By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 24, 2017).

Some of the country's biggest craft brewers are struggling with

falling sales, hurt by a glut of competitors crowding retail

shelves and moves by megabrewers to scoop up some of their

rivals.

"It is more competitive than it has ever been," said Ken

Grossman, founder and chief executive of Sierra Nevada Brewing Co.,

the No. 2 U.S. craft brewer by volume.

His company's retail-store sales were off 7.5% this year as of

July 16, according to Beer Marketer's Insights. The brewer's

shipment volumes fell 6.9% in 2016 -- its first decline since

Sierra Nevada was founded in 1980. Just two years ago, the Chico,

Calif., company logged record sales after opening a second brewery

in North Carolina.

After years of strong gains, American craft brewers are now

bracing for a shakeout. Shipments are falling for many independent

brewers stuck in the middle between local niche brands and

competitors that were bought by heavyweights such as Anheuser-Busch

InBev and Molson Coors.

Besides Sierra Nevada, those losing ground include Sam Adams

maker Boston Beer Co., the biggest independent brewer, as well as

smaller producers such as F.X. Matt Brewing Co., which brews

Saranac in upstate New York, and Abita Brewing Co. in Louisiana,

according to Beer Marketer's Insights.

Benj Steinman, president of the tracking firm, said many craft

brewers trying to push into regional and national markets are

finding they hit a wall once they surpass 100,000 barrels. Some

have stretched themselves too thin and lost ground in their home

markets, while others took on too much debt to expand brewing

capacity, brewers said. As they expand, they also lose the cachet

of being a local brand -- something many consumers seek out.

"They used to say a rising tide lifts all boats. And it is

definitely not that now," Mr. Steinman said. His firm estimates

that shipment volumes declined for 16 of the top 36 craft-style

U.S. brewers last year.

The troubles have continued this year. Retail-store sales of

craft-style beers -- from brewers big and small -- fell $143

million to $2.3 billion in the first half of 2017, according to

data from Nielsen. Craft beer shipments grew for years in the

double digits, even as overall beer sales fell. But craft demand

began to decelerate in 2016.

"We really had to put our big boy underpants on and up our

game," said Sam Calagione, founder and CEO of Dogfish Head Craft

Brewery in Milton, Del. The company's volumes were flat in 2016,

but have grown 27% so far this year, he said. "Is it too crowded,

the market? We're almost at the pace of two new breweries a day.

That pace isn't sustainable."

There were 5,562 total breweries in the U.S. as of June 30, up

roughly 900 from the previous June, according to the Brewers

Association.

Shipments are still rising for many of those craft brewers that

sold themselves to industry heavyweights, including Lagunitas,

which was bought by Heineken in May; Goose Island, owned by AB

InBev since 2011; and Ballast Point, which was purchased by

Constellation Brands Inc. for $1 billion in 2015. Those brands

benefit from their parent companies' distribution networks, capital

and marketing.

Earlier this month, Constellation, which distributes Corona in

the U.S., expanded its push into the craft beer market, acquiring

South Florida's small Funky Buddha Brewery for an undisclosed

amount. The microbrewery, which had 30% volume growth so far this

year, was looking to expand distribution beyond Florida and start

production in cans. Those moves would have required a capital

investment of between $6 million and $8 million, its founders said

in an interview.

"Local is still growing, and the larger ones are having

problems," co-founder Ryan Sentz said. "We saw that as a potential

roadblock in the future. We knew that aligning ourselves with a

partner would be exponentially easier."

Microbreweries like Funky Buddha continue to grow fast: The

5,000 small brewers shipping fewer than 100,000 barrels a year had

an average volume growth last year of 14%, double the growth rate

for the craft category overall, according to Beer Marketer's

Insights.

Dogfish Head, Saranac, Abita and other brewers grappling with

soft sales say they are cutting costs, spending more on marketing

and speeding up the launch of new products. Some are trying to

attract fans of whiskey, wine or margaritas with beers aged in

casks, infused with grapes or flavored with limes.

After a January product recall, Sierra Nevada is getting "back

on track, " Mr. Grossman said, with increased marketing and an

accelerated program for testing new products. Those experimental

brews are often released first through the company's tasting rooms

or its rare-beer club.

Boston Beer recently surprised analysts with second-quarter

results that showed sales declines had moderated; shipments to

retailers fell 3%, after a 14% drop in the first quarter. To regain

ground, executives say the company is cutting costs and pitching

its products -- including cider and hard tea -- to younger and more

diverse consumers.

"When the growth stopped, we had overbuilt," Boston Beer's chief

executive, Martin Roper, said in an email. "Our first reaction was

to wait to see if we could grow again...so it was a little bit of

denial about the new flat-to-negative trends continuing."

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

August 24, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

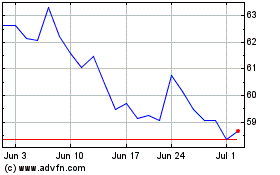

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

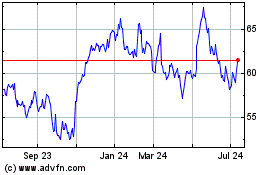

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024