Coty's Beauty Sales Slump

August 22 2017 - 12:48PM

Dow Jones News

By Sharon Terlep

Coty Inc. spent billions on dozens of Procter & Gamble Co.

brands with the goal of becoming one of the world's top players in

the beauty business. So far, the deal has brought mostly pain.

The New York-based company posted a surprise quarterly loss

Tuesday that executives attributed largely to sinking sales of

those products, which include CoverGirl and Max Factor cosmetics

and Clairol hair dye, and unexpected costs associated with the

business it has owned since October. Shares of Coty fell 13% to

$16.93 in morning trading.

Retailers have been reducing shelf space allotted to those

long-struggling P&G brands, exacerbating the already

challenging market for mass-market beauty products.

In an interview, Coty Chief Executive Camillo Pane said

executives didn't realize the extent to which the P&G brands

were suffering until the deal closed. Mr. Pane said he remains

confident that the $11.6 billion acquisition was a good move for

Coty in the long run.

"We feel absolutely confident that we have a roster of brands

that was much stronger than the two legacy companies before," he

said.

Because P&G and Coty were competitors at the time of the

acquisition, provisions of the deal prevented Coty from getting

information on the inner workings of the business.

"We were not aware of anything," Mr. Pane said of the troubles

P&G faced with its brands, such as high fixed costs in the

business and retailers' plans to shrink shelf space. "I don't know

how much they were aware."

Coty reported an adjusted net loss of $3.4 million. A year ago,

it reported an adjusted profit, which excluded the P&G beauty

business, of $45.7 million. Organic sales fell 5%, including a 10%

decline for the consumer beauty business.

Executives declined to provide details on how they would cut

costs or when they expected the business to turn around. The

company plans to shed some of its brands, mainly fragrances and

beauty products, that currently comprise 6% to 8% of its net

sales.

Coty also is pouring money into relaunching struggling brands,

including CoverGirl and Clairol, which contributed to

higher-than-expected costs for the quarter. The company's costs

rose to 53.1% of sales in the quarter ended June 30, from 46.6% a

year earlier.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

August 22, 2017 12:33 ET (16:33 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

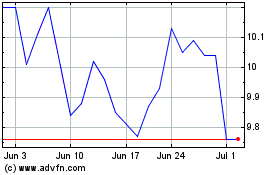

Coty (NYSE:COTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

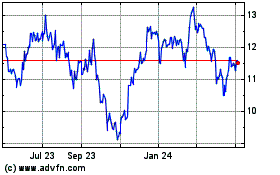

Coty (NYSE:COTY)

Historical Stock Chart

From Apr 2023 to Apr 2024