UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

August 2017

Commission file number: 001-36288

Akari

Therapeutics, Plc

(Translation of registrant's name into English)

24 West 40

th

Street, 8

th

Floor

New York, NY 10018

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(1):_____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulations S-T Rule 101(b)(7):_____

CONTENTS

On August 18, 2017,

the Board of Directors (the “Board”) of Akari Therapeutics, Plc (the “Company”) appointed Dr. David Horn

Solomon to the Board, effective as of August 28, 2017, as a Class A director until the 2018 annual meeting of the Company’s

shareholders. Dr. Solomon was also hired, pursuant to the Executive Employment Agreement, dated August 18, 2017 (the “Employment

Agreement”), to be the Chief Executive Officer of the Company, effective August 28, 2017 (the “Employment Date”).

The Employment Agreement

has a term of two years from the Employment Date with automatic renewals for successive one-year periods. Either party may give

notice of non-renewal of the current term at least 90 days prior to the expiration of the current term. The Company is entitled

to terminate the Employment Agreement upon notice in the case of termination with or without cause or upon Dr. Solomon’s

death or disability. Dr. Solomon is entitled to terminate the employment agreement upon notice for good reason or upon at least

90 days’ prior written notice. Termination of Dr. Solomon’s employment for any reason will constitute his resignation

from the Board, if he is serving as a director at that time.

Under the Employment

Agreement, Dr. Solomon’s annual base salary is $500,000 which is subject to review on an annual basis and he is entitled

to a one-time cash bonus of $50,000 plus relocation expenses of up to $80,000 with a gross up for taxes, and a monthly perquisite

payment of $1,000. Dr. Solomon must relocate his primary residence to and be resident in the New York metropolitan area by August

1, 2018. Dr. Solomon is also eligible to receive an annual cash bonus with a target of 40% of base salary, provided that the actual

amount of such bonus shall be determined by the Board or an appropriate committee thereof in its sole discretion. Any bonus for

a year in which Executive is employed for less than the full year will be prorated, The Employment Agreement also provides that

Dr. Solomon is entitled following the Employment Date to a stock option to purchase 26,000,000 Ordinary Shares (equivalent to 260,000

ADSs) under the Company’s Amended and Restated 2014 Equity Incentive Plan. The option will have a term of ten years with

an exercise price equal to the closing price of the grant date and will vest ratably on an annual basis over four years, beginning

on the grant date, provided that Dr. Solomon remains employed with the Company, and subject to acceleration in the case of change

of control.

Upon termination of

Dr. Solomon’s employment by the Company for cause or by Dr. Solomon without good reason or in the case of Dr. Solomon’s

disability or death or by non-renewal by Dr. Solomon, then he shall be entitled to any accrued but unpaid base salary, expense

reimbursement and vested and accrued benefits.

Upon termination of

Dr. Solomon’s employment without cause, or by Dr. Solomon for good reason or upon non-renewal by the Company of the term,

in addition to any accrued but unpaid base salary, expense reimbursement and vested and accrued benefits, he shall be entitled

to receive an amount equal to (i) 12 months of base salary in effect before the employment terminates, plus (ii) the target

annual performance bonus to which Dr. Solomon may have been entitled to for the year in which the employment terminates; provided

that, in the event of non-renewal of the term, such performance bonus is pro-rated unless termination occurs within one year of

a change in control. In each such instance of termination, Dr. Solomon shall also be entitled to an amount equal to the Company’s

share of the medical insurance premium that the Company pays for Dr. Solomon under its health care plan for the lesser of 12 months

following the date of termination and Dr. Solomon’s employment by any entity which provides medical and health benefits which

he is eligible to receive.

Upon termination of

Dr. Solomon’s employment by us without cause or by Dr. Solomon for good reason within one year of a change of control, in

addition to any accrued but unpaid base salary, expense reimbursement and vested and accrued benefits, he shall be entitled if

the Company’s valuation at the time of the change in control is not less than one-hundred-fifty-million dollars, to receive

an amount equal to 18 months of base salary in effect before the employment terminates, plus one and a half times the target annual

performance bonus to which Dr. Solomon may have been entitled to for the year in which the employment terminates. In such instance,

Dr. Solomon shall also be entitled to an amount equal to the Company’s share of the medical insurance premium that the Company

pays under its health care plan for the lesser of 18 months following the date of termination and Dr. Solomon’s employment

by any entity which provides medical and health benefits which he is eligible to receive.

The Employment Agreement

also contains restrictive covenants for the Company’s benefit and Dr. Solomon is required to maintain the confidentiality

of our confidential information.

The foregoing summary

of the Employment Agreement is subject to, and qualified in its entirety by, a copy of the Employment Agreement attached hereto

as Exhibit 10.1, which is incorporated herein by reference.

Prior to joining the

Company, Dr. Solomon was Managing Partner of SundCapital ApS, a healthcare investment fund based in Copenhagen, Denmark, a position

he held since 2016. From 2015 to 2016, Dr. Solomon was Chief Executive Officer of Bionor A/S (OSLO: BIONOR) and from 2008 to 2015

he was the Chief Executive Officer of Zealand Pharma A/S (Nasdaq: ZEAL). Since 2015, Dr. Solomon has served as a Board Member and

Chair of the Remuneration and Compensation Committee of TxCell S.A. (NYSE Euronext: TXCL) and Dr. Solomon previously served on

the boards of Onxeo SA (NYSE Euronext and NASDAQ: ONXEO) from 2011 to 2017 and Promosome, LLC from 2014 to 2017. Dr. Solomon

previously held senior positions at Carrot Capital and Vital Sensors, and served as a faculty member at Columbia University’s

College of Physicians and Surgeons. Dr. Solomon studied at Cornell University’s Weil Medicine and its Graduate School of

Medical Science/ Sloan Kettering Division in New York where he received his Ph.D. in 1991.

On August 21, 2017,

the Company issued a press release announcing the appointment of Dr. Solomon. A copy of the press release is attached hereto as

Exhibit 99.1, and is incorporated herein by reference.

The information

contained in this report and the statement in the first paragraph of Exhibit 99.1 is hereby incorporated by reference into all

effective registration statements filed by the Company under the Securities Act of 1933.

Exhibit No.

|

10.1

|

Executive Employment Agreement dated August 18, 2017 between Akari Pharmaceuticals Plc and David Horn Solomon

|

|

|

|

|

99.1

|

Press Release dated August 21 2017

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Akari Therapeutics, Plc

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert M. Shaw

|

|

|

|

Name:

|

Robert M. Shaw

|

|

|

|

General Counsel & Secretary

|

|

Date: August 21, 2017

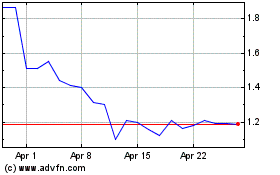

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

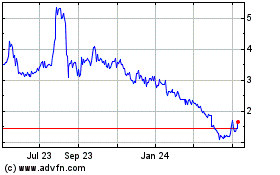

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024