Current Report Filing (8-k)

August 24 2017 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2017

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-35503

|

|

45-3190813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

175 West Jackson Boulevard

Chicago, Illinois 60604

(Address of principal executive offices, including zip code)

(312)

568-4200

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 or Rule

12b-2

of the Securities Exchange Act of 1934.

Emerging growth

company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

On August 18, 2017, Enova International, Inc. (the

“Company”) and certain subsidiary guarantors (collectively, the “Guarantors”) entered into a note purchase agreement (the “Purchase Agreement”) with Jefferies LLC, as representative of the initial purchasers named

therein (the “Initial Purchasers”), pursuant to which such Initial Purchasers agreed to purchase $250 million aggregate principal amount of the Company’s 8.500% Senior Notes due 2024 (the “Notes”), subject to the terms

and conditions set forth in the Purchase Agreement. The sale of the Notes is expected to be completed on September 1, 2017, subject to customary closing conditions.

The Purchase Agreement contains customary representations and warranties of the parties, as well as indemnification and contribution provisions whereby the

Company, on the one hand, and the Initial Purchasers, on the other hand, have agreed to indemnify each other against certain liabilities. The Purchase Agreement may be terminated under certain circumstances, including in the event that the Company

fails to satisfy the closing conditions set forth therein or upon the occurrence of certain trading and market conditions.

The foregoing description of

the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement filed hereto as Exhibit 10.1, which is incorporated herein by reference.

The Notes and related guarantees have not been registered under the Securities Act or the securities laws of any other jurisdiction, and may not be offered or

sold in the United States absent registration or an applicable exemption from the registration requirements. The offering and sale of the Notes and related guarantees will be made only to qualified institutional buyers in accordance with Rule 144A

under the Securities Act and to

non-U.S.

persons in accordance with Regulation S under the Securities Act.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

The following exhibit is furnished as part of this Report on Form

8-K:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Purchase Agreement by and among Enova International, Inc., the Guarantors party thereto and Jefferies LLC, as Representative of the Initial Purchasers listed therein, dated August 18, 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

Enova International, Inc.

|

|

|

|

|

By:

|

|

/s/ Lisa M. Young

|

|

|

|

Lisa M. Young

|

|

|

|

Vice President—General Counsel & Secretary

|

August 24, 2017

2

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Purchase Agreement by and among Enova International, Inc., the Guarantors party thereto and Jefferies LLC, as Representative of the Initial Purchasers listed therein, dated August 18, 2017

|

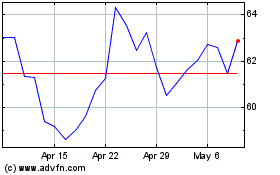

Enova (NYSE:ENVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

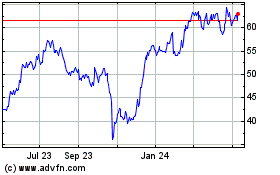

Enova (NYSE:ENVA)

Historical Stock Chart

From Apr 2023 to Apr 2024