Current Report Filing (8-k)

August 25 2017 - 4:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

August 25, 2017 (August 24, 2017)

E. I. du Pont de Nemours and Company

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-815

|

|

51-0014090

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

Of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

974 Centre Road

Wilmington, Delaware 19805

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(302) 774-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry into a Material Definitive Agreement

On August 24, 2017, E. I. du Pont de Nemours and Company (“DuPont”) and The Chemours Company (“Chemours”) entered into an amendment (“Amendment No. 1”) to the Separation Agreement, by and between DuPont and Chemours, dated as of July 1, 2015 (as so amended, the “Separation Agreement”).

Amendment No. 1 implements certain previously announced agreements between Chemours and DuPont, which were disclosed by DuPont on a Form 8-K filed on February 13, 2017, related to (1) DuPont’s settlement of cases and claims in the multi-district litigation in the United States District Court for the Southern District of Ohio (the “MDL”) alleging personal injury from exposure to perfluorooctanoic acid and its salts, including the ammonium salt (“PFOA”), in drinking water as a result of the historical manufacture or use of PFOA at the Washington Works plant outside Parkersburg, West Virginia (the “Settlement”), (2) the sharing of the cost of that settlement and (3) potential future PFOA costs.

On September 1, 2017, DuPont will pay $320.35 million to the plaintiffs in the MDL litigation in satisfaction of its previously announced liability under the Settlement and in accordance with its obligations pursuant to Amendment No. 1.

The foregoing description of Amendment No. 1 does not purport to be complete and is subject to, and qualified in its entirety by, the full text of Amendment No. 1, which is attached as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

2.1

|

|

Amendment Number 1 to Separation Agreement, dated August 24, 2017, between E. I. du Pont de Nemours and Company and The Chemours Company.

|

Cautionary Statement About Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. DuPont does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

E. I. DU PONT DE NEMOURS AND COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

/s/ Jeanmarie F. Desmond

|

|

|

Jeanmarie F. Desmond

|

|

|

Vice President and Controller

|

August 25, 2017

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

2.1

|

|

Amendment Number 1 to Separation Agreement, dated August 24, 2017, between E. I. du Pont de Nemours and Company and The Chemours Company.

|

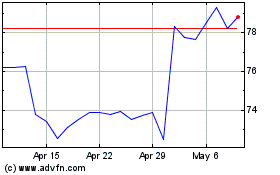

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

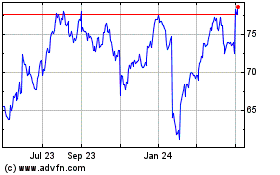

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024