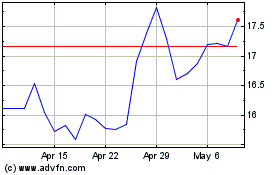

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

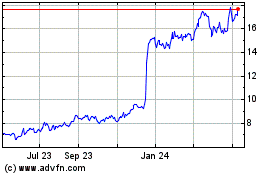

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Apr 2023 to Apr 2024