Cenovus Energy Inc. (TSX:CVE) (NYSE:CVE) has entered into a

definitive agreement to sell its Pelican Lake heavy oil operations,

as well as other miscellaneous assets in northern Alberta for gross

cash proceeds of $975 million. The sale is expected to close on or

before September 30, 2017, subject to normal closing conditions.

Proceeds from the sale will be applied against the $3.6 billion

asset-sale bridge facility put in place to help fund Cenovus’s

acquisition of assets from ConocoPhillips earlier this year. With

the close of this asset sale, the company intends to retire the

first tranche of the bridge facility. The remaining two tranches

mature in November 2018 and May 2019.

“This represents a significant first step in our strategy to

optimize our asset portfolio and deleverage our balance sheet as

planned following the acquisition of the ConocoPhillips assets,”

said Brian Ferguson, Cenovus President & Chief Executive

Officer. “The divestiture processes for the remainder of our legacy

conventional assets are proceeding as expected, with strong

interest from potential buyers.”

The sale process for the company’s Suffield oil and natural gas

assets is well advanced. The company also has data rooms open for

its Palliser assets in southern Alberta as well as its Weyburn

carbon-dioxide enhanced oil recovery operation in Saskatchewan. In

addition, Cenovus has certain other non-core assets that are

currently being considered for sale. The company intends to apply

proceeds from these additional asset sales against its outstanding

debt and remains focused on reaching its target of being below two

times net debt to adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA) in 2019.

CIBC Capital Markets and Barclays Capital Canada Inc. acted as

financial advisors to Cenovus for the Pelican Lake transaction.

| Transaction summary |

| Gross

proceeds ($ millions)1 |

$ |

975 |

| Current

production (BOE/d)2 |

19,600 |

| Operating

margin ($ millions)1,3,4 |

$ |

74 |

| Price per

flowing barrel ($ per BOE/d)1 |

$ |

49,800 |

1 All dollar amounts are in Canadian currency unless

otherwise specified.2 Includes heavy oil production from the

Pelican Lake operations as well as some natural gas production from

other miscellaneous assets in northern Alberta. 3 Year-to-date

as of June 30, 2017.4 Operating margin is an additional subtotal.

For more information, refer to the Non-GAAP Measures and Additional

Subtotal section of the Advisory below.

ADVISORYProduction Presentation

Basis Cenovus presents production volumes on a

net to Cenovus before royalties basis, unless otherwise stated.

Non-GAAP Measures and Additional SubtotalThe

following measures do not have a standardized meaning as prescribed

by IFRS and therefore are considered non-GAAP measures. You should

not consider these measures in isolation or as a substitute for

analysis of our results as reported under IFRS. These measures are

defined differently by different companies in our industry. These

measures may not be comparable to similar measures presented by

other issuers.

Net debt to adjusted EBITDA is a ratio that management uses to

steward the company’s overall debt position as a measure of the

company’s overall financial strength. Net debt is defined as debt

net of cash and cash equivalents. Debt is defined as short-term

borrowings and long-term debt, including the current portion.

Adjusted EBITDA is defined as earnings before finance costs,

interest income, income tax expense, depreciation, depletion and

amortization, goodwill and asset impairments, unrealized gains or

losses on risk management, foreign exchange gains or losses, gains

or losses on divestiture of assets and other income and loss,

calculated on a trailing 12-month basis.

Operating Margin is an additional subtotal found in Note 1 and

Note 8 of the Interim Consolidated Financial Statements (unaudited)

for the period ended June 30, 2017 and is used to provide a

consistent measure of the cash generating performance of Cenovus’s

assets for comparability of its underlying financial performance

between periods. Operating Margin is defined as revenues less

purchased product, transportation and blending, operating expenses,

production and mineral taxes plus realized gains less realized

losses on risk management activities.

Forward-Looking InformationThis document

contains certain forward-looking statements and forward-looking

information (collectively referred to as “forward-looking

information”) within the meaning of applicable securities

legislation, including the United States Private Securities

Litigation Reform Act of 1995, about our current expectations,

estimates and projections about the future, based on certain

assumptions made by us in light of our experience and perception of

historical trends. Although we believe that the expectations

represented by such forward-looking information are reasonable,

there can be no assurance that such expectations will prove to be

correct.

Forward-looking information in this document is identified by

words such as “expect”, “intends”, “target”, “focus”, or

similar expressions and includes suggestions of future outcomes,

including statements about: Cenovus’s ability to close the asset

sale transaction in a timely manner; Cenovus's intention to apply

proceeds from this asset sale to debt; Cenovus's intention to

retire the first tranche of its asset-sale bridge facility with the

close of this asset sale transaction; Cenovus’s positioning to

proceed in a timely manner with further asset sales; Cenovus's

intention to apply proceeds from additional asset sales against its

outstanding debt; and Cenovus's target for net debt to adjusted

EBITDA. Readers are cautioned not to place undue reliance on

forward-looking information as our actual results may differ

materially from those expressed or implied.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward-looking information is based include:

satisfaction of all conditions to the closing of the asset sale

transaction, including obtaining necessary regulatory and partner

approvals; successful closing of the asset sale transaction;

Cenovus’s successful completion of further asset sales, including

in a timely manner; application of asset sale proceeds against

outstanding debt in the manner as intended; and other risks and

uncertainties described from time to time in the filings Cenovus

makes with securities regulatory authorities.

The risk factors and uncertainties that could cause Cenovus's

actual results to differ materially include: risks inherent to

closing of the asset sale transaction, including obtaining

necessary regulatory or other third-party approvals and satisfying

other closing conditions in connection therewith; as well as the

other risk factors and uncertainties identified in Cenovus's Second

Quarter Report for the period ended June 30, 2017 (available on

SEDAR at sedar.com, on EDGAR at sec.gov and

Cenovus's website at cenovus.com), which remain accurate as of

the date of this release. Readers are cautioned that the foregoing

lists are not exhaustive and are made as at the date hereof. Events

or circumstances could cause our actual results to differ

materially from those estimated or projected and expressed in, or

implied by, the forward-looking information. For a full discussion

of Cenovus's material risk factors, see “Risk Factors” in our

Annual Information Form (AIF) or Form 40-F for the period ended

December 31, 2016 and the updates under "Risk Management" in

Cenovus’s Management’s Discussion and Analysis (MD&A) for the

period ended June 30, 2017.

Cenovus Energy Inc.Cenovus Energy Inc. is a

Canadian integrated oil company. It is committed to applying fresh,

progressive thinking to safely and responsibly unlock energy

resources the world needs. Operations include oil sands projects in

northern Alberta, which use specialized methods to drill and pump

the oil to the surface, and natural gas and oil production in

Alberta, British Columbia and Saskatchewan. The company also has

50% ownership in two U.S. refineries. Cenovus shares trade under

the symbol CVE, and are listed on the Toronto and New York stock

exchanges. For more information, visit cenovus.com.

Find Cenovus

on Facebook, Twitter, LinkedIn, YouTube and Instagram.

CENOVUS CONTACTS:

Investor Relations

Kam Sandhar

Vice-President, Investor Relations & Corporate Development

403-766-5883

Steven Murray

Manager, Investor Relations

403-766-3382

Media

Reg Curren

Senior Media Advisor

403-766-2004

Media Relations general line

403-766-7751

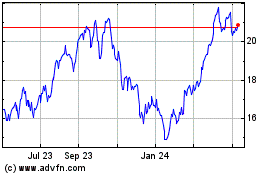

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

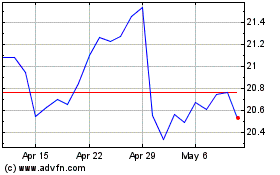

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Apr 2023 to Apr 2024