Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

August 28 2017 - 3:54PM

Edgar (US Regulatory)

As Filed Pursuant to Rule 424(b)(7)

Registration No. 333-190497

PROSPECTUS SUPPLEMENT NO. 5

(To Prospectus dated August 22, 2013)

5,581,835 SHARES OF COMMON STOCK

This prospectus supplement supplements information

contained in the prospectus dated August 22, 2013 covering the resale of shares of our common stock by selling stockholders as

described therein. This prospectus supplement is not complete without, and may not be delivered or utilized except in combination

with, the prospectus, including any amendments or supplements thereto. This prospectus supplement is incorporated by reference

into the prospectus and should be read in conjunction with the prospectus.

Investing in our common stock involves risks.

See “Risk Factors” beginning on page 2 of the prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

supplement is August 28, 2017.

Selling Stockholders

The following information is provided to update

the selling stockholder table in the prospectus to reflect the transfer by Martin Kornblum to Martin B Kornblum Living Trust U/D

DTD 01/22/06 of (1) 11,262 shares of our common stock and (2) a warrant to purchase up to 5,631 shares of our common stock. Where

the name of a selling stockholder identified in the table below also appears in the table in the prospectus the information set

forth in the table below regarding that selling stockholder supersedes and replaces the information regarding such selling stockholder

in the prospectus.

The table below sets forth, for each selling

stockholder, the name, the number of shares of common stock beneficially owned (directly and indirectly via warrants or options),

the maximum number of shares of common stock that may be offered pursuant to this prospectus and the number of shares of common

stock that would be beneficially owned after the sale of the maximum number of shares of common stock.

Unless set forth below, to our knowledge, none

of the selling stockholders are employees or suppliers of ours or our affiliates. Within the past three years, other than any relationships

described below, none of the selling stockholders has held a position as an officer or director of ours, nor has any selling stockholder

had any material relationship of any kind with us or any of our affiliates, except that certain selling stockholders acquired shares

of our common stock and warrants pursuant to the transactions described above. All information with respect to share ownership

has been furnished by the selling stockholders, unless otherwise noted. The shares being offered are being registered to permit

public secondary trading of such shares and each selling stockholder may offer all or part of the shares it owns for resale from

time to time pursuant to the prospectus. In addition, other than the relationships described below, none of the selling stockholders

has any family relationships with our officers, directors or controlling stockholders.

The term “selling stockholders”

also includes any transferees, pledgees, donees, or other successors in interest to the selling stockholders named in the table

below. Unless otherwise indicated, to our knowledge, each person named in the table below has sole voting and investment power

(subject to applicable community property laws) with respect to the shares of common stock set forth opposite such person’s

name. We will file additional prospectus supplements to the prospectus (or post-effective amendments thereto, if necessary) to

name successors to any named selling stockholders who are able to use the prospectus to resell the common stock registered thereby.

|

Name

of Selling Stockholder

|

Shares

Beneficially Owned Before the Offering (excluding shares issuable upon the exercise of warrants or options)

(1)

|

Shares

Beneficially Owned Before the Offering that are Issuable Upon the Exercise of Warrants or Options

(1)

|

Maximum

Number of Shares (including shares issuable upon the exercise of warrants or options) to be Offered in the Offering

|

Number

of Shares (including shares issuable upon the exercise of warrants or options)

Beneficially Owned Immediately

After Sale of Maximum Number of Shares in the Offering

|

|

#

of Shares

(2)

|

%

of Class

(1)(2)

|

|

Martin

B Kornblum Living Trust U/D DTD 01/22/06

|

11,262

|

5,631

|

16,893

|

--

|

--

|

|

Martin

Kornblum

|

--

|

--

|

--

|

--

|

--

|

|

|

(1)

|

Beneficial ownership is determined

in accordance with SEC rules and generally includes voting or investment power with respect

to securities. Shares of common stock subject to options or warrants currently exercisable,

or exercisable within 60 days of August 28, 2017, are counted as outstanding for computing

the percentage of the selling stockholder holding such options or warrants but are not

counted as outstanding for computing the percentage of any other selling stockholder.

|

|

|

(2)

|

Assumes all of the shares of common

stock offered (including shares issuable upon the exercise of warrants or options) are

sold.

|

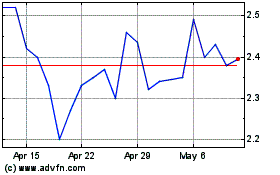

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

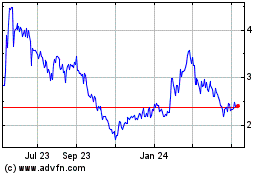

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Apr 2023 to Apr 2024