France's Total to pay $4.95 billion in shares, as Danish group

focuses on shipping

By Sarah Kent and Costas Paris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 22, 2017).

Total SA has agreed to acquire Danish conglomerate A.P.

Moeller-Maersk A/S's oil unit for $4.95 billion, signaling a

renewed appetite for deals in the global oil-and-gas industry.

The deal will help the French energy giant bolster its position

among the world's largest oil companies, potentially boosting its

earnings and cash flow and shoring up its ability to pay

dividends.

By 2019, Total now says its production will reach 3 million

barrels a day of oil and gas -- a level achieved by only a handful

of private companies including Exxon Mobil Corp. and Royal Dutch

Shell PLC. Total currently produces around 2.5 million barrels a

day.

For Maersk, among the world's largest shipping companies, the

deal streamlines its business as it grapples with historic

downturns in both the shipping and oil industries.

It is the first sale for Maersk after it announced plans to

break up the company last September. It is also looking to sell or

list by the end of next year other units, such as Maersk Drilling,

which operates oil and gas rigs mainly in the North Sea, and Maersk

Tankers, which moves oil and oil products on a fleet of 158

vessels, and Maersk Supply, a fleet of 44 support ships for

offshore operations.

Maersk is trying to reshape itself into a global supply-chain

player like United Parcel Service Inc. and FedEx Corp. The plan

involves moving more ships through its port operations, APM

Terminals, and more cargo inland through Damco, its

supply-management division handling airfreight, trucks and

warehouses.

"We are investing in our core business" of shipping, Maersk

Group Chief Executive Soren Skou said. The sale to Total "will

strengthen the financial flexibility of AP Moller-Maersk and free

up resources to focus our future growth on container shipping,

ports and logistics," he said.

The acquisition, announced by both companies on Monday, is the

latest sign of consolidation in the oil-and-gas industry, which

finally appears to be stabilizing after a prolonged downturn in

petroleum prices.

Total and other big oil companies say they have reduced their

costs enough to generate cash at crude prices at current levels,

about $50 a barrel, giving them flexibility to grow through

acquisitions.

In the U.S., where small shale-oil producers have proved

remarkably resilient amid low energy prices, the sector has

experienced a flurry of deals. So far this year, deals in North

America have totaled $73.2 billion, more than in all of 2016,

according to data from Edinburgh-based consultancy Wood

Mackenzie.

Activity has also picked up internationally, particularly in

Europe. Though the number of European deals so far this year stands

at roughly half the level of those completed in 2016, their value

has reached $16.8 billion, compared with $5.3 billion in all of

2016, according to Wood Mackenzie.

Many of the acquirers have been private-equity firms and smaller

players, eager to get a foothold in major oil areas such as the

North Sea.

Earlier this year, Shell sold its British North Sea assets to

Chrysaor Holdings Ltd. in a deal valued at as much as $3.8 billion.

Chrysaor is backed by Harbour Energy Ltd., an investment vehicle

managed by Washington-based EIG Global Energy Partners.

Total's acquisition of Maersk Oil is one of the biggest deals in

the sector since Shell's roughly $50 billion acquisition of BG

Group last year.

Total will pay for the deal with $4.95 billion in shares, while

also taking on $2.5 billion in Maersk oil debt. The French company

will also assume nearly $3 billion in expected costs for

decommissioning oil rigs in the North Sea.

In Monday trading, Total's shares rose 0.3% while Maersk closed

up 2.9%.

"We imagine [Total] investors won't be overly enthused with the

idea of buying more oil barrels when they are overly concerned with

falling oil demand," Bernstein said Monday in a note that praised

the deal for adding potentially profitable barrels.

The deal is a vote of confidence in the North Sea, where around

80% of Maersk's reserves are located. The region has been a major

oil-and-gas hub for decades but has also been plagued by high

costs, aging infrastructure and declining production.

Total will be northwest Europe's second-largest offshore

operator once the deal closes, expected in next year's first

quarter. The deal has been approved by both companies' boards but

remains subject to shareholder votes and regulatory approvals.

--Dominic Chopping contributed to this article.

Write to Sarah Kent at sarah.kent@wsj.com and Costas Paris at

costas.paris@wsj.com

(END) Dow Jones Newswires

August 22, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

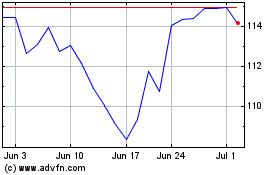

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

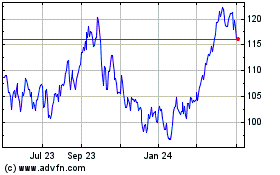

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024