Amended Current Report Filing (8-k/a)

August 25 2017 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

August 25, 2017 (August 16, 2017)

DARIOHEALTH

CORP.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-37704

|

|

45-2973162

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

9 Halamish Street

Caesarea Industrial Park

3088900, Israel

(Address of Principal

Executive Offices)

972-4-770-4055

(Issuer’s

telephone number)

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

Explanatory Note

On August 22, 2017,

DarioHealth Corp. (the “Company”) filed a Current Report on Form 8-K in connection with the closing of concurrent private

placement offerings (the “Prior 8-K”). This Current Report on Form 8-K/A (the “8-K/A”) is being filed to

clarify that the Series B Convertible Preferred Stock, $0.0001 par value per share (the “Series B Preferred Stock”)

is entitled to a fixed 6% dividend, to disclose that the Company filed a Certificate of Correction to the Certificate of Designation

of Preferences, Rights and Limitations of the Series B Preferred Stock to reflect the fixed 6% dividend of the Series B Preferred

Stock, as well as to file the relevant exhibits associated with the offerings.

No other changes were

made to the Prior 8-K and this Form 8-K/A should be read in connection with the Prior 8-K. Accordingly, except as specifically

noted above, this Form 8-K/A does not reflect events occurring after the filing of the Prior 8-K.. Unless filed herewith, references

to the exhibits in this Form 8-K/A are references to the exhibits filed with the Prior 8-K..

|

|

Item 1.01

|

Entry into a Material

Definitive Agreement.

|

Between August 16,

2017 and August 22, 2017, Company executed Securities Purchase Agreements (the “Securities Purchase Agreements”) with

a total of 23 accredited and non-U.S. investors relating to two concurrent placement offerings (collectively, the “Offering”)

of 483,333 shares of the Company’s common stock, $0.0001 par value per share (“Common Stock”), at a purchase

price of $1.80 per share and 2,307,654 shares of the Company’s newly designated Series B Preferred Stock at a purchase price

of $1.80 per share (collectively, the “Securities”). The closing of the Offering took place on August 22, 2017.

Pursuant to the Certificate

of Designation of Preferences, Rights and Limitations of the Series B Preferred Stock (the “Certificate of Designation”),

the shares of Series B Preferred Stock are convertible into an aggregate of 2,307,654 shares of Common Stock based on a conversion

price of $1.80 per share. Such conversion price is not subject to any future price-based anti-dilution adjustments but does carry

customary stock-based anti-dilution protection. The holders of the Series B Preferred Stock will not be entitled to convert such

preferred stock into shares of the Company’s Common Stock until the Company obtains stockholder approval for such issuance

and upon obtaining such stockholder approval shall automatically convert into shares of Common Stock. In addition, the holders

of the Series B Preferred Stock are entitled to a 6% fixed dividend, payable in shares of Common Stock, which shall be payable

upon the automatic conversion of the Series B Preferred Stock. The holders of the Series B Preferred Stock do not possess any voting

rights but the Series B Preferred Stock does carry a liquidation preference for each holder equal to the investment made by such

holder in the Offering, and such liquidation preference applies in certain deemed liquidation events such as a change in control

of the Company. In addition, the holders of Series B Preferred Stock are eligible to participate in dividends and other distributions

by the Company on an as converted basis. On August 23, 2017, the Company filed a Certificate of Correction to the Certificate of

Designation (the “Certificate of Correction”) to reflect that the holders of Series B Preferred Stock are entitled

to a fixed 6% dividend.

The Company has agreed

to file a registration statement covering the resale of the shares of Common Stock sold in the Offering, the shares of Common Stock

underlying the Series B Preferred Stock and the shares of Common Stock issuable upon the payment of the Series B Preferred Stock

dividend, within 60 days of closing.

In addition, in connection

with the Offering, the Company engaged a placement agent and the Company agreed to pay the placement agent an aggregate commission

of $140,000 for the placement of a portion of the Securities sold in the Offering. In addition the Company has agreed to pay a

certain finder a fee of $35,100 and issue 159,333 shares of Common Stock to two additional finders.

The Securities issued

in the Offering are exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities

Act”) pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated thereunder because,

among other things, the transaction did not involve a public offering, the investors are accredited investors, the investors are

taking the securities for investment and not resale and the Company took appropriate measures to restrict the transfer of the securities,

and pursuant to Regulation S of the Securities Act to non-U.S. investors. The Securities have not been registered under the Securities

Act and may not be sold in the United States absent registration or an exemption from registration. This Current Report on Form

8-K shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these Securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state or jurisdiction.

The description of

the Certificate of Designation, Certificate of Correction and the Securities Purchase Agreements, are qualified in their entirety

by reference to the complete text of the Securities Purchase Agreements and Certificate of Designation which have been filed with

this Current Report on Form 8-K as Exhibits 3.1, 3.2, 10.1 and 10.2.

|

|

Item 3.02

|

Unregistered Sales of

Equity Securities.

|

The response to this

item is included in Item 1.01, Entry into a Material Definitive Agreement, and is incorporated herein in its entirety.

|

|

Item 5.03.

|

Amendments to Articles

of Incorporation or Bylaws; Change in Fiscal Year.

|

The Certificate of

Incorporation of the Company authorizes the issuance of up to 5,000,000 shares of preferred stock and further authorizes the Board

of Directors of the Company to fix and determine the designation, preferences, conversion rights, or other rights, including voting

rights, qualifications, limitations, or restrictions of the preferred stock.

On August 22, 2017,

the Company filed the Certificate of Designation with the Delaware Secretary of State to designate the rights and preferences of

up to 2,4000,000 shares of Series B Preferred Stock, 2,307,654 of which were issued in connection with the Offering.

On August 25, 2017,

the Company filed the Certificate of Correction which reflected that the holders of Series B Preferred Stock are entitled to a

fixed 6% dividend.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report

of the Company contains or may contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Statements that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting

the generality of the foregoing, words such as “plan,” “project,” “potential,” “seek,”

“may,” “will,” “expect,” “believe,” “anticipate,” “intend,”

“could,” “estimate” or “continue” are intended to identify forward-looking statements. Readers

are cautioned that certain important factors may affect the Company’s actual results and could cause such results to differ

materially from any forward-looking statements that may be made in this Current Report. Factors that could cause or contribute

to differences between the Company’s actual results and forward-looking statements include, but are not limited to, those

risks discussed in the Company’s filings with the U.S. Securities and Exchange Commission. Readers are cautioned that actual

results (including, without limitation, the results of the Offering) may differ significantly from those set forth in the forward-looking

statements. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by applicable law.

Item 9.01 Financial Statements

and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Dated: August 25, 2017

|

DARIOHEALTH CORP.

|

|

|

|

|

|

By:

|

/s/ Zvi Ben David

|

|

|

|

Name: Zvi Ben David

|

|

|

|

Title: Chief Financial Officer, Treasurer and Secretary

|

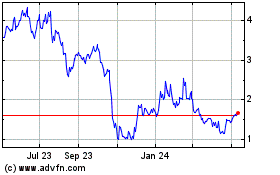

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

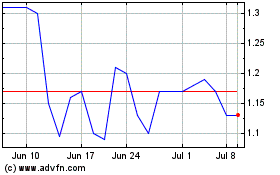

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Apr 2023 to Apr 2024