Current Report Filing (8-k)

August 17 2017 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2017

STEPAN COMPANY

(Exact

Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-4462

|

|

36-1823834

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Edens and Winnetka Road, Northfield, Illinois 60093

(Address of Principal Executive Offices)

(847)446-7500

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

As previously disclosed in Stepan Company’s (the “Company”) Current Report on Form

8-K

filed on

August 2, 2017, effective as of August 15, 2017 (the “Separation Date”), Mr. Scott Mason, Vice President, Supply Chain, retired and separated from the Company.

In connection with Mr. Mason’s departure, the Company and Mr. Mason entered into a Separation Agreement and Release, dated as of

August 15, 2017 (the “Separation Agreement”). Pursuant to the Separation Agreement, in consideration of Mr. Mason’s execution, delivery and

non-revocation

of a general release of

claims and his continued compliance with the terms and conditions of the Separation Agreement, Mr. Mason will be entitled to receive the following: (i) a cash amount equal to $397,232, 50% of which will be payable not later than the second

regular payroll date occurring on or after the effective date of the release and 50% of which will be payable on the first regular payroll date occurring on or after the six month anniversary of the Separation Date, (ii) a

pro-rated

portion constituting 62.5% of any 2017 incentive bonus award under the Company’s Management Incentive Plan that would otherwise have been payable to Mr. Mason under such plan had he remained

employed with the Company through December 31, 2017, (iii) a

pro-rated

portion constituting 62.5% of any profit sharing award under the Company’s Savings and Investment Retirement Plan that would

otherwise have been payable to Mr. Mason under such plan had he remained employed with the Company through December 31, 2017, and (iv) accelerated vesting of stock option awards covering 3,832 shares and stock appreciation right

awards covering 11,495 shares granted to Mr. Mason during the 2016 calendar year. Mr. Mason’s other equity-based awards will be treated in accordance with the terms and conditions of the applicable Company plans and award agreements

pursuant to which they were granted.

Pursuant to the terms of the Separation Agreement, Mr. Mason will be subject to a cooperation covenant that

will apply for five years following the Separation Date,

non-competition

and

non-solicitation

covenants that will apply for 12 months following the Separation Date and

non-disparagement and confidentiality covenants that will apply indefinitely. The foregoing description of the Separation Agreement is qualified in its entirety by reference to the terms of the Separation Agreement, which is filed herewith as

Exhibit 10.1 and is incorporated herein by this reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Separation Agreement and Release, dated as of August 15, 2017, by and between Stepan Company and Scott Mason

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Stepan Company

|

|

|

|

|

|

|

Date: August 17, 2017

|

|

|

|

By:

|

|

/s/ Jennifer Ansbro Hale

|

|

|

|

|

|

Name:

|

|

Jennifer Ansbro Hale

|

|

|

|

|

|

Title

|

|

Vice President, General Counsel and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Separation Agreement and Release, dated as of August 15, 2017, by and between Stepan Company and Scott Mason

|

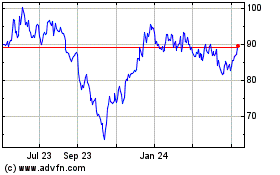

Stepan (NYSE:SCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

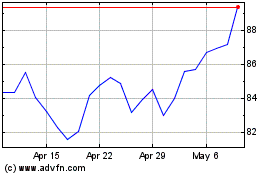

Stepan (NYSE:SCL)

Historical Stock Chart

From Apr 2023 to Apr 2024